Ethereum’s liquid staking tokens (LSTs) have become the cornerstone of advanced DeFi yield strategies, especially as the market matures into 2024. With Ethereum (ETH) trading at $4,140.68 as of September 30,2025, and institutional adoption on the rise, LSTs now offer a dynamic pathway for both passive and active investors to optimize returns while maintaining flexibility. But how do you capitalize on this evolving landscape without falling prey to unnecessary risk? Let’s break down the five most actionable strategies for maximizing yield with Ethereum LSTs, rooted in current best practices and market realities.

1. Utilize Leading LST Protocols for Secure and Liquid ETH Staking

The first step in any robust Ethereum liquid staking strategy is choosing a reputable protocol. In 2024, Lido Finance and Rocket Pool remain the gold standard for secure, liquid ETH staking. Lido’s stETH and Rocket Pool’s rETH dominate both in terms of total value locked (TVL) and user trust. These platforms allow you to stake ETH without sacrificing liquidity, meaning your capital remains accessible for further DeFi deployment.

Lido currently controls nearly 32% of all staked ETH, offering an attractive APR of around 6.2%. Rocket Pool appeals to those seeking decentralization and flexibility, with APRs between 4.9% and 5.5%. By using these protocols as your foundation, you ensure reliable base yields while unlocking access to a wide array of secondary DeFi opportunities.

2. Deploy LSTs in Top DeFi Lending Markets to Earn Dual Yields

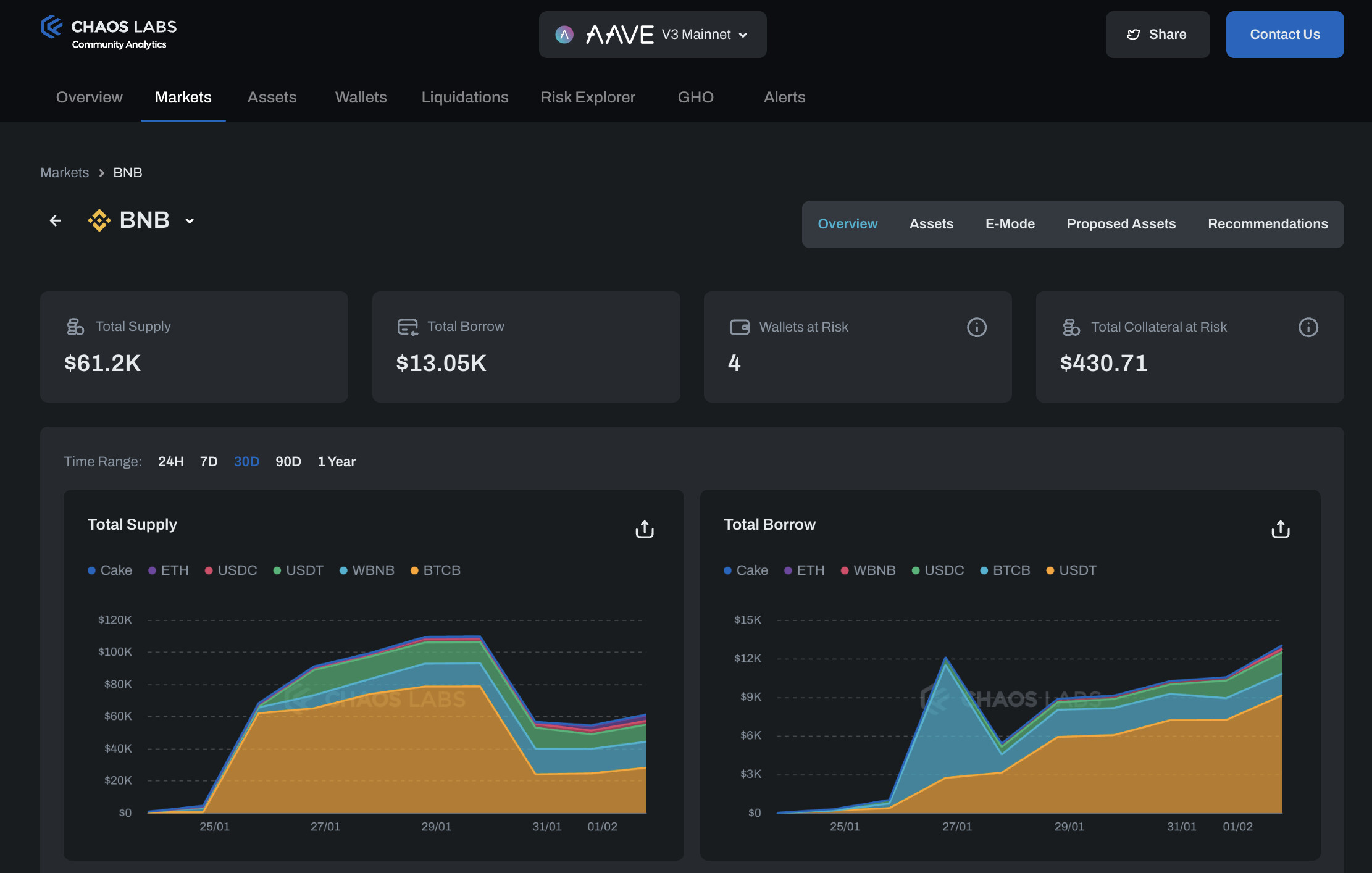

Once you hold LSTs like stETH or rETH, don’t let them sit idle, put them to work in leading lending markets such as Aave, Morpho Blue, or Compound v3. These platforms allow you to supply your LSTs as collateral or lend them out directly, generating an additional layer of yield on top of your base staking rewards.

This dual-yield structure is at the heart of modern yield stacking with LSTs. For example, supplying stETH on Aave not only accrues lending interest but also preserves your underlying staking APY from Lido, a powerful combination that amplifies returns without requiring leverage or excessive risk-taking.

Ethereum (ETH) Price Prediction 2026-2031

Professional outlook based on DeFi, liquid staking, and macro crypto trends as of Q4 2025.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,550 | $4,700 | $6,200 | +13.5% | Potential post-bull market retracement; DeFi adoption stabilizes, regulatory clarity increases. |

| 2027 | $4,100 | $5,400 | $7,800 | +14.9% | Gradual adoption of ETH 2.0 enhancements; LSTs mature, but competition from L2s and alt-L1s rises. |

| 2028 | $4,800 | $6,250 | $9,200 | +15.7% | Institutional DeFi grows; ETH remains core collateral, but macro headwinds possible. |

| 2029 | $5,500 | $7,300 | $11,000 | +16.8% | ETH benefits from global DeFi integration and further staking innovations; regulatory frameworks solidify. |

| 2030 | $6,200 | $8,400 | $13,200 | +15.1% | Bullish scenario: ETH secures dominant role in cross-chain DeFi; bearish: increased competition from new protocols. |

| 2031 | $6,900 | $9,500 | $15,000 | +13.1% | ETH achieves ‘blue chip’ status as Web3 backbone; scalability and utility drive new highs, but risks remain. |

Price Prediction Summary

Ethereum’s price outlook remains bullish through 2031, supported by the continued rise of DeFi, liquid staking, and increased institutional participation. While the average price is projected to grow steadily year over year, volatility persists with potential for both strong upside and periodic corrections. ETH’s role as the foundational asset in DeFi and staking positions it for long-term growth, but competition and regulatory changes could create headwinds.

Key Factors Affecting Ethereum Price

- Adoption and integration of liquid staking tokens (LSTs) in DeFi protocols

- Institutional and retail participation in ETH staking and DeFi

- Regulatory developments in major markets (US, EU, Asia)

- Upgrades to Ethereum protocol (scalability, security, new use cases)

- Competition from alternative L1s and L2s

- Global macroeconomic conditions and crypto market cycles

- Risks from slashing, smart contract exploits, and centralization of staking pools

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Leverage LST/ETH Liquidity Pools on DEXes for Yield Stacking and Trading Fees

The synergy between liquid staking tokens and decentralized exchanges (DEXes) is one of the most compelling developments in DeFi this year. By providing liquidity to pools such as stETH/ETH or rETH/ETH on platforms like Balancer or Curve, you not only earn trading fees but also capture protocol incentives, sometimes pushing total APYs well above standard single-sided staking yields.

This strategy requires careful attention to impermanent loss dynamics; however, if managed prudently with stable pools (such as Curve’s stETH/ETH), it can be a reliable way to compound returns while supporting ecosystem liquidity. As always, monitor pool performance metrics regularly, yield rates can fluctuate rapidly based on market demand and protocol emissions.

Top 5 Strategies to Maximize Yield with Ethereum LSTs in 2024

-

Utilize Leading LST Protocols (e.g., Lido, Rocket Pool) for Secure and Liquid ETH Staking: Platforms like Lido Finance and Rocket Pool allow you to stake ETH securely and receive liquid staking tokens (stETH, rETH) in return. As of September 30, 2025, Ethereum (ETH) trades at $4,140.68, and Lido alone holds nearly 32% of staked ETH, offering an attractive APR of 6.2%.

-

Deploy LSTs in Top DeFi Lending Markets (Aave, Morpho Blue, Compound v3) to Earn Dual Yields: Supply your LSTs (like stETH or rETH) to lending protocols such as Aave, Morpho Blue, or Compound v3. This strategy lets you earn both staking rewards and lending interest, maximizing your passive income.

-

Leverage LST/ETH Liquidity Pools on DEXes (Balancer, Curve) for Yield Stacking and Trading Fees: Provide liquidity to pools like stETH/ETH or rETH/ETH on decentralized exchanges such as Balancer and Curve. This approach lets you earn trading fees and additional incentives—Convex Finance, for example, offers a 7.55% APY on PXETH-STETH pools.

-

Participate in Automated Yield Aggregators (Yearn, Instadapp, Pendle) Optimized for LST Strategies: Platforms like Yearn, Instadapp, and Pendle automatically optimize LST strategies, reallocating assets to the highest-yield opportunities and compounding returns. Pendle, for instance, enables APYs from 20% to 50% by splitting yield and principal.

-

Diversify Across Multiple LSTs and DeFi Protocols to Mitigate Smart Contract and Platform Risks: Avoid concentration risk by spreading your ETH and LST holdings across several platforms and protocols. This reduces exposure to potential smart contract bugs, platform failures, or slashing events, helping to secure your overall yield strategy.

Navigating Today’s Liquid Staking Landscape: Why Diversification Matters

The sophistication of today’s Ethereum liquid staking ecosystem means there’s no single “best” approach, rather, it’s about layering strategies intelligently while minimizing exposure to platform-specific risks. In the next section, we’ll examine how automated yield aggregators like Yearn and Pendle are reshaping passive income streams for LST holders, and why diversification across multiple protocols remains non-negotiable for serious investors.

4. Participate in Automated Yield Aggregators Optimized for LST Strategies

For those seeking a more hands-off approach to LST yield optimization, automated yield aggregators such as Yearn Finance, Instadapp, and Pendle have become indispensable tools in 2024. These platforms specialize in sourcing, compounding, and rebalancing the best available yields for your stETH or rETH positions across DeFi, often utilizing on-chain automation and sophisticated risk modeling.

Pendle is particularly notable this year for its innovative approach to yield tokenization. Users can split their LSTs into principal and yield components, trading or staking each part independently to suit individual risk appetites. Yearn’s vaults, meanwhile, auto-compound rewards by routing funds through the most profitable pools and lending markets, removing the need for constant manual intervention.

The net result: you capture not just base staking rewards but also additional protocol incentives and fee income with minimal active management. However, always review aggregator strategies for smart contract risk and potential strategy shifts due to changing market conditions.

5. Diversify Across Multiple LSTs and DeFi Protocols to Mitigate Risks

No matter how attractive a single protocol or strategy appears, concentrated exposure can backfire, especially as DeFi matures and new risks emerge. The most resilient investors in 2024 are those who deliberately diversify across several LSTs (e. g. , stETH, rETH) as well as multiple DeFi protocols (spanning lending markets, DEXes, and aggregators).

This diversification isn’t just about chasing higher returns; it’s about minimizing the impact of smart contract exploits, governance failures, or abrupt changes in protocol incentives. By spreading capital across platforms like Lido, Rocket Pool, Aave, Curve, Yearn, and Pendle, you insulate your portfolio from idiosyncratic shocks while maintaining access to the highest-yielding opportunities available at any given time.

Remember: even top-tier protocols can face slashing events or technical setbacks. Regularly reassess your allocations based on evolving TVL figures, security audits, and community sentiment.

Putting It All Together: A Patient Pathway to Sustainable Yield

The Ethereum liquid staking landscape in 2024 is both richer and more complex than ever before. By layering these five actionable strategies, starting with leading LST protocols like Lido and Rocket Pool; deploying tokens in top lending markets such as Aave or Compound v3; providing liquidity on DEXes like Balancer or Curve; leveraging automated yield aggregators including Yearn or Pendle; and above all else diversifying across assets and platforms, you position yourself at the frontier of yield stacking while respecting risk management fundamentals.

If you’re ready to take your next step toward sustainable DeFi income with ETH at $4,140.68, explore our comprehensive guides on how liquid staking maximizes crypto yield without lockups. Patience and perspective remain your greatest allies, let them guide your journey through the ever-evolving world of Ethereum liquid staking tokens.