Retroactive DeFi yield is no longer a niche strategy reserved for insiders. With the rise of platforms like YO Yield and the evolution of multi-chain yield optimizers, maximizing both points and APR has become a science of smart positioning and active participation. For those aiming to capture future airdrops, optimize risk-adjusted returns, and stack rewards across protocols, the current landscape demands a focused approach. In this article, we break down three actionable strategies that leverage YOEX staking, vault diversification, and integrations with leading DeFi protocols such as Euler and Pendle.

Stake YOEX on YO Exchange to Earn High APY and Maximize Retroactive Points

Staking YOEX on YO Exchange is the foundation for any serious participant in the YO Yield retroactive DeFi ecosystem. The process is straightforward: acquire YOEX tokens, stake them via the platform interface (or through DappRadar integrations), and begin earning up to 25% APY. This staking not only generates attractive passive income but also accrues valuable retroactive points that may be essential for eligibility in future airdrops or reward distributions.

The dual benefit here is clear: by staking YOEX you support the underlying protocol while compounding your earning potential. Importantly, these retroactive points are tracked in real time on your user dashboard, so you can monitor your standing relative to upcoming campaigns or snapshot events. For users seeking to maximize their exposure, enabling collateralization can further unlock advanced DeFi strategies without sacrificing point accumulation.

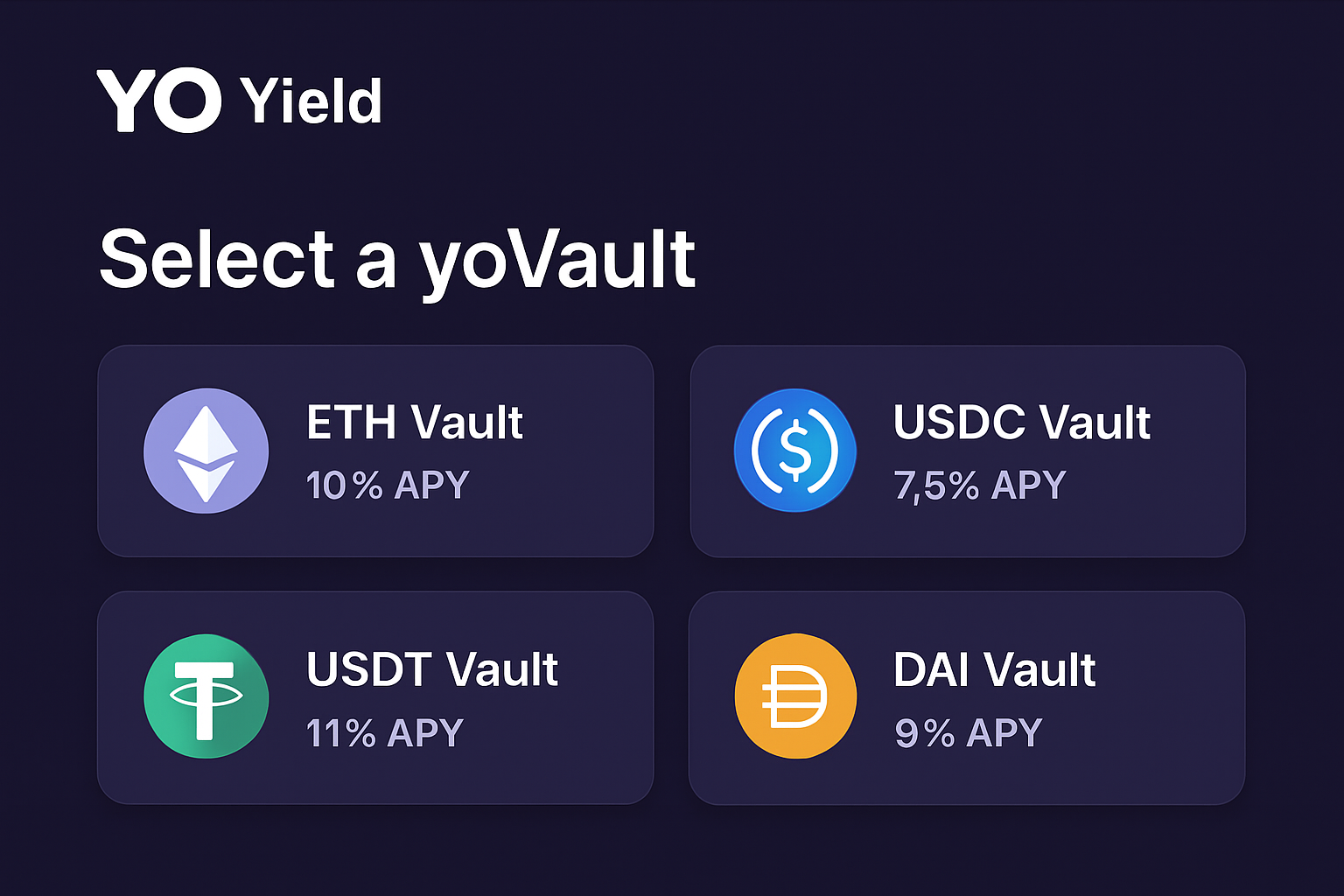

Diversify Deposits Across Multiple yoVaults for Optimized Yield and Enhanced Airdrop Eligibility

Single-vault strategies are becoming obsolete as DeFi matures. Instead, diversification across multiple yoVaults is emerging as a key tactic for both optimized yield and enhanced eligibility for retroactive rewards. Each yoVault targets different asset classes – from stablecoins to LSTs – with unique risk profiles and point multipliers.

This approach reduces concentration risk while maximizing your exposure to various yield sources. Critically, certain vaults (like those offering vyUSD markets) provide up to 5x point multipliers, making them especially attractive for points farming enthusiasts. Spreading your deposits ensures you don’t miss out on any protocol-specific incentives or special campaigns that could impact future airdrop allocations.

3 Strategies to Maximize Retroactive DeFi Yield with YO Yield

-

Stake YOEX on YO Exchange to Earn High APY and Maximize Retroactive PointsStaking YOEX tokens directly on the YO Exchange platform can generate up to 25% APY while accumulating valuable points for potential airdrops. This strategy not only boosts your passive income but also increases your eligibility for future retroactive rewards by supporting the YO ecosystem.

-

Diversify Deposits Across Multiple yoVaults for Optimized Yield and Enhanced Airdrop EligibilitySpread your assets across different yoVaults to tap into various DeFi protocols and asset classes. Diversification optimizes yield, maximizes points accrual, and strengthens your position for potential airdrops, as each vault targets unique strategies and risk profiles.

-

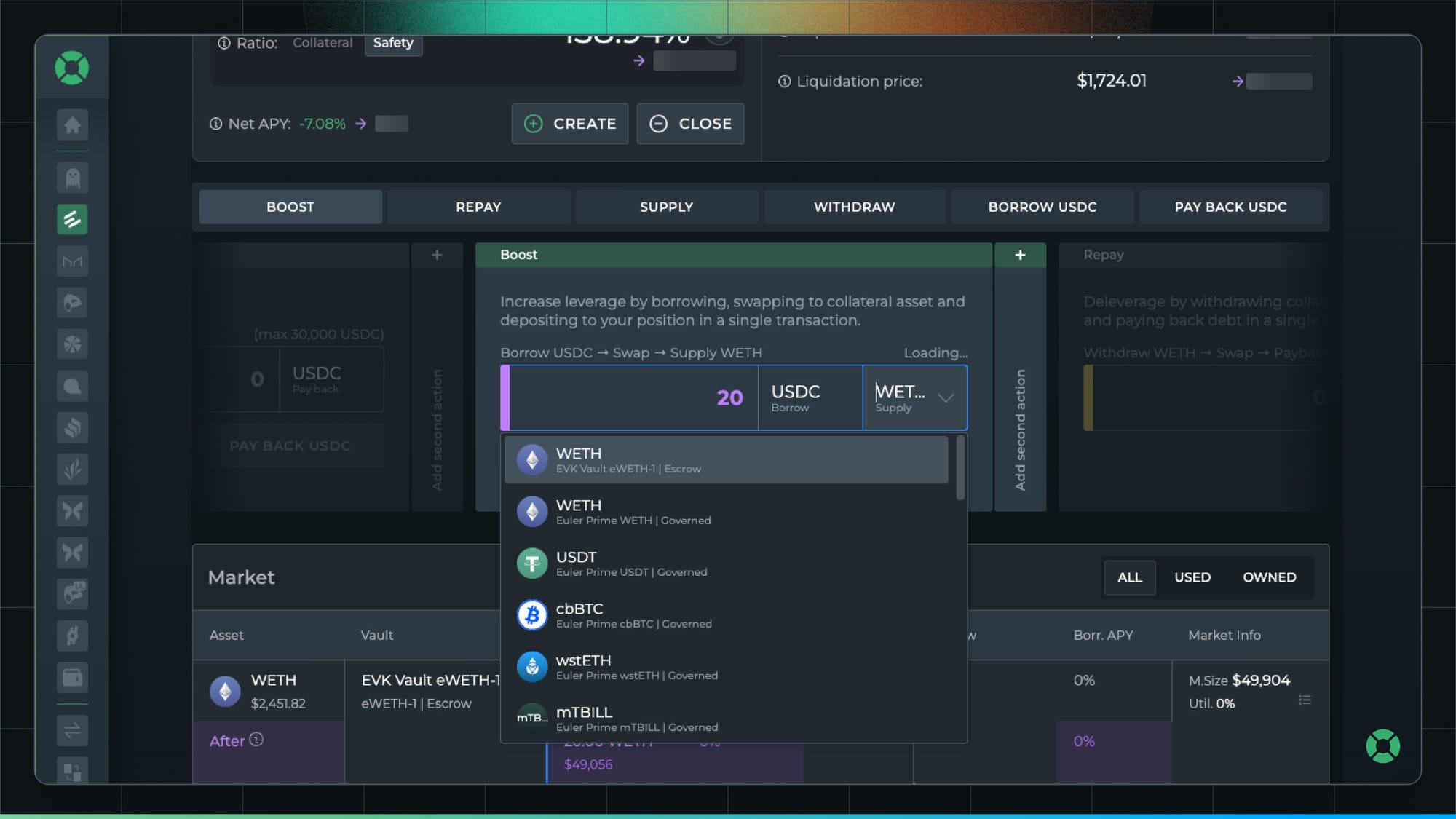

Leverage Euler and Pendle Protocols with YOUSD or LSTs to Stack DeFi APR and Retroactive RewardsIntegrate your YOUSD or liquid staking tokens (LSTs) with leading protocols like Euler and Pendle. These integrations enable advanced yield strategies—such as lending, borrowing, and yield tokenization—allowing you to stack APR from multiple sources while accumulating points for retroactive rewards.

Leverage Euler and Pendle Protocols with YOUSD or LSTs to Stack DeFi APR and Retroactive Rewards

The most sophisticated yield stackers are now integrating protocols like Euler and Pendle into their strategy mix via YO Yield’s supported assets such as YOUSD or liquid staking tokens (LSTs). By looping assets through lending markets on Euler or splitting yields with Pendle’s maturity pools, users can multiply their base APR while continuing to earn retroactive points within the YO ecosystem.

This synergy allows for recursive lending/borrowing loops or fixed-yield positions that boost overall returns beyond what standard staking can offer. It’s an advanced but increasingly accessible strategy thanks to seamless routing from platforms like [yo. xyz](https://www.yo.xyz/?utm_source=openai). Always monitor which integrations are currently incentivized on the dashboard – deprecated strategies do not accrue points, so staying updated is essential for full optimization.

For those new to integrating protocols, start by supplying YOUSD or your preferred LST to Euler’s lending markets. This lets you borrow against your collateral, redeploying borrowed assets into Pendle for fixed-yield opportunities or back into YO Yield vaults for compounding. The result: a self-reinforcing yield loop that amplifies both APR and points accrual. These integrations are particularly powerful during promotional windows when YO Yield offers boosted multipliers for specific protocol activity, an edge that can make the difference in competitive airdrop eligibility.

Risk management is crucial here. Recursive strategies increase exposure and potential returns, but also amplify liquidation risks if markets move sharply. Use the dashboard’s real-time analytics to monitor health factors and adjust positions proactively. For most users, a balanced allocation between standard vaults and advanced integrations provides the optimal mix of yield, safety, and points farming.

Staying Ahead: Monitoring Campaigns and Adapting Your Strategy

The retroactive rewards landscape is dynamic, with new campaigns, point boosts, and eligible protocols announced frequently. To consistently maximize your DeFi APR optimization efforts:

- Monitor YO Yield’s official channels: especially Twitter, for real-time updates on new vault launches or reward campaigns.

- Check the DeFi Dashboard regularly to ensure your assets remain in active strategies that qualify for points; migrate out of deprecated vaults promptly.

- Utilize referral programs to further boost your point accumulation with minimal effort.

This proactive approach ensures you’re not just earning base yields but are positioned for maximum retroactive DeFi rewards as protocols evolve. Remember: early movers who actively manage their positions tend to capture outsized benefits when snapshot events occur.

Key Takeaways for Maximizing Retroactive Yield with YO Yield

The current DeFi environment rewards strategic flexibility, diversification, and timely participation across integrated platforms like YO Exchange, Euler, and Pendle. By:

- Staking YOEX on YO Exchange for high APY and ongoing retroactive points

- Diversifying across multiple yoVaults to optimize both yield and airdrop eligibility

- Leveraging advanced integrations with Euler and Pendle using YOUSD or LSTs for compounded APR and points farming

You position yourself at the forefront of DeFi points farming, ready to capture not only today’s returns but tomorrow’s retroactive rewards as well.