Liquid Staking Tokens (LSTs) are rewriting the rules of capital efficiency in DeFi. Forget static staking – now you can earn staking rewards and keep your assets liquid, unlocking a flywheel of yield opportunities. With Ethereum (ETH) currently trading at $4,009.41, LST strategies are front and center for investors chasing yield without sacrificing flexibility.

How LSTs Power Double Yield Loops

The magic starts with the basic premise: stake your ETH, receive an LST (like stETH), and that token becomes your passport to a world of DeFi composability. You’re not just earning validator rewards – you’re opening the door to recursive strategies that stack yield on top of yield.

Here’s how a classic LST double yield loop plays out:

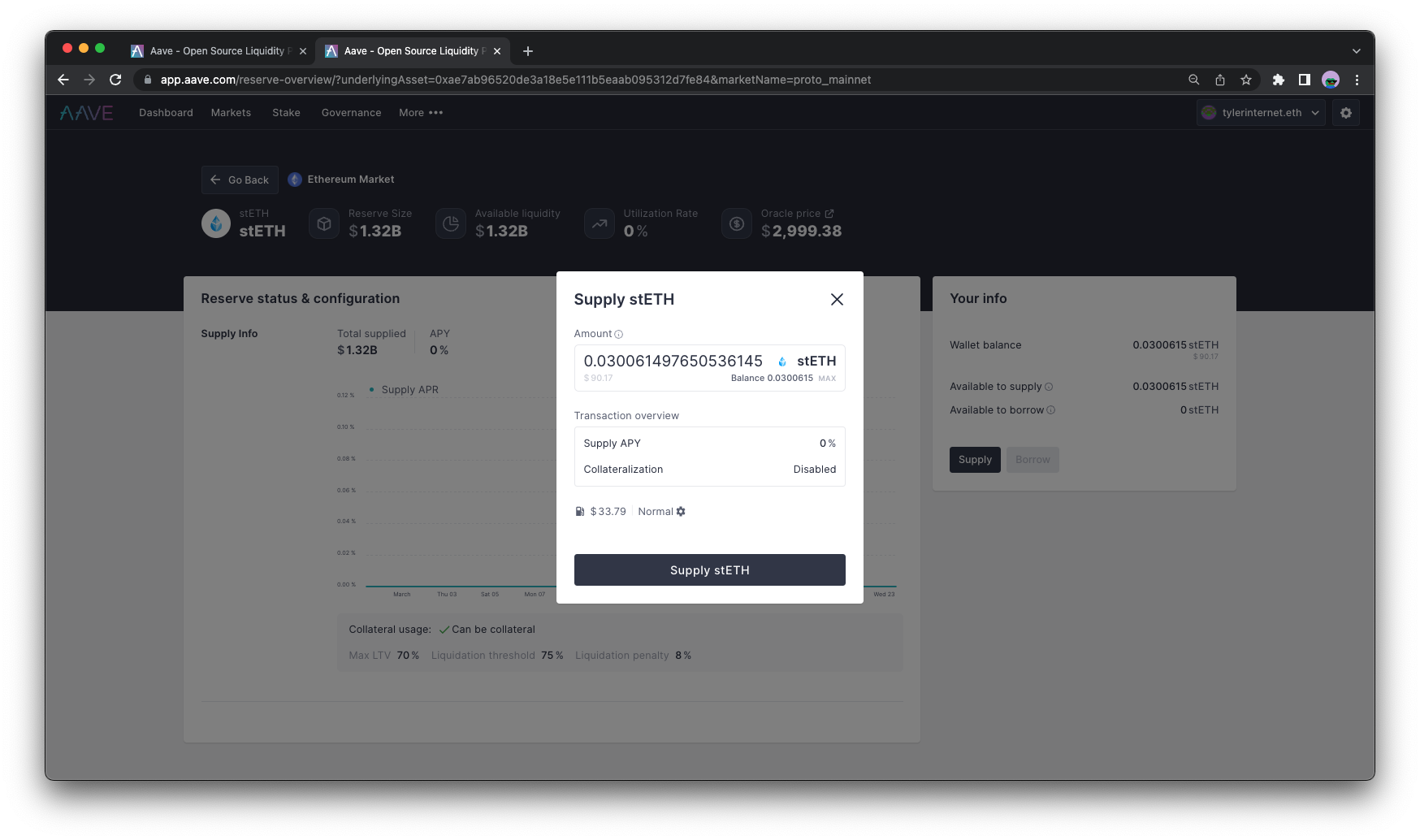

It’s simple in theory but powerful in practice. Stake ETH via a liquid staking protocol, receive stETH, then use that as collateral on a lending platform like Aave or Spark to borrow more ETH. Stake that borrowed ETH again, get more stETH, and repeat the process. Each loop compounds both your staking rewards and potential lending incentives.

Platforms Leading the Yield Loop Revolution

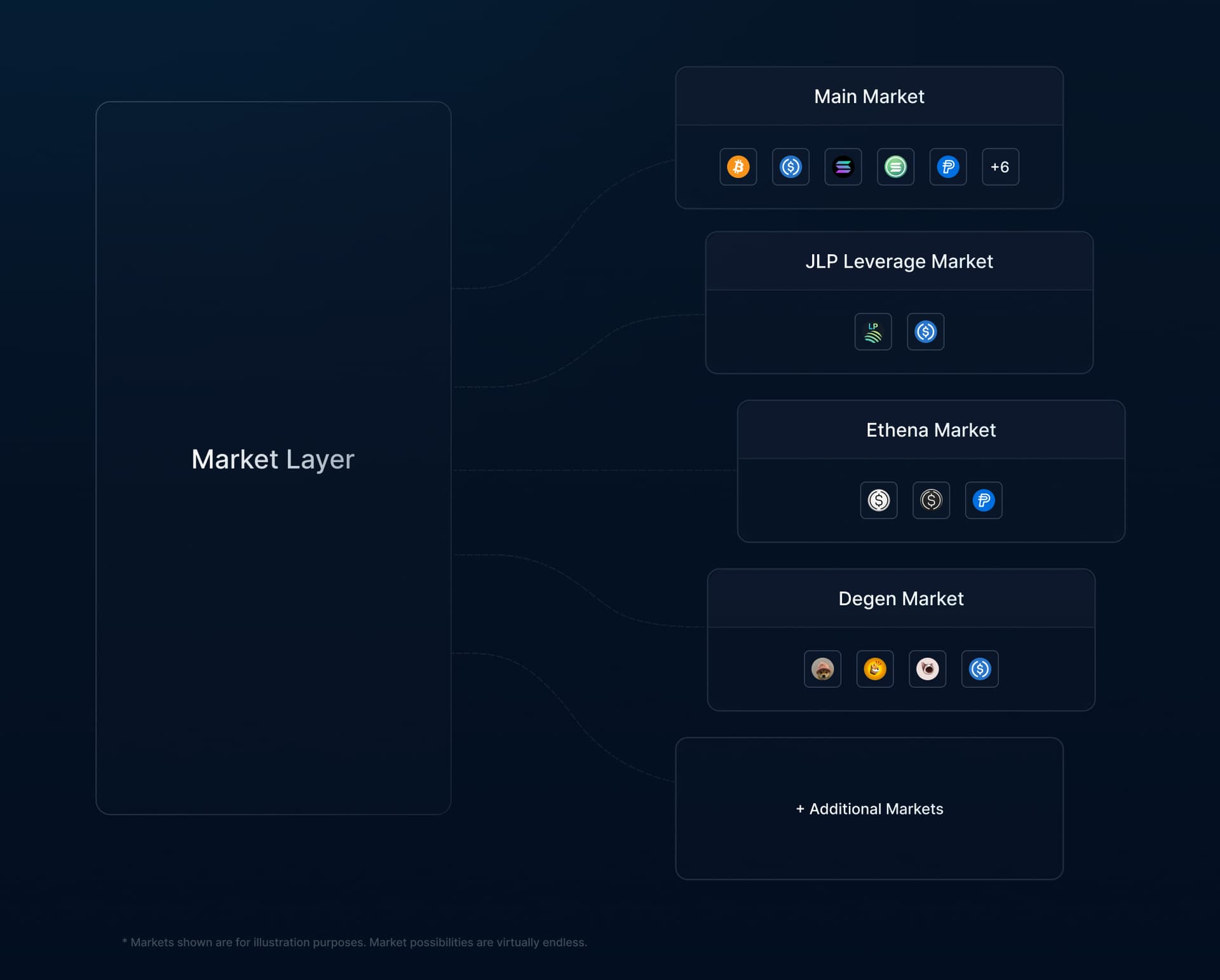

The rise of LSTs has inspired DeFi protocols to build products designed for aggressive yield stacking:

Top DeFi Platforms Powering LST Double Yield Loops

-

Index Coop Smart Loops (wstETH15x): Offers automated, leveraged looping strategies using wstETH to amplify ETH yields up to 15x. Features built-in risk controls and transparent APY multipliers.

-

Ankr Liquid Staking (ankrETH, ankrBNB): Provides liquid staking tokens for ETH and BNB that can be used as collateral in lending protocols, enabling recursive staking and double yield loops. Known for flexible integrations and competitive yields.

-

Kamino Finance (Solana): Facilitates leveraged staking loops with SOL and LSTs, letting users boost APY through automated multipliers. Popular for its user-friendly interface and real-time yield tracking.

-

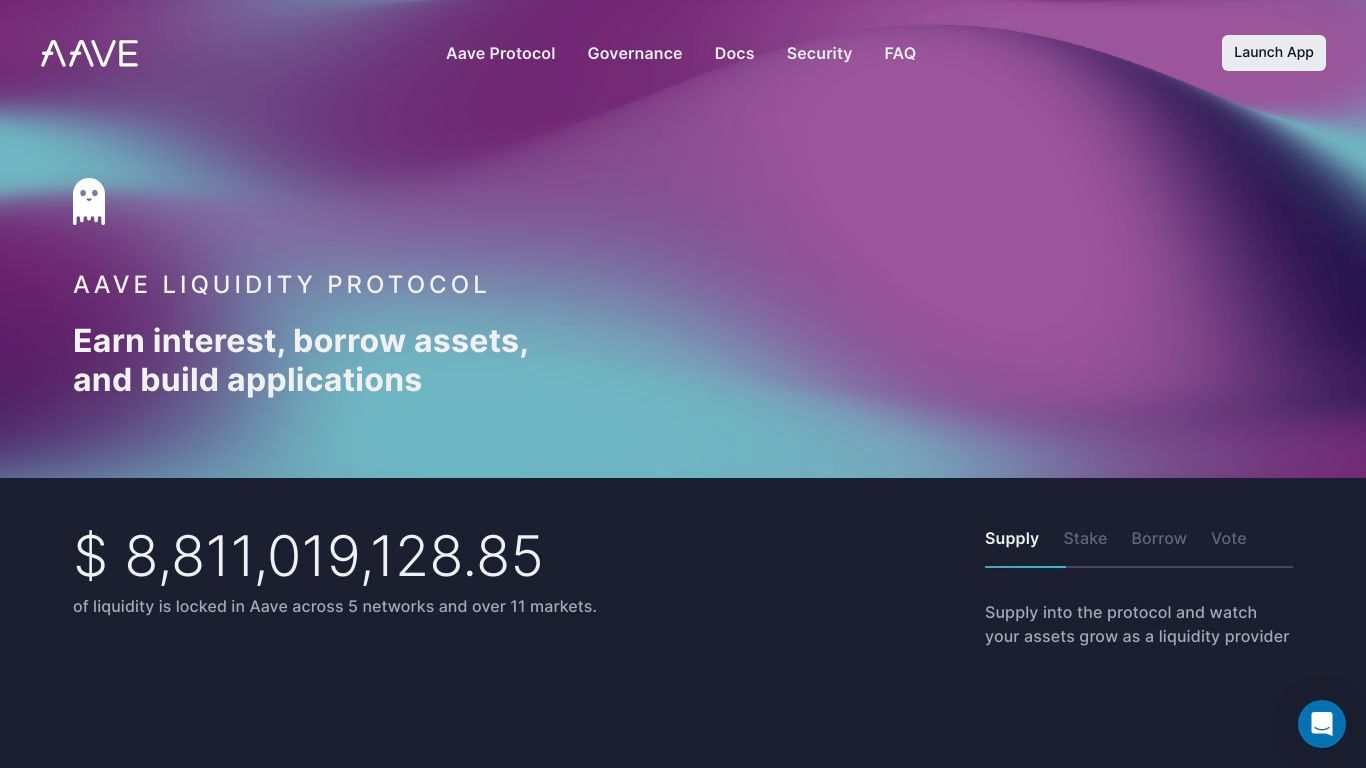

Aave Protocol: Supports major LSTs like stETH and rETH as collateral, allowing users to borrow ETH and re-stake, forming double yield loops. Offers dynamic interest rates and robust risk management tools.

-

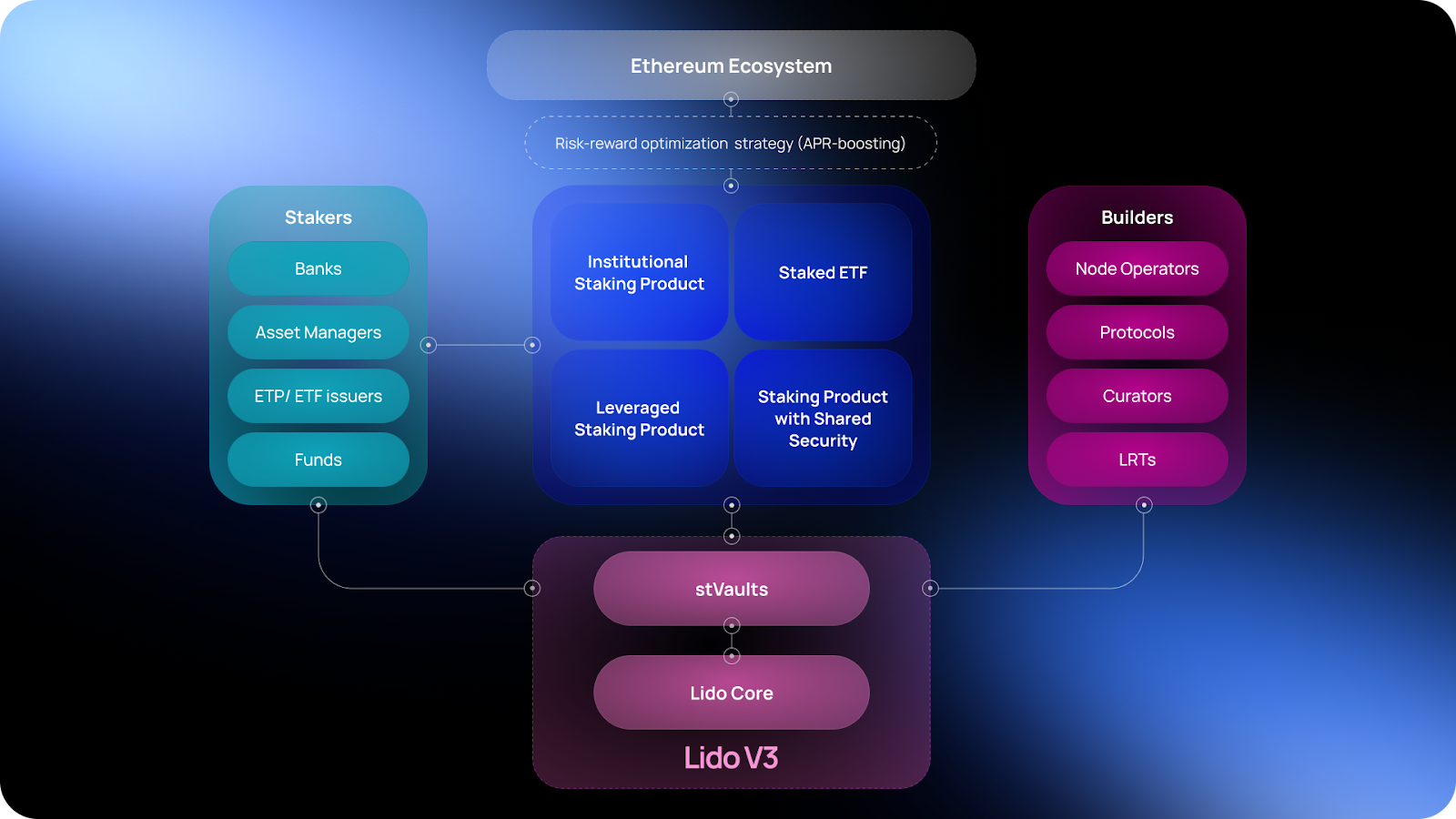

Lido Finance: The leading liquid staking platform for ETH, Lido’s stETH integrates seamlessly with DeFi lending markets, enabling users to maximize staking rewards through looping strategies.

Index Coop’s wstETH15x is making waves with its Smart Loops product, allowing users to leverage up to 15x their original ETH exposure using recursive staking-borrowing cycles. Ankr’s ankrBNB brings similar mechanics to BNB Chain, while Kamino Finance is pushing leveraged SOL strategies on Solana. These platforms are engineering new ways for users to maximize returns without waiting for lockups to end or missing out on other DeFi opportunities.

LST Flywheel: The Capital Efficiency Gamechanger

The real innovation is capital efficiency. In traditional staking, your tokens are locked – untouchable until unstaking completes. With LSTs, every step in the loop keeps your assets productive:

- Earning base chain staking rewards

- Unlocking borrowing power via collateralization

- Tapping into additional yields from farming or incentive programs within lending protocols

- Potentially qualifying for protocol airdrops due to active usage

This creates what many call the LST flywheel effect: each action feeds back into itself, compounding returns as long as market conditions remain favorable and risk is managed tightly.

Risk Management Is Non-Negotiable

No high-yield strategy comes without risk. Double yield loops expose you to liquidation if the value of your collateral (your stETH or other LST) drops sharply relative to your borrowed asset, especially critical given current market volatility around $4,009.41 ETH. Borrowing rates can spike unexpectedly, eating into profits or flipping positive yields negative in hours.

Ethereum (ETH) Price Prediction 2026-2031

Professional multi-year forecast factoring in DeFi, LST adoption, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,500 | $6,200 | +12% | Continued LST adoption, moderate DeFi growth |

| 2027 | $3,950 | $5,250 | $7,500 | +17% | Bullish DeFi expansion, ETH upgrades, increased institutional interest |

| 2028 | $4,200 | $5,900 | $9,000 | +12% | Mainstream LST integration, regulatory clarity, high network activity |

| 2029 | $4,000 | $6,750 | $11,000 | +14% | ETH 3.0 rollout, DeFi/LSTs drive new use cases, strong macro tailwinds |

| 2030 | $4,800 | $7,900 | $13,500 | +17% | Peak of DeFi/LST cycle, global adoption, Layer 2 scaling success |

| 2031 | $4,200 | $8,400 | $16,000 | +6% | Market maturity, competition from new chains, stabilized growth |

Price Prediction Summary

Ethereum is projected to experience steady growth from 2026 to 2031, driven by widespread adoption of Liquid Staking Tokens (LSTs), ongoing DeFi innovation, and major network upgrades. While short-term volatility and risk factors remain, the overall outlook is bullish, with ETH potentially reaching an average price of $8,400 by 2031. Minimum price predictions reflect possible bearish scenarios, while maximums assume optimal market and adoption conditions.

Key Factors Affecting Ethereum Price

- Growth and integration of LSTs in DeFi, unlocking double yield strategies and increasing ETH lock-up.

- Ethereum network upgrades (e.g., ETH 3.0, Layer 2 scaling) improving throughput and lowering fees.

- Regulatory developments impacting DeFi and staking services globally.

- Competition from other smart contract blockchains (Solana, Avalanche, etc.).

- Macro market cycles and institutional adoption of ETH as a portfolio asset.

- Potential risks: smart contract exploits, liquidation cascades in double yield loops, and changes in staking yields.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you want deeper tactical breakdowns or sustainable stacking blueprints using liquid staking tokens, check this out: How Liquid Staking Tokens (LSTs) Enable Sustainable Yield Stacking in DeFi.

Staying nimble is the name of the game. The best LST double yield loopers monitor their loan-to-value (LTV) ratios like hawks, using dashboards and automated alerts to avoid forced liquidations. Tools like DeFiLlama make it easy to compare lending rates and keep tabs on collateral health in real time. If you’re not proactive, a sharp ETH move below $4,009.41 could wipe out your stack faster than you can react.

Emerging Trends: Restaking and Layered Yields

The next evolution in yield stacking is restaking, using LSTs not just as collateral, but as productive assets in new protocols like EigenLayer. Here, stETH or similar tokens can be restaked to secure additional networks or participate in novel DeFi primitives. This unlocks layered yields: staking rewards and lending incentives and restaking returns, all on the same capital base.

This multi-layered approach is powering DeFi’s latest “restaking boom, ” with protocols racing to integrate LST support for everything from governance participation to liquidity mining. The composability of LSTs means capital never sits idle, every token has multiple jobs across the ecosystem.

Checklist: Are You Loop-Ready?

If you’re eyeing double yield loops for your next move, don’t skip due diligence:

- Assess protocol security: Only use audited platforms with strong track records.

- Understand liquidation mechanics: Know your collateral thresholds and triggers.

- Factor in all fees: Borrowing costs and swap fees add up fast.

- Diversify your loops: Don’t put all your LSTs into a single protocol or chain.

- Stay updated: Follow community updates for new risks or opportunities.

The Future of Yield Stacking with LSTs

LST-driven double yield loops are more than just a passing trend, they’re rewriting the playbook for capital efficiency in DeFi. As more protocols embrace interoperability and restaking options proliferate, expect even more creative strategies that let users extract every drop of value from their assets.

Top LST Use Cases Shaping DeFi in 2025

-

Restaking with EigenLayer: EigenLayer enables users to restake LSTs like stETH, unlocking layered yields by securing new protocols and earning additional rewards beyond native staking.

-

Double Yield Loops on Index Coop: Index Coop’s Smart Loops product (wstETH15x) lets users recursively loop LSTs as collateral and borrowings, compounding ETH yields up to 15x for tactical DeFi strategists.

-

LST-Powered Loyalty Programs: Platforms like Lido and Rocket Pool are rolling out loyalty and points systems for LST holders, rewarding long-term staking and active DeFi participation with exclusive perks and governance rights.

-

Cross-Chain Composability with Ankr: Ankr’s LSTs (e.g., ankrBNB, ankrETH) are bridging assets across major blockchains, enabling users to deploy LSTs in diverse DeFi ecosystems for optimized yield strategies.

-

Yield Multipliers on Kamino Finance: Kamino Finance on Solana offers leveraged staking loops, allowing users to multiply SOL yields by integrating LSTs into automated, high-APY strategies.

-

LSTs as Collateral in Lending Protocols: Major DeFi platforms like Aave and Compound accept LSTs (e.g., stETH, rETH) as collateral, letting users borrow stablecoins while still earning staking rewards, fueling capital efficiency.

The bottom line? Liquid staking tokens are turning static assets into dynamic engines of yield generation. If you want to see how these mechanics are being leveraged beyond pure finance, think loyalty programs and sustainable stacking, don’t miss this deep dive: How Liquid Staking Tokens (LSTs) Unlock Double Yield in On-Chain Loyalty Programs.

The landscape is evolving fast. Stay tactical, manage risk ruthlessly, and let the flywheel spin.