Bitcoin yield farming is evolving fast, and StackingDAO is at the forefront with its liquid stacking solutions for STX and sBTC. For DeFi users and yield seekers, this means a new level of flexibility: you can earn Bitcoin-denominated yield without giving up liquidity or waiting through lockup periods. As of September 20,2025, Stacks (STX) trades at $0.6525, reflecting the growing interest in Bitcoin DeFi stacking as protocols like StackingDAO drive adoption.

How Liquid Stacking Works: Unlocking Yield Without Lockups

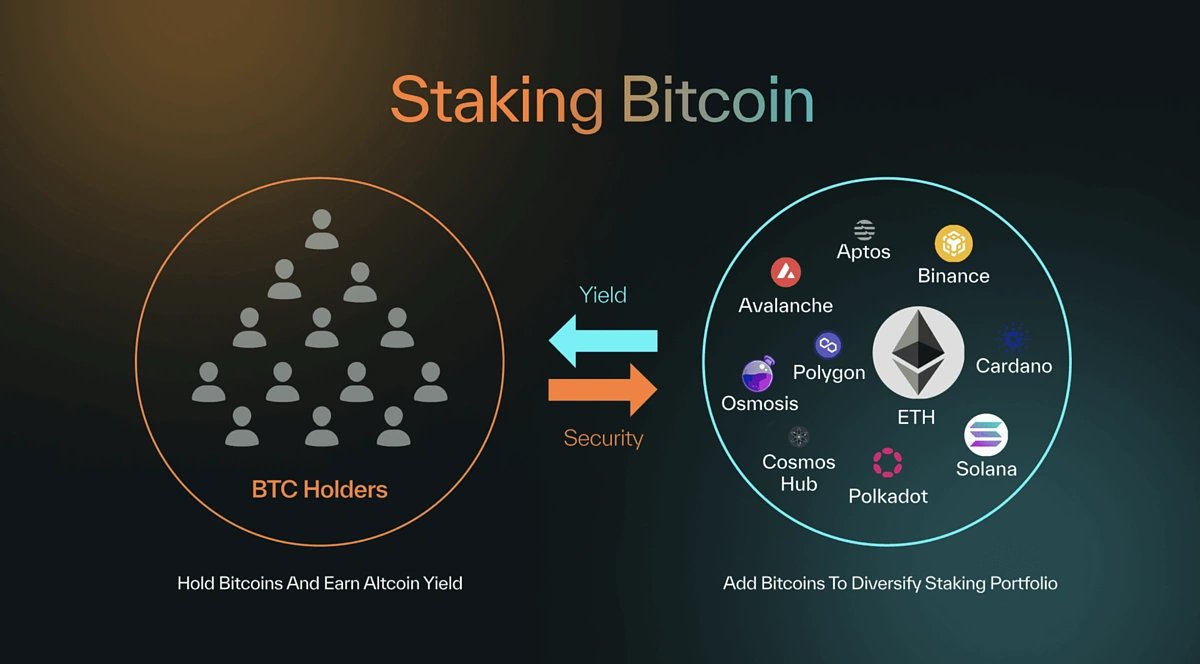

Traditional STX stacking requires locking up a minimum amount of tokens (historically around 90,000 STX) for fixed cycles, often lasting two weeks or more. This model has limited access for smaller holders and forced stackers to choose between earning BTC yield or maintaining liquidity. Liquid stacking, pioneered by platforms like StackingDAO, removes these barriers entirely.

With StackingDAO’s liquid stacking protocol, users deposit STX and instantly receive stSTX or stSTXbtc tokens in return. These tokens represent your staked position and accrue yield automatically. Most importantly, you can trade or use these tokens across DeFi platforms while continuing to earn Bitcoin rewards. No more waiting to unstack or worrying about minimum thresholds; it’s true flexibility for modern DeFi participants.

The Rise of stSTXbtc: Earning sBTC Rewards While Staying Liquid

The newest innovation from StackingDAO is stSTXbtc, a liquid stacking token that allows holders to earn sBTC rewards streamed directly to their wallets after each cycle. Each stSTXbtc token is backed 1: 1 with STX, ensuring transparency and security. Since its launch, over 2 million stSTXbtc have been minted in just one week – a testament to the demand for liquid stacking Bitcoin strategies that don’t compromise on accessibility.

This approach means you can participate in Bitcoin DeFi stacking with as little as a single STX token at the current price of $0.6525. There are no lengthy unstacking delays and no minimums – just immediate APY (currently up to 10% in sBTC), compounding your returns while keeping your capital flexible.

Yield Optimization Strategies With StackingDAO

StackingDAO yield isn’t just about passively holding stSTX or stSTXbtc; advanced users are leveraging these tokens as collateral on lending protocols like Zest to borrow assets while still earning their sBTC rewards. This double-dipping strategy – sometimes called “yield stacking” – is opening new frontiers in risk-managed Bitcoin DeFi returns.

The protocol also features an auto-compounding mechanism for STX yields and periodic point-based reward systems for active participants. Live statistics show that over 400 million STX have been stacked across the network, with average APYs consistently ranging from 8% to over 10%, depending on market conditions and protocol cycles (source). For the latest APY rates and cycle updates, users can always check the official tracker on StackingDAO’s site.

Stacks Technical Analysis Chart

Analysis by Naomi Ellsworth | Symbol: BINANCE:STXUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

To analyze this STX/USDT chart, begin by marking the long-term horizontal support zone near $0.65 (current price) and $0.60, as price has repeatedly formed bases here since 2022 and again in mid-2025. Add a horizontal resistance line around $1.00, a level that capped several rally attempts in 2025. Draw a downward sloping trend line from the 2024 peak (~$3.80) through the lower highs of late 2024 and 2025, connecting them to the most recent high in 2025 (~$1.10). Identify a rectangle to enclose the consolidation range between $0.60 and $1.00 during 2025. Use a callout or text box to note the effect of StackingDAO’s new liquid stacking (stSTXbtc) yielding increased utility/flexibility, which may become a catalyst for accumulation. No clear breakout or breakdown is visible at this time, so keep analysis conservative. Use the long position tool only if price reclaims $1.00 with high volume, as this would confirm a trend reversal.

Risk Assessment: medium

Analysis: Despite strong fundamental growth in the ecosystem and new DeFi innovations, technicals remain weak with price pinned near long-term support. Downtrend is not yet broken. Only consider increasing exposure on confirmed trend reversal.

Naomi Ellsworth’s Recommendation: For long-term, conservative investors, hold off on major accumulation until a clear breakout above $1.00 is confirmed with volume. Maintain strict risk controls if entering at current levels and avoid overexposure. Focus on capital preservation.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.65 – Primary long-term support, repeatedly tested in 2022 and 2025.

strong -

$0.6 – Secondary support, near historical base levels.

moderate

📉 Resistance Levels:

-

$1 – Key resistance and psychological level that has capped recent rallies.

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$0.65 – Potential long-term accumulation zone for disciplined investors, but only with strict risk controls.

medium risk -

$1 – Breakout entry if price closes above with strong volume and momentum.

low risk

🚪 Exit Zones:

-

$0.6 – Stop-loss for accumulation plays below support.

🛡️ stop loss -

$1.2 – First profit target for breakout plays.

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume analysis is not visible in this chart image. Recommend using a callout to remind to monitor for volume spikes on any breakout attempts.

Monitor for surges in volume on any move above $1.00 for confirmation.

📈 MACD Analysis:

Signal: No MACD visible on chart. Would recommend monitoring for bullish cross above zero-line if available.

MACD bullish cross above zero-line would further confirm a trend reversal.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Naomi Ellsworth is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

stSTXbtc (StackingDAO) Price & Yield Prediction 2026-2031

Forecasting the value and yield potential of stSTXbtc based on current market data, adoption rates, and future DeFi trends.

| Year | Minimum Price | Average Price | Maximum Price | Estimated Yield (APY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.60 | $0.82 | $1.05 | 8.5% | Continued growth in liquid stacking; steady BTC yield demand |

| 2027 | $0.72 | $0.98 | $1.30 | 8.0% | Broader DeFi adoption; STX ecosystem expands; increased competition |

| 2028 | $0.85 | $1.15 | $1.55 | 7.8% | BTC price appreciation; regulatory clarity; stSTXbtc integrated as collateral on more platforms |

| 2029 | $0.95 | $1.32 | $1.80 | 7.5% | Potential BTC bull cycle; institutional entry into liquid stacking |

| 2030 | $1.10 | $1.50 | $2.10 | 7.2% | Mainstream adoption of liquid stacking; rise in sBTC utility |

| 2031 | $1.25 | $1.75 | $2.40 | 7.0% | Mature DeFi ecosystem; stSTXbtc widely used in cross-chain protocols |

Price Prediction Summary

stSTXbtc is poised for steady price and yield growth, leveraging both BTC yield and the flexibility of liquid stacking. With increasing adoption, integration into DeFi, and rising BTC prices, stSTXbtc could see its value nearly triple by 2031 under bullish scenarios, while offering consistently attractive APY for holders. Bearish scenarios consider market downturns and increased competition, but the token’s utility and demand for BTC yield are likely to support its long-term value.

Key Factors Affecting StackingDAO stSTXbtc Price

- BTC price fluctuations (primary driver of sBTC yield)

- Adoption rates of StackingDAO and liquid stacking protocols

- Integration of stSTXbtc in DeFi lending/borrowing platforms

- Regulatory developments in STX and DeFi sectors

- Technological improvements in Stack’s protocol and sBTC infrastructure

- Market competition from other liquid staking and yield products

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re seeking flexible exposure to Bitcoin-denominated returns without sacrificing liquidity or composability within DeFi, StackingDAO’s liquid stacking ecosystem offers a compelling solution.

Another key advantage of liquid stacking with StackingDAO is the ability to exit or adjust your position instantly. Unlike traditional stacking, where users are locked in for set cycles and face delays when unstacking, stSTX and stSTXbtc holders can quickly swap or deploy their tokens across integrated DeFi platforms. This flexibility is especially valuable in today’s fast-moving markets, where opportunities and risks can shift rapidly.

With stSTXbtc, users not only keep their STX liquid but also unlock new composability. For example, you can use stSTXbtc as collateral on Zest to borrow stablecoins or other crypto assets, all while your principal continues to accrue sBTC yield. This creates a powerful flywheel effect for sophisticated DeFi strategies, enabling users to stack multiple layers of yield and maximize capital efficiency.

What Makes Liquid Stacking Unique?

Key Benefits of Liquid Stacking with StackingDAO

-

Instant Liquidity: With stSTXbtc, users can access their STX at any time, unlike traditional stacking which locks tokens for a set period.

-

Immediate Yield: Liquid stacking via StackingDAO allows users to earn sBTC rewards instantly after each stacking cycle, rather than waiting for the end of the lock-up period.

-

No Minimum Requirement: StackingDAO removes the traditional 90,000 STX minimum needed for native stacking, making yield accessible to all STX holders.

-

Higher Potential APY: As of September 20, 2025, StackingDAO users can earn up to 10% APY in sBTC, compared to lower rates often seen with traditional stacking.

-

DeFi Utility: stSTXbtc tokens can be used as collateral on platforms like Zest, enabling users to borrow assets while still earning sBTC rewards.

-

Auto-Compounding: StackingDAO’s protocol automatically increases the value of stSTXbtc as rewards are distributed, maximizing long-term returns without manual intervention.

-

Flexible Reward Options: Users can choose to earn BTC or STX yield, adapting their strategy based on market conditions and personal preferences.

What sets StackingDAO apart is its focus on user empowerment and transparency. Each stSTXbtc token is always backed 1: 1 with STX, visible on-chain for full auditability. Rewards are distributed automatically at the end of each cycle, so you don’t have to manually claim or worry about missing out. And with no minimum deposit requirements, anyone can participate, democratizing access to Bitcoin DeFi stacking.

The protocol’s point system further incentivizes long-term participation by rewarding users who hold stSTX tokens over time. These points may be redeemable for future benefits or governance rights as the ecosystem evolves, adding another layer of value for dedicated stackers.

Risks and Considerations

As with any DeFi protocol, it’s important to be mindful of smart contract risk and potential changes in yield rates due to market fluctuations or protocol upgrades. While StackingDAO has seen rapid adoption, with over 2 million stSTXbtc minted in a week, users should review documentation and stay updated via official channels before committing significant capital.

Additionally, price volatility in STX (currently $0.6525) can affect the dollar value of your position even as you earn Bitcoin-denominated rewards. Diversifying across protocols and monitoring APY trends are prudent steps for risk-conscious investors.

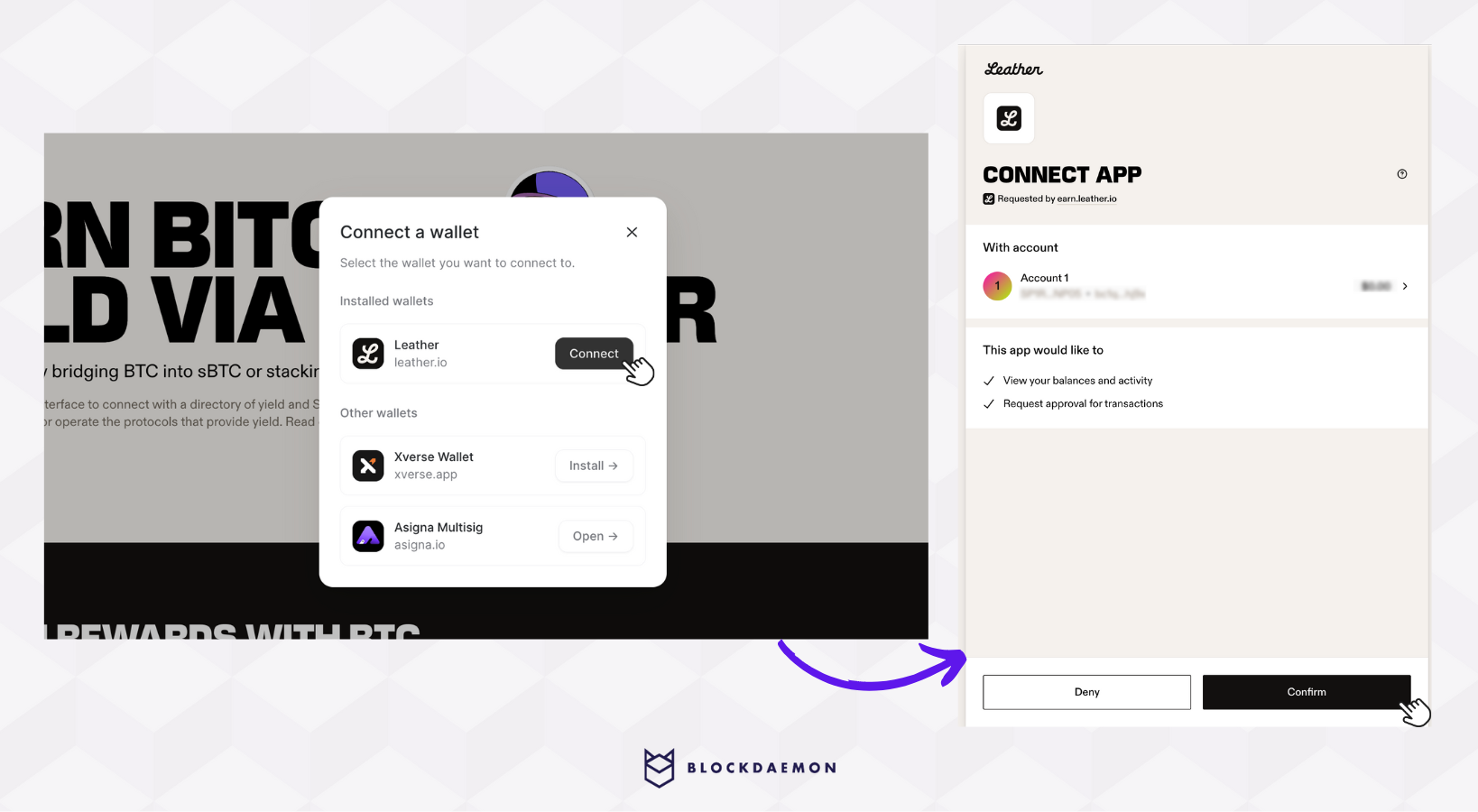

Getting Started With StackingDAO

If you’re ready to explore sBTC liquid stacking, getting started is straightforward:

The process involves connecting your wallet, depositing STX at the current price ($0.6525), receiving stSTXbtc tokens, and watching your sBTC rewards stream in after each cycle, no more waiting periods or complex setup required.

For those looking to optimize further, consider integrating your stSTXbtc into lending protocols or liquidity pools that support these assets, amplifying both yield potential and flexibility within your portfolio.

The rise of liquid stacking marks a pivotal shift in how investors approach Bitcoin DeFi opportunities. By combining instant liquidity, auto-compounding BTC yields up to 10%, and seamless composability across platforms like Zest, StackingDAO positions itself as an essential tool for both new stackers and seasoned crypto strategists alike.