Liquid staking tokens (LSTs) have rapidly become a cornerstone of modern DeFi strategies, offering investors the unique ability to unlock capital efficiency while still benefiting from network staking rewards. Instead of choosing between earning yield on staked assets or accessing liquidity, LSTs enable you to do both, making them a powerful tool for sophisticated crypto portfolio management.

What Are Liquid Staking Tokens and Why Use Them in Lending?

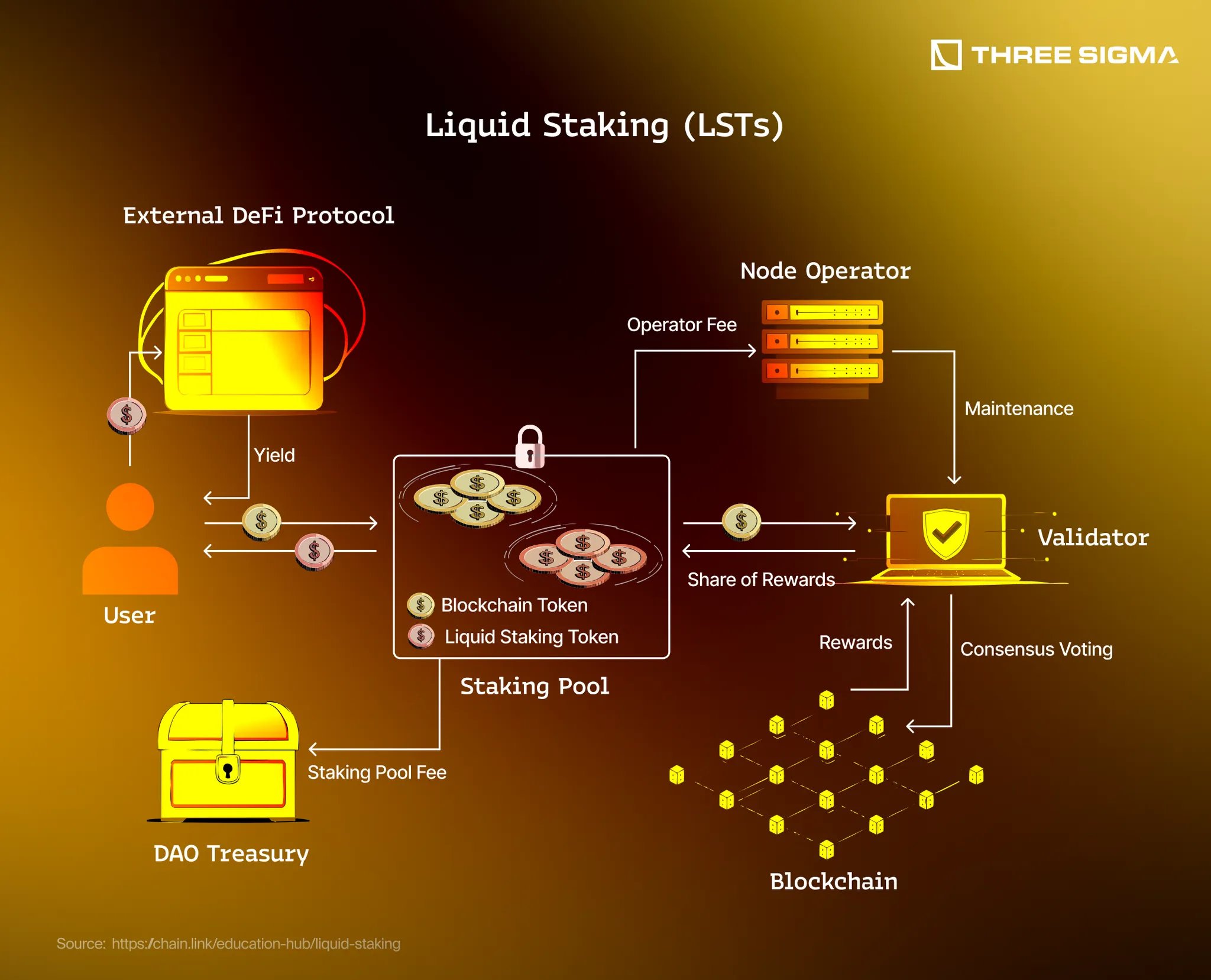

Traditionally, staking assets like Ethereum (ETH) meant locking them up, rendering those funds unusable until the end of the lockup period. Liquid staking providers changed this paradigm by issuing tokens such as stETH, rETH, and cbETH that represent your claim on staked ETH while remaining fully liquid. These LSTs accrue staking rewards and can be freely traded or deployed across DeFi protocols.

The real innovation comes when you use these LSTs as collateral in leading lending platforms like Aave, Compound, or MakerDAO. By doing so, you can borrow stablecoins or other crypto assets against your staked position, effectively stacking yield streams and enhancing your overall capital efficiency. This approach is central to advanced liquid staking DeFi strategies, enabling users to optimize returns without sacrificing security or flexibility.

How to Use LSTs as Collateral: Step-by-Step

To get started with using liquid staking tokens as collateral in DeFi lending protocols, follow these essential steps:

- Select a Compatible Lending Protocol: Not all platforms support every LST. Research protocols like Aave and Compound to confirm which tokens are accepted as collateral and what their loan-to-value (LTV) ratios are for each asset.

- Connect Your Wallet: Use a secure wallet such as MetaMask to connect with your chosen protocol. Ensure your wallet holds the desired amount of LST (e. g. , stETH).

- Deposit Your LST: Initiate the deposit process on the platform’s dashboard. Once confirmed on-chain, your LST will be locked as collateral by the smart contract.

- Borrow Against Your Collateral: After depositing, you can borrow stablecoins (like DAI or USDC) or other permitted assets up to the platform’s defined LTV ratio for your specific token.

This process allows you to unlock liquidity while still benefiting from ongoing staking rewards, a key advantage over traditional staking methods.

The Benefits of Yield Optimization with LST Collateral

The primary allure of using LST DeFi lending is enhanced yield stacking potential. By leveraging your liquid staking tokens as collateral, you’re able to:

- Easily access liquidity without unstaking underlying assets

- Earning dual yields: one from protocol lending/borrowing incentives and another from ongoing staking rewards via your LST

- Diversify exposure: deploy borrowed funds into additional yield-generating opportunities across DeFi

- Avoid opportunity cost: maintain exposure to potential ETH price appreciation while utilizing capital elsewhere in the ecosystem

This multi-layered approach is at the heart of advanced yield optimization with LST collateral, a strategy increasingly embraced by sophisticated DeFi investors looking for capital efficiency without compromising on security.

Navigating Key Risks When Using Liquid Staking Tokens in Lending Protocols

No strategy is without risk. While using liquid staking tokens as collateral offers compelling advantages, it’s crucial to understand potential pitfalls:

- Smart Contract Risk: All DeFi platforms rely on smart contracts that may contain vulnerabilities despite audits. Stick with reputable protocols that have undergone rigorous security reviews.

- Liquidation Risk: If the value of your collateral falls below a certain threshold, due either to market volatility or changes in protocol parameters, your position may be liquidated automatically. Monitor loan-to-value ratios closely and consider setting conservative borrowing limits.

- Slashing Risk: Rare but possible; if validators misbehave or network issues arise, some portion of underlying staked ETH could be slashed. Most major liquid staking providers take steps to minimize this risk but it remains present at a systemic level.

If you want a deeper dive into how liquid staking is transforming lending protocols within DeFi, I recommend reading more at onchainloyal.com/boosting-lending-protocols-with-liquid-staking-in-defi.

Staying proactive is essential when deploying LSTs as collateral. Platforms like Aave and Compound frequently update risk parameters, and market movements can be swift. Users should make use of dashboards that offer real-time analytics on collateral ratios, liquidation thresholds, and current yields. Many DeFi veterans set up automated alerts or bots to notify them if their positions approach risky levels, helping to avoid forced liquidations and protect capital.

Key Advantages & Common Pitfalls of Using LSTs as Collateral

-

Enhanced Capital Efficiency: Using liquid staking tokens (LSTs) like stETH, rETH, or cbETH as collateral lets you unlock liquidity while still earning staking rewards, maximizing your assets’ productivity.

-

Increased Flexibility Across DeFi: LSTs can be deployed on major lending protocols such as Aave, Compound, and MakerDAO, enabling you to borrow, lend, or participate in yield strategies without unstaking your underlying assets.

-

Smart Contract Vulnerabilities: Lending platforms operate on smart contracts, which can be susceptible to bugs or exploits. Always choose reputable, audited protocols to minimize this risk.

-

Liquidation Risk: If the value of your LST collateral drops or your loan-to-value (LTV) ratio becomes unsafe, your assets may be liquidated. Regular monitoring and prudent risk management are essential.

-

Slashing Risk: Your staked assets backing LSTs can face slashing penalties if validators misbehave. While leading LST providers have safeguards, this risk cannot be entirely eliminated.

It’s also wise to diversify across both protocols and LST issuers. For example, rather than concentrating all your assets in stETH on a single lending platform, consider splitting exposure between stETH, rETH, or cbETH across multiple reputable protocols. This diversification helps mitigate protocol-specific risks and reduces the impact of any potential smart contract exploit or governance change.

Best Practices for Using LST Collateral

To maximize the benefits while minimizing the risks associated with using liquid staking tokens as collateral, consider these best practices:

- Monitor Collateral Health: Regularly check your loan-to-value (LTV) ratio and set up notifications for significant price changes of your LSTs.

- Stay Updated on Protocol Changes: Lending protocols may adjust supported assets or risk parameters at any time.

- Diversify Across Assets and Platforms: Avoid overexposure to a single LST or protocol by spreading your positions.

- Understand Slashing Risks: Research how each liquid staking provider handles slashing events and whether they have insurance or mitigation mechanisms in place.

The most successful DeFi investors treat risk management as seriously as yield generation. Remember: capital preservation is the foundation of long-term wealth building in crypto.

Lending protocols are also becoming more sophisticated in how they manage risk for LSTs. Expect smarter liquidation engines, dynamic LTV adjustments based on volatility metrics, and even insurance integrations that further protect users from edge-case risks like validator slashing. As always in DeFi, staying informed is your best defense against both technical mishaps and market turbulence.

If you’re ready to explore yield optimization with LST collateral or want deeper insights into advanced strategies, stay connected with our community at Lstfi. Together we can navigate this fast-moving sector with confidence, unlocking new avenues for growth while keeping security front-of-mind every step of the way.