Liquid staking ETFs are rapidly rewriting the playbook for altcoin yield generation, providing a seamless bridge between traditional finance and the decentralized world of crypto. In 2025, these innovative products have not only unlocked new yield opportunities but are also fueling institutional adoption in ways that were nearly unimaginable just a few years ago.

Liquid Staking ETFs: The New Frontier for Altcoin Yields

Until recently, earning staking rewards on altcoins like Ethereum or Solana meant locking up your tokens and sacrificing liquidity. That tradeoff limited participation to die-hard DeFi natives comfortable with protocol risk and long lockups. Enter liquid staking ETFs: by pooling investor assets and staking them via professional validators, these funds convert on-chain yields into tradable ETF shares. Investors now gain exposure to both price appreciation and ongoing staking rewards – all without giving up liquidity.

This model is already attracting massive capital flows. In Q3 2025 alone, Ethereum ETFs saw inflows exceeding $33 billion, outpacing Bitcoin ETF inflows for the first time. Altcoin-focused offerings like Bitwise Solana and Canary Capital’s Litecoin ETF are broadening access even further, reshaping how mainstream investors approach crypto yield strategies.

Why Liquid Staking ETFs Are Winning Over DeFi Investors

The appeal for DeFi participants goes beyond simple convenience. By leveraging scale and professional validator relationships, liquid staking ETFs can often optimize yields better than solo stakers or smaller pools. According to Coinbase research, these funds capture higher execution-layer returns while maintaining robust liquidity management – a crucial balance in volatile markets.

But it’s not just about higher returns:

- Enhanced Liquidity: ETF shares can be bought or sold instantly on exchanges, eliminating the illiquidity penalty of traditional staking.

- Simplified Tax Reporting: For many jurisdictions, ETF structures streamline tax treatment versus interacting directly with multiple DeFi protocols.

- Regulatory Clarity: With the SEC clarifying that most liquid staking tokens are not securities (learn more here), the compliance fog is lifting – making institutional adoption less risky.

The Double-Edged Sword: Centralization vs Yield Optimization

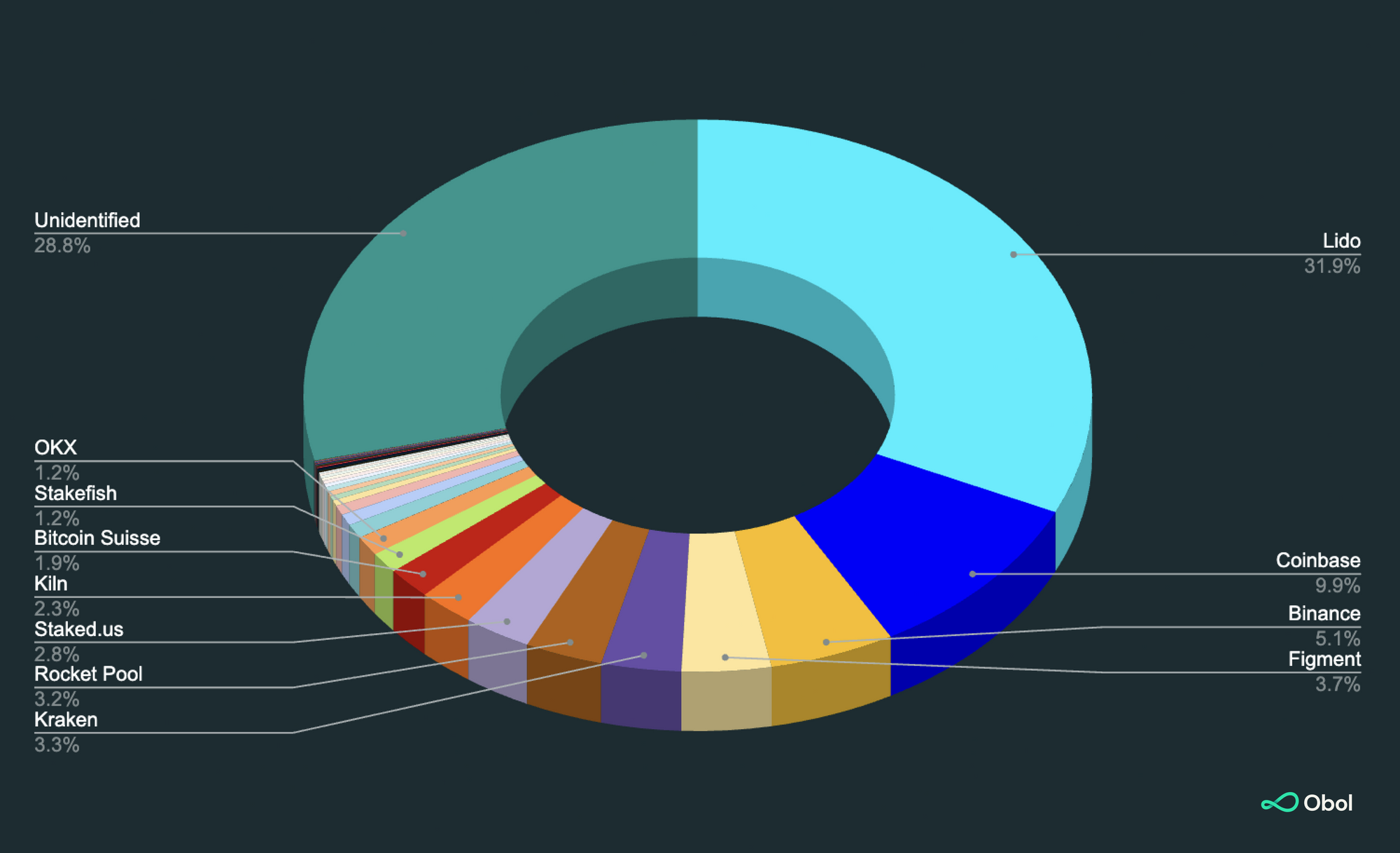

No innovation comes without tradeoffs. As liquid staking ETFs concentrate billions of dollars with a handful of major validators, concerns about network centralization are mounting. The very efficiency that boosts yields can also threaten blockchain decentralization if unchecked. For example, when too much economic weight is staked through a few providers, governance risks increase, potentially undermining the ethos of permissionless finance.

This centralization dilemma isn’t theoretical; it’s borne out in real-time debates within Ethereum’s community as well as among Solana stakeholders. As more capital pours into these products, expect scrutiny over how much power is wielded by top validators – and how ETF issuers respond to those risks through diversified validator sets or innovative governance models.

Navigating Liquidity Management and Redemption Risks

A key challenge for liquid staking ETFs is balancing high yields with investor liquidity needs. To avoid forced selling during large redemptions (which could hurt returns), funds typically hold a portion of assets unstaked as a buffer. While this protects against liquidity crunches, it can slightly reduce overall yields compared to protocols that stake everything at all times.

This tradeoff underscores why it’s crucial for DeFi investors to dig into each ETF’s structure: How do they manage liquidity? What proportion of assets remain unstaked? Who are their validator partners? Understanding these mechanics helps ensure your chosen vehicle aligns with your risk appetite and return objectives.

For those seeking to maximize yield with minimal friction, liquid staking ETFs offer a compelling set-and-forget strategy. Yet, the devil is in the details: not all ETFs are created equal. Some funds may prioritize aggressive yield optimization by staking the maximum possible, while others take a more conservative approach to safeguard liquidity during market turbulence. This divergence can lead to notable differences in net returns and redemption experiences, so due diligence is non-negotiable.

Transparency around validator selection and operational practices is becoming a key differentiator among top-performing products. Investors should look for issuers that publish regular disclosures on validator distribution, unstaked asset ratios, and governance participation. The best funds are not just maximizing yield, they’re actively contributing to network health and decentralization.

“The emergence of liquid staking ETFs marks a turning point for DeFi accessibility. It’s never been easier for both retail and institutional investors to capture altcoin staking yields without wrestling with protocol complexity or lockups. “

What This Means for Altcoin Yield Strategies in 2025

With $33 billion flowing into Ethereum ETFs in Q3 2025 alone, it’s clear that institutional appetite for regulated crypto yield exposure is only accelerating. But this new normal also raises the bar for individual DeFi investors: simply holding LSTs or participating in on-chain pools may no longer be enough to stay competitive with ETF-driven capital flows.

The good news? Liquid staking ETFs don’t have to be your only play. Many sophisticated DeFi users are now combining ETF exposure with direct LST yield stacking, cross-chain strategies, or even leveraging ETF shares as collateral in on-chain lending markets. The result: a more dynamic toolkit for building resilient, high-yield crypto portfolios.

Smart Tips for Evaluating Liquid Staking ETFs

-

Check Validator Concentration: Excessive reliance on a few validators can increase centralization risks. Look for ETFs that partner with a diverse set of professional validators, such as Coinbase Institutional Staking or Kraken Staking, to help maintain network security and decentralization.

-

Review Liquidity Buffers: Top ETFs like Grayscale Ethereum Trust often maintain liquidity buffers—unstaked assets reserved for redemptions. Examine ETF disclosures to ensure they strike a balance between maximizing yield and meeting potential withdrawal demands.

-

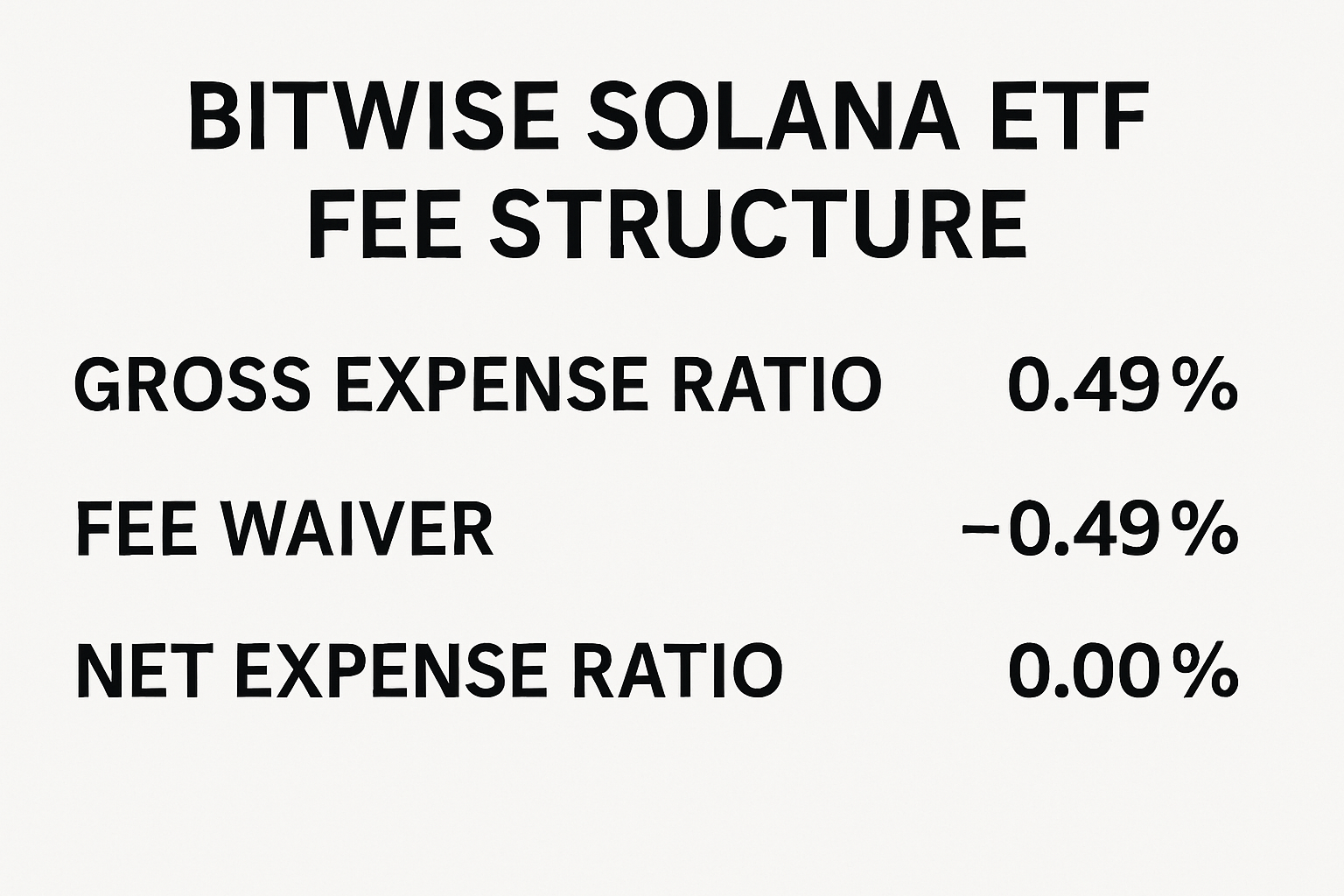

Compare Fee Structures: Fees can eat into staking yields. Analyze the ETF’s management and performance fees—Bitwise Solana ETF, for example, publishes its fee schedule transparently. Lower fees generally translate to higher net returns for investors.

-

Demand Transparent Reporting: Choose ETFs with clear, frequent reporting on staking strategies, validator partners, and yield breakdowns. Grayscale and Bitwise both provide regular updates, empowering investors to make informed decisions.

Key Takeaways: Staying Ahead in the Liquid Staking ETF Era

The arrival of liquid staking ETFs has fundamentally changed how altcoin yields are earned, and who can access them. For forward-looking DeFi investors:

- Don’t ignore ETF innovation: These products offer unparalleled liquidity and regulatory clarity but require careful evaluation of structure and risk.

- Diversify your yield stack: Blending ETF shares with direct LST strategies can help optimize returns while managing centralization risk.

- Stay informed on governance debates: Centralization concerns aren’t going away, monitor how major ETF issuers address validator diversity and network participation.

- Lean into transparency: Favor funds that provide real-time analytics on performance, validator sets, and liquidity management.

The landscape is moving fast, but so are the opportunities. As regulatory clarity sharpens and institutional adoption deepens, liquid staking ETFs will remain at the forefront of altcoin yield generation. With smart research and an adaptive mindset, DeFi investors can harness these tools to stay ahead of the curve, and unlock new frontiers of crypto income potential.