Liquid staking has become the DeFi power move of 2024, enabling investors to maximize crypto yield without lockups. Forget the days of watching your ETH or SOL sit idle in a validator contract. With liquid staking, you earn staking rewards and keep your capital nimble, ready to deploy across the hottest DeFi protocols at a moment’s notice. As Ethereum (ETH) holds firm at $4,469.01, the competition for flexible, compounding returns is heating up. Here’s how top protocols and strategies are rewriting the rules of yield stacking.

Why Liquid Staking Beats Traditional Staking in 2024

Traditional staking locks your assets away, often for months, leaving you unable to react to market swings or new opportunities. Liquid staking flips this on its head by issuing Liquid Staking Tokens (LSTs): tradable tokens that represent your staked position and accrue rewards in real time. These LSTs unlock a universe of DeFi integrations: from lending and borrowing to yield farming and restaking.

The global liquid staking market has surged past $185 million in 2024 (Valuates Reports), with no signs of slowing down. The main drivers? Enhanced liquidity management, immediate access to capital, and seamless integration with next-gen DeFi platforms.

Top 7 Liquid Staking Strategies and Protocols Maximizing Yield Without Lockups

Top 7 Liquid Staking Strategies & Protocols in 2024

-

Lido Finance: Ethereum Liquid Staking and DeFi Yield IntegrationLido allows users to stake Ethereum and receive stETH, a liquid staking token that accrues rewards and is widely accepted across DeFi platforms for additional yield opportunities. Lido’s deep integration with protocols like Curve and Aave maximizes capital efficiency and flexibility.

-

Marinade Finance: Non-Custodial Solana Liquid Staking with mSOLMarinade enables non-custodial staking of Solana (SOL) in exchange for mSOL, a liquid staking token. Users can use mSOL in Solana DeFi apps, combining staking rewards with DeFi yields—without lockups or centralized custody.

-

EigenLayer Restaking: Yield Stacking with Ethereum LSTsEigenLayer lets users restake their Ethereum liquid staking tokens (like stETH or rETH) to secure additional networks or services, earning multiple layers of rewards. This innovative strategy enables yield stacking while maintaining liquidity.

-

Rocket Pool: Decentralized ETH Liquid Staking for Node Operators and DelegatorsRocket Pool offers decentralized Ethereum staking with as little as 0.01 ETH. Users receive rETH, which can be used in DeFi, while node operators and delegators both earn rewards—maximizing accessibility and decentralization.

-

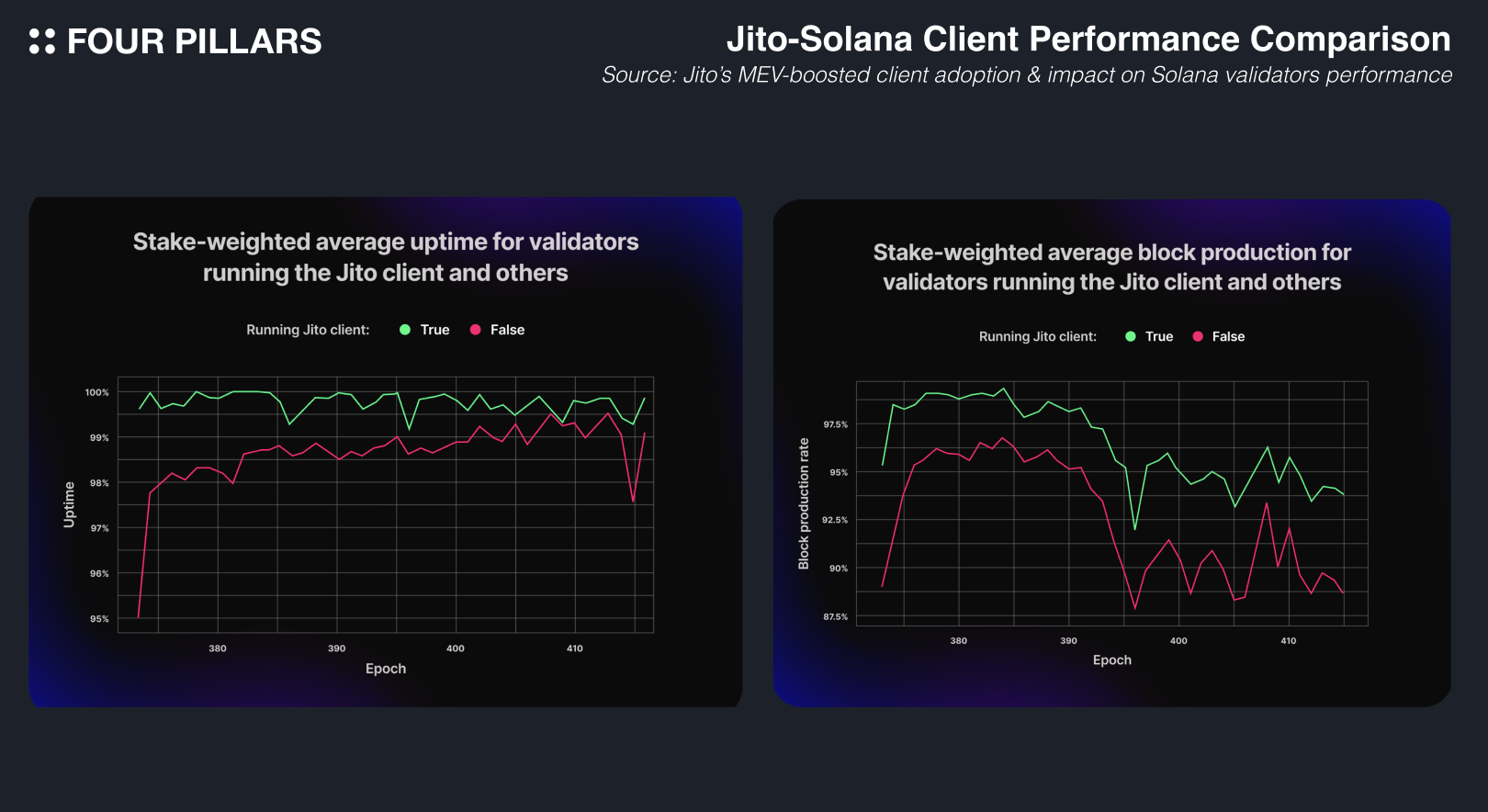

Jito: MEV-Boosted Solana Liquid Staking for Enhanced YieldJito provides liquid staking on Solana with a unique twist: it shares MEV (Maximal Extractable Value) rewards with users who stake SOL for JitoSOL, leading to higher yields than traditional staking.

-

Stader Labs: Multi-Chain Liquid Staking Solutions (ETHx, MaticX, BNBx)Stader offers liquid staking across multiple blockchains, including Ethereum (ETHx), Polygon (MaticX), and BNB Chain (BNBx). Users receive LSTs for each chain, enabling cross-chain DeFi yield strategies and flexible compounding returns.

-

Pendle Finance: Tokenizing and Trading Future Yields on LSTsPendle Finance allows users to tokenize and trade the future yield of their LSTs, unlocking advanced yield strategies like fixed-rate income or yield speculation—maximizing flexibility and optimizing returns in DeFi.

Lido Finance: Ethereum Liquid Staking and DeFi Yield Integration

Lido Finance is the undisputed king of Ethereum liquid staking in 2024. Stake your ETH and receive stETH, a token that not only accrues ETH staking rewards but can be deployed across DeFi blue chips like Curve, Aave, and Yearn for extra APY. The liquidity of stETH means you’re never stuck waiting out withdrawal periods; you can trade or use it as collateral instantly, compounding your earnings through multiple layers of yield stacking.

Marinade Finance and Jito: Solana’s Dual Approach to Flexible Yield

Marinade Finance brings non-custodial liquid staking to Solana with mSOL, your ticket to earning SOL rewards while keeping your funds liquid for trading or leveraging in Solana-based DeFi apps. What sets Marinade apart is its focus on decentralization: users retain custody over their keys while benefiting from a robust validator set.

Jito, meanwhile, supercharges Solana yields by capturing MEV (Maximal Extractable Value) on top of standard staking rewards. By holding JitoSOL instead of regular staked SOL, users tap into an additional stream of MEV revenue, an edge that’s only possible through liquid staking mechanics.

EigenLayer Restaking and Rocket Pool: Supercharging ETH Yields Through Restaking and Decentralization

The next wave in yield stacking DeFi? Restaking protocols like EigenLayer. Here’s how it works: take your Lido stETH or Rocket Pool rETH and restake them on EigenLayer to secure additional networks (AVSs), unlocking a second layer of rewards on top of base ETH yields. This strategy compounds returns without ever locking up your capital, a game changer for aggressive yield hunters.

Rocket Pool, meanwhile, democratizes Ethereum liquid staking by lowering entry barriers for both node operators and delegators. Stake as little as 0.01 ETH and receive rETH, a fully transferable token with built-in reward accrual that’s accepted across major DeFi platforms.

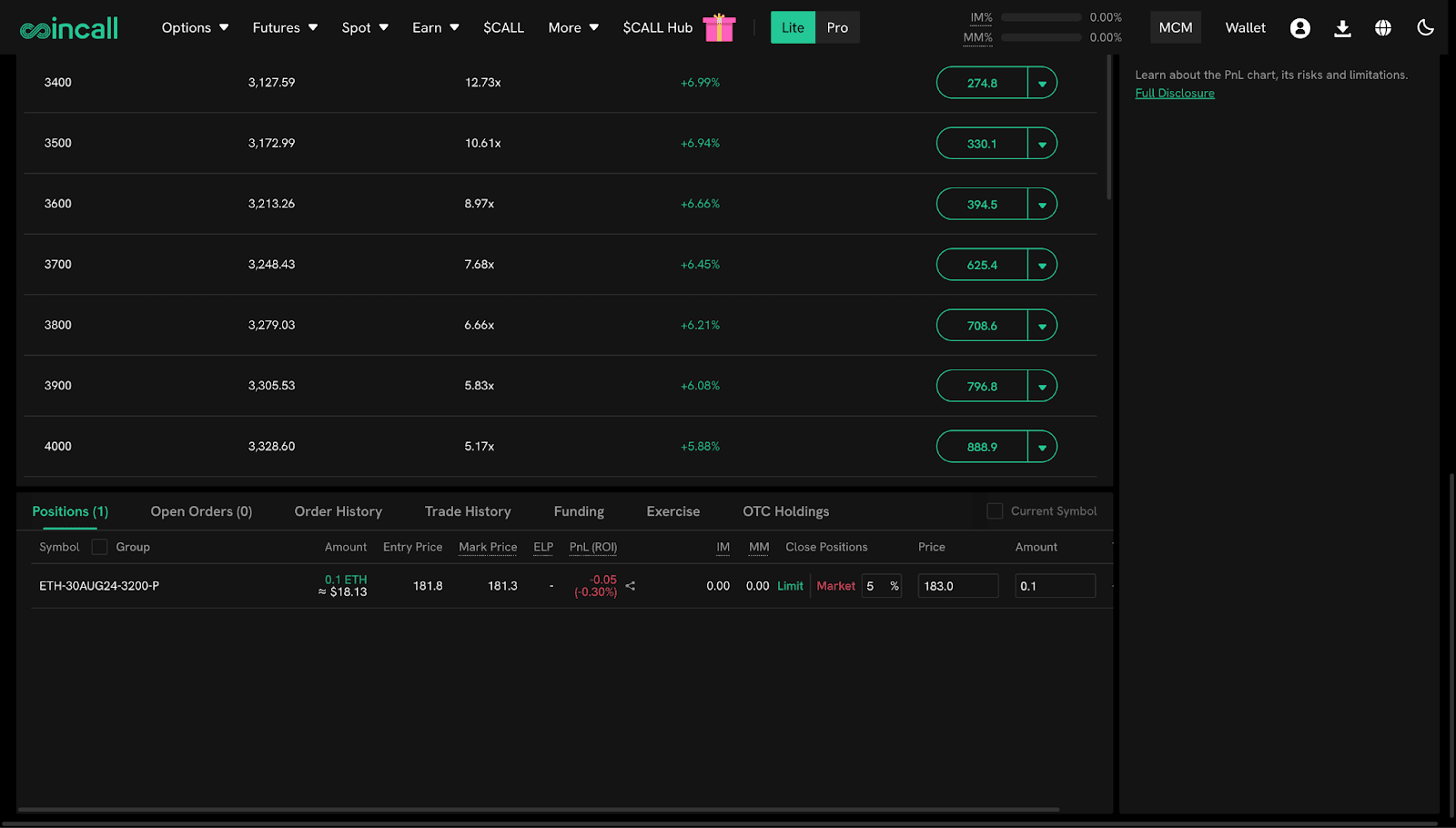

Ethereum (ETH) Price Prediction 2026-2031

Comprehensive ETH price outlook based on liquid staking trends, DeFi adoption, and evolving market conditions. All prices in USD.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change from 2025 Avg | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $6,700 | +16% | Continued DeFi & liquid staking growth; moderate volatility |

| 2027 | $4,600 | $6,100 | $8,500 | +17% | Layer-2 scaling, regulatory clarity, ETH ETF expansion |

| 2028 | $5,200 | $7,300 | $10,200 | +20% | Global institutional adoption, DeFi mainstreaming |

| 2029 | $6,000 | $8,600 | $12,800 | +18% | Major tech upgrades, new staking models, strong macro tailwinds |

| 2030 | $7,200 | $10,200 | $15,600 | +19% | ETH as DeFi backbone, cross-chain integrations, robust demand |

| 2031 | $8,400 | $12,000 | $18,900 | +18% | Widespread Web3/DeFi adoption, ETH as digital yield benchmark |

Price Prediction Summary

Ethereum is projected to experience steady, progressive price growth from 2026 to 2031, driven by increased adoption of liquid staking, DeFi innovation, and technological upgrades. While the minimum price scenario reflects possible market corrections and regulatory headwinds, the maximum price scenario incorporates robust institutional adoption and Ethereum’s strengthening role as the backbone of decentralized finance. Average price predictions suggest a healthy and sustainable uptrend, with ETH potentially reaching a five-year compound annual growth rate (CAGR) of 16-20%.

Key Factors Affecting Ethereum Price

- Growth and security of leading liquid staking protocols (e.g., Lido, Rocket Pool, EigenLayer)

- Ethereum scalability improvements (Layer-2, sharding)

- Regulatory developments (SEC/ETF approval, global policy)

- Institutional adoption and integration into financial systems

- Broader DeFi and Web3 ecosystem expansion

- Potential competition from alternative smart contract platforms

- Macro market cycles, including Bitcoin halving events and global risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staking with Rocket Pool is about more than just yield, it’s about decentralization. By empowering anyone to run a node or delegate ETH, Rocket Pool strengthens Ethereum’s security while letting users maximize returns with rETH. The real kicker? rETH can be pooled into DeFi protocols like Balancer or used as collateral in lending markets, stacking even more APY on top of your base rewards. With Ethereum trading at $4,469.01, the compounding effect of liquid staking plus DeFi integrations is too powerful to ignore.

Stader Labs and Pendle Finance: Multi-Chain Flexibility and Yield Tokenization

Stader Labs leads the multi-chain charge, offering liquid staking solutions for Ethereum (ETHx), Polygon (MaticX), and BNB Chain (BNBx). This cross-chain flexibility means you can deploy capital wherever yields are hottest, no lockups, no missed opportunities. Stader’s integration with restaking protocols lets you double-dip on rewards by layering DeFi incentives over native staking APY, all while keeping your assets liquid for instant redeployment.

Pendle Finance takes things a step further by tokenizing future yield streams from LSTs. Imagine locking in or trading the expected yield from stETH or mSOL, Pendle lets you do just that by splitting tokens into principal and yield components. This unlocks advanced strategies like hedging against rate changes, speculating on future APY, or even selling your future rewards for upfront liquidity. For sophisticated DeFi users, Pendle is the toolkit for making yield a tradable asset class.

Real-World Yield Stacking Playbook: How Pros Are Maximizing Returns

The most aggressive yield stackers in 2024 aren’t satisfied with single-layer rewards, they’re building multi-protocol loops:

- Stake ETH on Lido to receive stETH.

- Restake stETH on EigenLayer for additional AVS rewards.

- Deposit stETH into Curve or Aave to earn lending/yield farming fees.

- Tokenize future stETH yields on Pendle to lock in returns or speculate on APY swings.

This playbook isn’t limited to Ethereum: Solana power users are pairing Marinade mSOL with JitoSOL to capture both validator and MEV yields, then deploying those LSTs across Solana’s thriving DeFi ecosystem. On Polygon and BNB Chain, Stader’s MaticX and BNBx open similar doors, stacking native chain rewards with DeFi incentives and restaking bonuses where available.

Key Risks: Smart Contracts, Market Volatility and Slashing

No strategy is bulletproof. Liquid staking introduces smart contract risk at every step, if any protocol in your stack suffers a bug or exploit, your funds could be at risk. Market volatility can impact LST prices relative to their underlying assets (think depegs), potentially eroding returns during turbulent periods. And while rare, validator slashing events may hit your principal if underlying operators misbehave.

Smart investors mitigate these risks by spreading exposure across multiple platforms (Lido and Rocket Pool and Marinade), using audited protocols only, and keeping a close eye on protocol health metrics before looping capital through complex strategies.

The Future of Liquid Staking: Frictionless Yield and Capital Efficiency

The data doesn’t lie: as liquid staking protocols mature and integrate deeper with DeFi rails, the friction between earning passive income and maintaining liquidity disappears. In 2024’s market, with ETH anchored at $4,469.01: savvy users are leveraging these seven strategies not just for incremental gains but for exponential compounding via restaking and creative DeFi integrations.

If you want to stay ahead of the curve in yield stacking DeFi, keep these platforms at the top of your watchlist, and remember: yield doesn’t wait, neither should you.