Ethereum’s liquid staking revolution has fundamentally changed how investors approach yield optimization in DeFi. With ETH currently trading at $4,335.01 (as of October 9,2025), the demand for flexible, high-yield strategies is stronger than ever. Liquid staking tokens (LSTs) let you earn staking rewards while unlocking new layers of composability and yield stacking across DeFi protocols. But to truly maximize your ETH yield, it’s crucial to select the right platforms and strategies, and understand the risks and rewards unique to each.

Why Liquid Staking Tokens Are Essential for ETH Yield Optimization

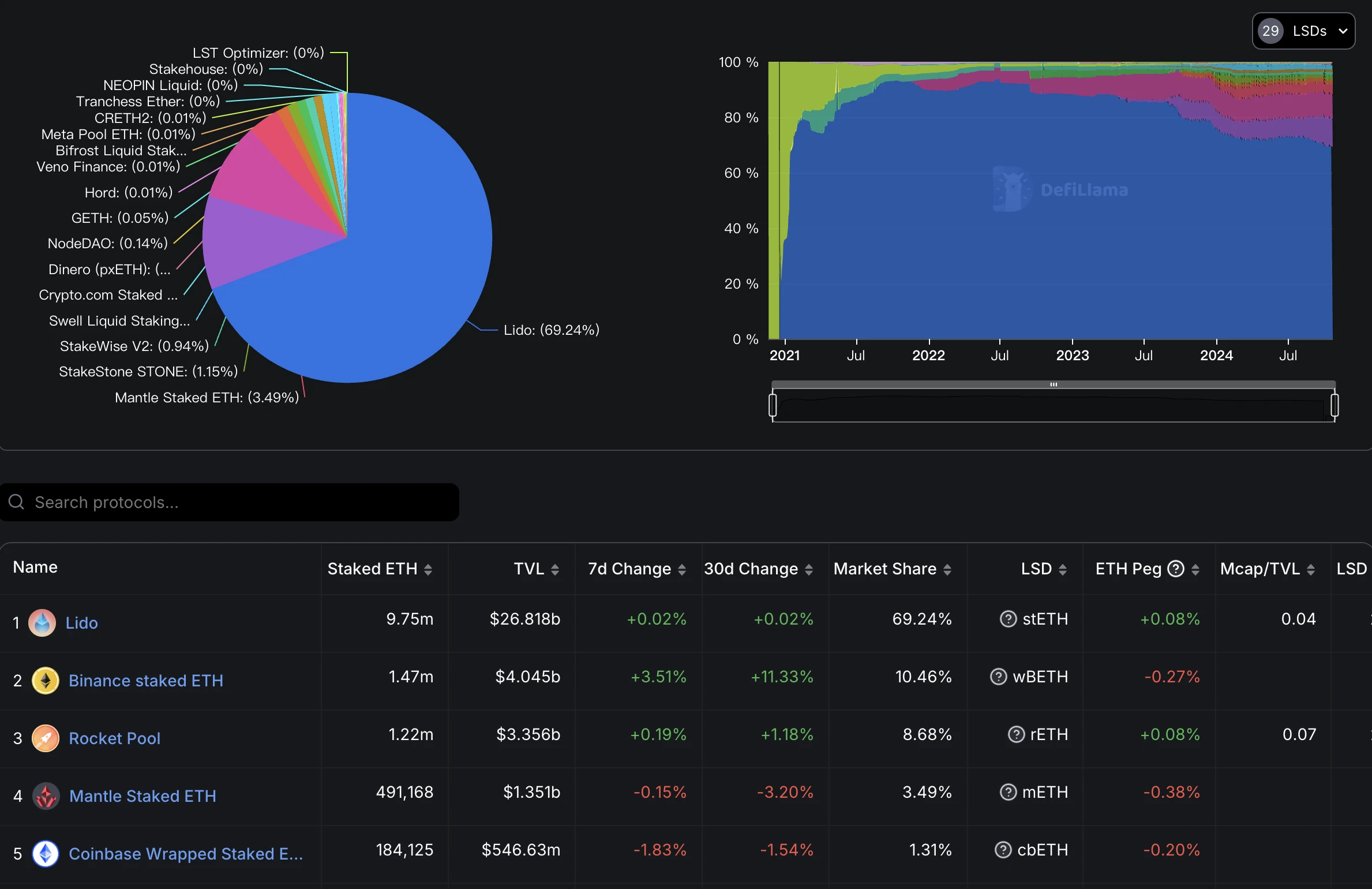

Traditional Ethereum staking locks your ETH, limiting your ability to participate in DeFi or respond to market shifts. LSTs like stETH (from Lido Finance) and rETH (from Rocket Pool) solve this by providing a liquid representation of your staked ETH that you can freely use across DeFi protocols. This unlocks powerful opportunities for yield stacking, layering multiple sources of returns on top of the base staking yield.

The liquid staking landscape has matured rapidly. Today’s top protocols offer strong security, deep integrations, and innovative ways to boost your returns beyond simple staking APRs. Let’s break down the seven most effective strategies for maximizing ETH yield in 2024 using LSTs.

1. Stake on Lido Finance: stETH as Your Base Layer

Lido Finance remains the dominant liquid staking protocol by total value locked, with stETH boasting broad adoption across 100 and DeFi integrations. When you stake ETH on Lido, you receive stETH, a token that accrues daily staking rewards while remaining fully liquid. You can trade, lend, or deploy stETH in other protocols without waiting for unbonding periods.

- Current APY: Typically around 4-5%, with rewards automatically reflected in your stETH balance

- Liquidity: Deep pools on Curve, Aave, Balancer, and more

- Ecosystem: Used as collateral or liquidity in dozens of apps, ideal for advanced yield stacking

Lido’s robust audits and transparent governance make it a favorite among both retail and institutional users seeking secure ETH yield with maximum flexibility.

2. Decentralized Staking with Rocket Pool: rETH Opportunities

If decentralization is a priority, or you want exposure to alternative reward structures provides Rocket Pool is an essential option. By staking any amount above 0.01 ETH, you receive rETH: a tokenized claim on staked ETH plus validator rewards from Rocket Pool’s decentralized node network.

- Extra Yield: rETH is widely accepted in lending markets (like Aave) and liquidity pools (Curve/Balancer), letting you stack trading fees or borrow against your position while earning base rewards.

- Diversification: Rocket Pool’s model spreads risk across thousands of independent validators.

This flexibility makes rETH a core building block for sophisticated yield optimization strategies in 2024.

3. Restake with EigenLayer: Amplify Rewards from Your LSTs

The rise of EigenLayer restaking has unlocked a new meta-layer of rewards for LST holders. By depositing stETH or rETH into EigenLayer, you help secure emerging protocols (known as Actively Validated Services or AVSs) and earn additional incentives on top of standard staking yields.

- Yield Amplification: Restakers may earn extra protocol tokens or fees from AVSs, potentially boosting total returns well above traditional staking APRs.

- Caution: Restaking introduces new risks tied to AVS performance and slashing conditions; always review protocol docs before participating.

This restaking approach exemplifies how composability turns simple staking into a multi-layered yield engine, one that savvy users can leverage for outsized gains when risk is managed appropriately.

Ethereum (ETH) Price Prediction 2026-2031

Professional forecast based on current market data, adoption trends, and DeFi/Liquid Staking developments (as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950.00 | $4,850.00 | $6,100.00 | +12% | Continued DeFi adoption and ETH staking drive steady growth; volatility remains due to global macro uncertainty. |

| 2027 | $4,400.00 | $5,600.00 | $7,900.00 | +16% | ETH 2.0 scaling features and institutional staking increase demand; regulatory clarity improves sentiment. |

| 2028 | $4,900.00 | $6,500.00 | $9,800.00 | +16% | Mainstream integration of LSTs in DeFi and TradFi; bullish scenario sees explosive growth, while bearish case faces regulatory headwinds. |

| 2029 | $5,300.00 | $7,250.00 | $12,000.00 | +12% | Ethereum ecosystem matures with high DeFi TVL; competition from alternative L1s/L2s tempers upside. |

| 2030 | $5,850.00 | $8,150.00 | $14,500.00 | +12% | ETH becomes a core Web3 asset; technological upgrades (sharding, rollups) expand scalability and use cases. |

| 2031 | $6,400.00 | $9,300.00 | $17,800.00 | +14% | Global adoption and integration in financial infrastructure; bullish cycle peak possible, but corrections expected post-peak. |

Price Prediction Summary

Ethereum’s price outlook through 2031 shows a progressive uptrend, supported by the rapid adoption of liquid staking, DeFi innovation, and broader institutional participation. While average price growth is expected to be steady, market cycles, competition, and regulatory developments may introduce significant volatility. Both bullish and bearish scenarios are considered in the wide min/max ranges, reflecting the dynamic nature of the crypto market.

Key Factors Affecting Ethereum Price

- Adoption of liquid staking tokens (LSTs) and DeFi protocols driving ETH demand and utility.

- Ethereum network upgrades (scalability, security, sharding) enhancing ecosystem value.

- Institutional and retail staking participation expanding ETH’s role as a yield-bearing asset.

- Regulatory developments impacting DeFi and staking services globally.

- Competition from alternative Layer 1 and Layer 2 blockchains influencing market share.

- Macro-economic trends, including global risk appetite and fiat currency dynamics.

- Integration of ETH and LSTs in traditional finance and global payment systems.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

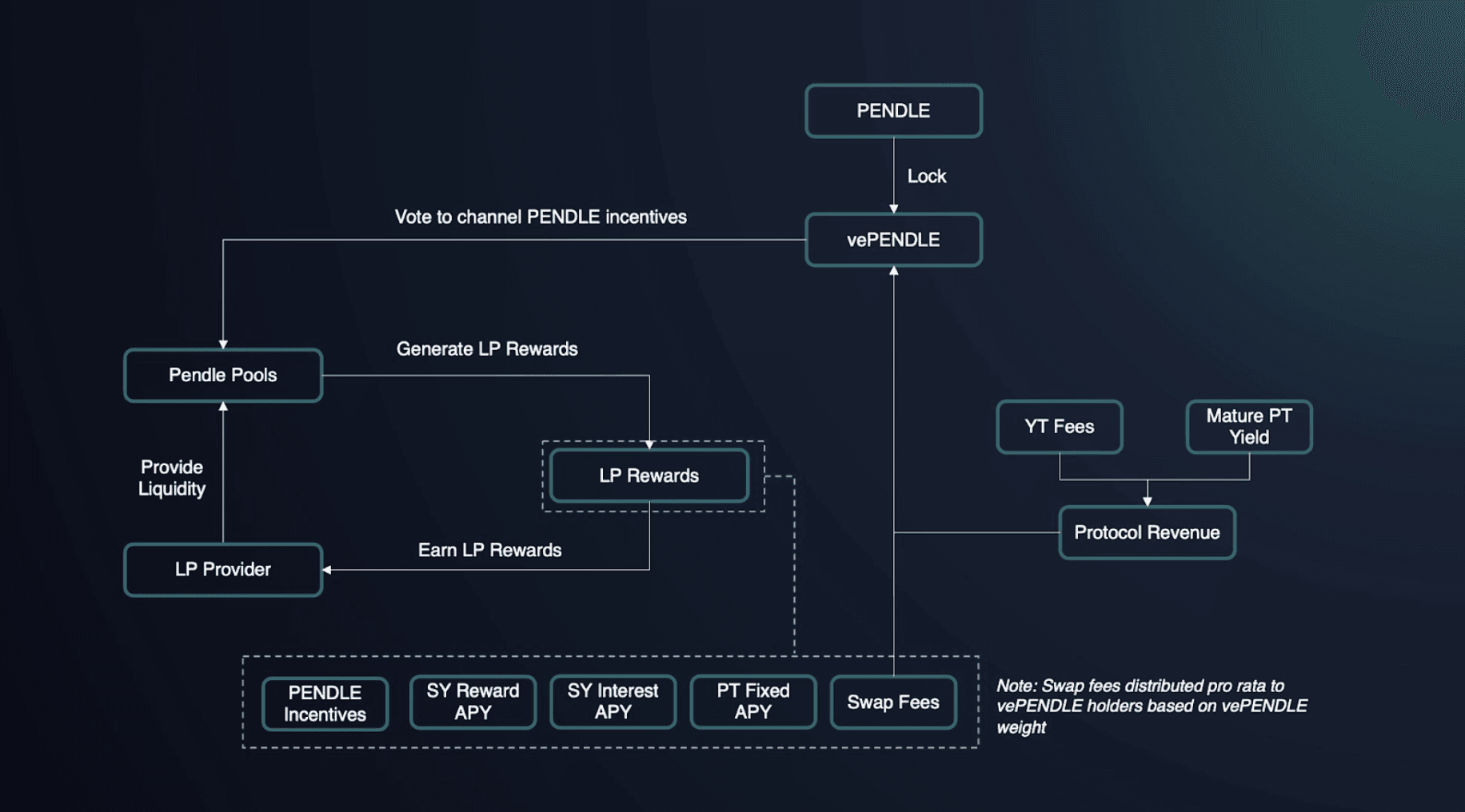

4. Pendle Finance Yield Tokenization: Advanced Yield Engineering

Pendle takes yield stacking further by letting you tokenize the future yield from LSTs like stETH or rETH. When you deposit an LST into Pendle, it splits into two tokens:

- Principal Token (PT): Represents ownership of the underlying asset (e. g. , stETH)

- Yield Token (YT): Represents the right to claim future yield until maturity

This separation allows you to trade future yields independently or deploy complex strategies like fixed-rate farming, leveraged yield positions, or hedging against rate fluctuations, empowering advanced users to fine-tune their risk/reward exposure in dynamic markets.

Which liquid staking protocol or strategy do you use most to maximize your ETH yield?

We’re curious to know which top protocol or strategy you rely on for stacking ETH yield with liquid staking tokens. Select the option you use most often!

If you’re ready to dive deeper into actionable strategies and step-by-step guides for each protocol discussed here, including how to combine them safely, explore our dedicated resource at How to Maximize ETH Yield with Liquid Staking Tokens on DeFi Platforms in 2024.

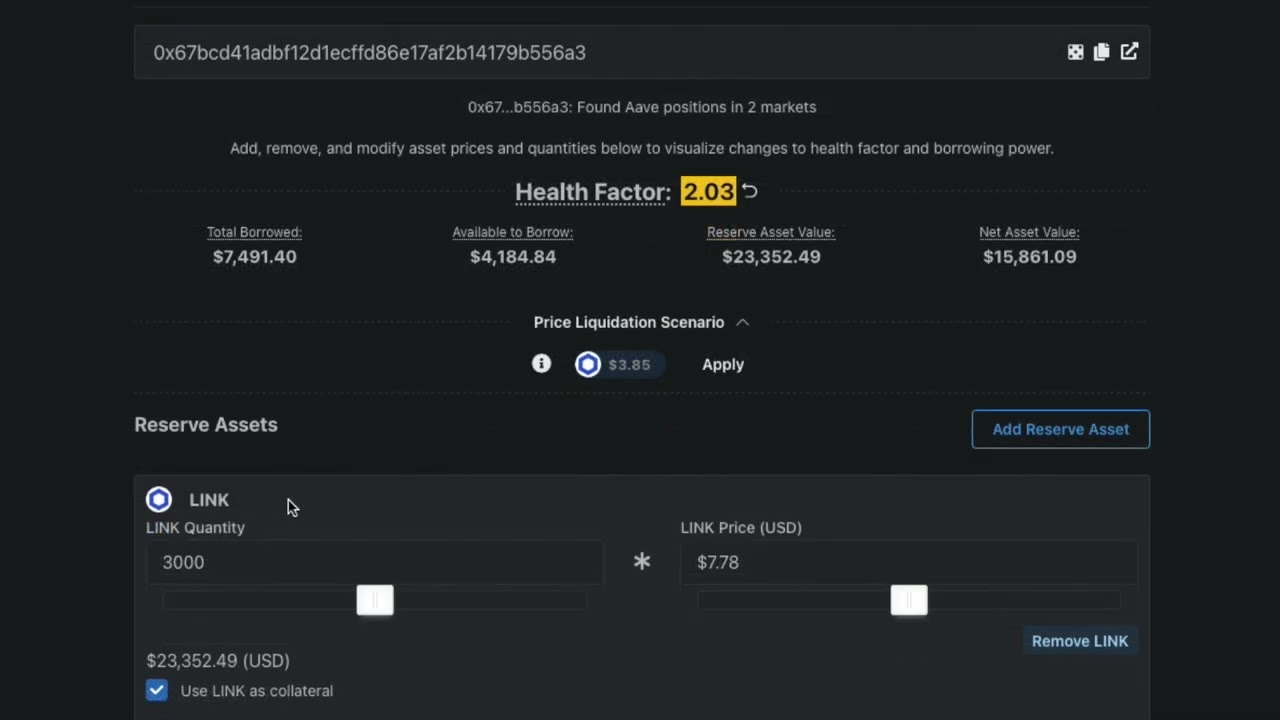

5. Aave Lending with LST Collateral: Borrow, Leverage, and Earn Simultaneously

One of the most popular yield stacking strategies is using your LSTs (e. g. , stETH or rETH) as collateral on Aave. This unlocks a new layer of capital efficiency: you continue earning staking rewards on your deposited LSTs while borrowing stablecoins or ETH against them. These borrowed funds can be reinvested into additional yield opportunities, such as stablecoin farming, leveraged staking, or even further LST purchases, compounding your returns.

- Dual Yield: Earn both staking rewards and potential DeFi yields from borrowed assets.

- Risk Management: Monitor your health factor and market volatility to avoid liquidation, especially during sharp ETH price movements (currently $4,335.01).

This strategy is ideal for experienced users who understand DeFi lending risks and want to maximize capital productivity with liquid staking tokens.

6. Balancer LST Pools and Boosted Vaults: Earn Trading Fees and Boosted Yields

Balancer offers sophisticated liquidity pools featuring LST pairs (like stETH/wETH or rETH/wETH). By providing liquidity, you earn a share of trading fees and, in certain pools, additional incentives via Aura Finance. Balancer’s Boosted Vaults further optimize capital deployment, automatically routing idle assets into yield-generating protocols while maintaining deep on-chain liquidity.

- Boosted Rewards: Earn from trading fees, staking yield, and Aura governance token incentives.

- Flexible Composability: Pools can be tailored for risk tolerance and yield goals, supporting advanced portfolio management.

This approach is perfect for users comfortable with impermanent loss and seeking to maximize their ETH yield through active liquidity provision.

7. Curve Finance LST Pools: Stable Swaps and Incentives

Curve Finance specializes in stable swaps, making it a top choice for LST liquidity. By depositing into pools like stETH/ETH or rETH/ETH, you earn swap fees and often receive protocol incentives (such as CRV or LDO tokens). Curve’s deep liquidity and efficient pricing minimize slippage, making it a favorite for both yield farmers and large traders.

- Stable Returns: Consistent fee income and regular protocol incentives.

- Low Slippage: Ideal for large trades and efficient portfolio rebalancing.

For those seeking predictable, liquid returns on their staked ETH, Curve’s LST pools are a must-consider component of any yield stacking strategy.

Best Practices: Managing Risk and Staying Informed

Maximizing ETH yield with liquid staking tokens is about more than just chasing the highest rates. It’s essential to:

Top 7 LST Yield Stacking Strategies for Risk Management

-

Lido Finance (stETH): Stake your ETH with Lido to receive stETH, a liquid staking token. stETH earns base staking rewards and is integrated across 100+ DeFi protocols, allowing you to maintain liquidity while maximizing yield. Lido is widely audited and considered a market leader for Ethereum liquid staking.

-

Rocket Pool (rETH): Use Rocket Pool for decentralized ETH liquid staking. rETH holders earn staking rewards and can access additional yield opportunities in DeFi pools and lending markets. Rocket Pool allows you to stake as little as 0.01 ETH, making it accessible and decentralized.

-

EigenLayer Restaking: Restake your LSTs (like stETH or rETH) on EigenLayer to earn extra rewards by helping secure new protocols and Actively Validated Services (AVSs). This strategy compounds returns but requires careful monitoring of protocol risks and smart contract security.

-

Pendle Finance Yield Tokenization: Deposit LSTs (e.g., stETH, rETH) into Pendle Finance to split and trade future yield. This enables advanced yield optimization strategies, such as locking in fixed yields or speculating on future returns, while maintaining exposure to ETH staking rewards.

-

Aave Lending with LST Collateral: Supply your LSTs as collateral on Aave to borrow stablecoins or leverage your positions. This approach lets you earn staking rewards on your collateral while accessing additional liquidity, but be mindful of liquidation risks and interest rates.

-

Balancer LST Pools & Boosted Vaults: Provide liquidity to Balancer pools containing LSTs (e.g., stETH/wETH, rETH/wETH) for trading fees and potential boosted yields via Aura Finance. This strategy diversifies yield sources but requires monitoring pool composition and impermanent loss.

-

Curve Finance LST Pools: Add liquidity to Curve‘s LST pools (e.g., stETH/ETH, rETH/ETH) to earn stable swap fees and incentives like CRV and LDO tokens. Curve’s deep liquidity and stable swap design help minimize slippage, but always assess pool risks and rewards.

Stay updated on protocol changes, monitor your positions, and diversify across multiple strategies to mitigate platform-specific risks. Always review smart contract audits and consider the impact of market volatility on both your collateral and borrowed assets. Remember, with ETH’s price currently at $4,335.01, even small swings can affect leveraged positions.

The Future of ETH Yield Stacking

The liquid staking ecosystem is evolving fast, with protocols like Lido, Rocket Pool, and EigenLayer pushing boundaries in composability and reward structures. As integrations deepen across Aave, Balancer, Curve, and Pendle, the opportunities for ETH yield optimization will only expand. Whether you’re a conservative staker or an advanced DeFi strategist, mastering these seven protocols and their interplay will put you at the forefront of ETH yield stacking in 2024 and beyond.

Ready to build your own yield stacking portfolio or learn how to combine these approaches? For detailed walkthroughs and real-time analytics, visit our comprehensive guide: How to Maximize ETH Yield with Liquid Staking Tokens on DeFi Platforms in 2024.