Solana’s SOL trades at $83.92, up $4.50 in the last 24 hours, signaling fresh momentum in its explosive DeFi ecosystem. As a day trader glued to charts, I see Solana LST yield stacking as the ultimate play for 2026 returns. Enter LSD protocol: an AI-driven beast automatically routing your SOL to top validators for liquid staking Solana returns beyond the standard 6-8% APY. Keep LSTs liquid, stack yields across DeFi, and eye 80% and potentials. Let’s break down the action.

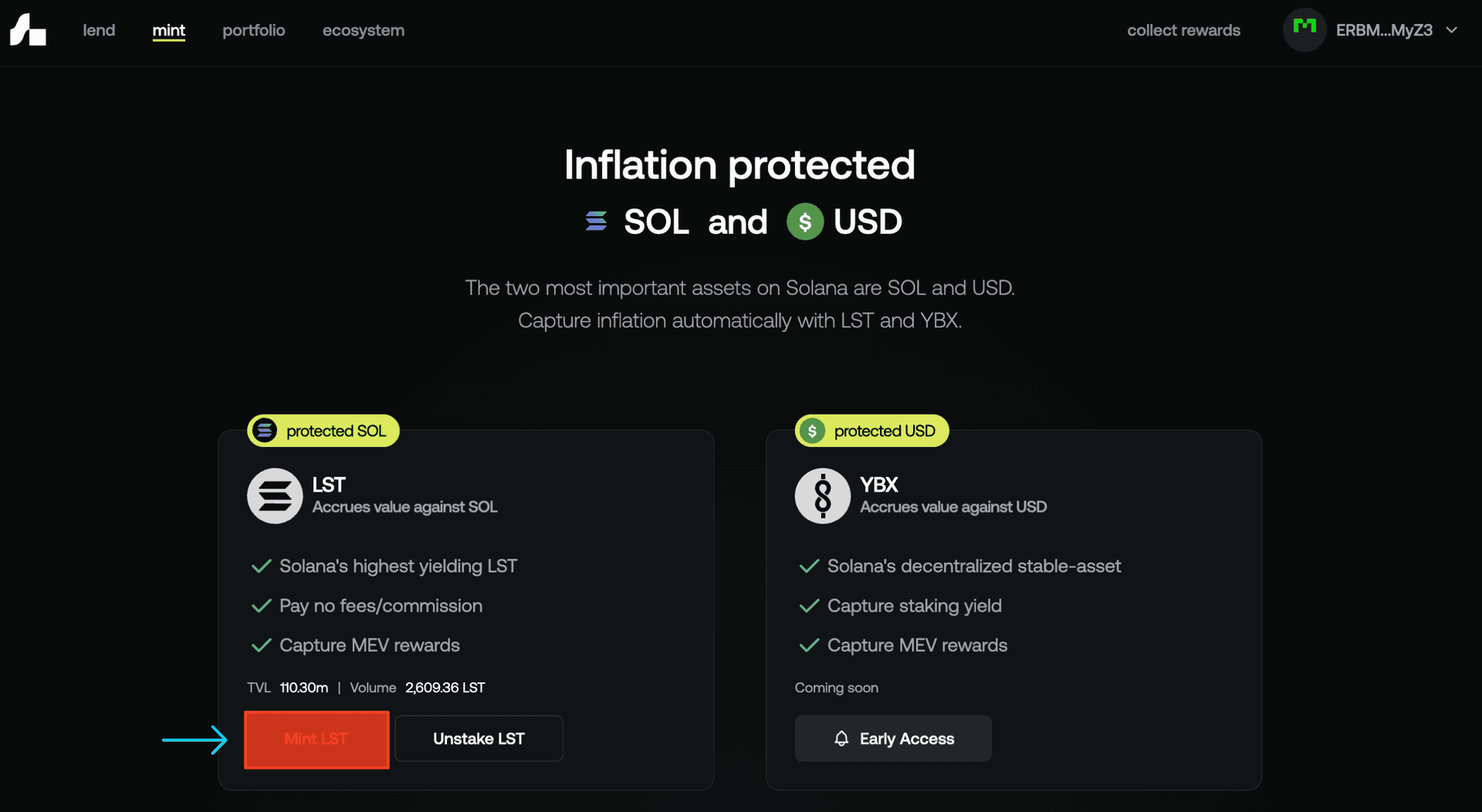

LSD flips the script on traditional staking. Stake SOL, snag LSD LSTs, and deploy them anywhere: lending, liquidity pools, vaults. No lockups, pure composability. With SOL at $83.92, protocols like Jito (MEV-boosted JitoSOL), Marinade (decentralized mSOL), Sanctum (Infinity pooling over 9% APY), and Kamino (automated vaults) set the stage. But LSD’s smarts optimize allocations, capturing peak efficiency. Traders, this is your DeFi yield optimization Solana ticket.

Mastering LSD LST Foundations for Yield Stacking

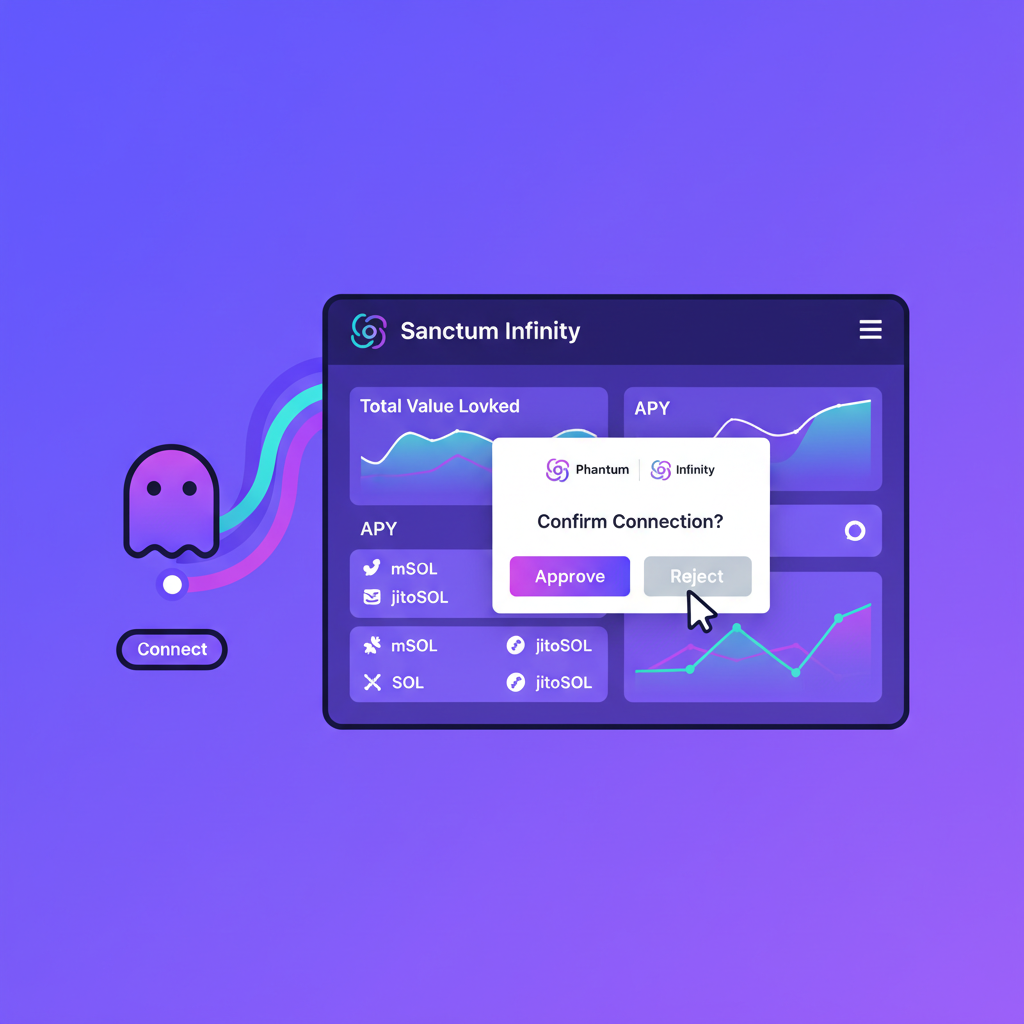

Yield stacking starts with LSD LSTs accruing base staking rewards plus MEV tips, outpacing native SOL staking. Picture this: deposit SOL into LSD, receive LSTs earning 6-8% passively while staying tradeable. Sanctum data shows top platforms hover in that range, but stacking amplifies it. Risk? Minimal with audited protocols, but always diversify validators. Action step: wallet-connect to LSD, stake 1 SOL, watch LSTs mint. Every tick screams opportunity at SOL’s $83.92 perch.

Why LSD over Jito or mSOL? Its AI dynamically shifts to highest-yield validators, blending Marinade’s decentralization with Jito’s MEV edge. Pair with Sanctum Infinity for multi-LST exposure, and you’re primed. Check this LST stacking blueprint for deeper dives.

Solana (SOL) Price Prediction 2027-2032

End-of-year price predictions incorporating LST yield stacking impacts, market cycles, and DeFi adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $120 | $225 | $350 | +50% |

| 2028 | $180 | $340 | $550 | +51% |

| 2029 | $250 | $480 | $800 | +41% |

| 2030 | $350 | $680 | $1,100 | +42% |

| 2031 | $450 | $900 | $1,400 | +32% |

| 2032 | $600 | $1,200 | $1,800 | +33% |

Price Prediction Summary

Solana (SOL) is forecasted to experience robust growth from 2027 to 2032, propelled by liquid staking token (LST) yield stacking strategies offering 6-27% APYs via protocols like Jito, Marinade, Sanctum, and Kamino. Starting from an estimated $150 end-2026 average, SOL’s average price could compound at ~40% annually, reaching $1,200 by 2032 amid bullish DeFi adoption, ETF inflows, and network upgrades. Minimums reflect bearish regulatory or macro risks, while maximums capture peak bull cycles.

Key Factors Affecting Solana Price

- Maturing Solana LST ecosystem (Jito MEV rewards, Sanctum Infinity pooling, Marinade decentralization) driving TVL and SOL demand

- Yield stacking up to 27% APY via leverage and restaking, enhancing holder returns and ecosystem stickiness

- Institutional adoption via ETFs like SSK, combining spot exposure with staking yields

- Solana scalability upgrades and high-throughput use cases in DeFi, payments, and AI

- Regulatory developments favoring staking clarity, tempered by potential crackdowns on DeFi leverage

- Market cycles aligned with Bitcoin halving effects, with bear dips in 2027-2028 and bull runs in 2029-2032

- Competition from Ethereum restaking and L1 rivals, offset by Solana’s cost-efficiency

- Macro factors: BTC correlation, global liquidity, and crypto market cap expansion to $10T+

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

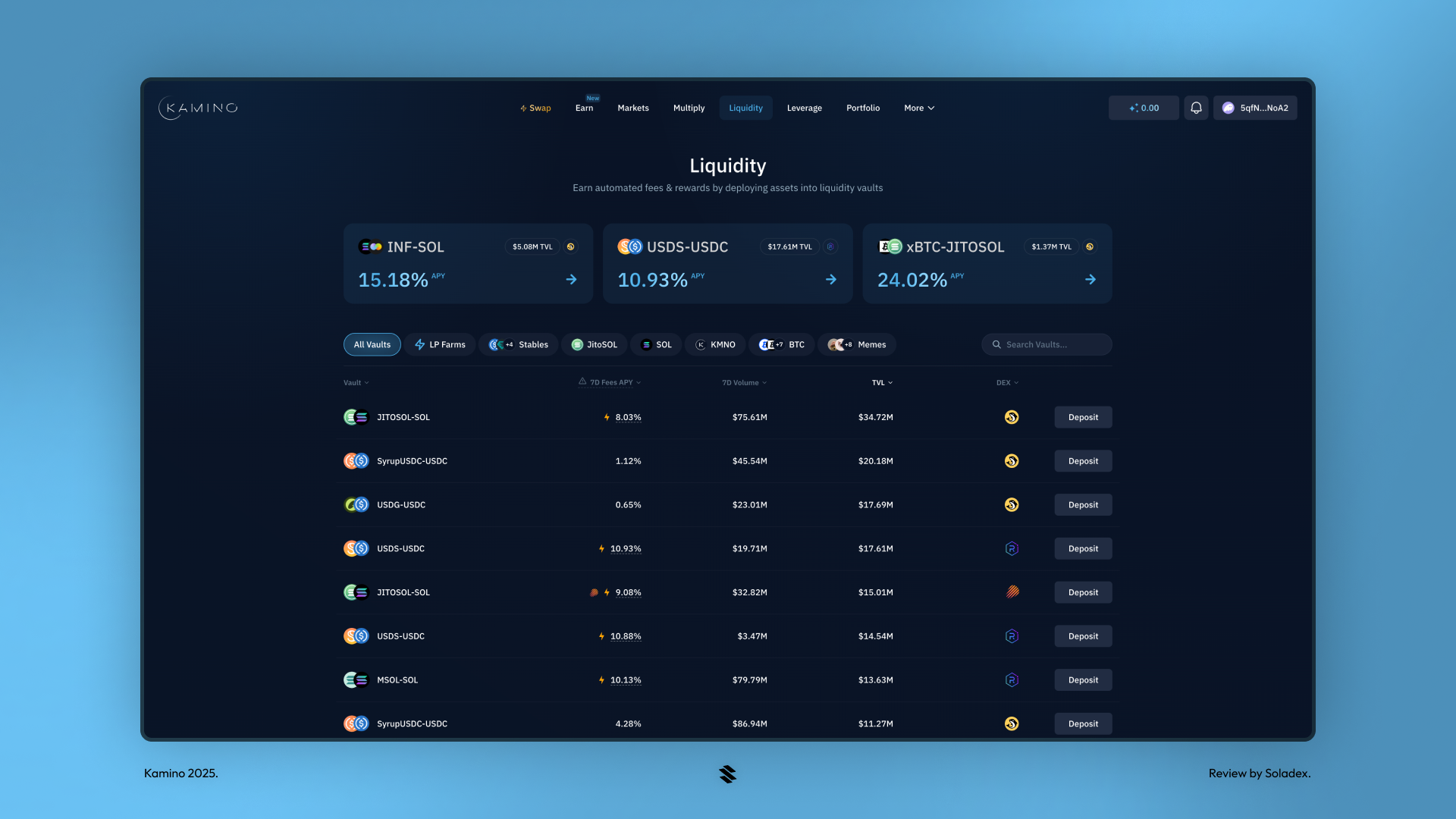

Strategy 1: LSD LST in Kamino Automated Liquidity Vaults

Kamino’s vaults are set-it-forget-it gold for compounded yields. Deposit LSD LSTs into their automated liquidity vaults alongside SOL or stables. Kamino rebalances positions, harvesting fees from Solana’s booming DEX volume. Expect base 6-8% staking and 10-20% liquidity fees, compounding daily. TVL surges prove it: vaults optimize JUP, JLP pairs too.

Actionable steps: 1) Mint LSD LSTs. 2) Head to Kamino. app, select LSD vault. 3) Deposit, enable auto-compound. At SOL $83.92, volatility juices fees. My chart take: RSI oversold bounce incoming, perfect entry. Risks? Impermanent loss, mitigated by Kamino’s automation. This nets 25% and blended APY for patient stackers.

Strategy 2: Lend LSD LST on Marginfi for Dual APYs

Marginfi turns LSD LSTs into lending machines. Supply your LSTs as collateral, earn staking yield plus borrower interest. Rates spike with demand: 5-15% lending APY on top of 6-8% base. Total? 12-25% risk-adjusted. Marginfi’s oracles keep it secure, no liquidation scares if LTV stays under 70%.

Pro move: ladder deposits during low utilization for fat premiums. With SOL at $83.92 and 24h high $84.07, borrow demand rises. Link it to low-risk LST lending tactics. I’ve traded this: enter on dips, exit on peaks, stack relentlessly.

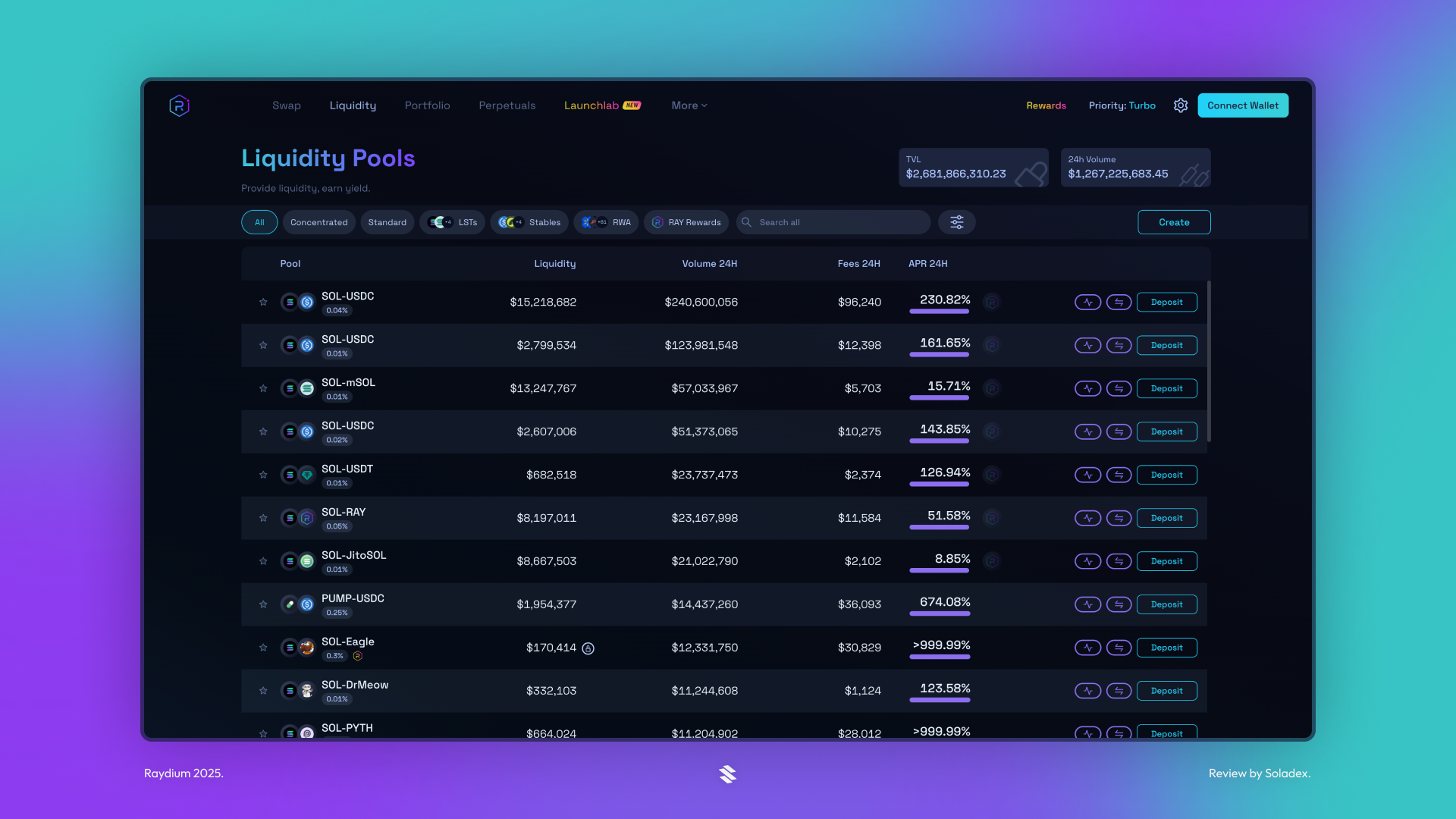

Strategy 3: Raydium CLMM Pools with LSD LST/SOL

Raydium’s Concentrated Liquidity Market Maker (CLMM) pools supercharge liquidity provision. Pair LSD LST/SOL, set tight ranges around $83.92, rake swap fees and staking rewards. CLMM concentrates capital, boosting efficiency over AMMs. Yields? 15-30% from fees alone, stacked on LSD’s base.

Trader edge: monitor volume spikes via charts, adjust ranges dynamically. Raydium’s Jito integration adds MEV kick. Step-by-step: approve LSD LST/SOL, create position at current price, harvest weekly. Impermanent loss? Offset by fees in bull runs. This is LSD protocol staking on steroids, pushing 40% and potentials.

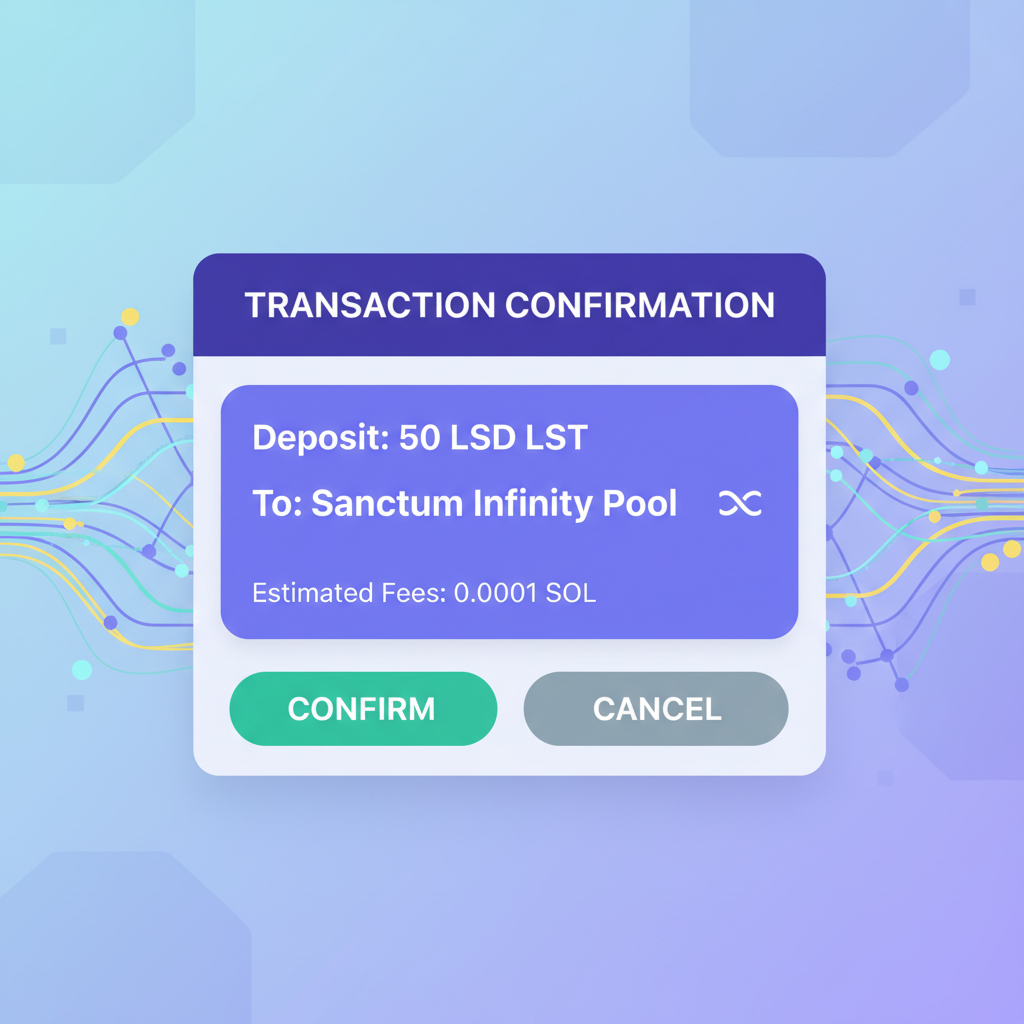

Strategy 4: Deposit LSD LST into Sanctum Infinity for Multi-LST Rewards

Sanctum Infinity pools your LSD LSTs with other top LSTs like JitoSOL and mSOL, delivering a blended APY smashing 9% and. Trading fees from Infinity’s liquidity layer stack on top, turning passive holdings active. At SOL’s $83.92, this diversification crushes single-protocol risks while amplifying liquid staking Solana returns.

Quick play: swap LSD LSTs into INF via Sanctum, hold for auto-rewards. Charts show INF stable amid SOL’s 24h low of $76.64 recovery. Pair with Kamino for loops hitting 27%. My take: volume upticks signal fee spikes; enter now before ETF flows like SSK inflate demand. Total stack? 20-35% blended, low drama.

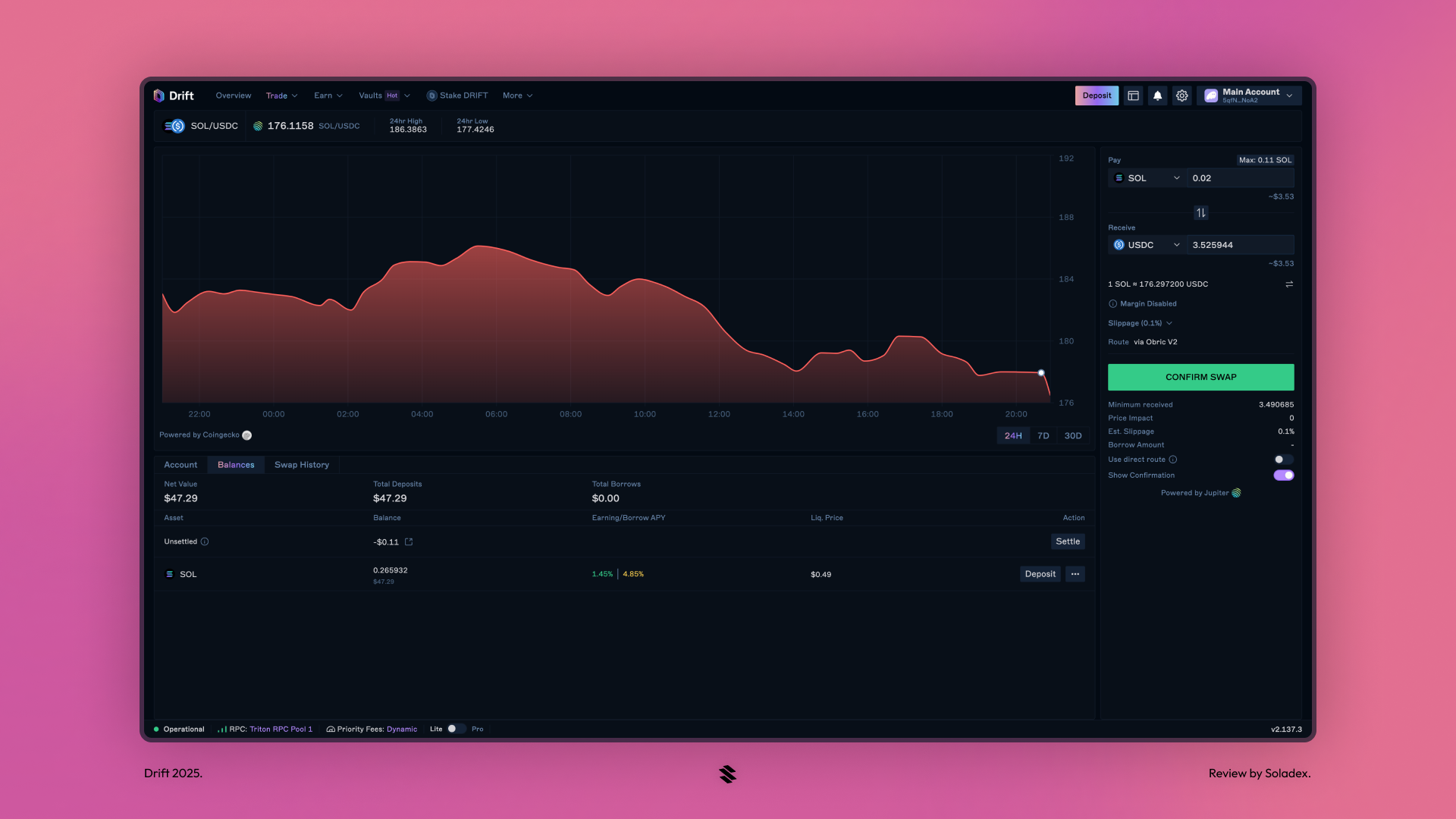

Strategy 5: Leveraged Looping: Collateralize LSD LST on Drift, Borrow SOL, Restake in LSD

Drift protocol unleashes leverage firepower. Collateralize LSD LSTs, borrow SOL at low rates, restake borrowed SOL into LSD for looped yields. Base 6-8% compounds exponentially: 2x leverage eyes 25-50%, 3x pushes 80% and in bull runs. SOL at $83.92 with and $4.50 24h keeps borrow costs tame.

Trader alert: watch health factor above 1.5x, harvest weekly. Drift’s perps integration hedges volatility. Risks amp with leverage; cap at 2x for sanity. This DeFi yield optimization Solana beast demands charts: MACD crossovers flag entries. Stack smart, scale wins.

Blend these for max firepower. LSD’s AI routing ensures base efficiency, while DeFi layers multiply. Jito MEV, Marinade decentralization, Sanctum pooling, Kamino automation, Drift leverage: full arsenal.

Top 5 LSD LST Yield Stacking Strategies Comparison

| Rank | Strategy | Est. APY Range (2026) | Key Risks | Platforms |

|---|---|---|---|---|

| #5 | LSD LST in Kamino Automated Liquidity Vaults for Compounded Yields | 12-20% | Smart contract risk, Impermanent loss, Market volatility | Kamino |

| #4 | Lend LSD LST on Marginfi for Staking + Lending APY | 10-22% (staking + lending) | Liquidation risk, Borrowing demand fluctuations, Platform risk | Marginfi |

| #3 | Provide LSD LST/SOL Liquidity on Raydium CLMM Pools | 18-35% | High impermanent loss, Fee volatility, Slippage | Raydium |

| #2 | Deposit LSD LST into Sanctum Infinity for Multi-LST Rewards | 9-27% | LST depeg risk, Pool concentration, Validator slashing (low) | Sanctum |

| #1 | Leveraged Looping: Collateralize LSD LST on Drift, Borrow SOL, Restake in LSD | 25-80+% | High liquidation risk, Leverage amplification, Oracle failure | Drift |

Real talk: impermanent loss in pools, liquidation in leverage, oracle fails. Mitigate with 20% position sizing, weekly rebalances. Audit checks on LSD, Marginfi, Drift keep it legit. At current TVLs, liquidity flows smooth.

Top 5 LSD LST Yield Stacks

-

#5: LSD LST in Kamino Vaults – Deposit into Kamino automated liquidity vaults for compounded yields: base 6-8% staking + LP fees.

-

#4: Lend LSD LST on Marginfi – Supply LSD LST for staking rewards + lending APY, earn dual yields risk-adjusted.

-

#3: LSD LST/SOL on Raydium CLMM – Provide liquidity in Raydium concentrated pools for trading fees atop 6-8% staking APY.

-

#2: LSD LST to Sanctum Infinity – Deposit for multi-LST rewards averaging 9%+ via pooled LSTs & trading fees.

-

#1: Leveraged Looping on Drift – Collateralize LSD LST, borrow SOL, restake in LSD protocol for 80%+ potential APY.

SOL’s RSI bounce from oversold at $76.64 low screams upside. Mint LSD LSTs today, deploy across these stacks. Every tick at $83.92 whispers 2026 riches. Track via LST capital efficiency guide. Chart it, stack it, profit.