Ethereum’s liquid staking revolution has hit its stride in 2025. With over 36 million ETH staked and Lido’s stETH trading at $3,850.40, the line between passive staking and active DeFi yield optimization is blurrier than ever. If you’re holding ETH or stETH, you’re sitting on a goldmine of opportunities, if you know how to stack your yield layers wisely. In this guide, we’ll break down the four most powerful, advanced strategies for maximizing ETH yield with stETH, tailored for the realities of today’s DeFi landscape.

Why stETH Remains the Core Yield Engine in 2025

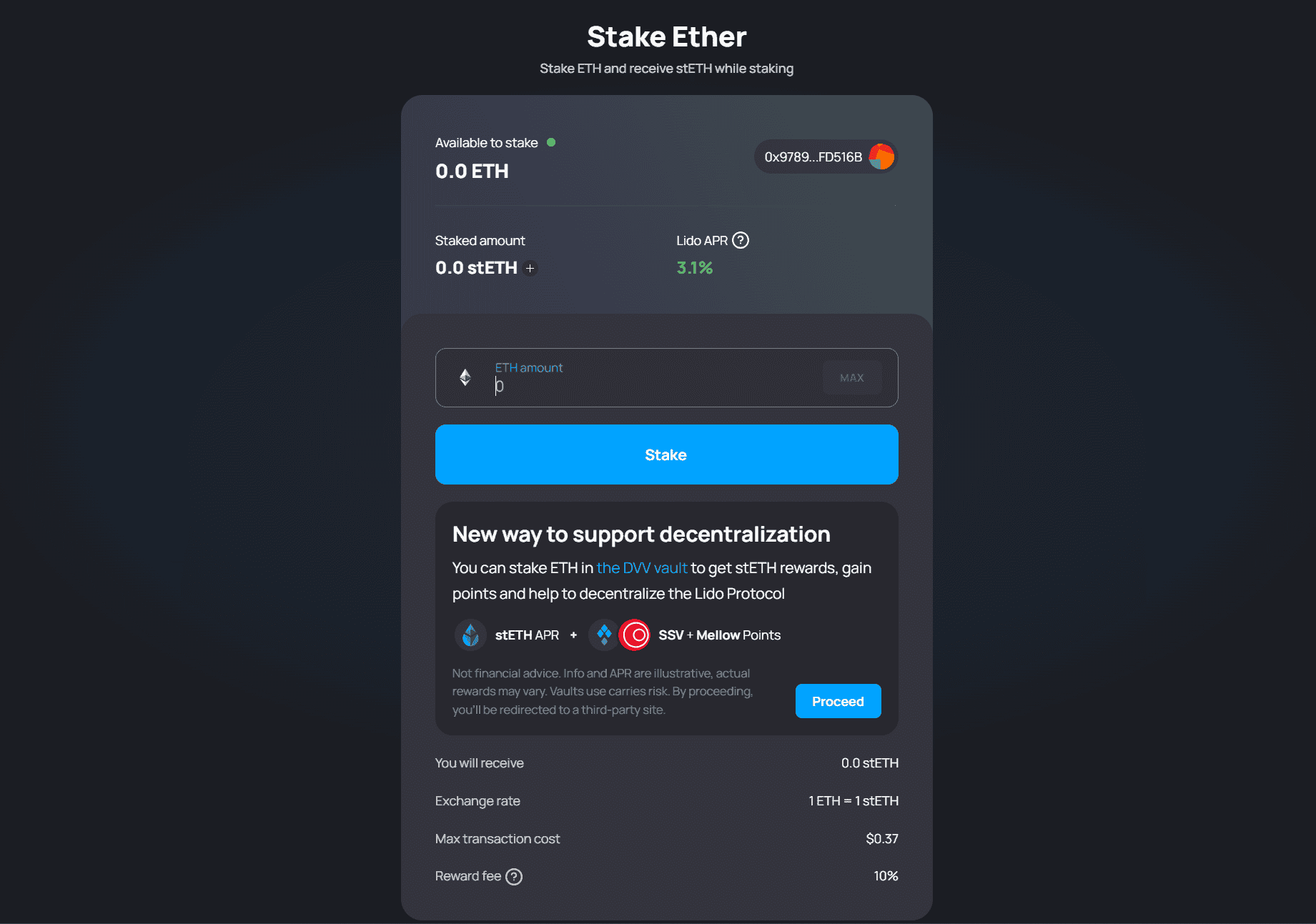

The minimal spread between ETH ($3,849.10) and stETH ($3,850.40) is more than a technicality, it’s a sign of deep liquidity and trust in the liquid staking ecosystem. Staking ETH via Lido to receive stETH not only earns you base staking rewards, but unlocks a universe of DeFi integrations. The smartest investors are now layering yields, compounding returns far beyond the base 3-4% APY. Let’s dive into the most effective methods for amplifying your ETH yield with stETH this year.

1. Restake stETH on EigenLayer for Additional Rewards

Restaking has emerged as the defining DeFi meta of 2025. By depositing your stETH on EigenLayer, you allow your capital to secure not just Ethereum, but also new middleware protocols and rollups. In return, you earn extra protocol-native rewards on top of your Lido yield. This layered security model is fundamentally changing how capital efficiency is measured in DeFi.

“Restaking with EigenLayer is how I turned my 3% ETH rewards into double digits, without ever selling my principal. ”

The caveat? Restaking introduces new risks: slashing on additional networks and smart contract complexity. But with EigenLayer’s TVL surging and audits stacking up, many see it as the essential first step for yield-maximizing ETH holders.

2. Provide stETH-ETH Liquidity on Curve and Stake LP Tokens in Convex

If you want to put your stETH to work in DeFi’s deep liquidity pools, Curve remains king. The stETH-ETH pool on Curve consistently offers some of the highest sustainable yields for ETH pairs, especially when you stake your LP tokens on Convex to farm extra CVX and CRV incentives.

Top Layered stETH Yield Strategies for 2025

-

Restake stETH on EigenLayer for Additional Rewards: Maximize your ETH yield by depositing stETH into EigenLayer, a leading restaking protocol. This approach lets you earn both Lido staking rewards and extra EigenLayer incentives, compounding your returns while supporting Ethereum’s decentralized security ecosystem.

-

Provide stETH-ETH Liquidity on Curve and Stake LP Tokens in Convex: Boost your yield by supplying liquidity to the stETH-ETH pool on Curve. Then, stake your Curve LP tokens with Convex Finance to earn trading fees, CRV, and CVX rewards—all while maintaining exposure to both ETH and stETH, which are closely pegged (stETH: $3,850.40, ETH: $3,849.10 as of October 22, 2025).

-

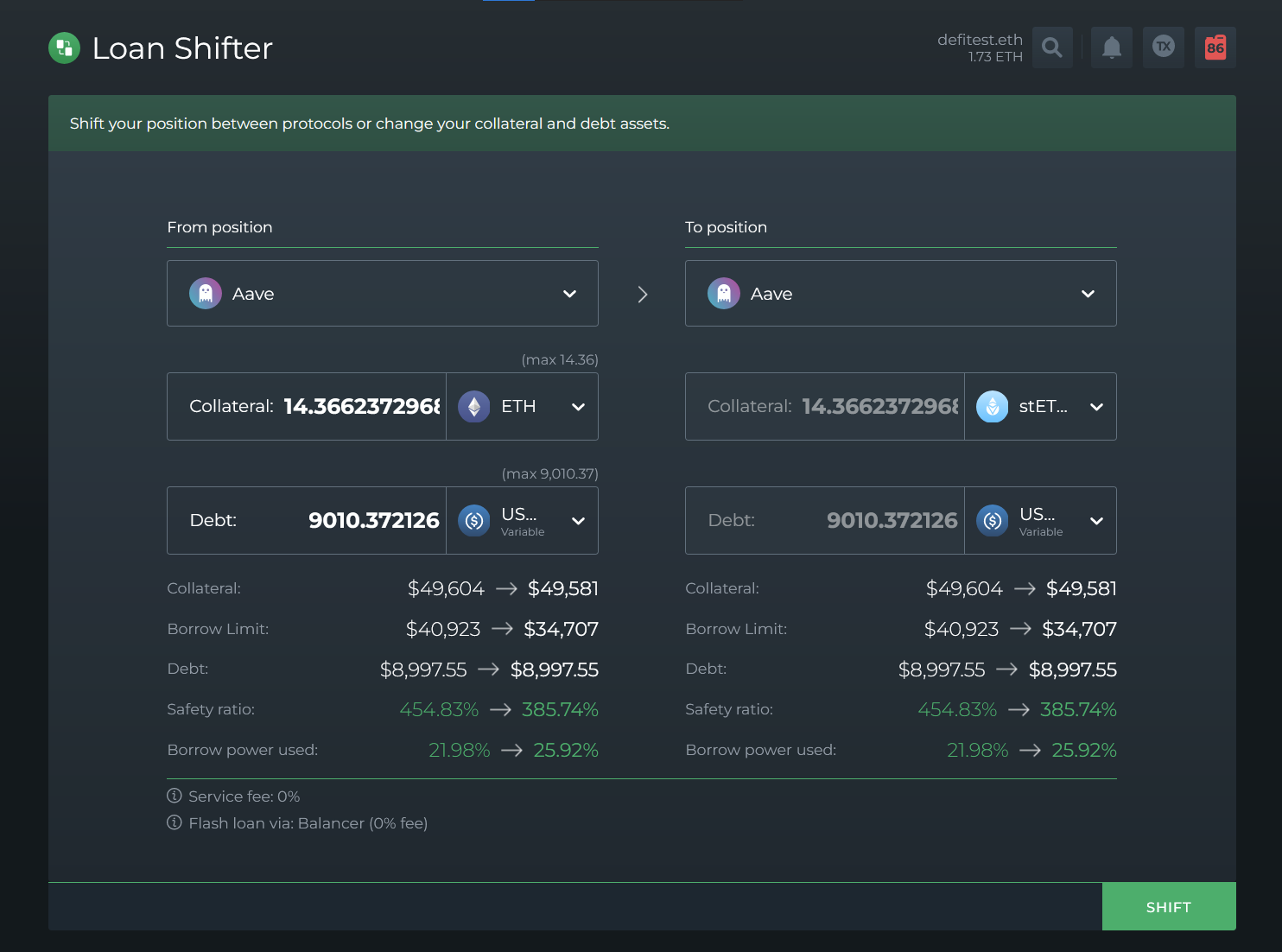

Lend stETH as Collateral on Aave or Morpho for Leveraged Yield: Deposit your stETH as collateral on established lending platforms like Aave or Morpho. Borrow ETH or stablecoins, then restake or deploy them in other DeFi strategies. This leverage loop can amplify your APY, but be mindful of liquidation risks during market volatility.

-

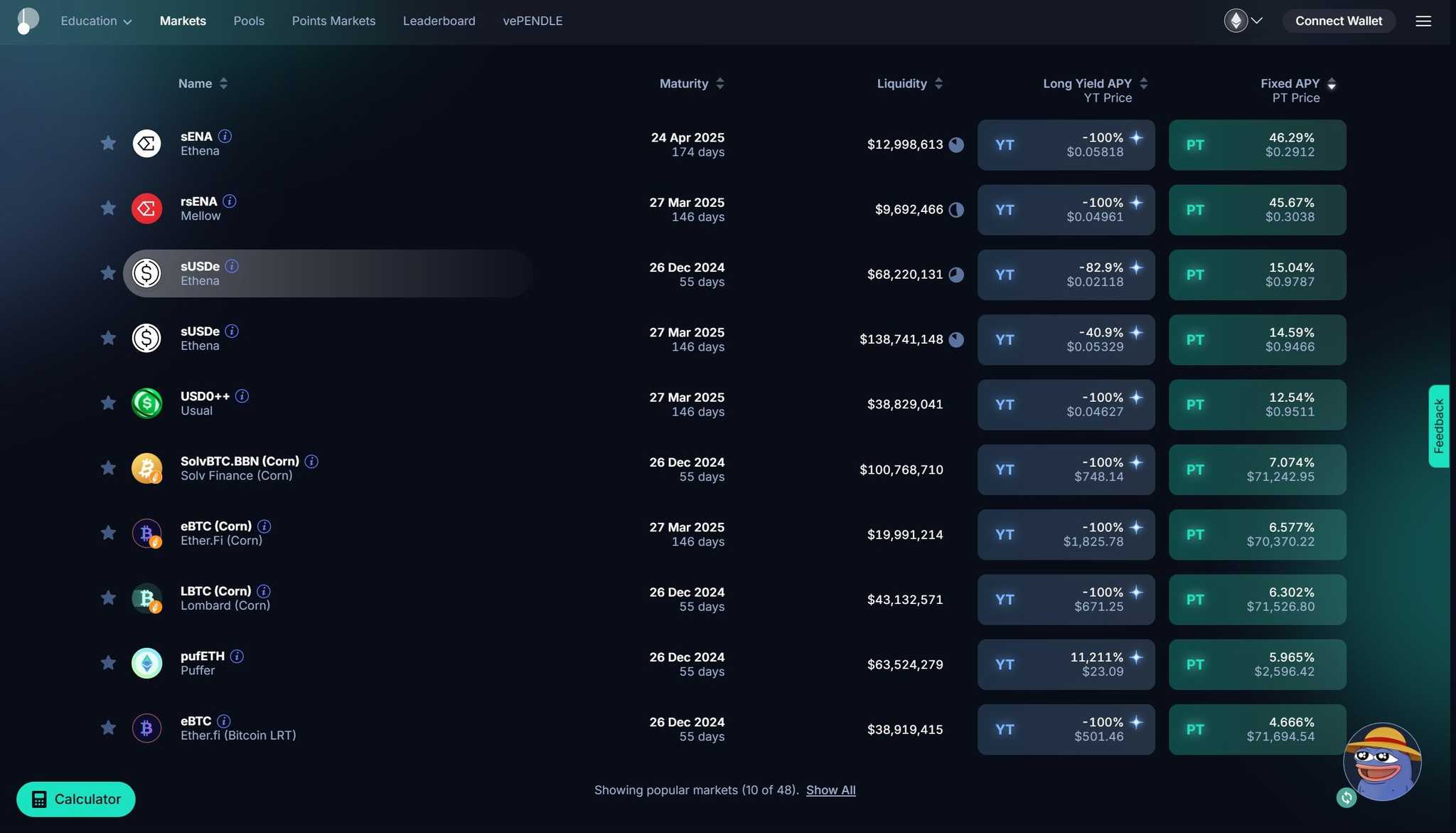

Participate in LSTfi Protocols Offering Staked ETH Structured Products: Explore innovative LSTfi platforms such as Pendle Finance and Ether.fi. These protocols enable you to split, trade, or bundle stETH yield streams, access fixed or variable rates, and diversify your strategies for optimized risk-adjusted returns.

This double-dipping approach means you’re earning:

- Lido staking rewards (via stETH)

- Trading fees from the Curve pool

- Convex protocol incentives (CVX/CRV)

The result? Sustainable APYs that can outpace simple staking by a wide margin, without sacrificing ETH exposure or liquidity. Of course, impermanent loss is always lurking; but with ETH-stETH pools’ tight peg, risk remains relatively contained compared to volatile pairs.

Ethereum Technical Analysis Chart

Analysis by Lucas Stanford | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

For this Ethereum (ETHUSDT) daily chart, I would draw a descending trend line from the October high near $4,700 down to the current price zone around $3,849, highlighting the lower high structure. I would mark horizontal support at $3,830 and resistance around $4,100 and $4,300. Rectangle tools can illustrate the consolidation range between $3,830 and $4,100. I’d annotate the recent failed retest of $4,100 as a bearish signal. Utilize vertical lines for key reversal dates in October, and arrows to mark swing highs and lows. Add callouts to show critical support/resistance and potential entry/exit zones. Use the long/short position tool to visualize risk/reward scenarios.