Real yield in DeFi isn’t about fleeting hype or unsustainable emissions – it’s about stacking every possible source of return, then compounding them with smart protocol design. MMTFinance is quietly rewriting the playbook for liquidity providers (LPs) on Sui by fusing two powerful engines: active liquidity provision and governance-driven voting incentives. If you’re chasing the highest sustainable yields in the ecosystem, this is where the game gets serious.

Why Yield Stacking Is Exploding on MMTFinance

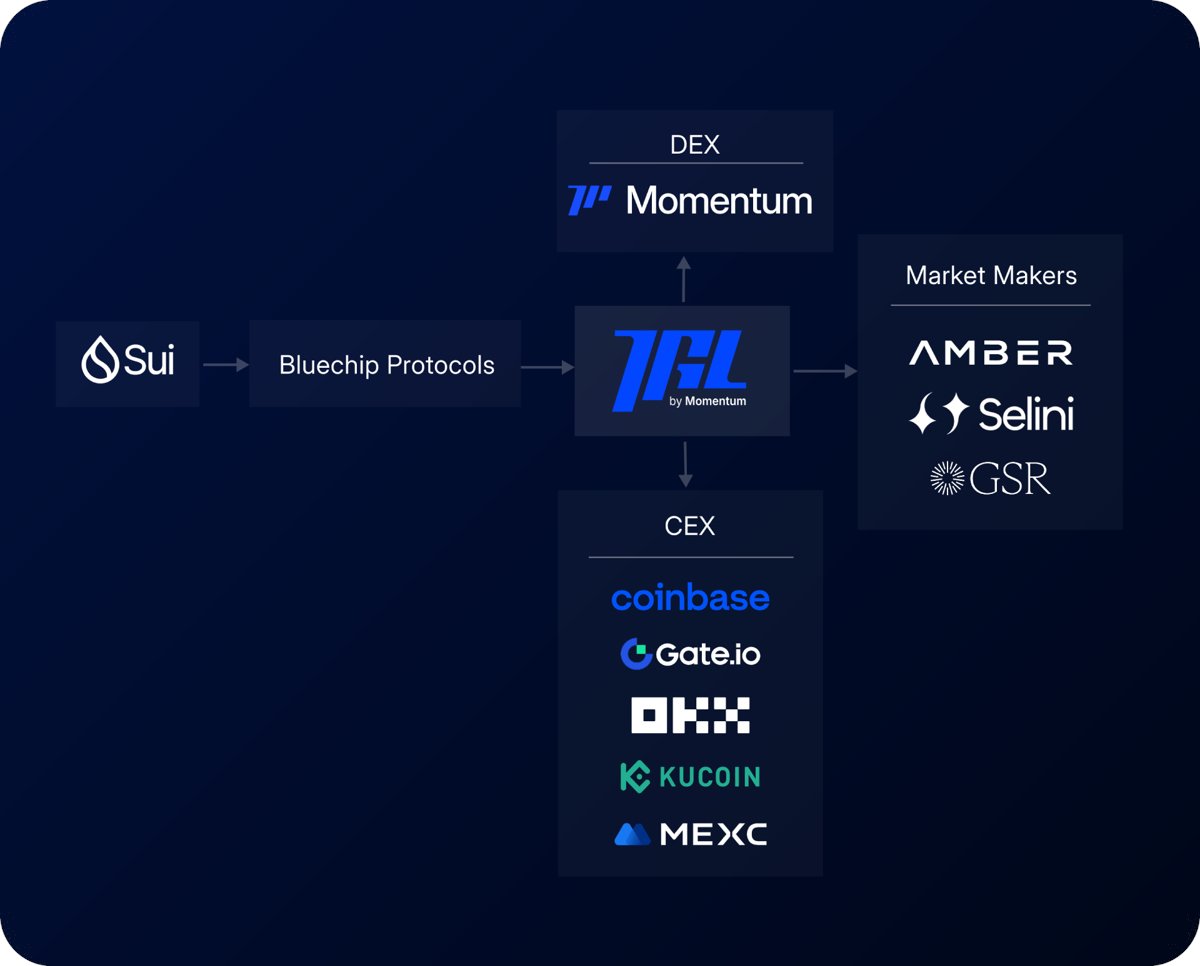

The core insight driving MMTFinance’s surge: incentives follow real volume. LPs aren’t just earning swap fees – they’re tapping into a dual-reward model that combines fee income, protocol emissions, and voting power. This is enabled by the ve(3,3) architecture: lock your $MMT tokens, receive veMMT, and direct emissions to the pools with actual trading activity. The result? More capital flows to productive pairs, and LPs who participate in governance get a larger slice of protocol rewards.

Auto-Rebalancing Vaults: Set-and-Forget Optimization

Manual yield farming is deadweight in an era of rapid market shifts. MMTFinance’s auto-rebalancing vaults automate optimal position management for single trading pairs. These vaults dynamically adjust allocations based on real-time market conditions and trading volume – maximizing both fee capture and reward emissions without constant micromanagement. For LPs, this means less stress and higher net returns over time.

Top Benefits of Auto-Rebalancing Vaults on MMTFinance

-

Automated Yield Optimization: Auto-rebalancing vaults on MMTFinance dynamically adjust liquidity positions to capture the best available yields, reducing manual intervention and maximizing returns for LPs.

-

Minimized Manual Management: These vaults continuously monitor market conditions and rebalance assets, allowing users to earn competitive yields without constant oversight or complex strategy adjustments.

-

Efficient Capital Allocation: By automatically reallocating liquidity to the most active trading pairs, vaults help LPs benefit from higher fee generation and protocol emissions, especially when paired with ve(3,3) mechanics.

-

Integrated Risk Management: Auto-rebalancing vaults diversify exposure across different pools and adapt to shifting market conditions, helping mitigate risks associated with impermanent loss and volatile assets.

-

Seamless Governance Participation: LPs using auto-rebalancing vaults can easily combine liquidity provision with MMT token voting, stacking yields from both trading fees and governance incentives.

The LP and Voter Combo: Maximizing Your Yield Strategy

The real alpha comes from combining liquidity provision with active participation in protocol governance. Here’s how it works:

- Provide liquidity to high-volume pairs via strategy or auto-rebalancing vaults

- Lock $MMT, receive veMMT voting power

- Vote to direct emissions toward your chosen pools (increasing your share of rewards)

- Earn fees and boosted rewards and influence over future upgrades

This stacked yield approach isn’t just theoretical – it’s being executed daily by top DeFi strategists seeking outsized returns with robust risk management. By routing capital through smart vaults and leveraging voting incentives, you’re not just chasing APR – you’re helping shape the entire protocol for long-term sustainability.