Liquid staking has transformed the landscape of Solana yield generation, but the arrival of JitoSOL marks a new paradigm in how users can maximize returns. By combining traditional staking rewards with MEV (Maximum Extractable Value) profits, JitoSOL offers a compelling answer to the question: How can you unlock extra DeFi yield on Solana without sacrificing liquidity or network participation?

6-Month Price Performance Comparison: JitoSOL, SOL, and Major Crypto Assets

Comparing the 6-month price performance of JitoSOL (MEV-enabled liquid staking token), native SOL, and other leading cryptocurrencies. Highlighting the impact of MEV rewards and yield differences for Solana stakers.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Jito Staked SOL (JitoSOL) | $263.77 | $250.78 | +5.2% |

| Solana (SOL) | $213.78 | $135.98 | +57.2% |

| Marinade Staked SOL (MSOL) | $283.58 | $269.40 | +5.3% |

| Bitcoin (BTC) | $113,633.00 | $60,195.25 | +88.7% |

| Ethereum (ETH) | $4,173.00 | $2,415.74 | +72.7% |

| Lido Staked Ether (STETH) | $4,168.42 | $2,414.44 | +72.6% |

| Binance Coin (BNB) | $1,015.64 | $560.77 | +81.1% |

| Lido DAO (LDO) | $1.12 | $0.5800 | +93.1% |

Analysis Summary

Over the past six months, JitoSOL and Marinade Staked SOL have shown modest price gains (~5%), reflecting the stable nature of liquid staking tokens tied to SOL’s underlying value. In contrast, native SOL has significantly outperformed its staked derivatives with a +57.2% increase, while major assets like Bitcoin, Ethereum, and Lido DAO have experienced even larger gains. JitoSOL’s value stability highlights its focus on yield maximization via staking and MEV rewards, rather than speculative price appreciation.

Key Insights

- JitoSOL and MSOL closely track SOL’s price but show only modest gains, as expected for liquid staking tokens designed to accrue staking and MEV rewards.

- Native SOL’s price appreciation (+57.2%) far outpaces its staked derivatives, reflecting higher market demand and volatility for the base asset.

- JitoSOL’s additional MEV rewards enhance yield for holders, but this is not directly reflected in price appreciation over six months.

- Major assets like Bitcoin (+88.7%), Ethereum (+72.7%), and Lido DAO (+93.1%) have outperformed both SOL and its staking derivatives in price terms, highlighting a broader bullish trend in the market.

All price data is sourced directly from the provided real-time market data as of 2025-09-24. The table compares current and 6-month historical prices, with percentage changes calculated as provided. No estimates or external data were used.

Data Sources:

- Main Asset: CoinMarketCap

- Solana: Yahoo Finance

- Ethereum: Yahoo Finance

- Bitcoin: Yahoo Finance

- Lido Staked Ether: Yahoo Finance

- Marinade Staked SOL: CoinMarketCap

- Binance Coin: Yahoo Finance

- Lido DAO: Yahoo Finance

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Solana Liquid Staking: Beyond Traditional Rewards

The classic model of staking SOL involves locking up tokens with validators to secure the network and earn protocol rewards. However, this approach ties up capital and caps yield at the base network rate. Enter JitoSOL, a liquid staking token on Solana that radically expands what’s possible for stakers. As of today, SOL trades at $213.82, making every basis point of extra yield especially meaningful for sophisticated investors and institutions alike.

With JitoSOL, users deposit their SOL into a non-custodial pool and receive liquid JitoSOL tokens in return. These tokens accrue not just standard staking rewards but also a share of MEV profits captured by Jito’s specialized validator infrastructure. This dual-reward model directly addresses two pain points in DeFi:

- Capital Efficiency: Liquid staking tokens like JitoSOL can be deployed across DeFi protocols for lending, farming, or collateralization while still earning yield.

- Yield Optimization: MEV extraction creates an additional revenue stream layered on top of base staking returns.

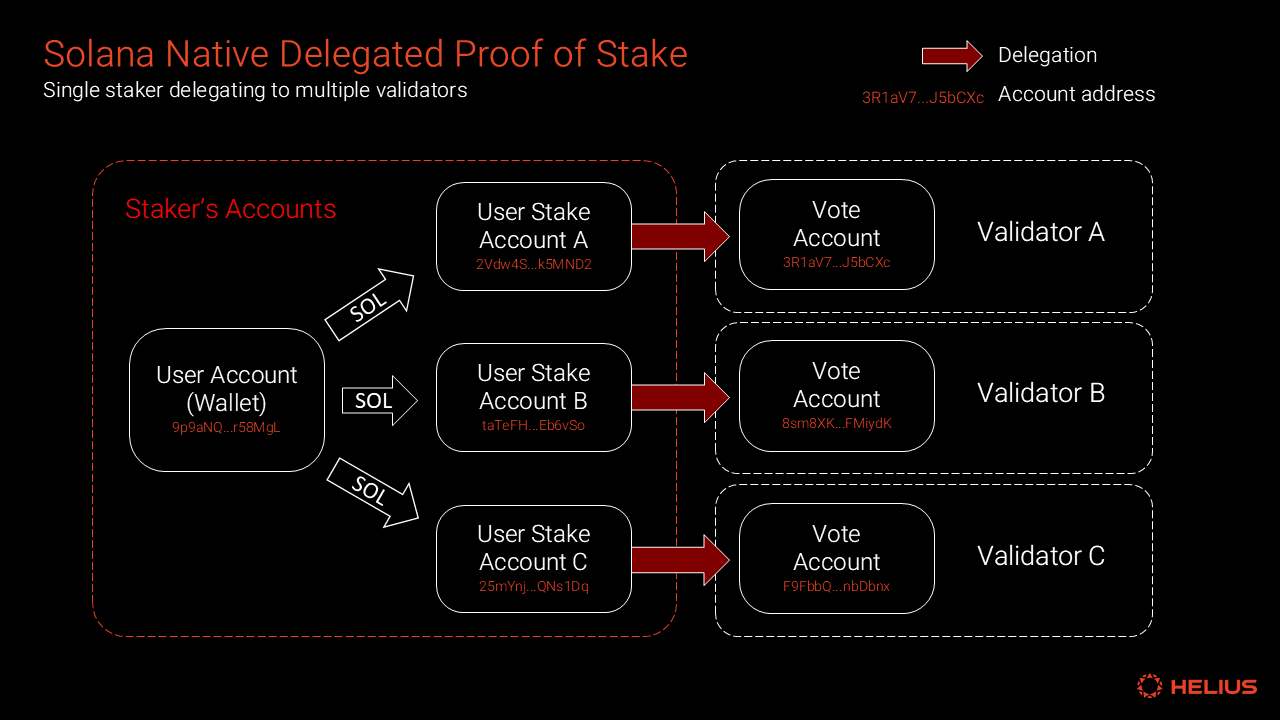

The Mechanics: How JitoSOL Captures MEV Yield on Solana

MEV on Solana refers to profits generated from reordering, including, or excluding transactions within blocks, think arbitrage opportunities or liquidation events triggered by high-frequency trading bots. Unlike most networks where these profits accrue to validators or block producers alone, Jito’s architecture routes a portion of these gains back to stakers via its liquid staking pool.

The process unfolds as follows:

- Stake SOL → Receive JitoSOL: Users deposit SOL into the pool; in return, they receive a proportional amount of JitoSOL tokens.

- MEV-Optimized Validators: The staked SOL is delegated to validators running Jito’s custom client, which is engineered to capture MEV efficiently.

- Pooled Distribution: Profits from MEV are aggregated and distributed back to all JitoSOL holders, boosting overall APY above standard rates.

- LST Utility: Because JitoSOL is fully liquid, it can be used across DeFi platforms for further compounding yields or providing liquidity.

The result? A self-reinforcing flywheel where more TVL leads to more MEV captured, and thus higher rewards for all participants.

The Macro View: Why MEV Rewards Matter in Today’s Market

The race for yield is intensifying as institutional capital flows into Solana’s DeFi ecosystem. With SOL holding steady at $213.82, incremental returns from innovative products like JitoSOL are increasingly attractive, especially when compared with vanilla staking options that lack both liquidity and access to MEV revenues.

This macro environment favors protocols that can consistently deliver outsized risk-adjusted returns while maintaining security and decentralization. By routing MEV rewards back to LST holders and supporting validator diversity, Jito bolsters both user incentives and network health, a critical consideration as competition among Solana liquid staking protocols heats up.

JitoSOL (JitoSOL) Price Prediction 2026–2031 vs. SOL

Forecasts based on current market conditions, MEV yield trends, and Solana ecosystem growth

| Year | Minimum Price (JitoSOL) | Average Price (JitoSOL) | Maximum Price (JitoSOL) | % Change (Avg vs. Prior Year) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $190.00 | $235.00 | $265.00 | +10% | MEV rewards keep JitoSOL yield above native SOL; SOL market remains bullish with continued DeFi adoption. |

| 2027 | $225.00 | $260.00 | $300.00 | +11% | JitoSOL benefits from increased integration across Solana DeFi; regulatory clarity boosts liquid staking sector. |

| 2028 | $240.00 | $295.00 | $340.00 | +13% | Rising institutional adoption of liquid staking; JitoSOL MEV strategies mature, supporting higher average yields. |

| 2029 | $260.00 | $335.00 | $385.00 | +14% | Solana ecosystem expands; JitoSOL maintains premium thanks to efficient MEV capture and DeFi composability. |

| 2030 | $290.00 | $380.00 | $440.00 | +13% | Technological advancements and broader DeFi integration push yields and demand for JitoSOL higher. |

| 2031 | $320.00 | $420.00 | $495.00 | +11% | Market matures; JitoSOL’s position as leading Solana LST remains strong, but growth rates stabilize. |

Price Prediction Summary

JitoSOL is projected to outperform native SOL in yield and price growth due to its dual reward structure (staking + MEV). As Solana’s DeFi ecosystem expands and MEV strategies become more sophisticated, JitoSOL’s value proposition strengthens. The predictions account for both bullish and bearish market cycles, with a logical, progressive increase in average price reflecting Solana’s adoption and JitoSOL’s unique value in the ecosystem.

Key Factors Affecting JitoSOL Price

- Solana network adoption and DeFi activity levels

- Efficiency and competitiveness of JitoSOL’s MEV strategies

- Regulatory developments around liquid staking and MEV extraction

- Overall crypto market sentiment and cycles

- Integration of JitoSOL across DeFi protocols and CEXs

- Technological improvements in Solana and staking infrastructure

- Potential emergence of competing liquid staking tokens or MEV solutions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

JitoSOL’s unique approach to Solana liquid staking is not just about squeezing out a few extra percentage points. It’s about fundamentally shifting how value is distributed in the staking ecosystem. By democratizing access to MEV rewards, JitoSOL empowers everyday stakers and DeFi users, rather than just validators, to benefit from the hidden revenue streams that underpin modern blockchain economies.

This model has powerful implications for DeFi composability. With JitoSOL, users are free to deploy their assets across lending markets, automated market makers, and yield aggregators, unlocking extra DeFi yield on Solana while retaining exposure to both staking and MEV-derived rewards. This kind of capital efficiency is a game changer for portfolio construction and risk management in digital asset markets.

Risk Factors and Considerations for JitoSOL Users

No yield strategy is without trade-offs. While JitoSOL offers superior returns compared to traditional staking, users should be aware of several factors:

Risks and Considerations When Using JitoSOL

-

Smart Contract Vulnerabilities: JitoSOL relies on complex smart contracts and validator infrastructure. Bugs or exploits in the protocol could put staked funds at risk.

-

MEV Extraction Risks: While MEV boosts yield, it introduces new attack vectors and operational risks. MEV strategies may not always be profitable and can be subject to manipulation or technical failures.

-

Slashing and Validator Performance: Jito delegates SOL to MEV-enabled validators. If these validators misbehave or go offline, stakers may face slashing penalties, impacting returns.

-

Liquidity and Market Risks: Although JitoSOL is designed for liquidity, market demand can fluctuate. Large sell-offs or low liquidity on DeFi platforms could make it difficult to redeem JitoSOL for SOL at expected rates.

-

Protocol and Governance Changes: Updates to the Jito protocol or governance decisions could alter reward structures, fees, or supported integrations, affecting user yields and experience.

-

Regulatory Uncertainty: The regulatory landscape for liquid staking and MEV on Solana is still evolving. Future regulations could impact the use, taxation, or legality of JitoSOL.

Slashing risk remains present if a validator misbehaves, although Jito’s infrastructure is designed to minimize this through robust validator selection. Smart contract risk is also inherent in any protocol-based solution; thorough audits and active monitoring help mitigate these concerns but cannot eliminate them entirely.

A final consideration: as the popularity of MEV grows, competition among validators may compress MEV profits over time. Staying updated on protocol changes and reward dynamics will be crucial for maximizing long-term returns.

How to Get Started with JitoSOL

The process is straightforward for those looking to tap into JitoSOL MEV yield. Users simply deposit SOL via the official pool interface or compatible wallets such as Phantom. In return, they receive liquid JitoSOL tokens which can be tracked, traded, or deployed across a growing array of Solana DeFi platforms.

The ability to earn both base staking rewards and dynamic MEV income, without sacrificing liquidity, is why many see JitoSOL as the new benchmark for liquid staking token Solana strategies.

The current market price of SOL at $213.82 underscores the significance of every incremental basis point earned through advanced strategies like this one. As more capital flows into Solana’s DeFi stack, expect further innovation around LSTs and MEV capture mechanisms, making it more important than ever for investors to stay informed and agile.

‘tweet: A tweet from @JitoNetwork announcing record-breaking weekly MEV rewards distributed to JitoSOL holders’

Key Takeaways: JitoSOL’s Role in Yield Stacking on Solana

- Diversified Yield Streams: Combine base staking returns with MEV rewards for superior APY.

- LST Composability: Use your JitoSOL across multiple DeFi protocols without lock-up periods.

- Network Health: Support decentralization and efficiency by participating in a protocol that incentivizes high-performance validators.

- Real-Time Adaptation: Monitor market conditions (like SOL’s current price at $213.82) and adjust your strategy as new opportunities emerge.

JitoSOL (JITOSOL) Price Prediction vs. SOL Yield Outlook (2026-2031)

Forecast based on current market, MEV yield trends, and Solana ecosystem growth. Prices reflect JitoSOL’s premium over SOL due to enhanced yield and DeFi utility.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | JitoSOL Premium vs. SOL (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $220.00 | $245.00 | $280.00 | +3% to +6% | Continued DeFi adoption, stable MEV rewards |

| 2027 | $235.00 | $275.00 | $320.00 | +4% to +7% | Solana upgrades, JitoSOL DeFi integration expands |

| 2028 | $260.00 | $310.00 | $375.00 | +4% to +8% | Bullish on MEV extraction, regulatory clarity |

| 2029 | $290.00 | $345.00 | $430.00 | +5% to +9% | Institutional adoption, higher MEV competition |

| 2030 | $315.00 | $390.00 | $500.00 | +5% to +10% | Peak cycle, Solana ecosystem maturity |

| 2031 | $340.00 | $425.00 | $565.00 | +5% to +11% | Sustained adoption, advanced MEV strategies |

Price Prediction Summary

JitoSOL is forecasted to maintain a steady premium over SOL due to its combined staking and MEV yield. As MEV strategies mature and DeFi integration deepens, JitoSOL could significantly outperform traditional SOL staking, especially in bullish market scenarios. However, price volatility will reflect both Solana’s broader market cycles and the evolving MEV landscape.

Key Factors Affecting JitoSOL Price

- Solana network upgrades and scalability improvements

- Regulatory clarity on liquid staking and MEV practices

- Growth of Solana DeFi and demand for liquid staking tokens

- Competition from other liquid staking protocols and MEV solutions

- Crypto market cycles and global macroeconomic conditions

- MEV extraction efficiency and validator participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.