The landscape of liquid staking DeFi is rapidly evolving, and the rise of automated yield optimizers is at the heart of this transformation. As Ethereum (ETH) trades at a robust $4,441.16: reflecting a 2.58% daily increase, investors are seeking smarter, more efficient ways to maximize returns on their staked assets without sacrificing liquidity or taking on excessive risk. Automated yield optimizers are emerging as essential tools, reshaping how participants engage with liquid staking protocols and turbocharging yield strategies for both newcomers and seasoned DeFi veterans.

Automated Yield Optimizers: The Engine Behind Effortless DeFi Growth

In the traditional DeFi landscape, yield farming and staking required constant monitoring, manual reallocation, and an appetite for risk. Enter automated yield optimizers: platforms like Yearn Finance, Beefy Finance, and Convex Finance that leverage smart contracts to actively manage and optimize your staked assets. These protocols don’t just automate the basics, they continuously scan the DeFi ecosystem for the highest-yielding opportunities, reallocating funds in real time and compounding rewards to deliver superior, risk-adjusted returns.

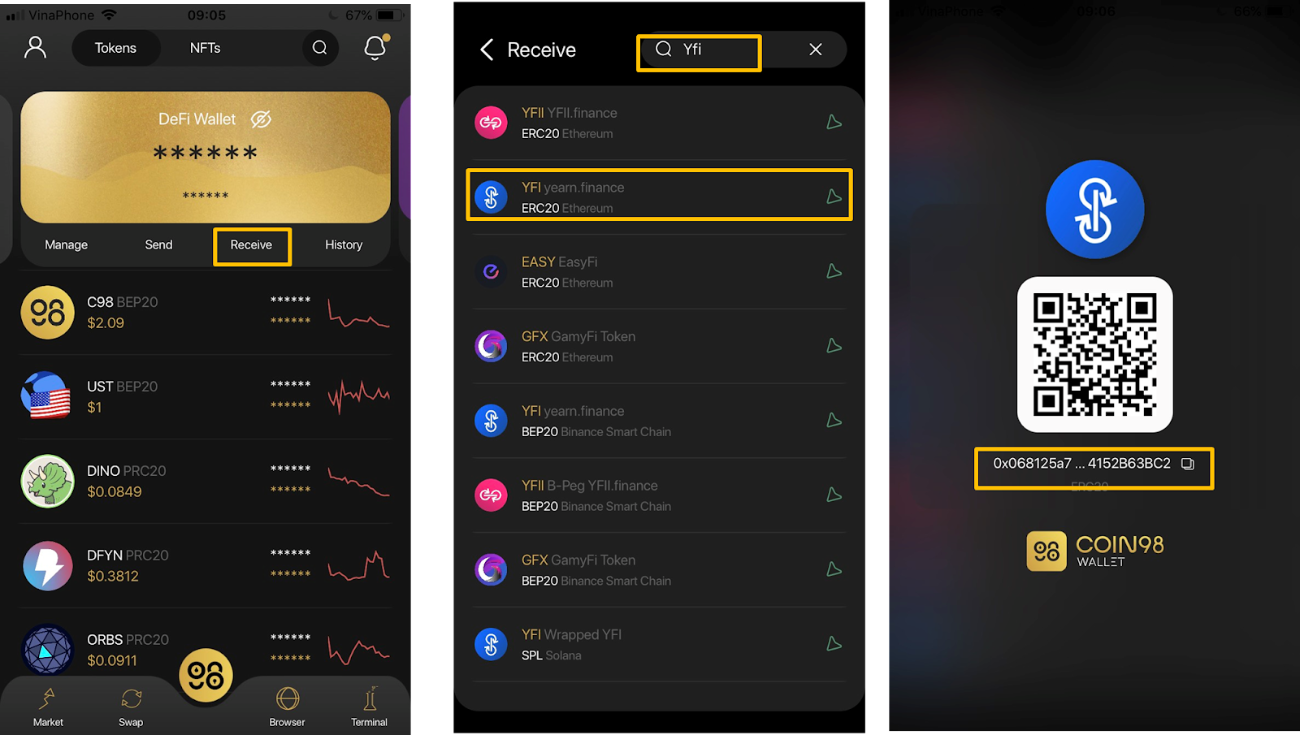

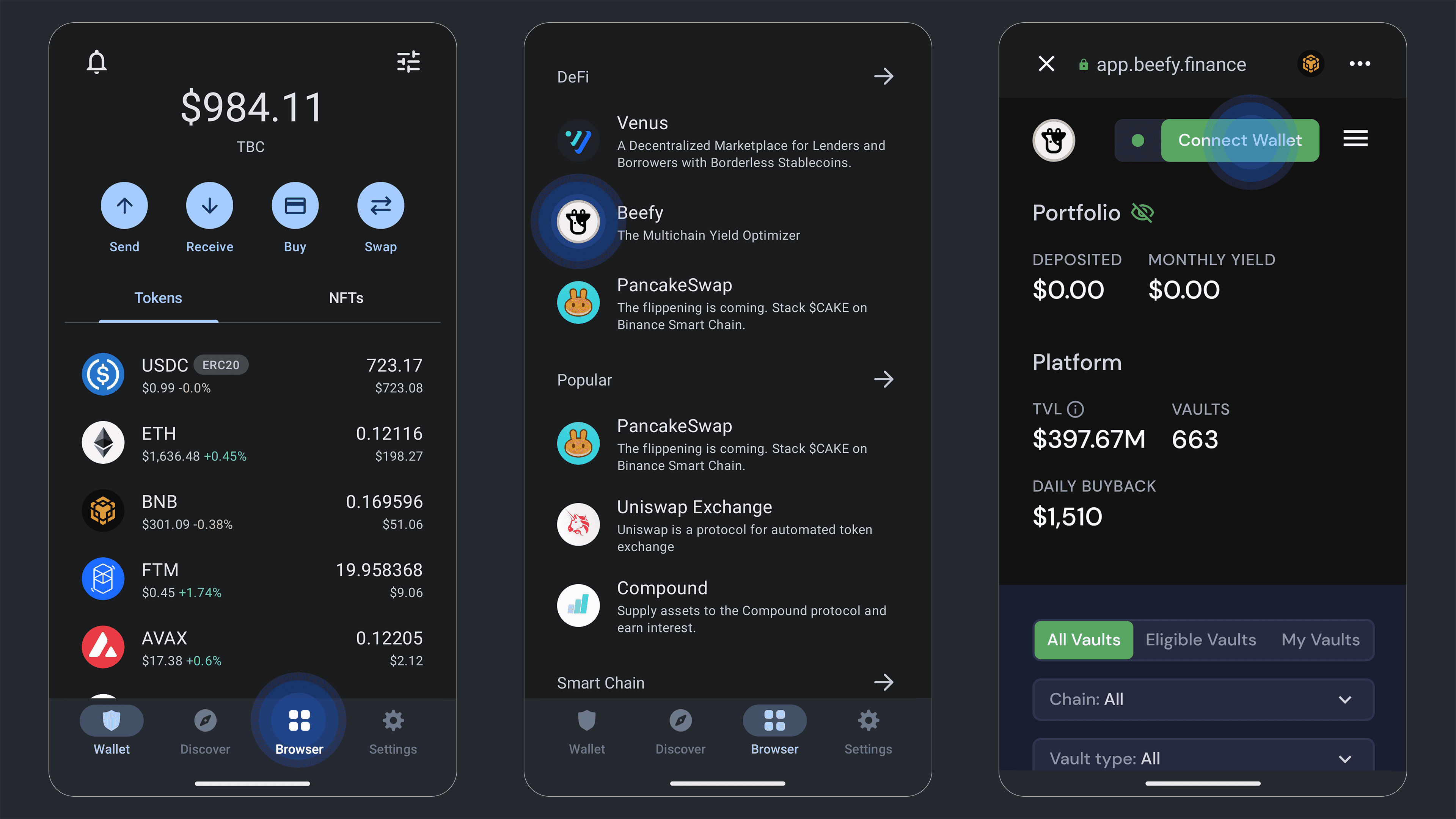

For example, Beefy Finance stands out as a cross-chain yield optimizer that aggregates farming opportunities from multiple platforms, using automated vault strategies to manage assets and auto-compound rewards (source). Similarly, Yearn Finance’s yVaults have become synonymous with set-and-forget yield farming, allowing users to stake their assets and let the protocol handle everything from asset reallocation to reward harvesting.

Why Liquid Staking Needs Automation Now More Than Ever

Liquid staking protocols like Lido DAO (LDO), currently at $1.22 (up 4.27%), and Rocket Pool (RPL) at $5.10 (up 3.87%), have unlocked a new paradigm for DeFi users. By issuing liquid staking tokens (LSTs) that represent staked assets, these platforms enable users to earn staking rewards while maintaining the flexibility to deploy LSTs across DeFi for additional yield.

However, with opportunity comes complexity. The proliferation of protocols, fluctuating APYs, and cross-chain opportunities make manual yield optimization nearly impossible for most. This is where automated yield optimizers shine. They offer:

- Auto-Compounding: Rewards are automatically reinvested, boosting APYs without user intervention.

- Dynamic Asset Allocation: Funds are shifted in real time to capitalize on the highest yields across protocols.

- Risk Diversification: Assets are distributed across multiple platforms to mitigate protocol-specific risks.

- Cost Efficiency: Automated strategies batch transactions, reducing gas fees and slippage (source).

Leading Platforms Powering Real-Time Yield Reallocation

The competition among yield optimizers has never been fiercer. Platforms like Convex Finance specialize in optimizing yields for Curve Finance liquidity providers by automating staking and reward collection (source). Meanwhile, newer entrants such as Dapylon and YieldNest are pushing the envelope with AI-driven cross-chain yield strategies and personalized optimization based on risk profiles.

Here’s how the top platforms stack up:

Top Automated Yield Optimizers for Liquid Staking DeFi

-

Yearn Finance — Renowned for its yVaults, Yearn Finance automates yield strategies for staked assets, maximizing returns through smart auto-compounding and dynamic protocol allocation.

-

Beefy Finance — A leading cross-chain yield optimizer, Beefy Finance offers auto-compounding vaults that aggregate opportunities across multiple DeFi protocols, supporting liquid staking assets for optimal APY.

-

Convex Finance — Specializing in Curve Finance optimization, Convex automates staking and reward collection for liquidity providers, boosting yields on staked assets and liquid staking tokens.

-

Autofarm — This cross-chain aggregator enables users to earn returns on staked assets by simply depositing into Autofarm vaults, which automate yield farming across numerous DeFi protocols.

-

Veda — Veda leverages advanced automation to embed yield strategies across blockchains and protocols, optimizing returns on liquid staking tokens through continuous, data-driven rebalancing.

-

YieldNest — Integrating AI-driven strategies with liquid restaking, YieldNest delivers sophisticated, automated yield optimization for users seeking enhanced returns and risk management.

-

maxAPY — Operating 24/7, maxAPY automates and optimizes yield farming across 100+ strategies and 20+ protocols, making it a go-to for maximizing yields on liquid staking assets.

-

Dapylon — Dapylon stands out with its AI-powered, cross-chain yield aggregation, converting market data into automated strategies for liquid staking and beyond.

The integration of AI and multi-agent architectures, as seen with platforms like YieldNest and NAMI, promises even more granular real-time yield reallocation and risk-adjusted DeFi returns. These innovations are not just boosting profits, they’re making liquid staking accessible to a broader audience by abstracting away complexity.

Market Context: Navigating the 2025 Liquid Staking Surge

The current surge in ETH, LDO, and RPL prices underscores growing confidence in liquid staking protocols and their supporting tools. As ETH holds firm at $4,441.16, LDO at $1.22, and RPL at $5.10, investors are increasingly turning to automated optimizers for a competitive edge in yield stacking. The ability to earn staking rewards while simultaneously deploying LSTs across lending, trading, and farming protocols is unlocking new layers of composability, and automated optimizers are the linchpin making this possible.

Ethereum (ETH), Lido DAO (LDO), and Rocket Pool (RPL) Price Predictions 2026-2031

Professional outlook based on DeFi, liquid staking, and automated yield optimization trends.

| Year | Asset | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Scenario |

|---|---|---|---|---|---|---|

| 2026 | ETH | $3,900 | $5,300 | $6,200 | +19% | ETH 2.0 upgrades drive staking demand, minor regulatory headwinds |

| 2026 | LDO | $1.00 | $1.45 | $2.10 | +19% | Lido maintains dominance, new competitors emerge |

| 2026 | RPL | $4.40 | $6.20 | $8.10 | +21% | Rocket Pool expands integrations, market share grows |

| 2027 | ETH | $4,200 | $6,200 | $7,800 | +17% | Mainstream DeFi adoption, global regulatory clarity |

| 2027 | LDO | $1.10 | $1.70 | $2.40 | +17% | Lido expands to new chains, yield optimizer partnerships |

| 2027 | RPL | $4.80 | $7.10 | $9.30 | +15% | Rocket Pool launches new features, increased decentralization |

| 2028 | ETH | $4,800 | $7,300 | $9,500 | +18% | Automated yield optimizers mature, ETH as DeFi backbone |

| 2028 | LDO | $1.35 | $2.10 | $2.95 | +24% | Liquid staking grows, Lido integrates restaking |

| 2028 | RPL | $5.20 | $8.80 | $11.50 | +24% | Rocket Pool partners with institutional DeFi platforms |

| 2029 | ETH | $5,200 | $8,600 | $11,000 | +18% | ETH ETF approval, institutional inflows |

| 2029 | LDO | $1.60 | $2.65 | $3.60 | +26% | Lido innovates with cross-chain liquid staking |

| 2029 | RPL | $5.90 | $10.20 | $13.60 | +16% | Rocket Pool increases validator incentives |

| 2030 | ETH | $5,800 | $10,000 | $13,500 | +16% | ETH becomes global settlement layer, high DeFi TVL |

| 2030 | LDO | $1.95 | $3.20 | $4.40 | +21% | LDO governance expands, new staking derivatives |

| 2030 | RPL | $6.50 | $11.80 | $15.70 | +16% | Rocket Pool achieves major global expansion |

| 2031 | ETH | $6,300 | $11,800 | $15,600 | +18% | Peak adoption, DeFi/TradFi convergence |

| 2031 | LDO | $2.10 | $3.70 | $5.20 | +16% | Lido maintains leadership, faces mature competition |

| 2031 | RPL | $7.10 | $13.20 | $18.10 | +12% | Rocket Pool mature ecosystem, strong validator growth |

Price Prediction Summary

ETH, LDO, and RPL are expected to experience substantial growth from 2026 to 2031, driven by mainstream DeFi adoption, technological advancements in yield optimization and liquid staking, and increasing institutional participation. While ETH remains the DeFi backbone, LDO and RPL should benefit from innovations in automated yield strategies and expanding cross-chain capabilities. Both bullish and bearish scenarios are reflected in the wide min/max ranges, accounting for regulatory, technological, and competitive risks.

Key Factors Affecting Ethereum Price

- Adoption of automated yield optimizers in liquid staking protocols

- Upgrades to Ethereum (scalability, security, and staking features)

- Regulatory clarity and potential for ETH ETF approval

- Competition among liquid staking protocols (e.g., Lido, Rocket Pool, new entrants)

- Market cycles and macroeconomic conditions

- Institutional adoption and integration of DeFi in traditional finance

- Innovation in DeFi (restaking, cross-chain staking, AI-driven yield strategies)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As we move deeper into 2025, expect automated yield optimizers to play an even more central role in shaping the future of liquid staking DeFi. Their promise? To make yield stacking smarter, safer, and more lucrative for all participants.

Looking ahead, the synergy between automated yield optimizers and liquid staking tools is poised to redefine what’s possible in DeFi. With the complexity of yield strategies ever-increasing, think cross-chain vaults, risk-adjusted APYs, and AI-powered rebalancing, automation is no longer a luxury but a necessity for anyone seeking real alpha in today’s markets.

How AI and Automation Are Reshaping Yield Stacking

Next-generation platforms like YieldNest and NAMI are leveraging artificial intelligence and multi-agent systems to personalize yield optimization. These protocols don’t just react to market conditions, they anticipate them. By analyzing on-chain data, liquidity trends, and risk metrics in real time, these optimizers can dynamically reallocate assets across dozens of protocols, ensuring users capture the highest available yields while minimizing downside exposure.

This evolution is especially critical as more users deploy liquid staking tokens (LSTs): such as those issued by Lido DAO (LDO at $1.22) and Rocket Pool (RPL at $5.10): into diverse DeFi strategies. Automated optimizers abstract away the operational headache, handling everything from auto-compounding to gas-efficient batch transactions. The result? Higher net returns with lower friction and fewer missed opportunities.

The rise of cross-chain yield strategies is another game changer. Platforms like Beefy Finance and Autofarm have built robust infrastructures that scan yields across multiple blockchains, allowing users to chase the best opportunities without juggling dozens of interfaces or wallets. As interoperability improves, expect even greater efficiency and capital mobility within the liquid staking DeFi ecosystem.

Key Benefits for Investors

- Hands-off yield stacking: No more manual rebalancing or chasing APY updates, let automation do the heavy lifting.

- Real-time yield reallocation: Stay ahead of market shifts with strategies that adapt instantly to changing conditions.

- Diversified risk exposure: Spread your assets across protocols and chains for a more resilient portfolio.

- Lower costs: Batching and smart routing minimize gas fees and slippage, especially on high-demand blockchains.

For power users and newcomers alike, these innovations mean more time spent strategizing, and less time micromanaging. The days of spreadsheet-driven farming are fading; sophisticated automation is now table stakes for anyone serious about maximizing DeFi returns.

“Decode the charts, unlock opportunity. “

The message is clear: as the market matures and liquid staking volumes soar, buoyed by ETH’s current price at $4,441.16: the platforms that can deliver seamless, secure automation will define the next era of decentralized finance. Whether you’re yield stacking across protocols or simply seeking passive returns on your staked assets, automated optimizers are your passport to smarter, safer, and more dynamic DeFi participation.