Bitcoin’s ascent to $115,042.00 has catalyzed a new era of yield opportunities for holders seeking to do more than just HODL. The emergence of bitcoin liquid staking protocols means BTC can now be deployed in DeFi to earn passive yield, all while retaining liquidity and composability. Platforms like BOB and Stacking DAO are at the vanguard, offering innovative ways to maximize BTC yields through liquid staking tokens (LSTs) and multi-layered DeFi integrations.

Bitcoin Maintains Position Above $100,000: Yield Strategies Evolve

With Bitcoin trading at $115,042.00 (24h low: $113,975.00, high: $115,948.00), the opportunity cost of leaving BTC idle is higher than ever. The BOB Earn LST ecosystem and Stacking DAO’s liquid stacking suite are redefining how users can extract yield from their Bitcoin without sacrificing access or security. These platforms are not only about staking – they are about unlocking a double yield loop BTC and activating the LST flywheel for compounding returns.

BOB: One-Click BTC Staking and Hybrid Yield Vaults

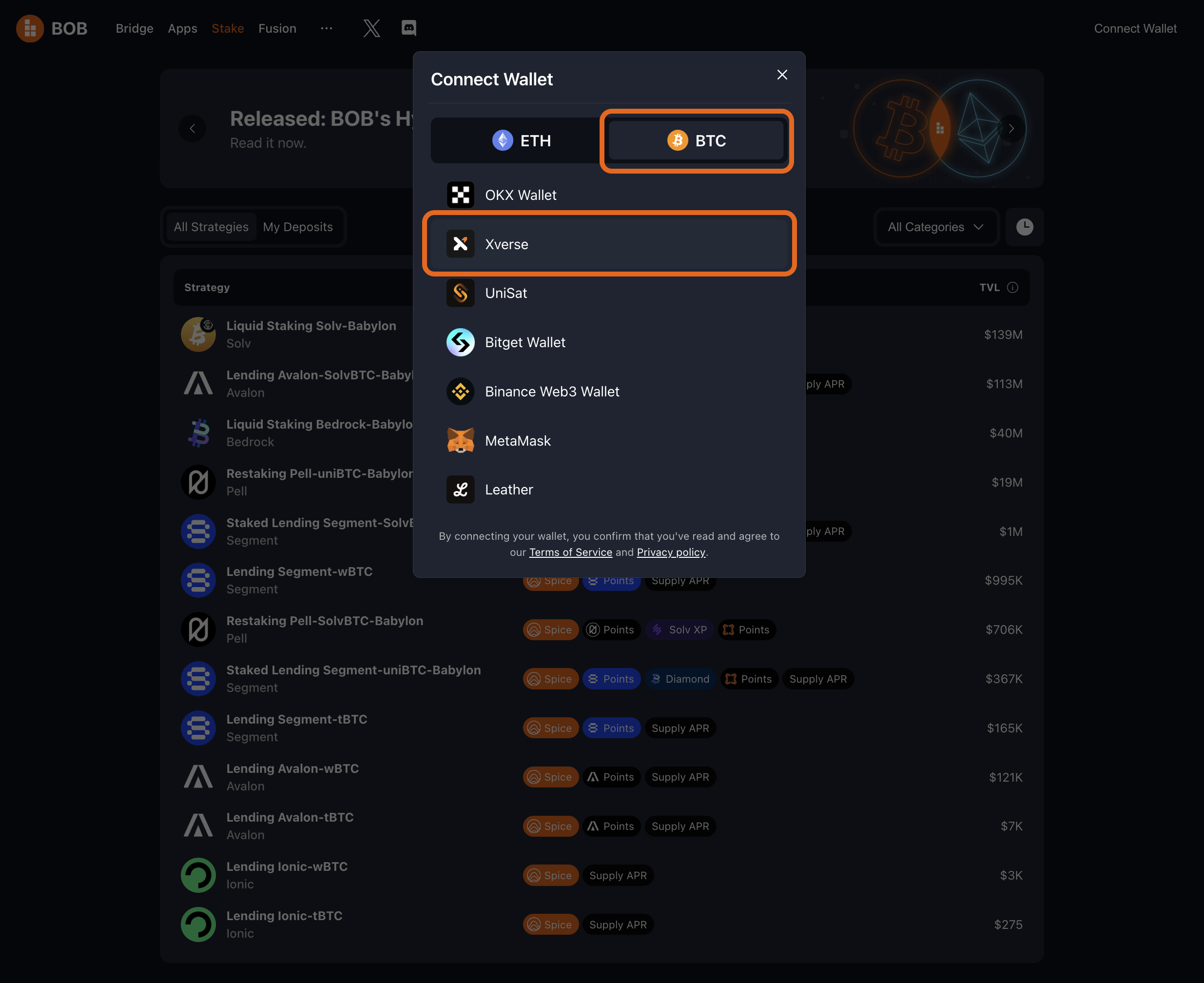

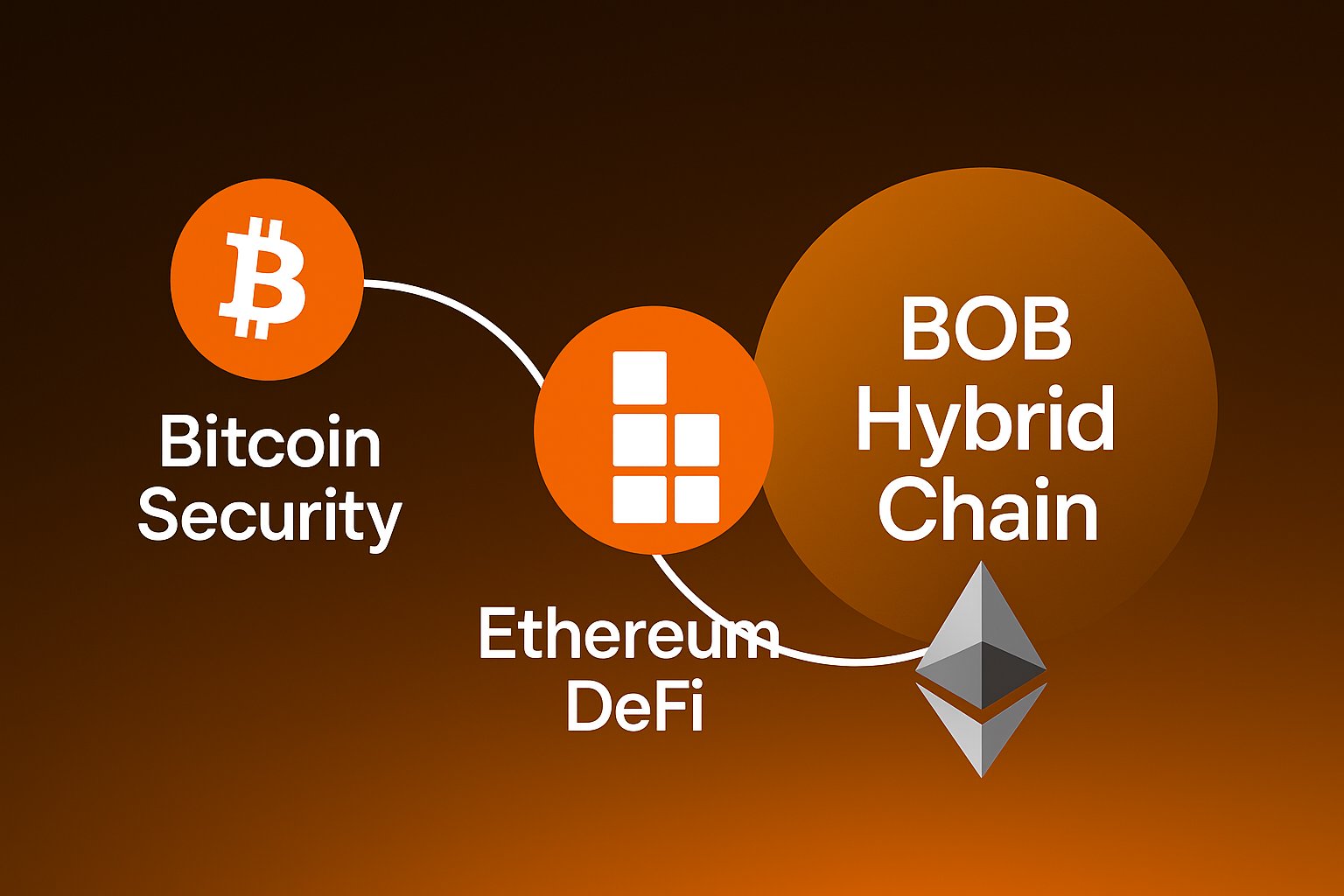

BOB (Build on Bitcoin) is pioneering a multi-chain BTC yield layer, allowing users to stake BTC in a single click and receive LSTs that are usable across the DeFi landscape. With Hybrid BTC yield products, BOB aggregates yield opportunities from multiple chains and protocols, returning rewards in BTC. This dramatically simplifies yield stacking for users who previously needed to navigate disparate interfaces and bridges.

BOB Stake, the platform’s 1-click staking portal, empowers users to deposit BTC and instantly mint LSTs, which can then be deployed into lending, borrowing, and liquidity mining protocols. This seamless process is a game-changer for those looking to optimize capital efficiency and stay agile in a rapidly shifting market.

Stacking DAO: Liquid Stacking for Continuous Bitcoin Yield

Stacking DAO’s approach is equally compelling. By offering liquid stacking options like stSTX and stSTXbtc, users can earn yield immediately upon minting, sidestepping the traditional 14-day lock-up that has historically limited stacking flexibility. stSTX grows in value over time, auto-compounding rewards, while stSTXbtc delivers daily sBTC rewards that are claimable at any time. Both tokens are composable across the Stacks DeFi ecosystem, enabling further yield opportunities and participation in emerging point programs.

Notably, Stacking DAO’s dual stacking model allows users to stake both BTC and STX, earning a share of the BTC committed by miners. This model is attractive for sophisticated users seeking to maximize their exposure to both assets while benefiting from the protocol’s unique yield mechanics.

Bitcoin (BTC) Price Prediction 2026-2031

Based on current 2025 market data ($115,042.00) and analysis of DeFi, LST adoption, and macro crypto trends.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $95,000 | $125,000 | $160,000 | +8.7% | DeFi adoption grows, moderate regulatory clarity |

| 2027 | $110,000 | $145,000 | $200,000 | +16.0% | Major LST/DeFi integrations, increasing institutional flows |

| 2028 | $125,000 | $170,000 | $240,000 | +17.2% | Expanding BTC use cases, global ETF approvals |

| 2029 | $140,000 | $200,000 | $285,000 | +17.6% | Next BTC halving, strong network growth |

| 2030 | $130,000 | $225,000 | $330,000 | +12.5% | Market volatility, high adoption but regulatory headwinds |

| 2031 | $150,000 | $260,000 | $380,000 | +15.6% | Mature BTC DeFi ecosystem, mainstream financial integration |

Price Prediction Summary

Bitcoin is projected to continue a steady upward trajectory over the next six years, driven by increased adoption of liquid staking, integration into DeFi, and broader institutional acceptance. While volatility and regulatory uncertainties remain, the average price is expected to nearly double by 2031 compared to current levels, with bullish scenarios pushing BTC above $350,000 if market conditions are favorable.

Key Factors Affecting Bitcoin Price

- Adoption of BTC liquid staking tokens (LSTs) and DeFi protocols (e.g., BOB, Stacking DAO)

- Bitcoin network upgrades and scalability improvements

- Global regulatory environment and ETF approvals

- Institutional investment inflows and macroeconomic trends

- Market cycles (e.g., post-halving effects and bull/bear transitions)

- Competition from other smart contract and DeFi platforms

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Integrating LSTs Across DeFi: The LST Flywheel in Action

The true power of LSTs lies in their composability. Once minted, BOB and Stacking DAO LSTs can be integrated into a growing array of DeFi protocols. For example, users can supply their LSTs as collateral, participate in liquidity pools, or loop yields by leveraging lending platforms. This creates a yield flywheel that can amplify returns far beyond what traditional staking offers.

Stacking DAO’s integrations with protocols like Zest, Bitflow, Velar, Arkadiko, and Hermetica illustrate the breadth of opportunities available for LST holders. These integrations not only enable additional yield but also unlock access to governance, incentives, and future airdrops – all while maintaining exposure to the underlying BTC yield.

As the Bitcoin DeFi landscape continues to mature, the importance of staying informed and agile cannot be overstated. Platforms like BOB and Stacking DAO are setting the standard for what is possible with liquid staking tokens bitcoin, offering a toolkit for maximizing yield in a market where every satoshi counts.

Risk management remains paramount as you integrate liquid staking tokens bitcoin into your yield strategy. While the composability and liquidity of LSTs open new doors, users should always evaluate smart contract risks, protocol security, and the underlying economics of each platform. The recent proliferation of hybrid yield products and instant staking portals like BOB Stake has democratized access, but also demands a disciplined approach to due diligence and portfolio balancing.

For those seeking to optimize every layer of their BTC stack, the double yield loop BTC is increasingly within reach. By staking BTC via BOB’s managed vaults, then deploying the resulting LSTs across Stacks DeFi or other integrated protocols, users can effectively stack multiple streams of passive income. This approach not only maximizes capital efficiency, but also positions users for upside as new integrations and airdrop opportunities emerge within the LST flywheel.

Checklist: Maximizing BTC Yields with LSTs

Staying ahead in this environment means keeping a close eye on the evolving landscape. Both BOB and Stacking DAO are actively expanding their integrations, launching new products, and refining their user experience. For example, the introduction of BOB’s Hybrid BTC yield products delivers a seamless way to aggregate and optimize BTC yield across chains, while Stacking DAO’s liquid stacking suite continues to innovate around instant rewards and composability.

“Value is built, not found. ” The LST revolution is evidence of this principle in action. By leveraging the tools at your disposal, BOB’s one-click staking, Stacking DAO’s dual stacking, and the broader DeFi ecosystem, you’re not just earning yield. You’re participating in the construction of a new financial layer for Bitcoin itself.

Key Benefits of Using LSTs for BTC Yield Optimization

-

Instant and Continuous BTC Yield: Liquid Staking Tokens (LSTs) like stSTX and stSTXbtc from Stacking DAO enable users to earn BTC yield immediately upon minting, bypassing the typical 14-day lock-up period of traditional stacking. Rewards are distributed daily and can be claimed at any time.

-

Seamless Integration with DeFi Protocols: LSTs are DeFi-native assets, allowing holders to use them across major Stacks DeFi platforms such as Zest, Bitflow, Velar, Arkadiko, and Hermetica. This unlocks additional yield opportunities and points, maximizing the utility of staked BTC.

-

One-Click BTC Staking via BOB Stake: BOB Stake offers a one-click staking portal for BTC, simplifying the process of accessing multiple BTC LST protocols in a single transaction. This streamlines user experience and broadens access to yield-generating opportunities.

-

Multi-Chain Yield Aggregation with BOB Hybrid Vaults: BOB Hybrid BTC Vaults deploy user assets into DeFi applications across various blockchains, returning BTC-denominated yields to depositors. This provides exposure to diverse yield sources without managing multiple wallets or interfaces.

-

No Long-Term Lock-Ups or Exit Penalties: LSTs like stSTX and stSTXbtc offer flexibility—users can redeem or trade their tokens at any time, avoiding the illiquidity and penalties associated with traditional staking or stacking.

-

Compounding and Enhanced Yield Potential: LSTs such as stSTX are designed to auto-compound rewards, increasing in value over time and further amplifying BTC yield returns for holders.

-

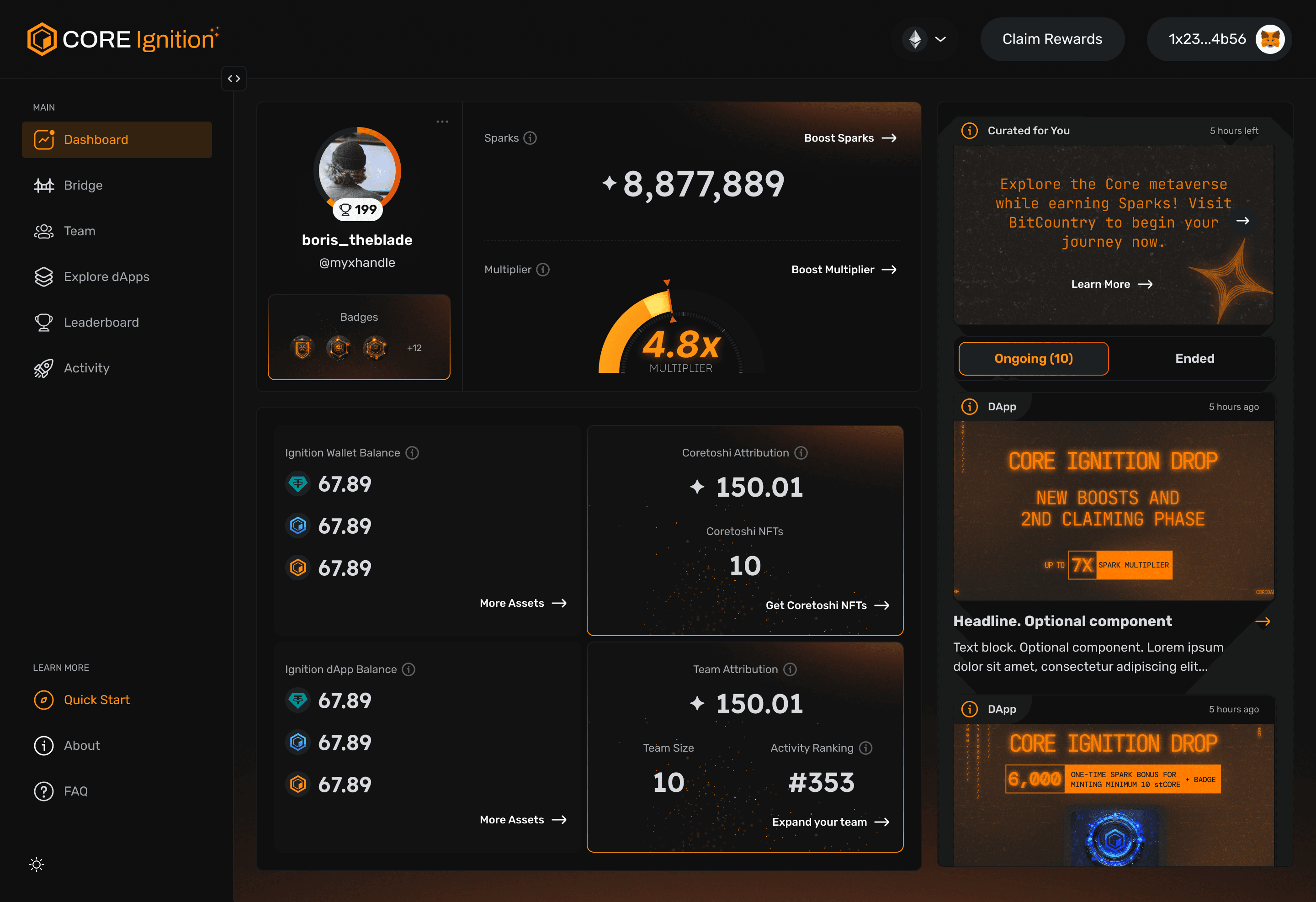

Transparent, Real-Time Yield Tracking: Platforms like Stacking DAO and BOB provide real-time dashboards for monitoring earned BTC, token balances, and DeFi integrations, empowering users to make informed yield optimization decisions.

As Bitcoin sustains its position above $100,000: with the current price at $115,042.00: the imperative to put your assets to work is stronger than ever. Whether you’re a seasoned DeFi user or just exploring btc staking DeFi for the first time, the combination of BOB and Stacking DAO provides a robust foundation for yield stacking, liquidity, and long-term value creation. Monitor the evolving integrations, weigh your risk, and embrace the compounding power of the LST flywheel as the next chapter of Bitcoin DeFi unfolds.