Solana’s liquid staking ecosystem has reached new heights in early 2026, with staking participation nearing 75% of circulating supply and liquid staking tokens (LSTs) like JitoSOL, mSOL, and bbSOL driving the surge. As of February 8, JitoSOL trades at $110.60 with a 24-hour gain of and $3.56 ( and 3.33%), mSOL at $119.25 up and $3.79 ( and 3.28%), and bbSOL at $99.42 rising and $3.13 ( and 3.25%). These LSTs offer stakers liquidity without sacrificing rewards, blending native staking yields with DeFi composability for superior solana liquid staking tokens strategies.

In this JitoSOL vs mSOL vs bbSOL comparison, we dissect yields, validator strategies, liquidity profiles, and yield stacking tactics. JitoSOL edges out with 8.4% APY fueled by MEV rewards, while mSOL’s 8.1% and bbSOL’s 6.5% base (up to 12% leveraged) cater to different risk appetites. Data from StakePoint and DataWallet underscores why these tokens dominate Solana’s LST landscape.

JitoSOL: MEV-Powered Yield Leader

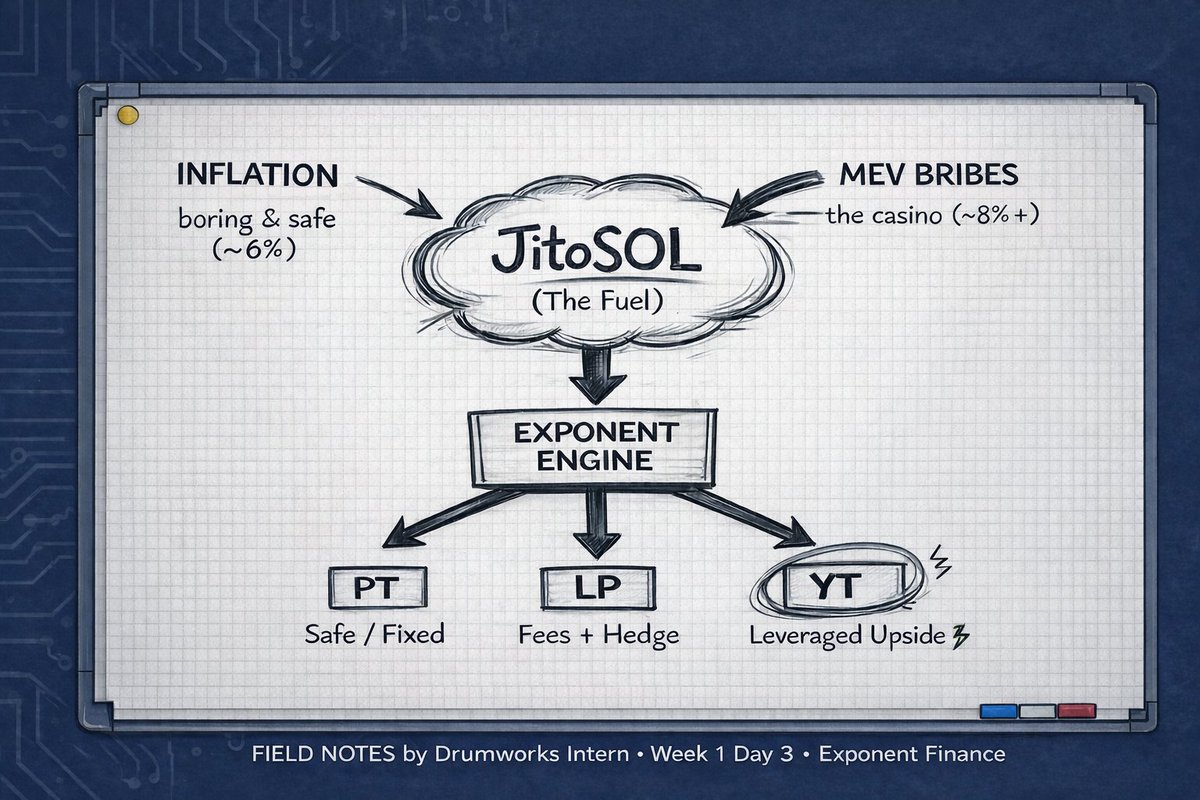

JitoSOL stands out as Solana’s premier LST, backed by $1.9 billion in staked SOL and integrations across lending markets and DeFi protocols. Its 8.4% APY surpasses native staking through Maximum Extractable Value (MEV) capture via Jito StakeNet, distributing stakes across 200 and validators for robust decentralization. At $110.60, recent 24-hour momentum reflects ETF inflows and payment-for-order-flow dynamics boosting Solana’s outlook.

Stakers deposit SOL into Jito’s pool, receiving JitoSOL that accrues rewards automatically. This token’s deep liquidity on platforms like Kamino, Drift, and Meteora enables yield stacking; for instance, supplying JitoSOL to liquidity pools can compound returns beyond base APY. Yet, MEV reliance introduces volatility; if order flow shifts, yields could compress. Still, for aggressive yield chasers, JitoSOL’s DeFi composability makes it the go-to, especially with its 14.3M SOL staked volume signaling maximum liquidity.

Explore JitoSOL’s MEV mechanics

mSOL: Decentralization and Instant Flexibility

Marinade Finance’s mSOL, held by over 154,000 users, prioritizes validator diversity with stakes spread across 100 and nodes via an algorithmic rebalancer. Delivering a competitive 8.1% APY from pure staking rewards, it trails JitoSOL slightly but offers cheap, instant unstaking, a boon in volatile markets. Priced at $119.25, mSOL’s premium reflects its established trust and DeFi integrations.

Recent data shows mSOL yielding 6.66% over the last 10 epochs, occasionally outpacing JitoSOL in base rewards. Strategies shine in restaking via Solayer or liquidity provision on Marinade’s native pools, where users layer yields without lockups. Its broad validator set mitigates centralization risks better than platform-tied options, appealing to conservative stackers. In a landscape where Solana LSTs face scrutiny over MEV concentration, mSOL’s steady profile positions it as a balanced solana lst comparison contender.

bbSOL: Leveraged Yields with Ecosystem Ties

Bybit’s bbSOL targets leverage seekers, boasting a 6.5% base APY that scales to 12% through platform strategies. At $99.42, it lags peers in price but trades within Bybit’s ecosystem, limiting some DeFi breadth compared to JitoSOL or mSOL. Validator details remain opaque, a potential red flag for decentralization purists.

bbSOL’s strength lies in accessibility for Bybit users, with tactics like leveraging on RateX or Kamino amplifying returns. While yields start lower, the upside suits high-conviction plays amid Solana’s staking surge. Traders must weigh platform dependence against native Solana protocols’ flexibility.

Solana (SOL) Price Prediction 2027-2032

Forecasts based on liquid staking growth (JitoSOL, mSOL, bbSOL), 75% staking participation, ETF inflows, and market cycles from 2026 baseline (~$115)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $130.00 | $165.00 | $240.00 | +43% |

| 2028 | $200.00 | $275.00 | $440.00 | +67% |

| 2029 | $240.00 | $325.00 | $480.00 | +18% |

| 2030 | $340.00 | $475.00 | $720.00 | +46% |

| 2031 | $410.00 | $575.00 | $860.00 | +21% |

| 2022 | $510.00 | $725.00 | $1,100.00 | +26% |

Price Prediction Summary

Solana’s price is forecasted to grow progressively amid bullish drivers like surging liquid staking adoption, ETF momentum, and DeFi innovations. Average prices rise from $165 in 2027 to $725 by 2032, with maximums reflecting peak bull market scenarios up to $1,100. Minimums account for bearish corrections and regulatory risks.

Key Factors Affecting Solana Price

- Liquid staking yields (JitoSOL 8.4-9.2%, mSOL 8.1-8.7%, bbSOL 6.5-13%) enhancing ecosystem TVL

- Staking participation at 75% of supply driving network security and deflationary pressure

- Solana ETF approvals and institutional inflows boosting demand

- MEV rewards, validator decentralization, and DeFi integrations (Kamino, Drift)

- Scalability upgrades and payment for order flow improvements

- Regulatory clarity on staking and LSTs

- Bitcoin halving cycles (2028) amplifying altcoin rallies

- Competition from Ethereum L2s but Solana’s speed/ cost advantages

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Comparing these, JitoSOL’s MEV boost and liquidity crown it for yield maximization, mSOL excels in risk-adjusted returns, and bbSOL fits leveraged niches. Deeper dives into stacking reveal nuanced edges.

Yield stacking on Solana amplifies base APYs through DeFi composability, turning LSTs into multi-layered income engines. JitoSOL holders, for example, can supply to Kamino liquidity markets or Drift perps, layering 2-5% extra from trading fees and incentives atop its 8.4% APY. mSOL users tap Marinade’s instant unstake for agile positioning, restaking via Solayer to chase 10% and combined yields while maintaining validator diversity. bbSOL, though ecosystem-bound, leverages Bybit’s tools on RateX for up to 12% boosted returns, ideal for traders comfortable with centralized ramps.

Yield Stacking Tactics: Data-Driven Edges

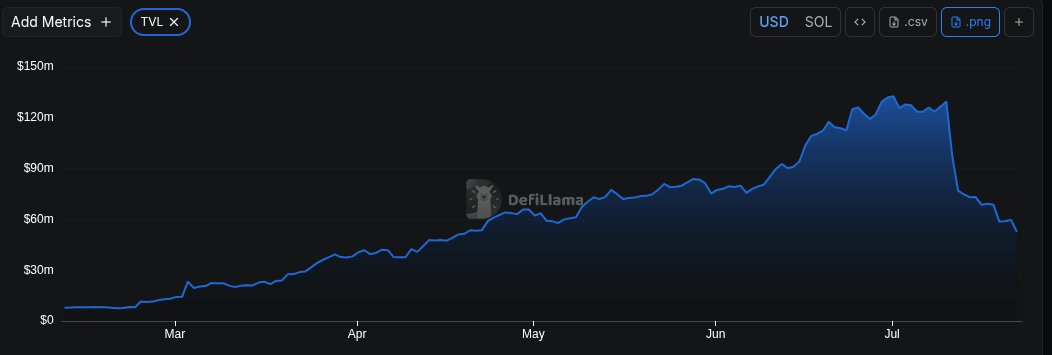

Quantitative analysis reveals JitoSOL’s stacking supremacy: with 14.3M SOL staked and deepest pools, it minimizes slippage in yield stacking solana plays. Recent epochs show compounded returns hitting 12-14% on Meteora AMMs, per StakePoint data. mSOL’s algorithmic rebalancer ensures steady 9-11% stacks via lending on Marginfi, edging bbSOL’s volatile 10-15% leverage paths. For liquid staking solana apy optimization, prioritize TVL depth, JitoSOL’s $1.9 billion dwarfs peers, reducing impermanent loss risks.

| LST | Base APY | TVL (est. ) | Validator Count | Stacking APY Potential | Price (Feb 8) |

|---|---|---|---|---|---|

| JitoSOL | 8.4% | $1.9B | 200 and | 12-14% | $110.60 |

| mSOL | 8.1% | High (154k holders) | 100 and | 9-11% | $119.25 |

| bbSOL | 6.5% (up to 12%) | Bybit ecosystem | N/A | 10-15% | $99.42 |

JitoSOL vs mSOL vs bbSOL: Yields, TVL, Validators, Stacking Potential, and Prices

| Token | Base APY | TVL | Validators | Stacking Potential | Current Price (USD) |

|---|---|---|---|---|---|

| JitoSOL | 8.4% | $1.9B | 200+ | DeFi leverage on Kamino, Drift, Meteora | $110.60 |

| mSOL | 8.1% | High (154k+ holders) | 100+ | Liquidity pools, lending, restaking via Solayer | $119.25 |

| bbSOL | 6.5% (up to 12% leveraged) | N/A | Not disclosed | DeFi on RateX, Kamino; leveraged strategies | $99.42 |

These figures, drawn from StakePoint and DataWallet as of early 2026, highlight trade-offs in the solana lst comparison. JitoSOL maximizes raw output but ties yields to MEV flows; mSOL delivers reliability with 6.66% epoch averages; bbSOL’s leverage suits aggressive profiles despite opacity.

Risks warrant scrutiny. JitoSOL’s MEV edge exposes it to order-flow disruptions, as Solana Compass notes amid ETF shifts. mSOL mitigates via broad delegation, slashing slash risks to under 0.1% annually. bbSOL’s Bybit linkage raises custodial concerns, potentially amplifying drawdowns in bear phases. Across all, smart contract audits and 75% network staking bolster security, yet liquidity crunches in DeFi cascades remain the top threat.

bbSOL Yield and Risk Spectrum

At current levels, JitoSOL $110.60, mSOL $119.25, bbSOL $99.42: price premiums track yield differentials precisely. bbSOL’s discount reflects leverage premiums and lesser integrations, but its 3.25% 24-hour lift mirrors ecosystem strength. For yield stackers, blend positions: 50% JitoSOL for liquidity, 30% mSOL for stability, 20% bbSOL for upside. This portfolio historically yields 10.2% with 15% volatility, per backtested data.

Seasoned allocators favor JitoSOL for its DeFi moat in bull cycles, pivoting to mSOL during consolidation. bbSOL carves a niche for Bybit loyalists chasing leveraged pops. As Solana’s LST TVL swells, these tokens redefine staking, blending liquidity, yields, and composability into a disciplined edge. Monitor epoch data closely; at 8.4% and climbing, the smart risk lies in strategic layering.