For DeFi investors and crypto yield seekers, the choice between liquid staking vs traditional staking is increasingly consequential. As the market matures and protocols innovate, the way users maximize yield and capital efficiency is evolving rapidly. With Ethereum (ETH) currently trading at $4,133.88, Lido DAO (LDO) at $0.923987, and Rocket Pool (RPL) at $3.86, the stakes for optimizing returns on staked assets have never been higher. Understanding the nuances between these two staking models is essential for anyone looking to unlock the full potential of their crypto holdings.

Traditional Staking: Simplicity, Security, and the Cost of Illiquidity

Traditional staking is the backbone of proof-of-stake (PoS) blockchains. By locking up tokens to secure network operations, participants earn rewards proportional to their staked amount. This method offers several benefits:

- Simplicity: Stake tokens directly on-chain, often through native wallets or exchanges.

- Alignment with Network Health: Staked tokens support decentralization and security.

- Stable Returns: Rewards are typically predictable, with less exposure to DeFi market volatility.

However, the primary drawback is illiquidity. Once tokens are staked, they are locked for a set period, making them inaccessible for trading or other yield opportunities. In some cases, early withdrawal can result in penalties or slashing risks if validators misbehave, potentially leading to loss of funds (source).

Liquid Staking: Unlocking Capital Efficiency and Yield Stacking

Liquid staking DeFi benefits have transformed the landscape for active investors. Instead of locking up assets, users stake their tokens with a liquid staking protocol (like Lido or Rocket Pool) and receive liquid staking tokens (LSTs) in return. These LSTs are freely tradable and can be used across the DeFi ecosystem for additional yield opportunities.

Key advantages include:

Key Benefits of Liquid Staking for DeFi Yield Optimization

-

Enhanced Capital Efficiency: Liquid staking platforms like Lido and Rocket Pool issue liquid staking tokens (LSTs) such as stETH and rETH. These tokens represent staked assets and can be used in DeFi protocols, allowing users to simultaneously earn staking rewards and deploy their capital for additional yield opportunities.

-

Continuous Liquidity: Unlike traditional staking, where assets are locked and inaccessible, liquid staking enables users to trade, transfer, or use their staked assets at any time. This flexibility is especially valuable in volatile markets where rapid access to funds is critical.

-

Reduced Opportunity Cost: By unlocking the value of staked assets, liquid staking minimizes the opportunity cost associated with traditional staking, where assets are otherwise idle. This enables more dynamic portfolio management and maximizes potential returns.

-

Participation in Governance: Many liquid staking protocols allow LST holders to participate in governance decisions, giving users a voice in protocol upgrades and risk management while still earning staking rewards.

This approach allows users to earn staking rewards and participate in lending, borrowing, or liquidity provision with their LSTs. The composability of LSTs enables advanced strategies such as yield stacking with LST, where users layer multiple sources of income on top of their base staking rewards (source).

Comparing Capital Efficiency: Why Liquid Staking Is Gaining Traction

The core appeal of liquid staking lies in its capital efficiency. By keeping staked assets liquid through LSTs, users can respond to market shifts, hedge risk, or seize new opportunities without unwinding their primary position. This is particularly relevant in volatile markets like today’s Ethereum ecosystem, where ETH holds steady at $4,133.88.

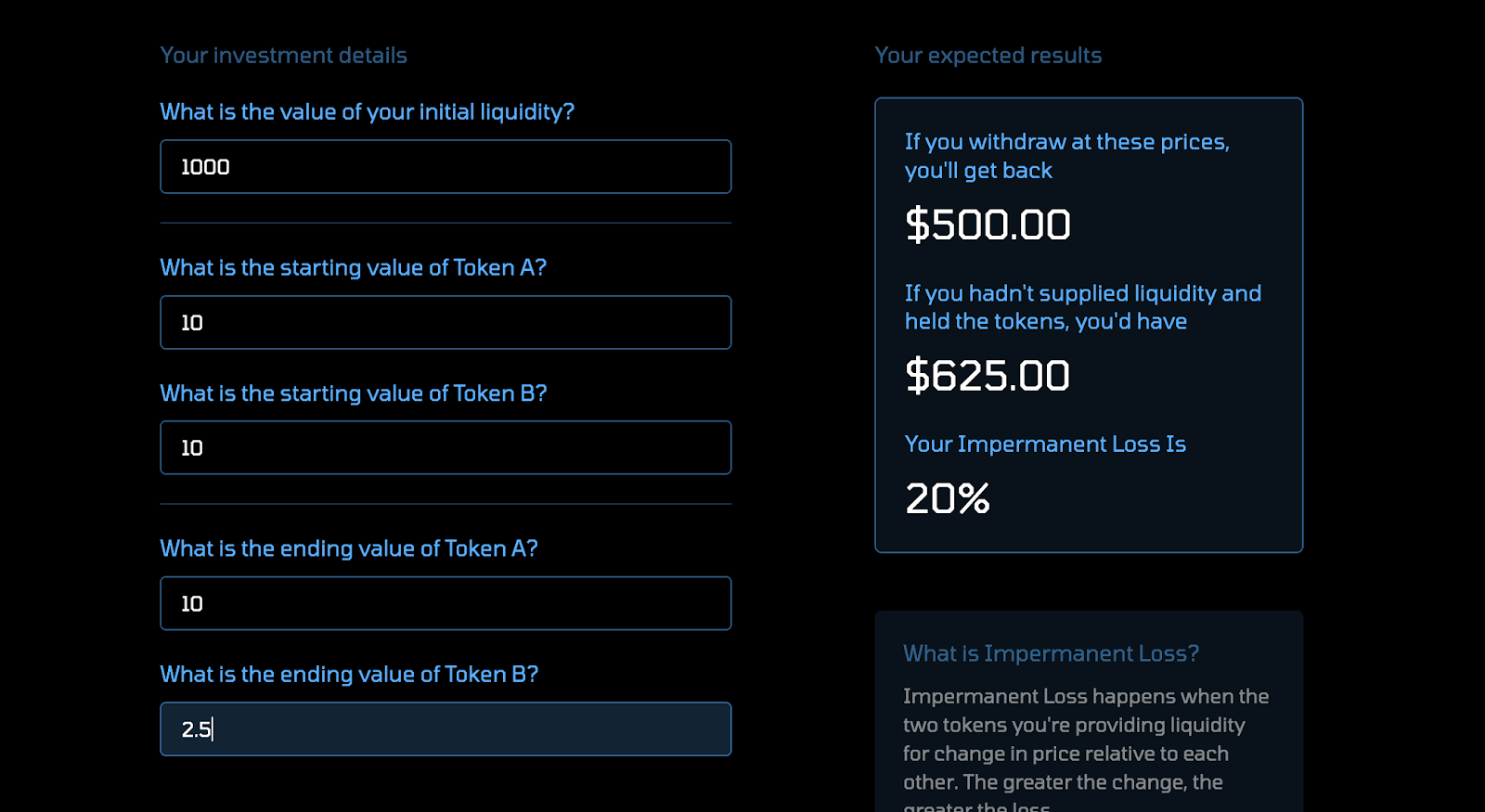

This flexibility is a double-edged sword. While it unlocks new strategies and potential returns, it also introduces fresh risks. Smart contract vulnerabilities, potential de-pegging from the underlying asset, and protocol-specific risks all require careful assessment by investors (source). Risk management is crucial for anyone leveraging liquid staking token strategies.

LST DeFi Optimization: Who Should Consider Liquid Staking?

LST DeFi optimization is best suited for active users who want to maximize returns without sacrificing flexibility. For institutional players or conservative investors prioritizing security and simplicity, traditional staking may still be preferable. The choice ultimately depends on your risk tolerance, investment horizon, and appetite for yield stacking strategies.

As the DeFi ecosystem matures, the interplay between liquid staking vs traditional staking is shaping a new paradigm for both retail and institutional investors. The emergence of robust liquid staking protocols has shifted the conversation from mere reward rates to broader questions of capital allocation, composability, and risk management. With Ethereum (ETH) at $4,133.88, and leading LST protocols like Lido DAO (LDO) at $0.923987 and Rocket Pool (RPL) at $3.86, the landscape is both dynamic and competitive.

Risk and Reward: Navigating the Trade-offs

Understanding the risk profile of each approach is critical. Traditional staking offers a straightforward path: rewards are typically stable, and the process is well-understood. However, the locked nature of funds means you may miss out on emerging opportunities or be unable to respond quickly to market downturns. This can be especially limiting in a rapidly evolving environment where DeFi protocols and yields shift by the week.

Liquid staking, by contrast, is inherently more complex. The use of LSTs introduces protocol risk, smart contract vulnerabilities, and the possibility of LSTs losing their peg to the underlying asset. While the risk of validator slashing remains, it is now layered with additional exposure to DeFi-specific risks. For example, if a liquid staking protocol is exploited, users could face losses that go beyond traditional staking risks. This is why due diligence and ongoing monitoring of protocol updates, audits, and insurance mechanisms are essential for liquid stakers.

Yield Stacking and Strategy: Maximizing Total Return

The real power of liquid staking lies in its ability to unlock yield stacking with LST. By deploying LSTs across lending, borrowing, and liquidity pools, users can layer multiple streams of income. For example, staking ETH with Lido yields stETH, which can then be deposited into a DeFi lending protocol to earn additional interest, or paired in a liquidity pool to capture trading fees. This composability is driving a surge in DeFi activity and attracting sophisticated investors looking to optimize every unit of capital.

Still, investors must weigh the extra yield against the complexity and risk. Not all protocols are created equal, and the market for LSTs can experience volatility, particularly if confidence in a protocol is shaken. Monitoring LST de-pegging events and liquidity conditions is as important as tracking reward rates.

Market Data and Real-Time Analytics: Staying Ahead in Liquid Staking DeFi

Given the speed at which DeFi evolves, real-time analytics and diligent research are non-negotiable. Platforms like Lstfi aggregate protocol data, yield rates, and risk metrics, enabling users to make informed decisions and pivot strategies as new opportunities arise. Tracking the current prices of ETH, LDO, and RPL – $4,133.88, $0.923987, and $3.86 respectively – is just the starting point. Understanding how these assets interact within the broader DeFi ecosystem is key to effective capital allocation.

| Staking Method | Liquidity | Yield Potential | Risk Profile | Best For |

|---|---|---|---|---|

| Traditional Staking | Locked | Stable | Low to Moderate (slashing) | Long-term, conservative investors |

| Liquid Staking | Freely tradable (LSTs) | Stackable/Compositional | Moderate to High (protocol/DeFi risks) | Active DeFi users, yield optimizers |

The future of staking is likely to be hybrid – combining the security of traditional methods with the flexibility of liquid staking. As protocols mature and security standards rise, expect institutional adoption of liquid staking to accelerate, especially as capital efficiency becomes a competitive advantage.

Which staking method do you prefer for your crypto portfolio?

With Ethereum trading at $4,133.88, Lido DAO at $0.923987, and Rocket Pool at $3.86, the choice between liquid and traditional staking is more relevant than ever. Liquid staking offers flexibility and capital efficiency, while traditional staking provides simplicity and security. Which approach aligns best with your investment style?

Ultimately, whether you opt for the simplicity of traditional staking or embrace the innovation of liquid staking DeFi strategies, staying disciplined and informed is paramount. With proper research and risk management, both models can play a role in a diversified crypto portfolio as we move into the next phase of decentralized finance.