If you’ve spent any time in DeFi lately, you’ve probably noticed the surge of opportunities to earn staking points and qualify for lucrative airdrop rewards. The landscape as of September 2025 is more competitive than ever, with protocols like Symbiotic, StakeStone, and EigenLayer rolling out innovative points programs that directly impact your eligibility for future token drops. But with so many platforms and strategies in play, how do you actually maximize your chances before these windows close?

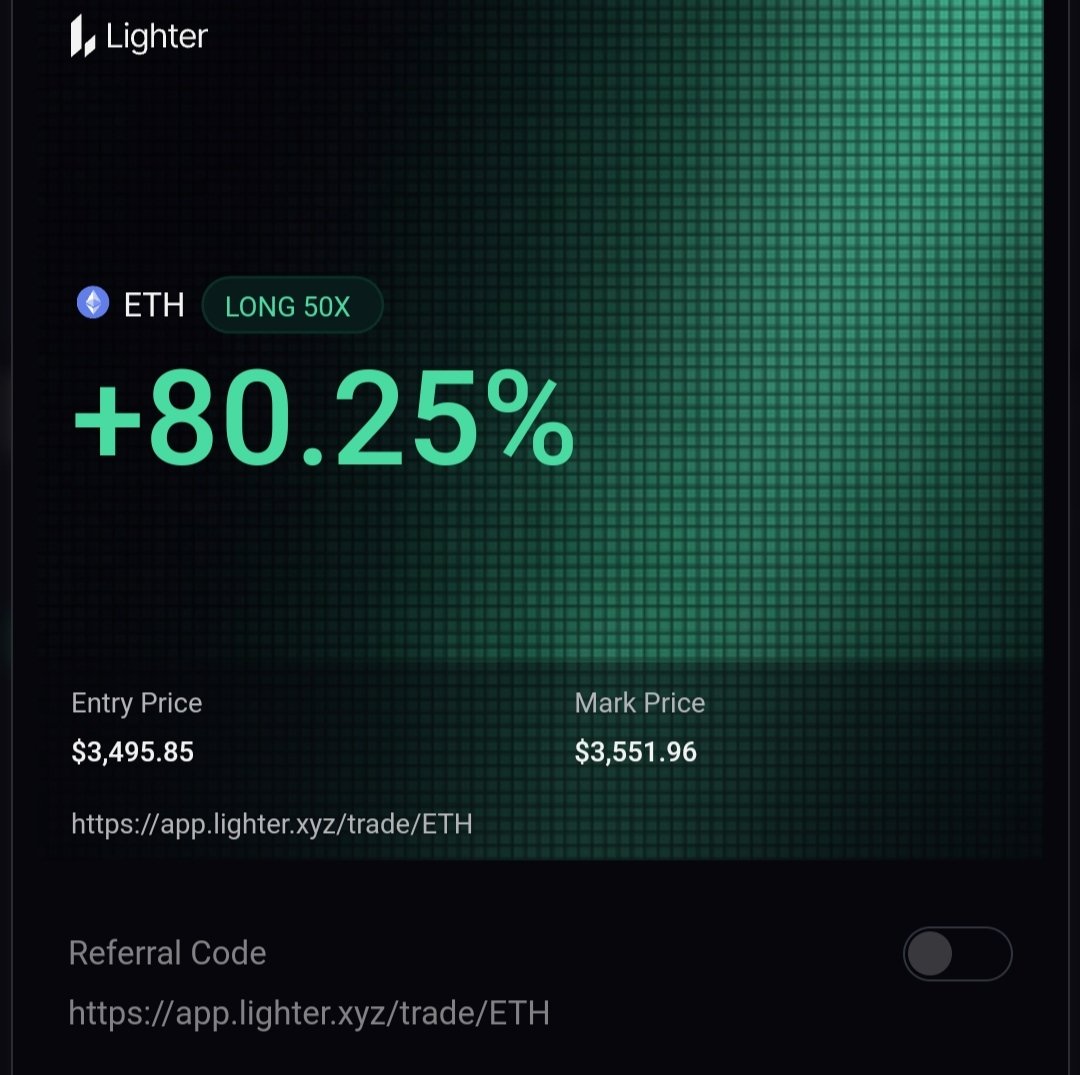

The answer lies in a focused approach: targeting the top actionable strategies that consistently deliver results. Whether you’re looking to stack loyalty points on Lighter or restake your liquid staking tokens (LSTs) for compounded rewards, the right moves can make the difference between a modest bonus and a life-changing allocation.

Why Staking Points and Airdrop Rewards Matter in 2025

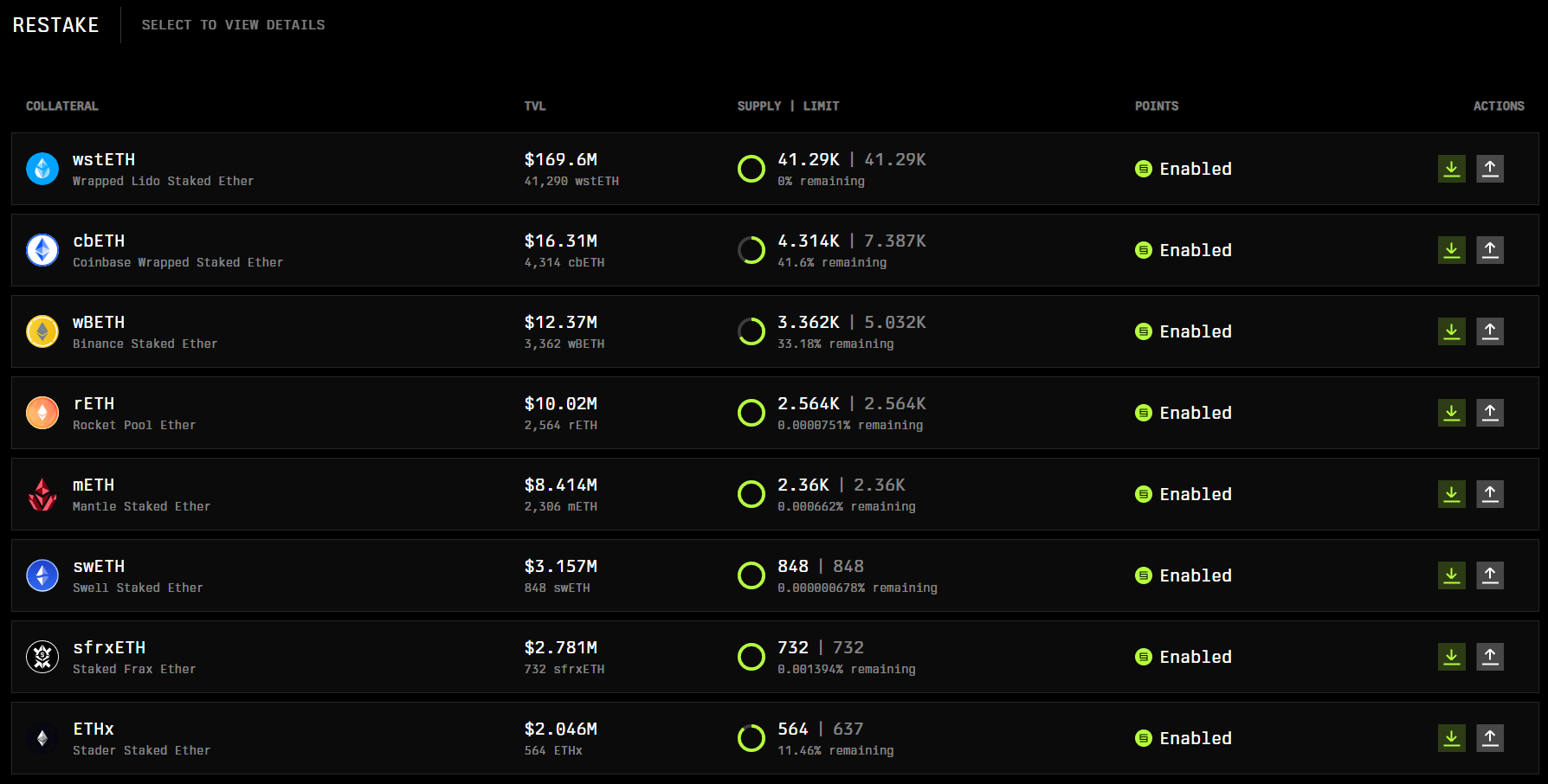

Staking isn’t just about passive income anymore. Platforms are now rewarding active users with points systems that often serve as precursors to major airdrops. For example, Symbiotic lets you earn points by restaking popular assets like wstETH and rETH, while EigenLayer tracks user engagement through its restaked points program. These points can become significant when protocols distribute governance tokens or launch new reward campaigns.

The sheer scale is eye-opening: The Lighter platform’s points program has seen participants turn $363K bets into outsized rewards (AInvest). EtherFi, Lido, Rocket Pool – all are competing to incentivize deeper user participation with layered reward structures. In this environment, knowing where and how to engage is everything.

The Top 5 Strategies to Qualify for Staking Points and Airdrop Rewards

Top 5 Strategies to Qualify for DeFi Staking Points & Airdrops

-

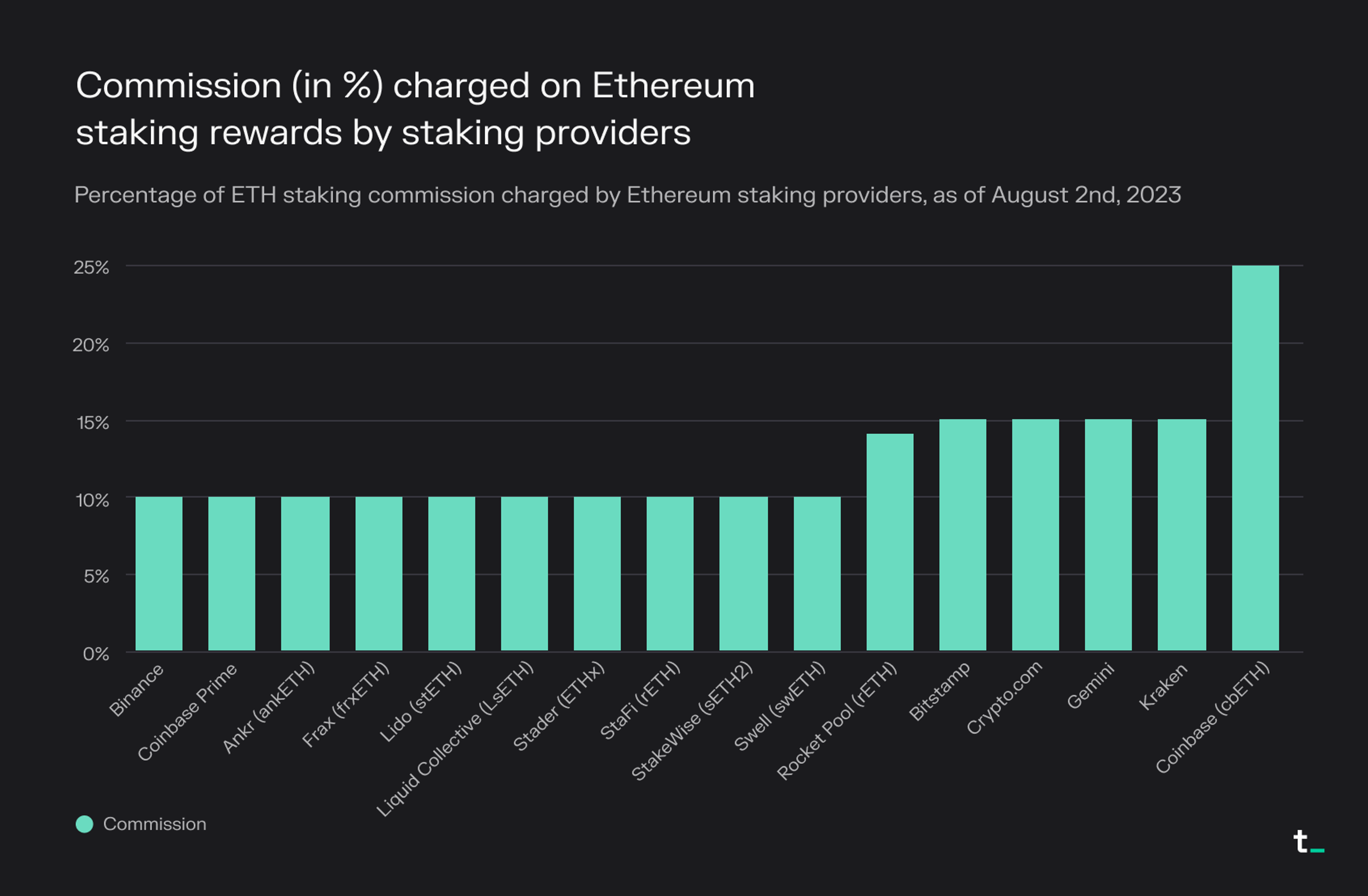

Actively Stake and Provide Liquidity on Leading Liquid Staking Protocols (e.g., EtherFi, Lido, Rocket Pool) to accumulate points and qualify for upcoming airdrops. These platforms reward users for staking ETH and other assets, and participation often boosts your eligibility for future token distributions.

-

Participate in DeFi Platform-Specific Points Programs (e.g., Lighter, EigenLayer) by trading, staking, or providing collateral to maximize loyalty rewards and airdrop eligibility. These programs track your activity and assign points that may convert into valuable airdrops.

-

Utilize Multi-Protocol Yield Stacking Strategies (e.g., restaking LSTs on EigenLayer or Pendle) to earn compounded points across multiple reward campaigns. By layering your participation, you can maximize both staking yields and airdrop eligibility.

-

Monitor Official Announcements and Community Channels for time-sensitive bonus events or quests that offer multiplier points or priority airdrop access. Staying active on Discord, Twitter, and project blogs helps you catch limited-time opportunities that can significantly boost your rewards.

Let’s break down each strategy so you can act decisively before deadlines hit:

1. Actively Stake and Provide Liquidity on Leading Liquid Staking Protocols

The first step is direct participation in platforms like EtherFi, Lido, or Rocket Pool. By staking ETH or other supported assets, not only do you earn base yield but also accumulate protocol-specific points that boost your eligibility for upcoming airdrops. Providing liquidity – especially in pools featuring LSTs – often multiplies your potential rewards.

2. Participate in Platform-Specific Points Programs (Lighter and EigenLayer)

Loyalty matters in DeFi right now. Programs such as Lighter incentivize trading and collateral provision with escalating point multipliers; these are explicitly tied to future token distributions. Similarly, EigenLayer’s restaked points system measures your long-term engagement and could be the ticket to priority allocations when their next round of rewards goes live.

3. Engage in Early-Stage Testnets and Beta Programs (Blast, Renzo, Symbiotic)

If you’re willing to experiment early with new protocols like Blast or Symbiotic, you can often secure retroactive rewards simply by being an active tester or beta participant. These programs track wallet activity – from bridging funds to interacting with smart contracts – then distribute surprise airdrops based on your historical involvement.

Yield Stacking and Staying Ahead of Bonus Events

4. Utilize Multi-Protocol Yield Stacking Strategies

This is where things get interesting for power users: by restaking your earned LSTs on platforms like EigenLayer or Pendle, you compound both your yield and point accrual across multiple campaigns simultaneously. It’s an advanced but highly effective way to maximize both ongoing returns and future airdrop eligibility.

5. Monitor Announcements and Time-Sensitive Quests for Bonus Multipliers

The fastest-moving opportunities are often announced via official project channels or community Discords/Twitter spaces. Time-limited quests can offer multiplier points or priority access for those who act quickly – which means staying plugged into updates is essential if you want first dibs on the best deals.