The rise of liquid staking has transformed how DeFi participants generate yield, offering a unique blend of flexibility, liquidity, and compounding opportunities. At the heart of this revolution is the liquid staking flywheel effect, a self-reinforcing cycle that powers sustainable DeFi yield and protocol growth. But how exactly does this mechanism work, and why is it so crucial for the long-term health of liquid staking protocols?

What Is the Flywheel Effect in Liquid Staking?

The flywheel effect in crypto describes a positive feedback loop where growth begets more growth. In the context of liquid staking, it starts when users stake their assets (like ETH or BNB) with a protocol and receive liquid staking tokens (LSTs) in return. These LSTs can then be used across DeFi platforms, yield farms, lending markets, liquidity pools, unlocking additional earning potential.

As more users participate and lock value into the protocol, its total value locked (TVL) increases. This boosts liquidity and stability, making the protocol more attractive to new users and institutional capital. Higher participation leads to greater rewards for everyone involved, which further incentivizes additional deposits. The result? A virtuous cycle that amplifies both user returns and protocol resilience.

Real-World Examples: Mantle cmETH and Lista DAO

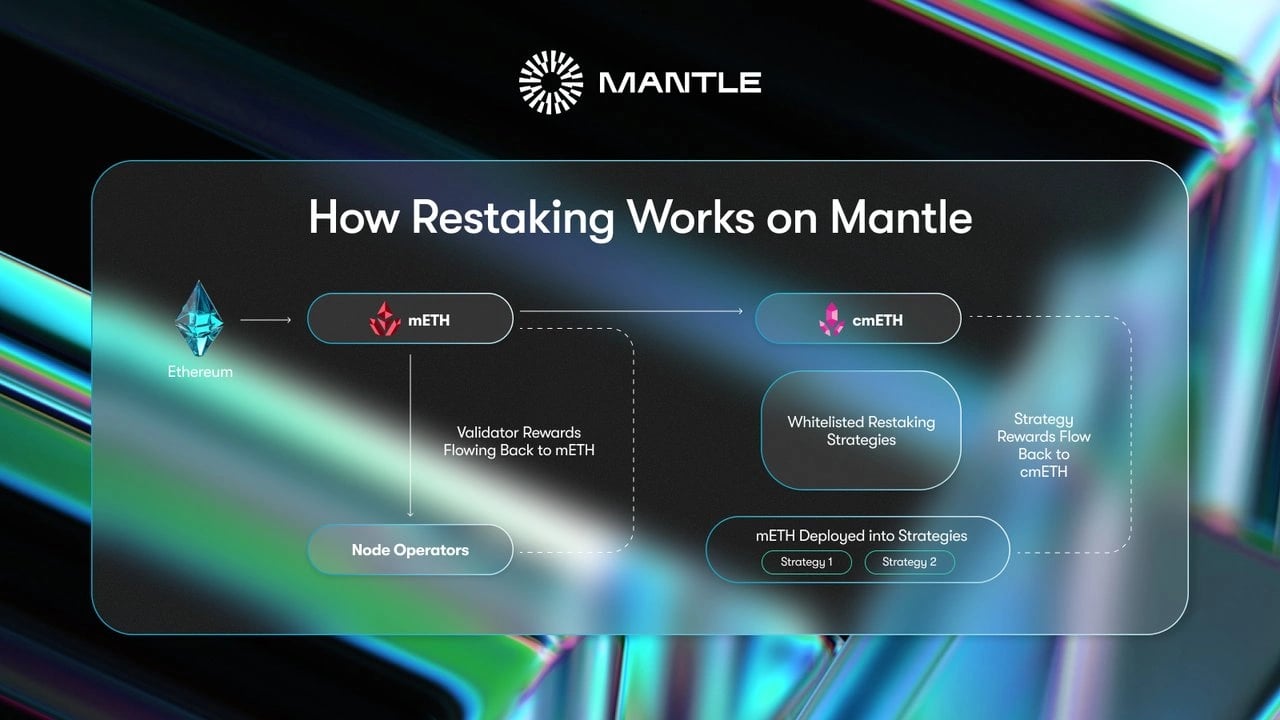

To see this dynamic in action, consider Mantle’s cmETH. Through its Metamorphosis campaign, users who stake mETH receive cmETH, a high-yield token that accrues multiple reward streams including ETH base yield, mETH/AVS incentives, COOK rewards, and Mantle DeFi yield. By enabling users to further boost their earnings through MNT-powered ‘Powder’ production, Mantle creates a compelling incentive structure where rewards are continuously reinvested into the ecosystem. This not only maximizes individual user returns but also strengthens overall protocol health by locking up value and deepening liquidity.

Read more about Mantle’s multi-layered reward approach here.

Lista DAO offers another striking example: managing 1 million BNB in staked assets requires an efficient system to maintain security and maximize sustainable returns for all participants. Their scale demonstrates how large TVLs can supercharge the flywheel effect, greater collateral leads to higher yields, which draws even more participants seeking robust yet reliable returns.

Key Mechanisms Driving Sustainable DeFi Yield in Liquid Staking

-

Automated Compounding of Staking Rewards: Many liquid staking protocols, such as Lido and Rocket Pool, automatically reinvest staking rewards back into the protocol. This compounding effect boosts overall yield and eliminates the need for manual claim-and-restake actions, reducing costs and maximizing returns for users.

-

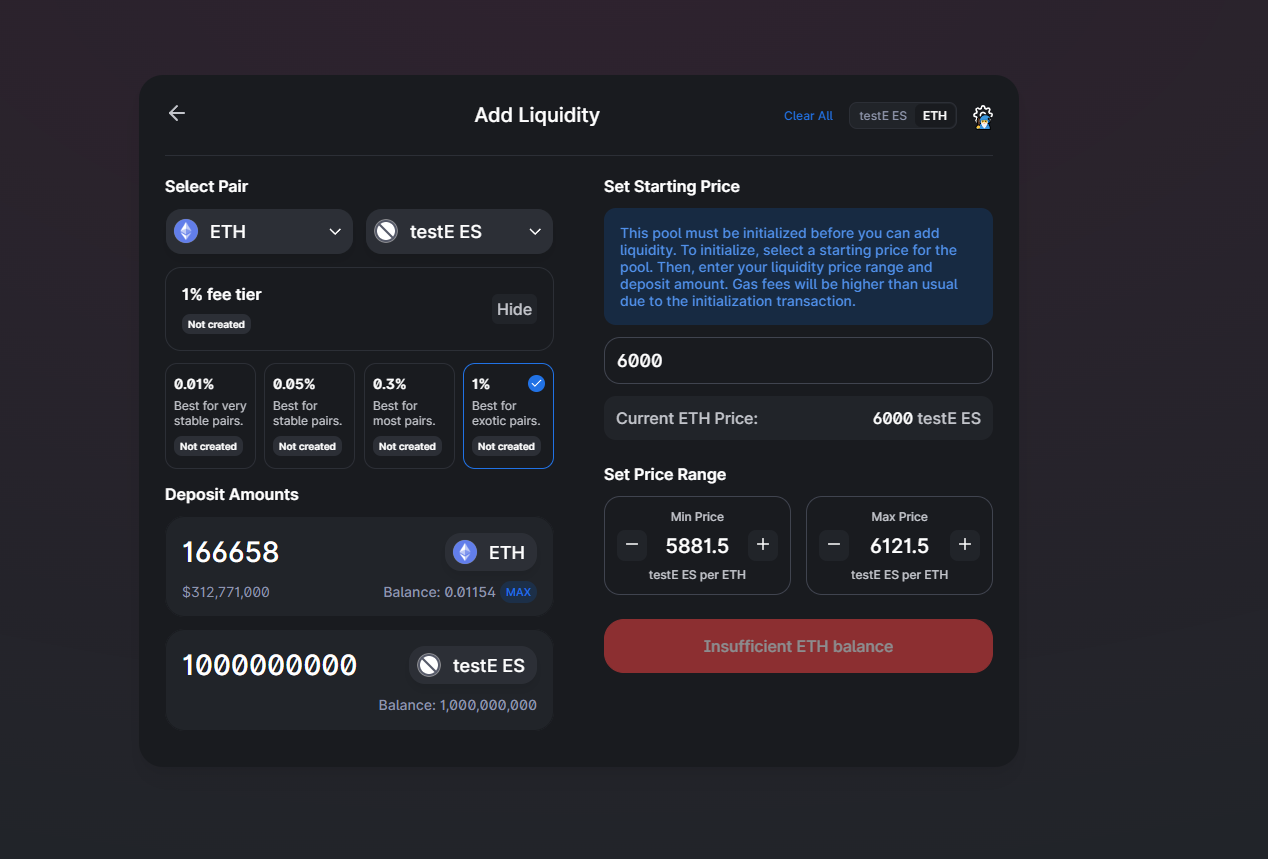

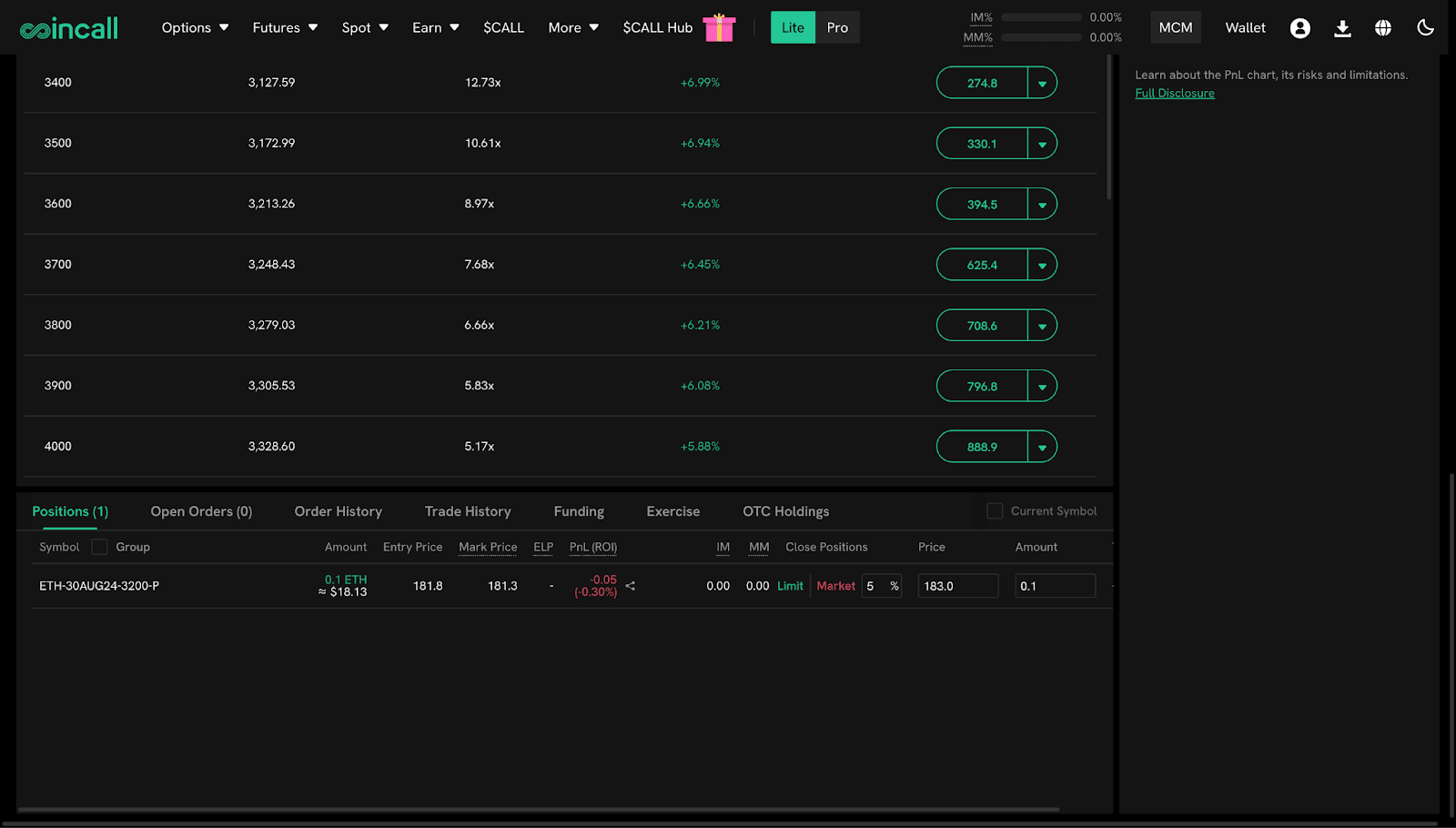

Liquidity Provision with Liquid Staking Tokens (LSTs): Users can deploy their LSTs (like stETH or rETH) on decentralized exchanges such as Uniswap or Balancer, earning trading fees in addition to staking rewards. This ‘yield stacking’ approach enables multiple revenue streams from the same capital.

-

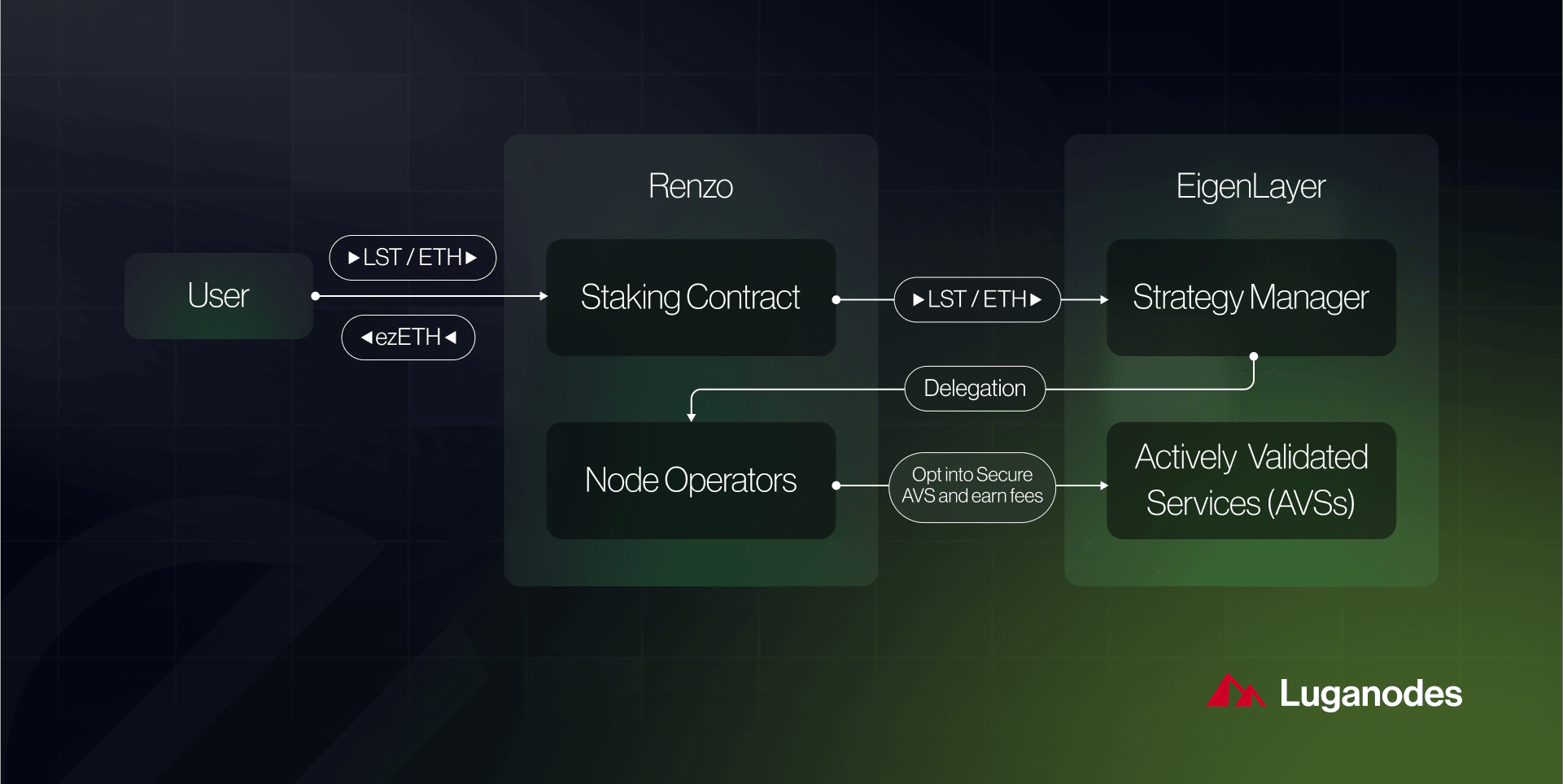

Restaking and Liquid Restaking Tokens (LRTs): Protocols like EigenLayer allow users to restake their LSTs into Actively Validated Services (AVSs), receiving LRTs in return. These tokens provide additional yield opportunities, including AVS incentives, points, and airdrops, while maintaining liquidity and composability.

-

Multi-Reward Campaigns and Ecosystem Incentives: Protocols such as Mantle with its cmETH token offer users access to multiple reward streams—combining staking yield, DeFi incentives, and campaign rewards (e.g., COOK, MNT tokens). This drives user engagement and reinforces the flywheel effect.

-

Protocol Governance and Vote Incentives: Platforms like Convex Finance optimize yield by accumulating governance tokens (e.g., veCRV) and directing rewards to their users. This mechanism aligns incentives, encourages long-term participation, and supports sustainable yield growth.

Sustainable Yield Mechanisms That Power the Flywheel

The sustainability of these yields relies on several foundational mechanisms:

- Compounding Rewards: Many protocols automate compounding by continually reinvesting earned rewards back into the pool. This eliminates manual claiming/restaking cycles (and their associated costs), allowing yields to snowball over time.

- Liquidity Provision: Users can deploy their LSTs into decentralized exchanges or lending platforms to earn additional fees or interest on top of base staking rewards, a process known as yield stacking.

- Restaking and Liquid Restaking Tokens (LRTs): Platforms like EigenLayer let users restake LSTs into Actively Validated Services (AVSs), receiving new LRTs that layer on fresh sources of incentives such as AVS-driven points or token emissions.

This multifaceted approach not only attracts new capital but also ensures that yields remain competitive without relying on unsustainable inflationary practices.

The Institutional Shift and Protocol Dominance Through Flywheels

The institutional embrace of liquid staking has further accelerated these dynamics. As highlighted by recent data showing Ethereum’s liquid restaking TVL at around $24 billion (source), major players are increasingly drawn to protocols where sustainable yield mechanisms are transparent and scalable.

This is one reason why dominant platforms like Lido have maintained their lead within the LSD market, their well-designed flywheel ensures rapid TVL growth without sacrificing security or composability. Similarly, Berachain’s Infrared balances participant liquidity by leveraging its own version of the flywheel effect (source). These examples underscore how treasury growth in DeFi isn’t just about raw numbers, it’s about designing incentives that reinforce themselves over time.

Protocols that successfully harness the flywheel effect crypto are able to deliver sustainable DeFi yield even as market conditions shift. This is because the mechanisms at play, compounding, liquidity layering, and restaking, create a resilient ecosystem where rewards are not solely dependent on new inflows or inflationary token emissions. Instead, value is recycled and amplified within the protocol, which is especially appealing for both retail and institutional investors seeking long-term exposure.

Let’s break down why this matters for users aiming to maximize their liquid staking token returns:

- Enhanced Security: As TVL rises, so does the economic security of the underlying blockchain. This reduces risk for all participants and attracts even more capital.

- Yield Optimization: Automated compounding and multi-layered incentives mean your staked assets are always working for you, even while you deploy LSTs elsewhere in DeFi.

- Treasury Growth: Protocols can reinvest fees and a portion of rewards into development or insurance funds, further strengthening their ecosystem.

Emerging Trends: Multi-Dip Staking and Beyond

The next wave of innovation is already underway. Concepts like multi-dip staking, where users can sequentially restake their assets across multiple protocols (often called ‘yield stacking’), are gaining traction. For example, a user might stake ETH to receive an LST, provide that LST as liquidity on a DEX for trading fees, then restake the resulting LP tokens with a platform like EigenLayer for additional rewards. Each step in this process fuels the flywheel further by locking up more value and generating more yield streams.

This approach is not without its risks, smart contract vulnerabilities or liquidity crunches could disrupt the cycle, but well-designed protocols mitigate these challenges by maintaining robust collateralization models and transparent governance frameworks. The presence of real-time analytics platforms like Lstfi empowers users to track protocol health and optimize their strategies accordingly.

Top Liquid Staking Protocols Leveraging the Flywheel Effect

-

Lido Finance: The largest liquid staking protocol on Ethereum, Lido leverages the flywheel effect by issuing stETH for staked ETH, enabling users to earn staking rewards while using stETH across DeFi platforms. Its dominance and deep integrations amplify sustainable yield and protocol growth.

-

Mantle (cmETH): Mantle’s cmETH token exemplifies the flywheel effect with its multi-reward structure—users earn ETH yield, mETH and AVS yield, COOK rewards, and Mantle DeFi yield. The protocol’s campaigns, like Metamorphosis, incentivize reinvestment and ecosystem loyalty.

-

EigenLayer: As a pioneer in liquid restaking, EigenLayer allows users to restake LSTs into Actively Validated Services (AVSs), receiving LRTs (Liquid Restaking Tokens). This layered approach compounds yield opportunities and drives protocol participation through a robust flywheel mechanism.

-

Lista DAO: Backed by over 1 million BNB staked, Lista DAO utilizes the flywheel effect to maintain a secure and sustainable system. Its scale and focus on efficient rewards distribution attract more users, reinforcing growth and yield sustainability.

-

Infrared (IRED): Built within the Berachain ecosystem, Infrared shares and balances liquidity among participants by leveraging flywheel mechanics. Its design encourages continuous participation and liquidity growth, enhancing rewards for all users.

How to Participate in the Liquid Staking Flywheel

If you’re considering entering this space, start by evaluating protocols with proven track records of sustainable yield generation. Look for transparency in reward mechanisms and active community governance. Tools that display live TVL data, APY projections, and risk metrics are invaluable for making informed decisions.

You can also diversify across multiple protocols or chains, staking BNB with Lista DAO or exploring Berachain’s Infrared ecosystem are just two examples where different versions of the flywheel effect play out in real time (see more here). Remember that compounding DeFi yield isn’t just about chasing high numbers; it’s about understanding how incentives align across each layer of your strategy.

The bottom line? The liquid staking flywheel is more than just a buzzword, it’s an engine driving treasury growth DeFi-wide. By leveraging compounding yields, strategic liquidity placement, and innovative restaking models like $MSIA staking or LRT issuance, protocols create lasting value that benefits both early adopters and newcomers alike.