In the evolving tapestry of DeFi, Aptos stands out as a high-throughput blockchain primed for explosive growth in 2026, driven by its Move-based smart contracts and surging ecosystem TVL. Amid this momentum, aptos LST leverage emerges as a sophisticated play, particularly through Amnis Finance’s innovative loop of stAPT and amAPT. This strategy unlocks compounded staking yields without the drag of illiquidity, positioning yield stackers to capture outsized returns as global capital rotates into layer-1 alternatives.

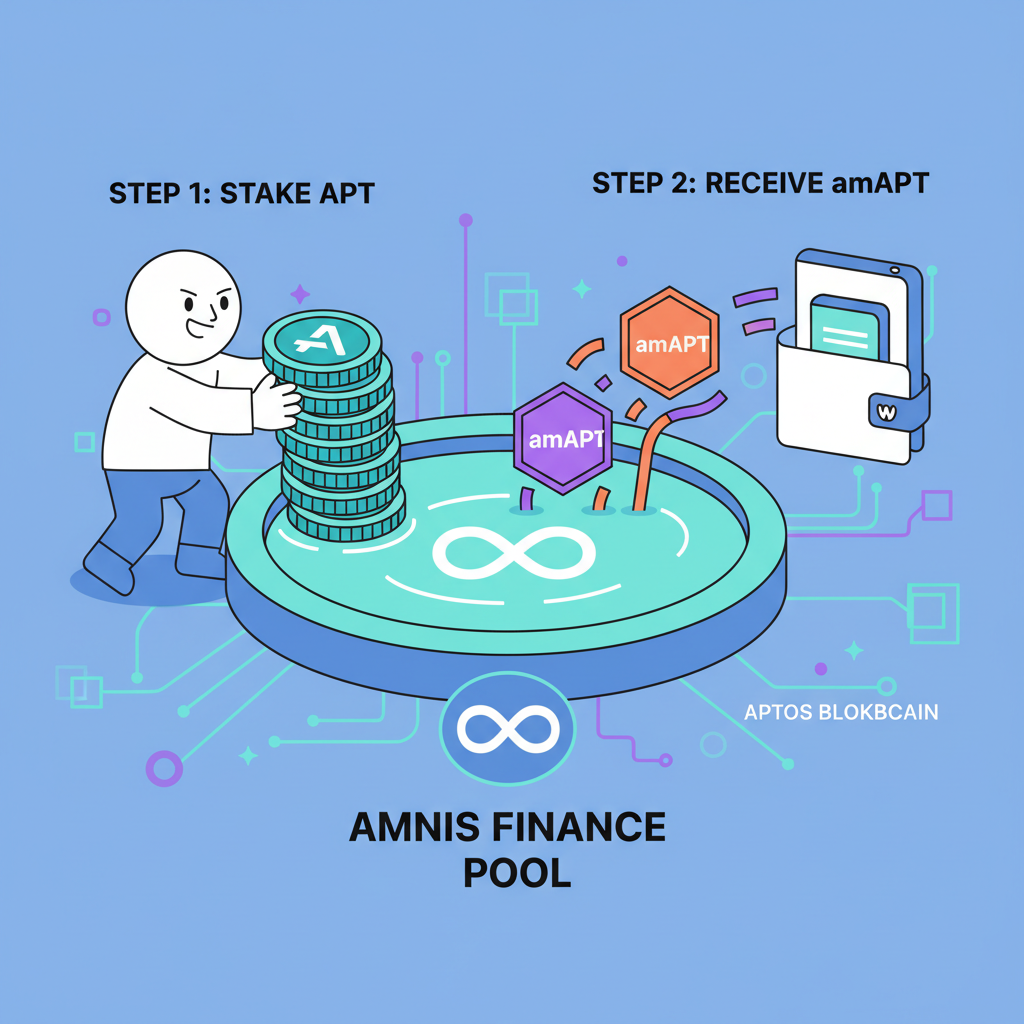

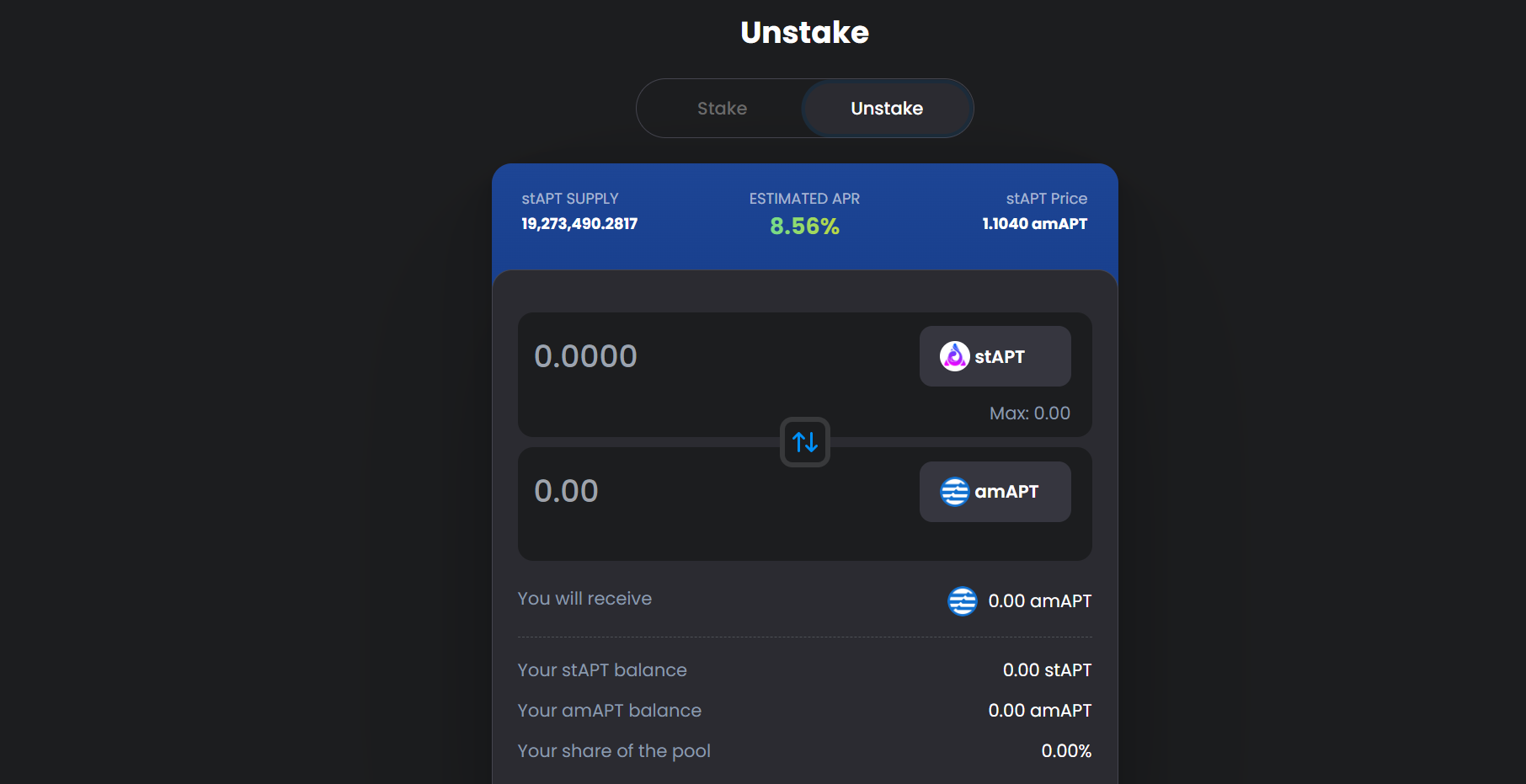

Amnis Finance has solidified its position as Aptos’ premier liquid staking protocol, boasting over 35 million APT staked across more than 417,000 users as of early 2026. This dominance stems from a dual-token model that separates liquidity from compounding: stake APT to mint amAPT at a 1: 1 ratio, preserving capital deployability while accruing base staking rewards of around 7%. For those chasing higher multiples, depositing amAPT into the stAPT vault auto-compounds these gains, delivering an enhanced APR hovering near 7.2%.

Aptos DeFi Ecosystem: Liquid Staking as the Yield Foundation

The Aptos network’s DeFi sector has matured rapidly, with liquid staking tokens (LSTs) forming the bedrock for aptos liquid staking defi. Protocols like Amnis, Thala, TruFin, and Kofi compete, but Amnis leads with superior TVL growth-11x in 2024 alone-and integrations across lending hubs like Aries Markets. This infrastructure enables seamless yield stacking, where LSTs fuel lending, borrowing, and liquidity provision without forfeiting staking rewards.

Holding stAPT in a wallet automatically accumulates rewards, and it doubles as collateral in lending markets.

Macro tailwinds amplify this setup: as institutional inflows target high-APY chains, Aptos’ sub-second finality and 160,000 TPS capacity draw parallels to Solana’s 2025 surge. Investors leveraging LSTs here sidestep native staking lockups, maintaining flexibility amid volatile macro cycles like potential Fed pivots or Bitcoin halving aftershocks.

Unpacking Amnis’ Dual-Token Powerhouse: amAPT and stAPT Mechanics

At the core of amapt yield farming lies Amnis’ bifurcated tokens. amAPT serves as the liquid wrapper for staked APT, tradable on DEXes and deployable in DeFi primitives-think LP pairs on Thala or collateral at Aries for borrowing loops. Yields accrue passively, often cited at 9% and in bullish snapshots, blending native staking with protocol incentives.

stAPT elevates this via auto-compounding: exchange amAPT 1: 1 for stAPT, which rebases upward with rewards. This stapt compound yields mechanism eliminates manual claims, ideal for passive strategies. As one Messari report notes, it removes liquidity trade-offs, letting users farm yields across the Aptos ecosystem while securing the network.

| Token | Function | Key Yield Feature |

|---|---|---|

| amAPT | Liquid staking derivative | Base rewards and DeFi composability |

| stAPT | Compounded wrapper | Auto-rebasing at ~7.2% APR |

Check our guide on capital efficiency with LSTs for deeper deployment tactics in lending protocols.

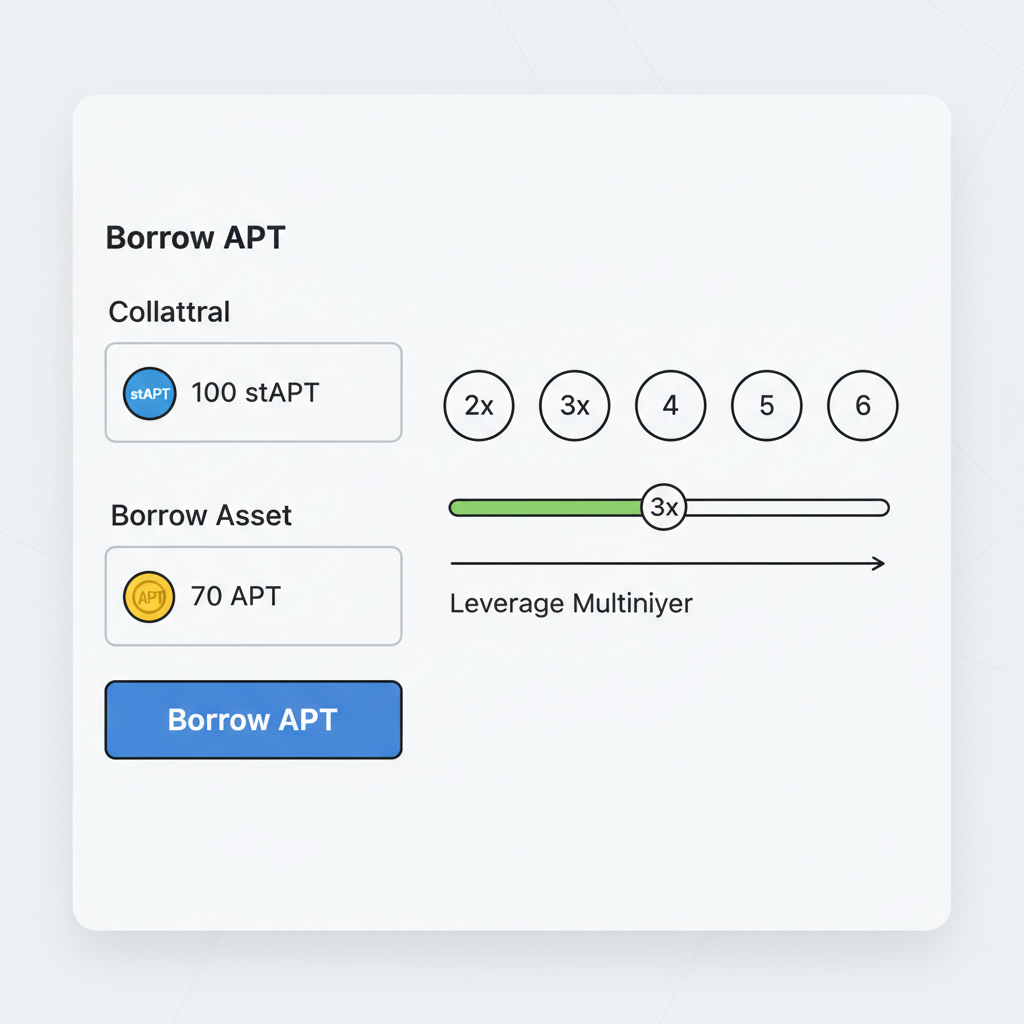

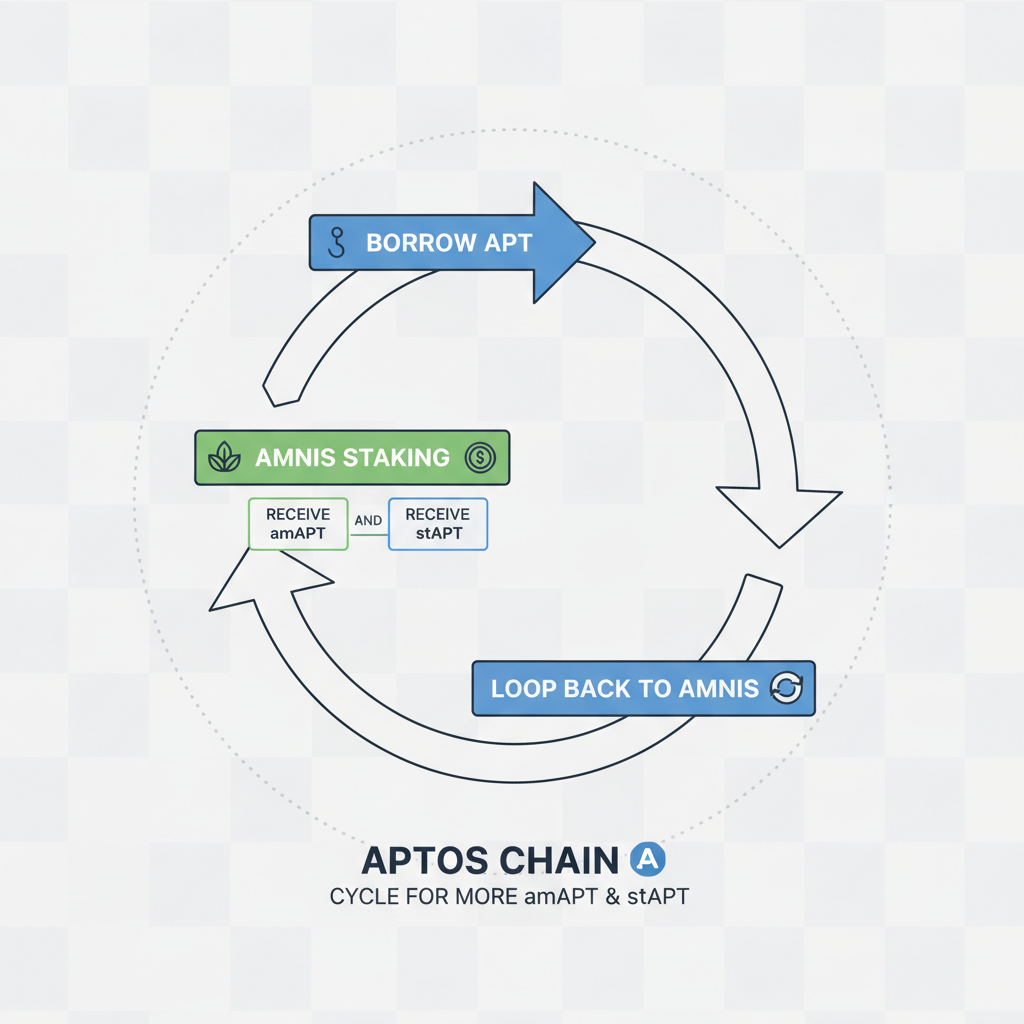

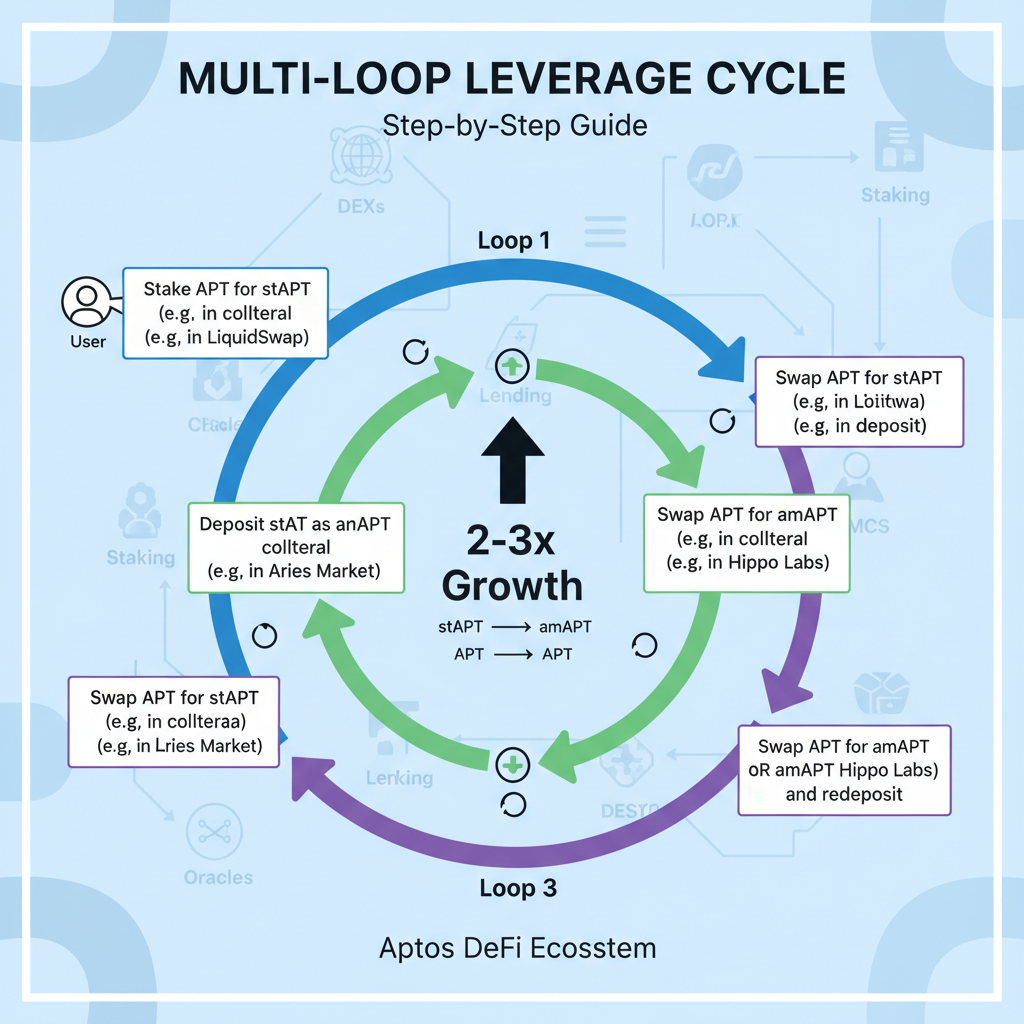

Initiating the stAPT Looping Strategy for 2026 Leverage

The stapt looping strategy amplifies base yields through iterative deposition and DeFi recursion, tailored for aptos staking leverage 2026. Start by staking APT into amAPT via Amnis dashboard. Hold for liquidity or immediately vault into stAPT for compounding kickoff. From here, leverage enters: supply stAPT (or amAPT) as collateral on Aries Markets to borrow APT, restake borrowed APT into fresh amAPT, and repeat-depositing into stAPT vaults.

This loop multiplies exposure: a 7.2% compounded base, plus lending spreads (often 2-4%) and LP fees from APT/stAPT pairs. Risks concentrate in oracle deviations and liquidation thresholds, but Aptos’ robust MEV protection mitigates front-running. In a 2026 outlook, with ecosystem TVL projected to triple amid MoveVM upgrades, this play could net 15-20% effective APRs for disciplined stackers.

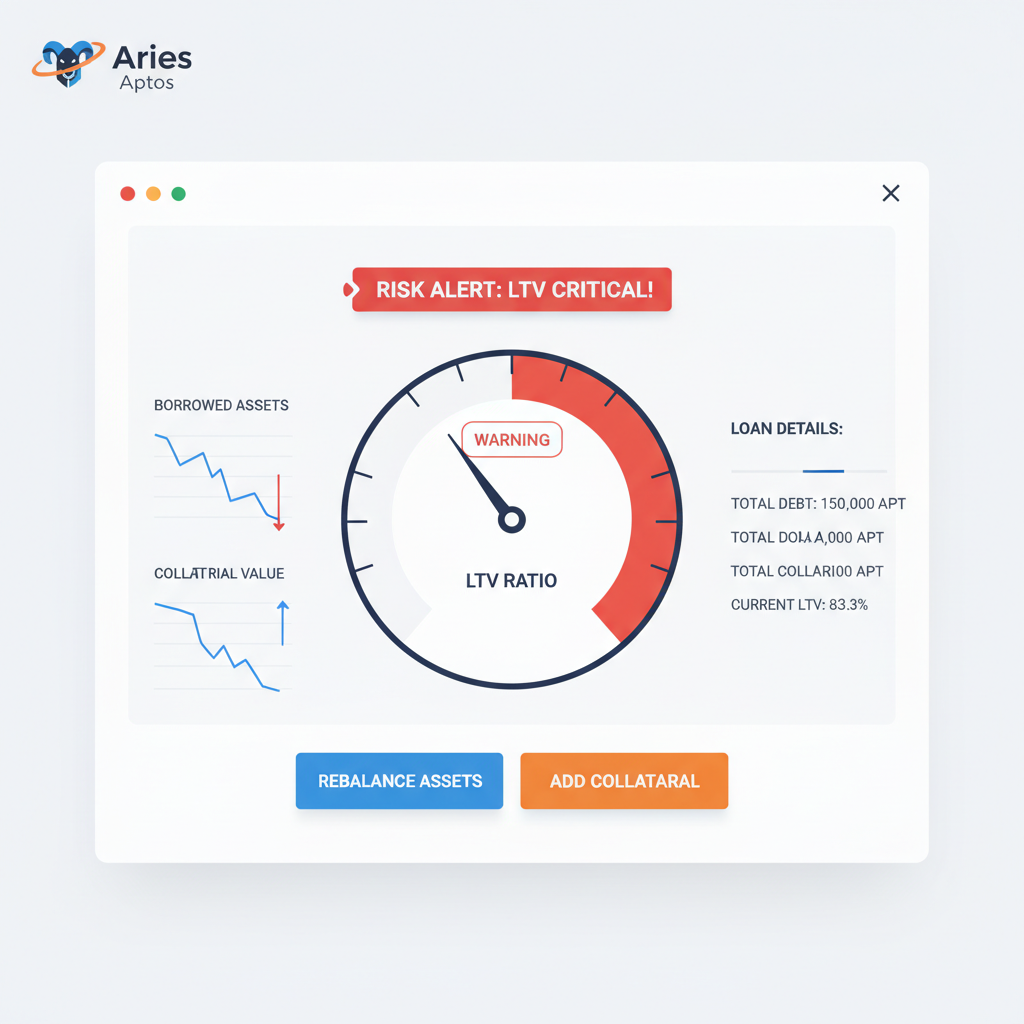

Yet execution demands precision. Borrowed APT must stay above liquidation ratios-typically 70-80% LTV on Aries-while monitoring exchange rates between amAPT and stAPT, which fluctuate with reward accruals. Over-leveraging invites liquidation cascades in downturns, but conservative 2-3x loops balance upside with stability, echoing Solana LST strategies that delivered 25% and yields in bull phases.

Mastering the Loop: Step-by-Step stAPT Leverage Deployment

Once looped, composability shines. Pair stAPT/amAPT on Thala DEX for trading fees, or lend into Echo Protocol’s yield farms bridging Bitcoin liquidity. This aptos LST leverage web multiplies base 7.2% compounding with 3-5% lending premiums, pushing effective yields toward 18% in optimistic 2026 scenarios. Amnis’ 417,000 users underscore adoption, with TVL surges signaling institutional entry via Aries Markets’ full-suite offerings.

Risk calibration remains paramount. Aptos’ native protections-shielded oracles and MEV auctions-curb exploits, but macro shocks like prolonged yield suppression from global rate hikes could pressure collateral values. Diversify loops across Kofi or TruFin for redundancy, and cap exposure at 20% of portfolio. For buffered approaches, explore low-risk LST lending to layer yields sans aggressive borrowing.

Amnis empowers staking without lockups: amAPT for DeFi flexibility, stAPT for hands-off compounding at scale.

2026 Macro Outlook: Aptos LSTs in a Yield Renaissance

Zooming out, Aptos positions as DeFi’s next efficiency frontier. With MoveVM enhancements slated for Q1 2026-boosting parallel execution-Aptos could rival Sui’s throughput while undercutting gas fees. LST dominance, led by Amnis’ 35 million APT staked, funnels capital into a virtuous cycle: higher security budgets inflate rewards, drawing more TVL. Against Bitcoin’s halving echoes and Ethereum’s restaking fatigue, aptos staking leverage 2026 offers uncorrelated alpha.

Yield stackers eyeing global rotations-from Treasuries yielding sub-4% to Aptos’ 7-9% baselines-will find stapt looping strategy irresistible. Protocol incentives, like Amnis’ vaults capturing extra emissions, layer atop network APRs, potentially sustaining 10% and floors even in neutral markets. Pair this with Aries’ 11x TVL growth trajectory, and the ecosystem morphs into a yield machine.

Aptos (APT) Price Prediction 2027-2032

Forecast based on liquid staking growth (Amnis Finance amAPT/stAPT), DeFi expansion, and market cycles from 2026 base ($15-$25-$45)

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $20 | $35 | $60 | +40% |

| 2028 | $28 | $52 | $90 | +49% |

| 2029 | $40 | $78 | $140 | +50% |

| 2030 | $55 | $110 | $200 | +41% |

| 2031 | $80 | $155 | $280 | +41% |

| 2032 | $110 | $210 | $380 | +36% |

Price Prediction Summary

APT is forecasted to see robust growth through 2032, propelled by Amnis Finance’s dual-token LST system (amAPT for liquidity, stAPT for 7-9% compounded yields), surging DeFi TVL, and Aptos ecosystem upgrades. Average prices climb from $35 in 2027 to $210 by 2032, with bullish maxima over $380 if LST TVL triples amid favorable cycles; bearish minima reflect regulatory or competitive pressures.

Key Factors Affecting Aptos Price

- Amnis Finance dominance with >$178M TVL and 417K+ users, enabling leveraged DeFi plays

- Aptos DeFi maturation (lending on Aries Markets, DEX yields, Kofi Finance stKAPT)

- Market cycles: post-2026 recovery into 2028-2029 bull run

- Regulatory clarity boosting staking and LST adoption

- Aptos tech upgrades for scalability and Move ecosystem growth

- Competition from Solana/Sui and overall crypto market cap expansion

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Forward thinkers integrate stAPT into broader portfolios, hedging via BTC bridges on Echo while looping for APT upside. As Fed easing cycles revive risk assets, this Amnis-powered flywheel accelerates, rewarding those who blend macro vision with DeFi precision. Aptos LSTs aren’t just staking-they’re the leverage launchpad for 2026’s yield chasers.