Leverage staking on Solana is gaining traction among yield-maximizing DeFi investors, thanks to its ability to amplify rewards and unlock new strategies with liquid staking tokens like JSOL and protocols such as SOLAnode. As of September 19,2025, Solana (SOL) is trading at $236.53, reflecting a dynamic market environment where every basis point of APY matters. While traditional staking offers reliable returns, leverage staking allows users to borrow additional SOL against their collateral and stake a larger sum, potentially boosting APY but also introducing new risks. This nuanced approach requires methodical risk management and a clear understanding of protocol mechanics.

Why Leverage Staking Is Reshaping Solana Yield Strategies

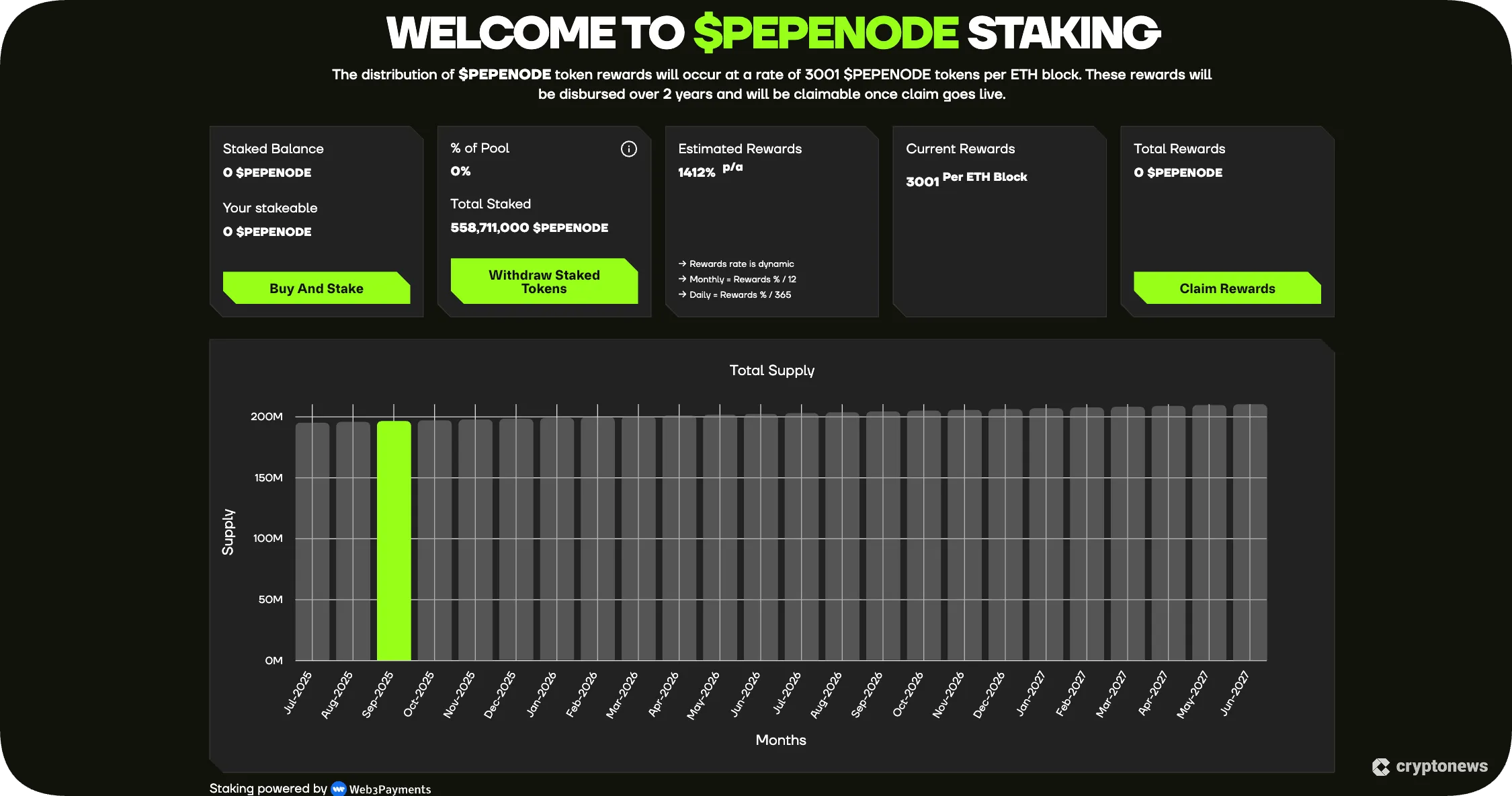

Leverage staking Solana is not just about chasing higher numbers, it’s about optimizing capital efficiency in a maturing DeFi landscape. By utilizing platforms like JPool’s Direct Staking feature, users can apply leverage to their SOL positions via flash loans, effectively multiplying their potential rewards. For example, instead of staking 100 SOL directly, you could borrow an additional 50 SOL (depending on the allowed Loan-to-Value ratio) and stake 150 SOL in total. The result? A proportional increase in potential rewards, provided the additional yield outpaces the cost of borrowing.

This technique has become especially relevant as liquid staking options proliferate across Solana. Tokens like JSOL (from JPool) provide immediate liquidity for staked positions, letting users participate in DeFi while still earning validator rewards. Meanwhile, protocols such as SOLAnode are pushing boundaries by integrating advanced APY optimization tools and automated risk controls.

The Mechanics: How Does Leverage Staking Work on Solana?

The process begins with setting up a compatible wallet, most commonly Phantom or Solflare, and acquiring SOL at the current market price of $236.53. Once funded, users connect their wallets to leverage-enabled platforms like JPool or explore emerging solutions from SOLAnode. Here’s how a typical workflow unfolds:

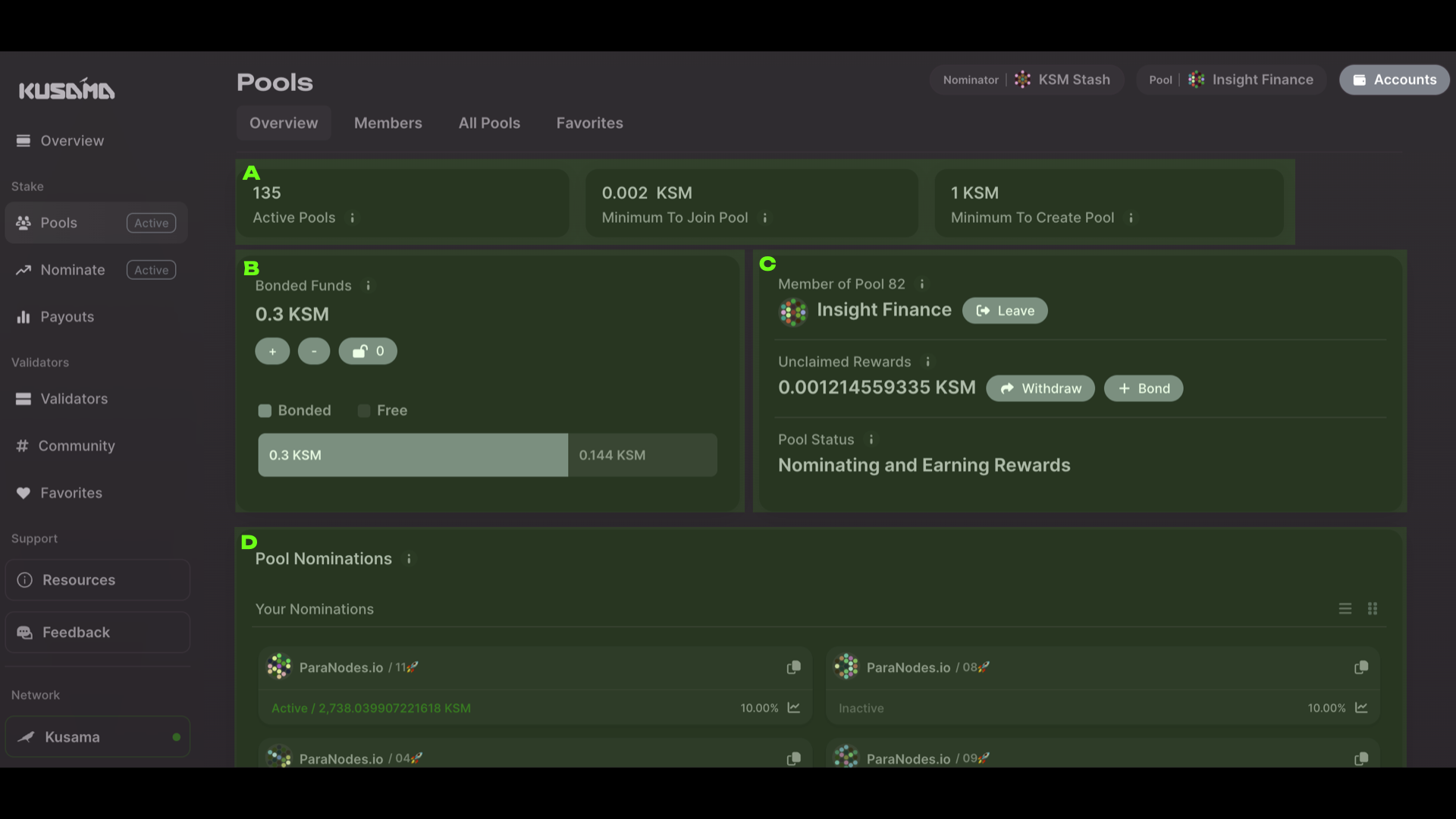

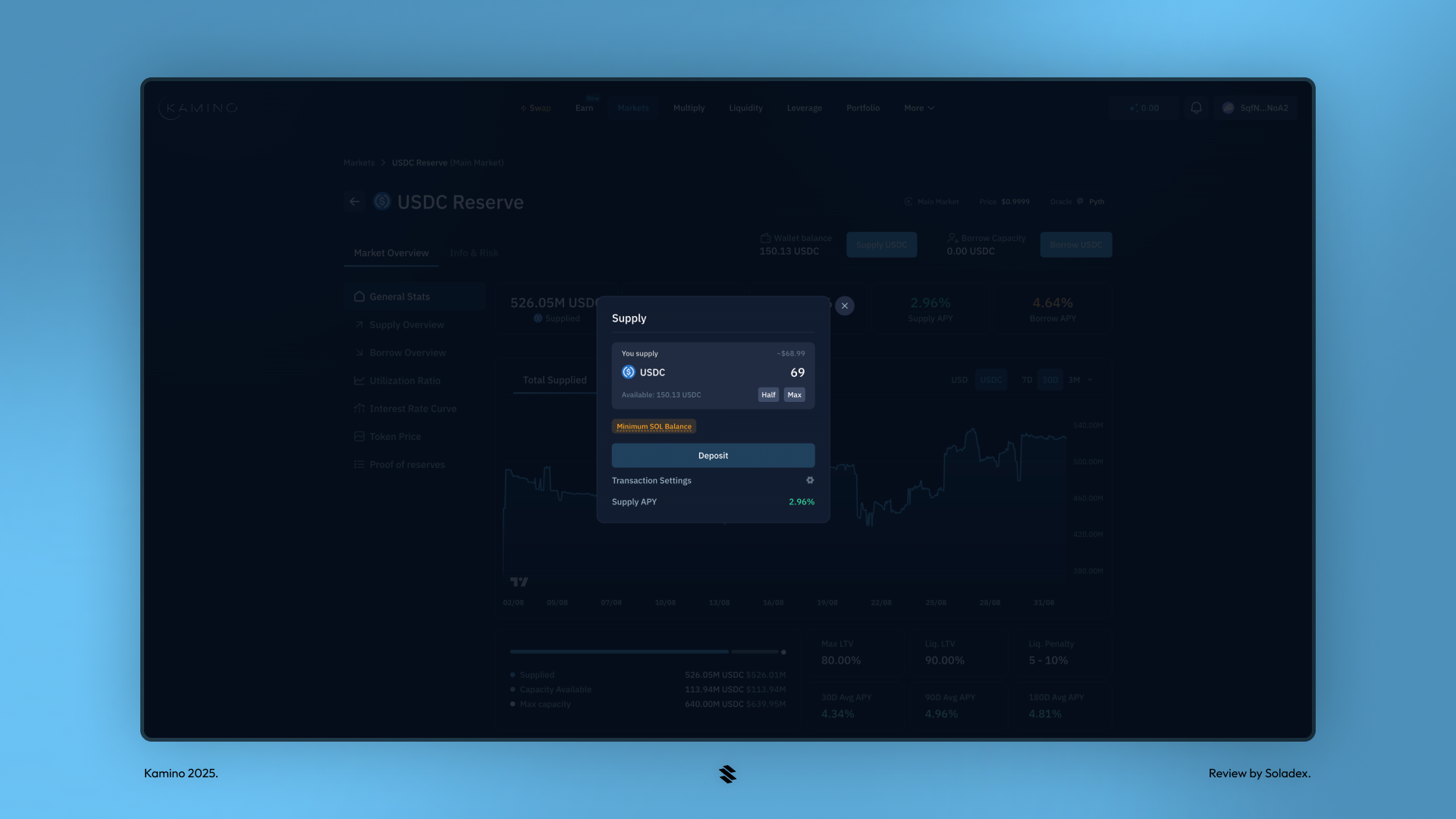

On these platforms, enabling leverage usually involves toggling a multiplier option before confirming your stake. The platform will automatically borrow extra SOL (often through flash loans), add it to your staked amount, and issue you liquid staking tokens such as JSOL in return. Throughout this process, two critical metrics must be monitored:

- LTV Ratio (Loan-to-Value): Indicates how much you’ve borrowed compared to your collateral.

- Health Factor: Measures how close your position is to liquidation if borrow costs rise or validator rewards fall.

If the cost of borrowing surpasses your earned APY for an extended period, or if market volatility sharply reduces collateral value, your position may be partially or fully liquidated to protect protocol solvency.

Navigating Risk: What You Need To Know Before Leveraging Your Stake

The allure of higher APY through leverage staking comes hand-in-hand with increased complexity and risk exposure. As discussed frequently in the community (see r/solana discussions), liquidation is a real possibility if macro conditions shift or if protocol parameters change unexpectedly.

The most prudent investors treat leverage as a tool, not a shortcut, and regularly monitor their positions using dashboard analytics provided by platforms like JPool and SOLAnode.

Solana (SOL) Price Prediction 2026-2031

Based on current price ($236.53 as of September 2025), leverage staking trends, and evolving market dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $180.00 | $260.00 | $340.00 | +10% | Volatility expected as leverage staking grows; upside from DeFi adoption |

| 2027 | $210.00 | $295.00 | $410.00 | +13% | Maturing DeFi ecosystem and institutional interest support price |

| 2028 | $230.00 | $335.00 | $470.00 | +14% | Major protocol upgrades and broader adoption drive growth |

| 2029 | $260.00 | $380.00 | $540.00 | +13% | Potential regulatory clarity and new use cases expand market |

| 2030 | $290.00 | $430.00 | $610.00 | +13% | Sustained adoption, but competition may limit upside |

| 2031 | $320.00 | $480.00 | $690.00 | +12% | Long-term growth from integration in global finance, but cyclical corrections likely |

Price Prediction Summary

Solana (SOL) is positioned for steady growth through 2031, driven by its robust staking ecosystem, increasing leverage staking participation, and strong DeFi adoption. While price volatility and corrections are likely, the overall trend remains positive, with average prices expected to nearly double by 2031. Upside potential hinges on continuous network upgrades, successful scaling, and broader regulatory acceptance, while risks include competition and macroeconomic headwinds.

Key Factors Affecting Solana Price

- Expansion of leverage staking and liquid staking products on Solana

- Broader DeFi and NFT ecosystem growth on Solana

- Network upgrades and scalability improvements

- Regulatory developments—both positive and negative

- Increased institutional participation and new use cases

- Competition from other scalable blockchains (e.g., Ethereum, Avalanche, Sui)

- Global macroeconomic cycles impacting risk assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The key takeaway? While leveraged JSOL staking strategies can supercharge returns during favorable conditions, they require vigilance and an appetite for active management.

For those seeking to maximize capital efficiency, combining liquid staking Solana with leverage can unlock a new layer of yield stacking. By minting JSOL or similar LSTs, you retain the ability to deploy your staked position into additional DeFi protocols, whether that means providing liquidity on AMMs, participating in lending markets, or integrating with auto-compounders. SOLAnode, in particular, has emerged as a standout for its competitive SOLAnode APY and risk-adjusted automation features that help manage liquidation thresholds and optimize validator selection.

However, it’s essential to remember that leverage staking risks are not just theoretical. If Solana’s price dips sharply from its current level of $236.53, or if protocol fees increase unexpectedly, leveraged positions can quickly become underwater. This is why advanced users often set conservative LTV ratios and utilize stop-loss mechanisms where available.

Best Practices for Leveraged Staking with JSOL and SOLAnode

Top 5 Safety Tips for Leverage Staking Solana

-

Monitor Your Health Factor Closely: When using platforms like JPool for leverage staking, always keep an eye on your Health Factor. A low Health Factor increases your risk of liquidation if the value of your collateral (JSOL) drops or if interest rates rise.

-

Stay Informed on SOL Price Movements: Solana (SOL) is currently trading at $236.53 (as of September 19, 2025). Because leverage staking amplifies both gains and losses, significant price drops can quickly erode your position and trigger liquidation.

-

Understand Borrowing Costs and Interest Rates: Platforms like JPool and Kamino Finance charge interest on borrowed SOL. If the borrow rate exceeds your staking APY, your net returns may turn negative. Regularly review current rates before and during your strategy.

-

Choose Reputable Validators and Platforms: Only stake with established validators via trusted platforms such as JPool or Kamino Finance. Validator performance and platform security directly impact your staking safety and rewards.

-

Set Conservative Leverage Multipliers: While higher leverage can boost APY, it also increases liquidation risk. Start with a lower leverage multiplier and gradually adjust as you gain experience and understand market volatility.

If you’re considering this strategy, here are several best practices to help you navigate the landscape:

- Diversify Validators: Don’t concentrate all your staked SOL with a single validator, spread risk across reputable operators.

- Monitor Protocol Updates: Stay informed about changes in borrowing rates, APY calculations, and platform integrations.

- Avoid Over-Leveraging: Conservative leverage (e. g. , 1.2x, 1.5x) often provides a better balance between risk and reward than maximum multipliers.

- Automate Health Checks: Use dashboard alerts or automation tools to stay ahead of liquidation triggers.

- Understand Tax Implications: Leverage staking may have complex tax consequences depending on your jurisdiction, consult a professional if needed.

The future of liquid staking on Solana is rapidly evolving as protocols compete to deliver higher yields without sacrificing security. As more users adopt strategies like leveraged JSOL staking or explore new offerings from SOLAnode, expect continued innovation in both APY optimization and risk management tooling.

Final Thoughts: Is Leverage Staking Right for You?

If you’re an experienced DeFi participant with a strong grasp of market dynamics, and you’re comfortable accepting increased volatility, leverage staking on Solana can be a powerful way to enhance returns while maintaining exposure to network growth. However, it’s not suitable for everyone; beginners should start with basic liquid staking before experimenting with leverage.

The current market price of Solana ($236.53) underscores the importance of careful entry points and proactive risk controls when deploying leveraged strategies. Ultimately, the blend of JSOL’s liquidity and SOLAnode’s automated optimizations offers sophisticated investors a flexible toolkit, but only if used judiciously within an overall portfolio framework.