USDe yield farming is rewriting the rules for stablecoin returns. With Ethena’s synthetic dollar surging to a $12 billion supply and new integrations across DeFi, savvy users are stacking yields with real-time, on-chain transparency. But in a market where safety and performance must align, which strategies actually deliver high APY without exposing you to excessive risk?

Why USDe Is the Yield Engine of 2025

Ethena’s USDe isn’t just another stablecoin. It’s engineered for stability through a delta-neutral mechanism: staked ETH collateral is balanced by short ETH perpetuals, keeping its peg at $1 while generating native yield from both staking rewards and funding rates. This design has made USDe the top choice for yield farmers who want to combine safety with aggressive returns.

The Ethena protocol’s TVL reflects this trust, billions of dollars are now staked in sUSDe strategies. Meanwhile, integrations with blue-chip DeFi protocols like Aave V3 and ConvergeOnChain have unlocked new avenues for stacking returns with robust risk management.

Top Three Safe and High-APY USDe Yield Farming Strategies

Top 3 Safe & High-Yield USDe Farming Strategies

-

Stake USDe for sUSDe Yield on Ethena: Deposit USDe into the Ethena protocol to mint sUSDe, earning native yield sourced from funding rates on delta-neutral derivatives positions. This is currently the most direct and popular method, offering competitive APY (around 30%) with protocol-level safety and high TVL.

-

Supply USDe to Aave V3 Lending Markets: Lend USDe on Aave V3 (available on Ethereum mainnet and select L2s) to earn lending interest while maintaining liquidity. This strategy benefits from Aave’s robust risk management and large user base, with additional incentives often provided by both Aave and Ethena.

-

Provide USDe Liquidity in ConvergeOnChain Pools: Pair USDe with ETH or other major assets in ConvergeOnChain’s AMM pools to earn trading fees and potential LP rewards. Advanced users can further optimize by leveraging concentrated liquidity or participating in incentivized pools, balancing yield with impermanent loss risk.

Let’s break down the most compelling ways to maximize your capital efficiency and APY using USDe within the Ethena and Converge ecosystem:

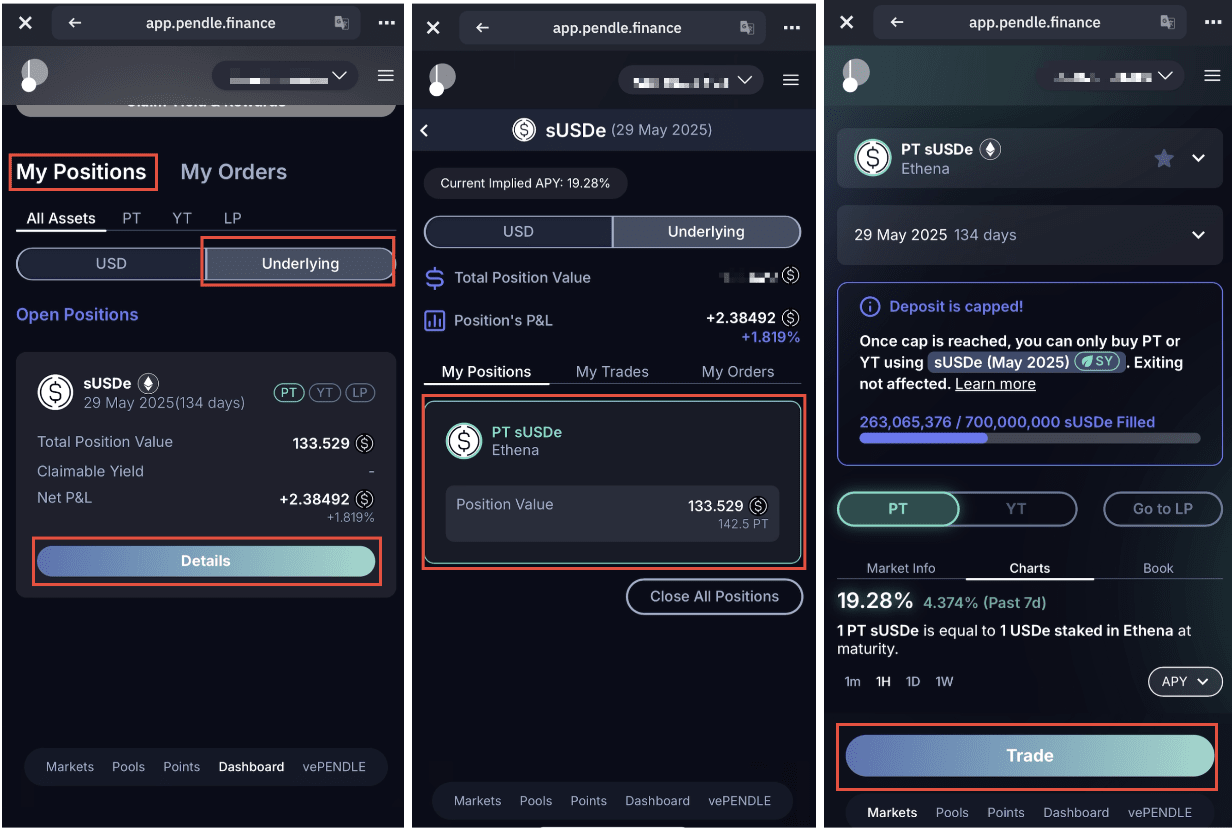

1. Stake USDe for sUSDe Yield on Ethena

This is the flagship strategy for anyone serious about safe stablecoin yield. By depositing your USDe into the Ethena protocol, you mint sUSDe, a staked token that accrues yield natively. The source? Funding rates from delta-neutral derivatives positions combined with ETH staking rewards.

Current APY: Approximately 30%, fluctuating based on market funding rates and ETH staking performance (source). This method is direct, transparent, and backed by rigorous audits. Ethena’s protocol-level safety plus high TVL make it a favorite among institutional and retail DeFi users alike.

Pro tip: Since all rewards are paid in additional USDe (via sUSDe appreciation), compounding is seamless, just hold your sUSDe or restake periodically for maximum effect.

2. Supply USDe to Aave V3 Lending Markets

If you want to keep your liquidity flexible while still earning passive income, supplying USDe to Aave V3 is a top-tier option. Available on Ethereum mainnet and select L2s, this strategy lets you earn lending interest alongside potential incentives from both Aave and Ethena.

Aave’s risk engine is best-in-class, collateral parameters are fine-tuned based on real-time analytics, minimizing systemic risks even during volatile markets. The large user base ensures deep liquidity so you can enter or exit positions efficiently.

- Lending APR: Typically ranges between 6-12% depending on utilization rates.

- BONUS: Watch for periodic incentive programs that can push effective yields higher, these are often announced directly within the protocol UI or via official channels.

If you’re looking for more details on how these lending markets work in practice, check out this overview of DeFi integrations.

The Power of Protocol Security and Real-Time Analytics

No matter which strategy you choose, protocol security is non-negotiable. Both Ethena Labs and Aave have undergone extensive audits; ConvergeOnChain leverages proven AMM frameworks with transparent risk disclosures. Still, smart contract risk remains inherent, always monitor your positions using real-time dashboards or analytics aggregators before deploying large amounts of capital.

The next section will dive deeper into providing liquidity via ConvergeOnChain pools, including how advanced LPs use concentrated liquidity ranges to turbocharge their returns while mitigating impermanent loss exposure.

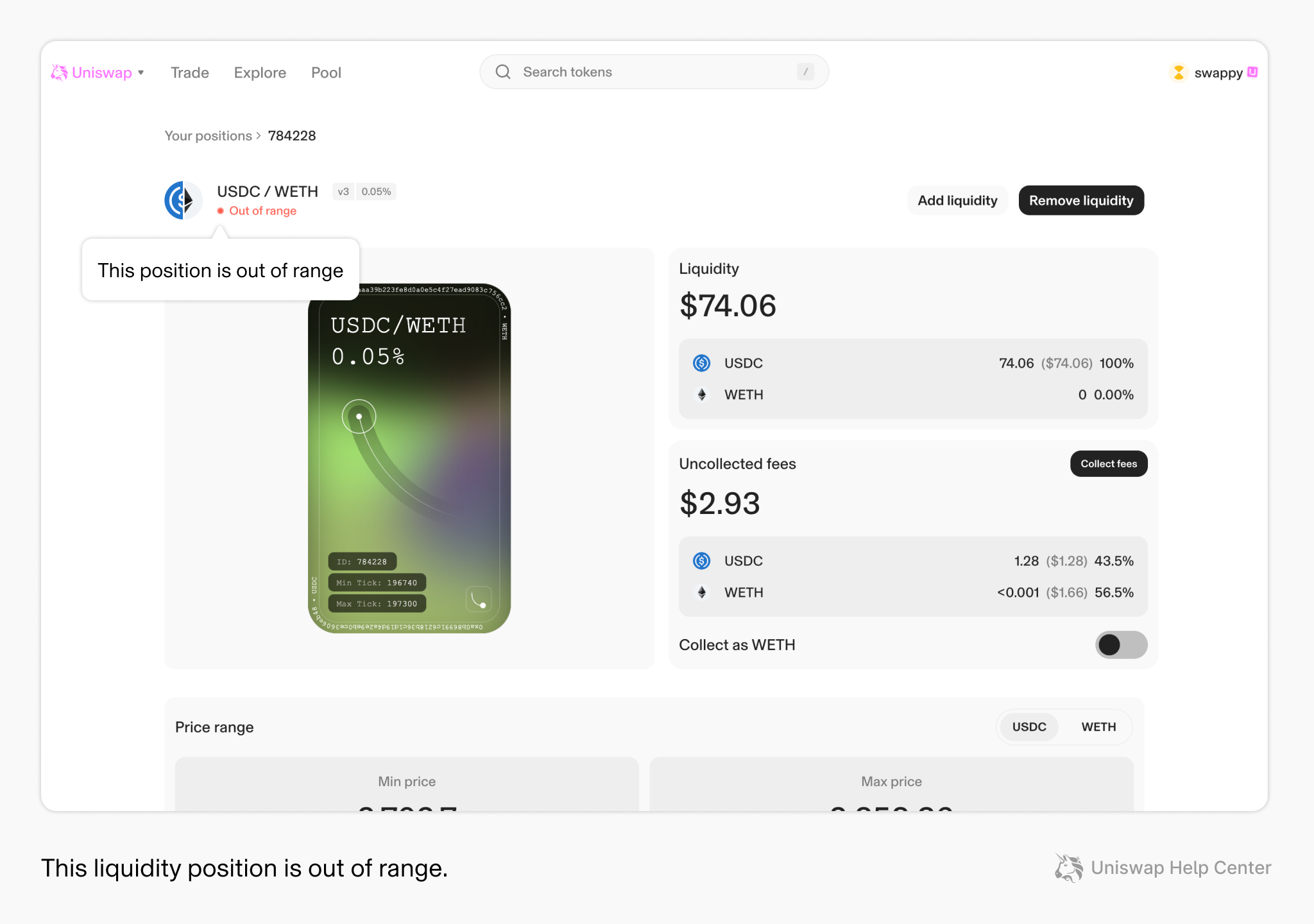

3. Provide USDe Liquidity in ConvergeOnChain Pools

For users seeking to actively manage their capital and tap into trading fee rewards, ConvergeOnChain’s AMM pools are a smart play. By pairing USDe with ETH or other major assets, you become a liquidity provider (LP) in high-volume pools that benefit from both swap fees and protocol incentives. This approach is especially appealing in volatile markets, where stablecoin/ETH pairs see elevated trading volumes.

- Trading Fees: Earned on every swap, these can add up quickly during periods of high volatility.

- LP Incentives: ConvergeOnChain and Ethena frequently run incentive programs for USDe pools, further boosting your yield.

- Advanced Optimization: Skilled LPs can leverage concentrated liquidity strategies, focusing their capital within tight price bands to maximize fee capture while reducing idle exposure.

Note: While impermanent loss (IL) is always a factor when providing liquidity, pairing with a stablecoin like USDe helps mitigate the impact compared to more volatile pairings. Still, it’s wise to monitor pool performance and rebalance as needed.

Stacking Yields Safely: Risk Management Essentials

The golden rule of USDe yield farming: high APY means nothing if you lose principal. Here’s how top DeFi users keep risk in check while chasing those double-digit returns:

- Diversify Strategies: Don’t go all-in on one protocol or pool. Spread your USDe across sUSDe staking, Aave lending, and ConvergeOnChain LP positions for balanced exposure.

- Monitor Real-Time Analytics: Use dashboards to track APY shifts, funding rate changes, and pool utilization, yields move fast in DeFi.

- Avoid Excessive Leverage: Leveraged yield loops can boost returns but also amplify liquidation risk. Stick to moderate collateral ratios unless you’re an advanced user with strict monitoring routines.

- Stay Updated on Incentives: Protocols often rotate incentives; being early to new reward programs can significantly enhance your effective APY.

The Bottom Line: Why USDe Is Dominating Safe Stablecoin Yield

The convergence of Ethena’s delta-neutral architecture, Aave’s lending engine, and ConvergeOnChain’s advanced AMMs has created an ecosystem where safe stablecoin yield, flexibility, and aggressive APY are no longer mutually exclusive. Whether you prefer the set-and-forget simplicity of sUSDe staking or the hands-on optimization of LP strategies on ConvergeOnChain, there’s a playbook here for every risk profile.

The key is dynamic allocation, move your capital where yields are highest but never lose sight of protocol security or market conditions. With real-time analytics at your fingertips and the combined firepower of three blue-chip protocols behind you, USDe holders are positioned at the forefront of DeFi yield innovation in 2025.