Staking has long been the bedrock of decentralized finance, but for years, the conversation has revolved almost exclusively around Ethereum. With Ethereum (ETH) currently priced at $4,470.83, many investors are questioning whether its 2, 3% staking yield is enough to justify the risk and opportunity cost. The DeFi landscape is evolving rapidly, and a new wave of protocols is expanding staking’s reach far beyond ETH, pushing yields higher and bringing non-traditional assets like Bitcoin into the fold.

Multipli: Unlocking Staking Yields Beyond Ethereum

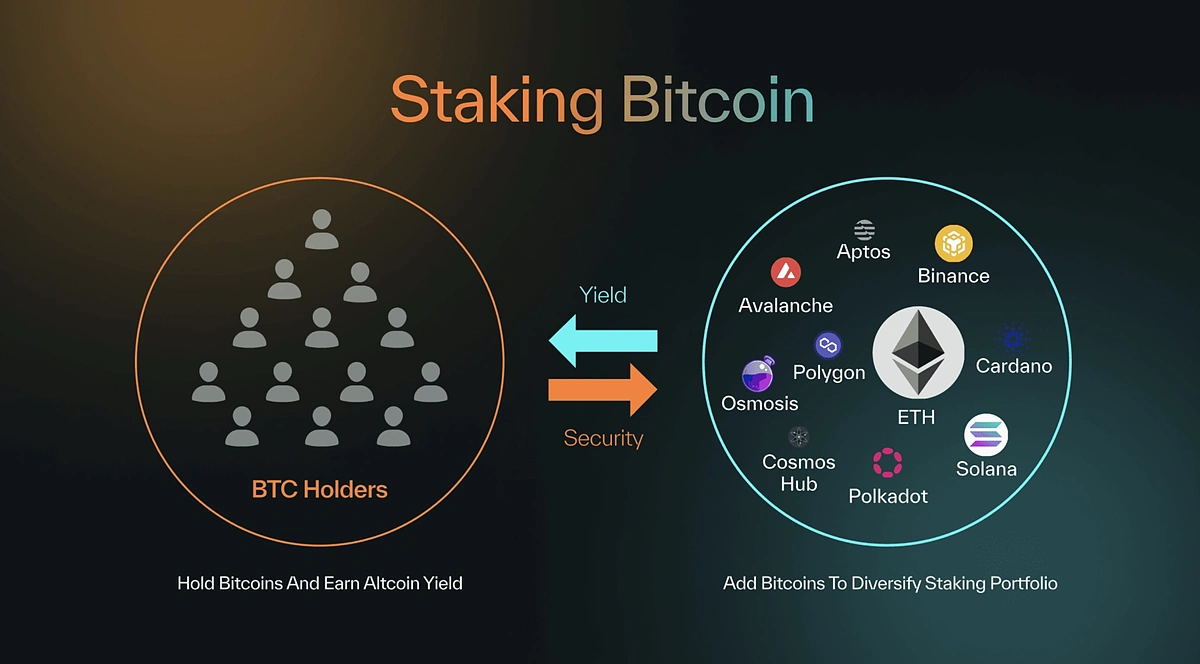

Multipli is at the forefront of this transformation, offering a platform that enables cross-asset staking strategies. Unlike traditional staking platforms limited to proof-of-stake tokens, Multipli uses advanced financial engineering to generate yields on both stakeable and non-stakeable assets, including Bitcoin (BTC), which historically lacked any native staking mechanism. This distinction matters: it means holders of flagship assets like BTC can now earn passive income without sacrificing liquidity or taking on excessive risk.

The protocol’s secret sauce lies in its use of delta-neutral contango strategies across spot and futures markets. By exploiting price differentials in contango conditions, a market state where futures prices exceed spot prices, Multipli can deliver sustainable yields that are uncorrelated to simple token inflation or network activity. Backtests since January 2020 show risk-free profits as high as 20% on stablecoins and approximately 11% on native assets, according to recent research.

Yield Generation for Non-Stakable Assets: The Bitcoin Paradigm Shift

The ability to generate yield from non-stakable assets is a game changer for crypto investors. For years, major holdings like Bitcoin have sat idle in wallets or cold storage, valuable but unproductive. Multipli’s approach empowers users to put these dormant assets to work by wrapping BTC into synthetic tokens that participate in sophisticated yield strategies.

This model stands in contrast to earlier attempts at synthetic staking or lending, which often came with high counterparty risk or opaque mechanisms. Multipli’s delta-neutral hedging ensures that users are not simply chasing speculative returns; instead, they are tapping into structural opportunities created by market inefficiencies.

Institutional Backing and Real-World Asset Integration

Multipli isn’t just another DeFi experiment, it has attracted $21.5 million in funding from leading firms like Pantera Capital and Sequoia. Partnerships with asset managers such as Nomura and Spartan Capital further signal institutional confidence in their approach. These collaborations allow Multipli to tokenize delta-neutral hedge fund strategies, making them accessible to everyday users who want exposure to professional-grade yield products.

The protocol’s integration of real-world tokenized assets (RWA) expands its utility even further. Investors can now earn 6, 15% APY on wrapped Bitcoin or stablecoins by participating in institutional-grade strategies typically reserved for hedge funds or accredited investors (source). This cross-pollination between traditional finance and DeFi blurs boundaries, and creates new opportunities for portfolio diversification without sacrificing decentralization.

Ethereum (ETH) Price Prediction 2026–2031

Forecast based on current market context, Multipli’s cross-asset strategies, and evolving DeFi trends

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,050 | $6,200 | +13% | Potential regulatory headwinds; ETH yield innovations drive resilience |

| 2027 | $4,600 | $5,800 | $7,500 | +15% | Layer-2 and DeFi expansion; staking yields attract institutional inflows |

| 2028 | $5,250 | $7,000 | $9,200 | +21% | Mainstream RWA tokenization; ETH as DeFi backbone; increased competition |

| 2029 | $6,300 | $8,500 | $11,300 | +21% | Global adoption of cross-asset strategies; ETH integration with traditional finance |

| 2030 | $7,200 | $10,000 | $13,800 | +18% | Regulatory clarity, ETH supply reduction, and ETH ETF potential |

| 2031 | $8,400 | $11,800 | $16,500 | +18% | Widespread DeFi utility, AI/IoT integrations, and mature ETH staking markets |

Price Prediction Summary

Ethereum is projected to experience steady growth through 2031, driven by innovation in staking yields, DeFi adoption, and integration with real-world assets. While volatility remains, the advent of cross-asset strategies like Multipli’s and broader regulatory clarity are likely to support higher average prices and set new all-time highs.

Key Factors Affecting Ethereum Price

- Proliferation of multi-asset staking and cross-chain DeFi platforms (e.g., Multipli)

- Sustained institutional investment and partnerships (Pantera, Sequoia, Nomura)

- Regulatory developments in the US, EU, and Asia impacting DeFi and staking

- Continued ETH supply reduction via staking and EIP-1559 burn mechanism

- Integration of ETH with tokenized real-world assets and traditional finance

- Competition from scalable Layer-1s and Bitcoin staking innovations

- Macro market cycles, adoption rates, and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For users accustomed to the limitations of single-asset staking, Multipli’s cross-asset approach is a paradigm shift. By leveraging both traditionally stakeable tokens and blue-chip assets like Bitcoin, the platform enables yield stacking that was previously out of reach for most investors. This democratization of sophisticated yield strategies is especially timely in a market where ETH’s 2, 3% annual return feels increasingly insufficient compared to the risk profile.

Key Advantages of Multipli Cross-Asset Staking

-

Unlocks Yield on Non-Stakeable Assets: Multipli enables users to stake assets like Bitcoin (BTC)—which traditionally lack native staking mechanisms—transforming them into yield-generating instruments and expanding DeFi earning opportunities beyond Ethereum.

-

Enhanced Returns Through Delta-Neutral Strategies: By leveraging delta-neutral contango strategies in spot and futures markets, Multipli offers sustainable, risk-mitigated yields—up to 25% on stablecoins and 15% on non-stable cryptocurrencies—outperforming many conventional staking platforms.

-

Institutional-Grade Partnerships and Backing: Backed by Pantera Capital, Sequoia, and partners like Nomura and Spartan Capital, Multipli delivers tokenized hedge fund strategies and robust, scalable returns for both retail and institutional investors.

-

Backtested Performance and Proven Results: Multipli’s strategies have been backtested since January 2020, consistently securing risk-free profits of up to 20% on stablecoins and 11% on native assets by capitalizing on price differentials in contango markets.

-

Broader Asset Flexibility and Portfolio Diversification: Multipli supports staking for a wide range of assets—including wrapped Bitcoin, stablecoins, and real-world tokenized assets—allowing investors to diversify portfolios and maximize capital efficiency within a single DeFi ecosystem.

What sets Multipli apart from earlier multi-asset protocols is not just its breadth, but its attention to risk management and transparency. The delta-neutral strategies employed are designed to minimize exposure to directional price movements, focusing instead on capturing value from market structure inefficiencies. This means that potential returns, up to 25% APY on stablecoins and 15% on non-stable cryptocurrencies, per recent market data, are not simply products of leverage or unsustainable incentives, but rather a function of disciplined arbitrage and hedging (source).

Comparing Yield Strategies: Multipli vs. Traditional Staking Platforms

The contrast between Multipli’s model and standard staking platforms is stark. While traditional DeFi staking often relies on inflationary rewards or validator fees, mechanisms that can erode over time, Multipli’s yields stem from provable market dynamics. Its integration with real-world tokenized assets (RWA) further enhances this edge by introducing new sources of alpha beyond the crypto-native universe.

| Platform | Supported Assets | Yield Source | Typical APY (%) |

|---|---|---|---|

| Multipli | BTC, ETH, Stablecoins, RWAs | Delta-neutral contango strategies and RWA integration | 6, 25% |

| Traditional Staking (ETH) | ETH only | Validator rewards/inflationary emission | 2, 3% |

| Lending Protocols | Borrows/lends multiple assets | Lending interest rates/borrower demand | 3, 8% |

This multidimensional approach also helps mitigate concentration risk, a persistent concern in DeFi portfolios overly reliant on a single chain or asset class. As more protocols like Bedrock and Supra introduce multi-asset liquid staking and cross-chain integrations (source: supra. com, source: bedrock. technology), the competitive landscape will continue to evolve, but Multipli’s early mover advantage in cross-asset yield generation remains significant.

Navigating Risks and Looking Ahead: The Future of Cross-Asset Staking Yields

No yield strategy is without tradeoffs. While delta-neutral positions are designed to reduce volatility exposure, they do introduce complexities around execution risk, smart contract vulnerabilities, and reliance on robust derivatives markets. For users considering platforms like Multipli, due diligence remains essential, especially as institutional capital flows into these protocols and competition intensifies.

The upshot? As we enter Q4 2025 with Ethereum trading at $4,470.83, it’s clear that static approaches to staking are losing ground to flexible cross-asset solutions. For those seeking higher returns without abandoning blue-chip assets or taking on unchecked leverage, platforms like Multipli represent the next chapter in decentralized yield generation, a chapter where value is engineered through creativity as much as capital.