Ethereum staking is no longer a passive pursuit. With ETH trading at $3,900.07 as of October 23,2025, the DeFi landscape has evolved so rapidly that maximizing yields now demands both strategic selection and active management. Liquid staking tokens (LSTs) are at the heart of this transformation, letting you unlock capital efficiency and stack multiple layers of yield, all without giving up exposure to ETH’s upside or the ability to exit at a moment’s notice.

Why Liquid Staking Tokens Dominate ETH Yield Strategies in 2024

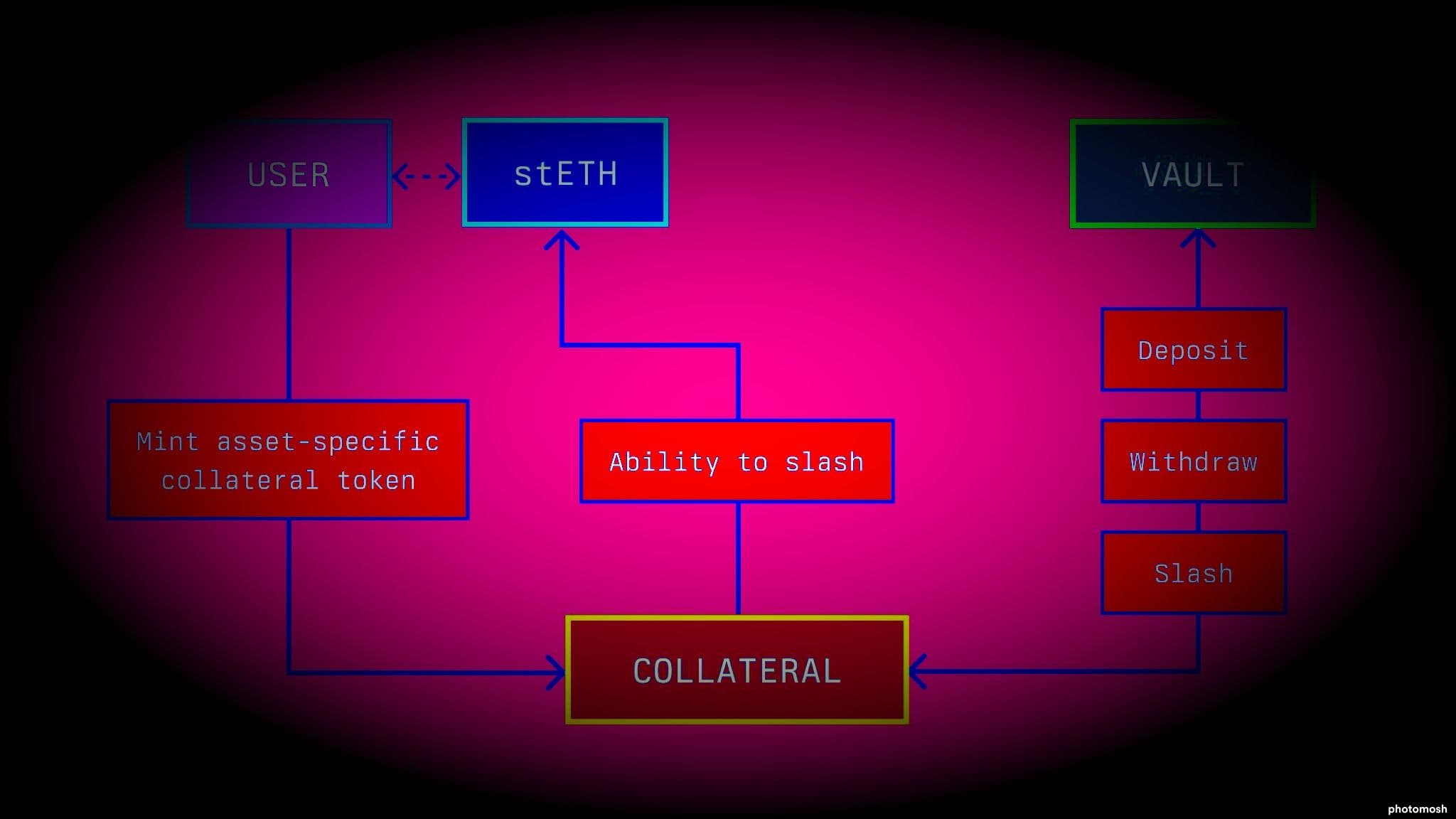

LSTs have become the backbone of modern Ethereum staking strategies. Instead of locking up your ETH for months, you can stake with platforms like Lido Finance, Rocket Pool, or leverage restaking protocols like EigenLayer. Each protocol issues its own LST, such as stETH, rETH, or restaked variants, that can be freely traded or used as collateral across DeFi.

This flexibility is critical in 2024’s yield environment. According to recent data, base ETH staking yields have trended downward and become more volatile since October 2022, often hovering around 4% APY. But by integrating LSTs into DeFi lending, borrowing, and restaking protocols, savvy users are regularly pushing their effective yields well above this baseline, sometimes north of 10% when stacking rewards.

Lido Finance: Stake ETH for stETH and Access DeFi Yield Opportunities

Lido Finance remains the juggernaut of liquid staking on Ethereum. By depositing your ETH with Lido, you receive stETH, a liquid token representing your staked position plus accrued rewards. As of late 2025, Lido offers an APR around 6.2%, outpacing most solo-staking setups.

The real power comes from what you can do with stETH:

- DeFi Collateralization: Use stETH as collateral on lending protocols like Aave or Maker to borrow stablecoins while continuing to earn staking rewards.

- Liquidity Provision: Pair stETH with ETH or stablecoins on decentralized exchanges to earn trading fees and incentive rewards.

- Yield Stacking: Deploy borrowed assets into further yield-generating strategies for compounding returns.

This approach lets you optimize capital efficiency while maintaining exposure to Ethereum price action, a core principle for advanced yield stackers in today’s market.

EigenLayer: Restake LSTs for Additional Yield and Protocol Security Rewards

The biggest innovation in 2024 is arguably EigenLayer’s restaking protocol. Here’s how it works: instead of letting your stETH or rETH sit idle after earning base staking rewards, you deposit these tokens into EigenLayer. This enables your assets to secure additional protocols, earning extra yield (sometimes up to 20%) through what’s known as “restaking. ”

This model not only boosts your overall APY but also supports emerging networks that need decentralized security without requiring new native tokens. For sophisticated users seeking asymmetric upside with manageable risk, EigenLayer is an essential part of any modern ETH staking stack.

Ethereum (ETH) Price Prediction 2026-2031: Outlook for ETH and Liquid Staking Tokens

Professional price forecasts based on current market trends, staking innovations, and crypto adoption cycles.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,100 | $5,200 | +5% | Consolidation after 2025 rally; ETH staking demand remains strong |

| 2027 | $3,500 | $4,600 | $6,000 | +12% | Adoption of liquid staking expands; ETH 2.0 upgrades boost sentiment |

| 2028 | $3,900 | $5,400 | $7,200 | +17% | DeFi/LST use cases mature; possible regulatory headwinds |

| 2029 | $4,200 | $6,100 | $8,500 | +13% | Institutional inflows grow; ETH as DeFi collateral standard |

| 2030 | $4,500 | $7,000 | $10,000 | +15% | Wider mainstream adoption; high LST/DeFi utilization |

| 2031 | $4,800 | $7,850 | $12,000 | +12% | ETH ecosystem matures; LST protocols dominate staking landscape |

Price Prediction Summary

Ethereum is expected to maintain a strong growth trajectory through 2031, supported by increasing adoption of liquid staking tokens (LSTs), DeFi expansion, and continuous protocol upgrades. While price volatility and regulatory risks remain, the average ETH price is projected to rise steadily, with bullish scenarios driven by institutional adoption and innovative staking products. Liquid staking will continue to boost ETH’s utility and demand, anchoring its role in the evolving crypto ecosystem.

Key Factors Affecting Ethereum Price

- Expansion and innovation in liquid staking protocols (LSTs) and restaking platforms (e.g., Lido, Mantle, Ether.fi, Renzo)

- Continued ETH 2.0 upgrades enhancing scalability, security, and staking yields

- Institutional adoption and integration of ETH/LSTs in DeFi and traditional finance

- Potential regulatory developments impacting staking and DeFi activity

- Competition from alternative L1s and new staking solutions

- Macro-economic factors impacting crypto market cycles and investor sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Rocket Pool: Decentralized ETH Staking with rETH and Flexible DeFi Integrations

If decentralization is your priority, or you want more control over node operations provides Rocket Pool offers a compelling alternative. When you stake with Rocket Pool, you receive rETH, a liquid token that accrues staking rewards over time. Rocket Pool stands out due to its permissionless nature; anyone can become a node operator or simply provide liquidity without running hardware themselves.

The beauty of rETH lies in its flexibility:

- Easily tradable: rETH can be swapped instantly on major DEXes if you need liquidity before the withdrawal queue clears.

- DeFi integrations: Use rETH across lending markets, liquidity pools, and even some restaking protocols, mirroring many of the advantages offered by stETH but with added decentralization guarantees.

- Diversified risk: By spreading your stake between Lido (stETH) and Rocket Pool (rETH), you reduce protocol-specific risks while maximizing access to emerging DeFi opportunities.

In practice, maximizing ETH staking yields in 2024 is about more than chasing the highest APR. It’s about layering strategies, managing risk, and staying nimble as DeFi protocols evolve. With ETH at $3,900.07, even small percentage improvements in yield can mean thousands of dollars in extra income for active stackers.

Strategic Yield Stacking: How to Combine LST Protocols for Maximum Return

The most effective approach is often a hybrid one, combining the strengths of Lido Finance, EigenLayer, and Rocket Pool to construct a diversified, resilient yield portfolio:

Top Strategies to Maximize ETH Staking Yields in 2024

-

Lido Finance: Stake ETH for stETH and Access DeFi Yield OpportunitiesStake your ETH on Lido Finance to receive stETH, a liquid staking token. stETH holders earn an attractive ~6.2% APR and can deploy their stETH across leading DeFi platforms like Aave and Curve for additional yield. This strategy lets you earn staking rewards without sacrificing liquidity or DeFi opportunities.

-

EigenLayer: Restake LSTs for Additional Yield and Protocol Security RewardsAmplify your staking returns by restaking your LSTs (like stETH or rETH) on EigenLayer. EigenLayer enables you to earn restaking rewards—potentially boosting your total annual yield to up to 20%—while contributing to the security of emerging protocols. This innovative approach stacks yields and supports Ethereum’s broader ecosystem.

-

Rocket Pool: Decentralized ETH Staking with rETH and Flexible DeFi IntegrationsLeverage Rocket Pool for decentralized ETH staking and receive rETH, a liquid staking token. rETH holders enjoy competitive yields and can use their tokens in DeFi protocols for lending, borrowing, or liquidity provision. Rocket Pool’s decentralized approach enhances security and offers flexible integrations across the DeFi landscape.

1. Start with Lido or Rocket Pool: Stake your ETH with either platform to mint stETH or rETH, gaining instant liquidity and base staking rewards.

2. Restake via EigenLayer: Move your LSTs into EigenLayer to unlock additional protocol security rewards on top of your base APY. This is where the real yield stacking happens, your assets are now working double-time.

3. Deploy in DeFi: Use your stETH or rETH as collateral across lending protocols or liquidity pools to further amplify returns. Some users borrow stablecoins against their LSTs and redeploy them into additional staking or farming strategies, a classic flywheel effect that compounds gains over time.

This multi-protocol approach not only diversifies your risk but also positions you to capture upside from both established and emerging DeFi primitives. For a deeper dive on these layered strategies, check out our guide on maximizing yield stacking with LSTs.

Risk Management: What Every Yield Stacker Must Watch For

Chasing high yields comes with real risks, smart contract bugs, depegging events, governance attacks, and sudden changes in protocol incentives can all impact your stack. Here’s how savvy users manage exposure:

- Diversify platforms: Split capital between Lido (stETH) and Rocket Pool (rETH) rather than concentrating risk on a single protocol.

- Monitor peg stability: Keep an eye on stETH/ETH and rETH/ETH ratios on DEXes to spot early signs of depeg risk during market volatility.

- Stay updated: Actively follow protocol governance forums and audits for changes that could affect rewards or security.

- Avoid leverage spirals: Borrowing against LSTs can amplify returns but also magnifies liquidation risk if ETH price drops sharply from its current $3,900.07 level.

The best defense is education and vigilance, never treat staking as set-and-forget in today’s fast-moving market.

Community Insights: What Are Top Stakers Doing Now?

The data doesn’t lie, 2024 has seen explosive growth in liquid staking TVL as more users adopt these advanced strategies. The most successful stakers are those who actively rebalance between protocols based on shifting yields and incentives while keeping a close eye on smart contract risks. If you want to see how the community is adapting in real time, check out this trending discussion below:

The Future of ETH Yield Optimization Starts Here

The landscape for Ethereum staking is more dynamic, and more rewarding, than ever before. By leveraging platforms like Lido Finance, integrating advanced restaking via EigenLayer, and embracing decentralized alternatives like Rocket Pool, you can build a resilient yield stack that adapts to whatever the market throws at you next.

If you’re ready to move beyond basic staking, and start extracting every basis point from your ETH, now’s the moment to act strategically. Track real-time yields, diversify smartly, layer protocols intelligently, and stay plugged into the latest developments at liquidstakers. com for actionable insights every step of the way.