Yield stacking on Bitcoin has entered a new era. With BTC trading at $109,664.00, the opportunity to maximize returns using liquid staking tokens (LSTs) on the Stacks network is more compelling than ever. If you’re ready to move beyond passive holding and start compounding your Bitcoin yield, leveraging StackingDAO and Zest Protocol is your tactical edge. This isn’t just about earning yield – it’s about amplifying it through advanced DeFi strategies that keep your capital liquid and working across multiple layers of the Stacks ecosystem.

Looping STX Liquid Staking: The Power Play

The first step in this yield-maximizing playbook is looping STX liquid staking. Here’s how it works: you stake STX through StackingDAO to mint stSTX – a liquid staking token that auto-compounds rewards and remains tradable. Instead of letting your stSTX sit idle, deploy it as collateral on Zest Protocol, where you can borrow BTC or sBTC against your position.

This borrowed BTC/sBTC isn’t for spending – it’s for reinvesting back into more STX staking, creating a looping flywheel effect. Each cycle compounds your exposure to stacking rewards, while maintaining liquidity via stSTX. The result? Exponential stacking returns, boosted by cross-protocol leverage – all while keeping an exit route open thanks to liquid tokens.

Step-by-Step Looping STX Liquid Staking Guide

-

Looping STX Liquid Staking with StackingDAO and Zest Protocol: Stake your STX via StackingDAO to receive liquid stSTX tokens. Next, use stSTX as collateral on Zest Protocol to borrow BTC or sBTC. Reinvest these borrowed assets into more STX staking, compounding your yield across multiple cycles while maintaining liquidity and maximizing your exposure to Bitcoin’s current price of $109,664.00.

-

BTC Yield Farming with Restaked LSTs: After staking STX and receiving stSTX, deploy these liquid tokens across DeFi protocols within the Stacks ecosystem (like Zest Protocol) to earn additional BTC-denominated yield. This strategy leverages restaking and cross-protocol integrations, letting you maximize capital efficiency and stack more Bitcoin rewards.

-

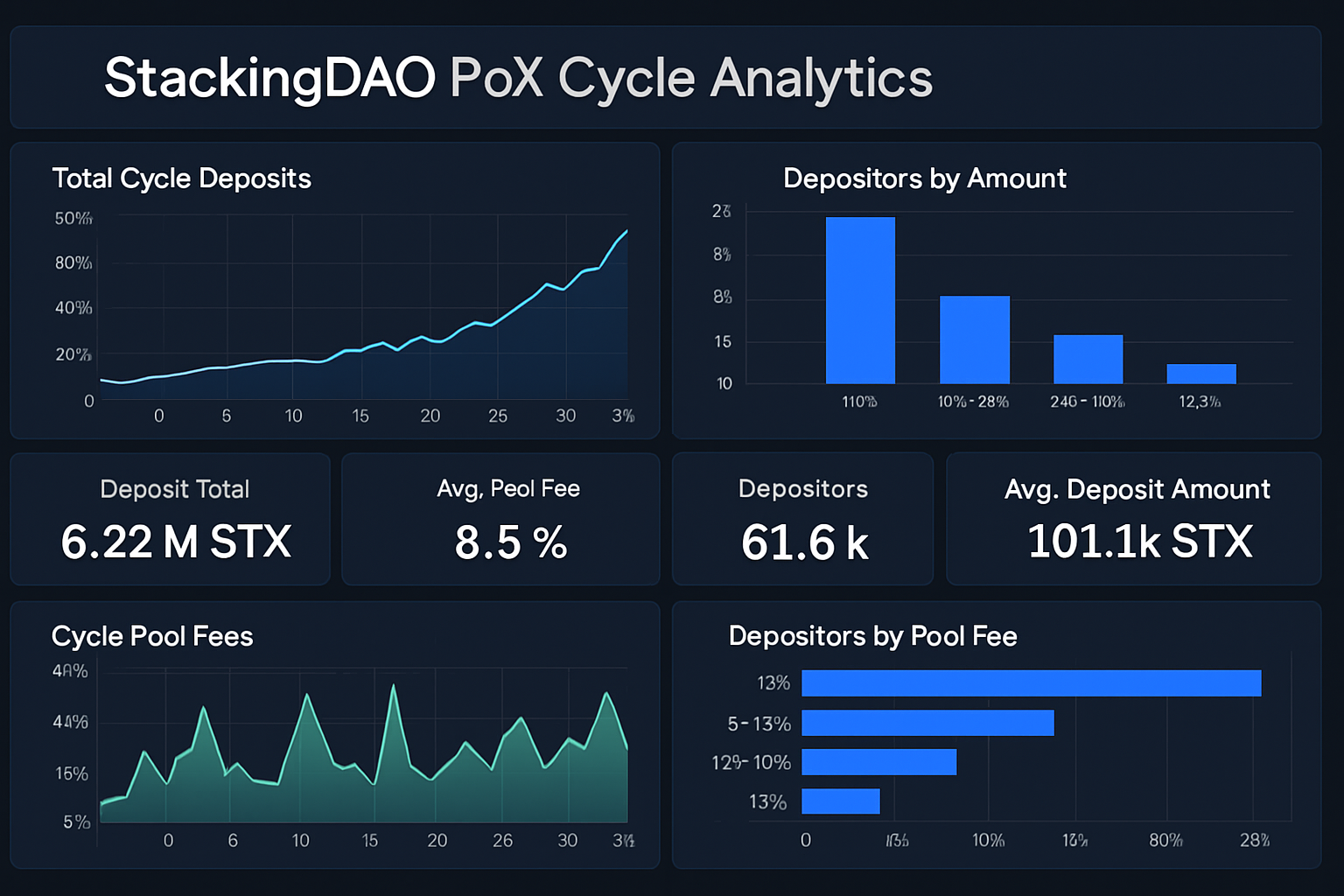

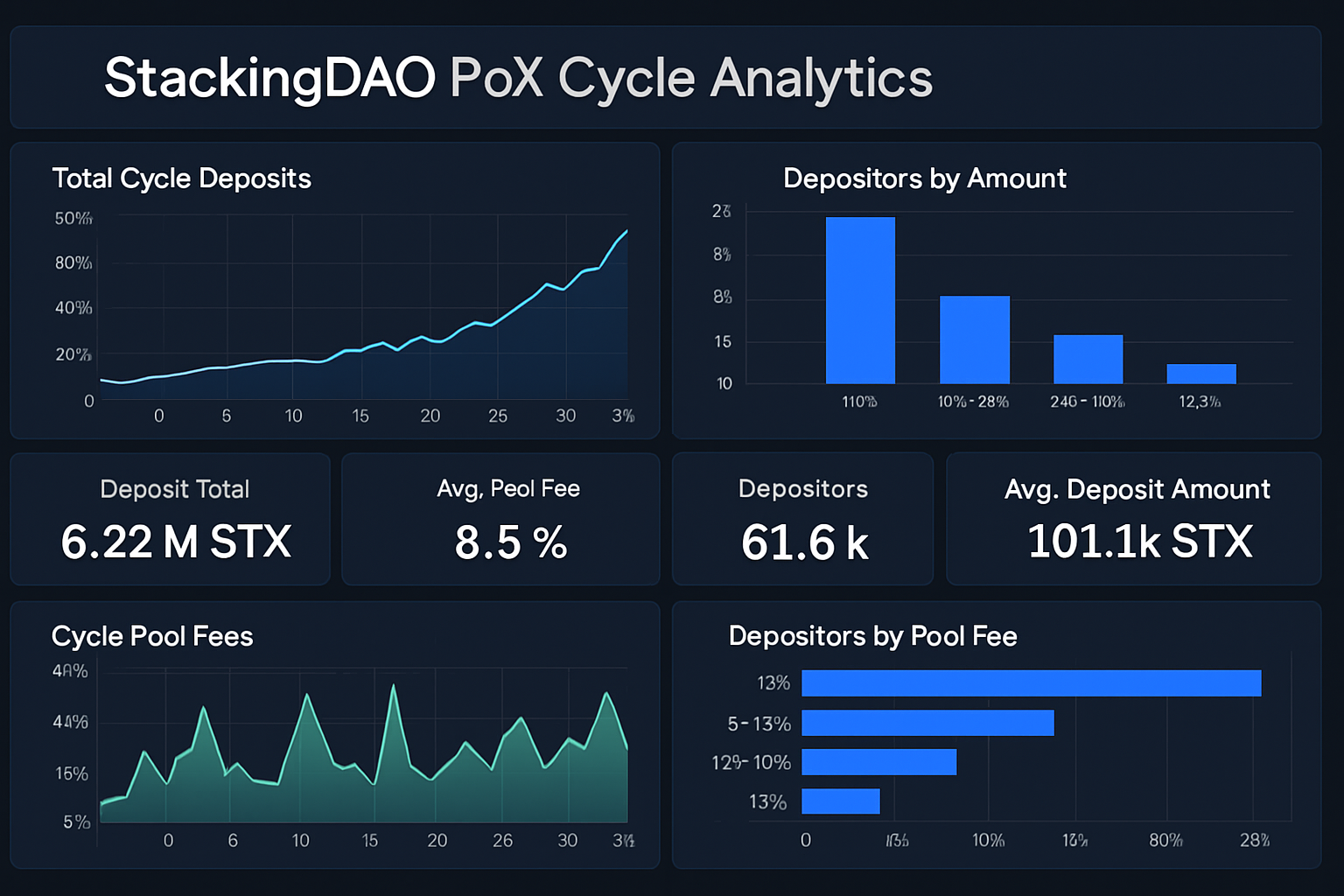

Dynamic Yield Optimization Using Real-Time PoX Cycle Data: Monitor StackingDAO analytics to identify optimal PoX (Proof of Transfer) cycles. Dynamically allocate your STX to maximize BTC rewards, using automated rebalancing tools or manual adjustments based on real-time yield trends for enhanced returns. Stay agile and capture the highest yields as market conditions shift.

BTC Yield Farming with Restaked LSTs: Double-Dipping on Yield

The next strategy takes things further: BTC yield farming with restaked LSTs. After minting stSTX, don’t just stop at holding or looping – deploy these tokens across multiple DeFi protocols within the Stacks ecosystem. Zest Protocol is a prime venue, offering additional BTC-denominated returns for supplying stSTX as liquidity or collateral.

This approach lets you stack yields from several sources at once: native stacking rewards from StackingDAO, interest from borrowers on Zest Protocol, and potentially even trading fees if you provide liquidity on decentralized exchanges like Bitflow. It’s a dynamic way to maximize capital efficiency and extract every possible satoshi of yield from your assets.

Dynamic Yield Optimization Using Real-Time PoX Cycle Data

If you want to trade like a pro in the LSTfi arena, static strategies won’t cut it. That’s where dynamic yield optimization using real-time PoX cycle data comes into play. The Proof of Transfer (PoX) mechanism on Stacks determines when and how much BTC reward is distributed per cycle. By actively monitoring analytics dashboards from StackingDAO, you can identify which cycles are projected to deliver the highest yields.

This data-driven approach lets you time your deposits and reallocate STX dynamically – either manually or via automated tools – chasing the most lucrative windows for stacking rewards. The result? You’re not just earning average APY; you’re tactically boosting returns by staying ahead of market flows and protocol incentives.

If you’re serious about maximizing Bitcoin yield stacking with LSTs, these three strategies are non-negotiable tools in your arsenal. In the next section we’ll break down risk management tips and walk through actionable steps for each tactic so you can execute confidently in today’s $109,664 BTC market.

Let’s get tactical about execution. Here’s how you can put these advanced bitcoin liquid staking and yield stacking bitcoin strategies into motion to capture every bit of upside the Stacks ecosystem has to offer.

Step-by-Step: Looping, Restaking, and Optimizing for Maximum BTC Yield

1. Looping STX Liquid Staking with StackingDAO and Zest Protocol: Start by staking your STX through StackingDAO to mint stSTX. Next, use your stSTX as collateral on Zest Protocol to borrow sBTC or BTC, right now, with Bitcoin at $109,664.00, every satoshi counts. Reinvest the borrowed assets into more STX via StackingDAO, repeating the loop as risk tolerance allows. This compounding flywheel is how aggressive DeFi tacticians multiply their stacking rewards while maintaining liquidity for rapid repositioning.

2. BTC Yield Farming with Restaked LSTs: Once you’ve minted or looped stSTX, don’t let it idle. Deploy those tokens into DeFi protocols like Zest for extra yield, supply them as liquidity or collateral to earn additional BTC-denominated returns on top of your base stacking rewards. Take it a step further by providing liquidity on Bitflow’s stSTX-STX pools to rake in trading fees and rack up more StackingDAO points for future incentives (details here). This is true restaking bitcoin: capital efficiency meets relentless yield pursuit.

3. Dynamic Yield Optimization Using Real-Time PoX Cycle Data: Don’t just set and forget, stay glued to the analytics dashboards from StackingDAO. Watch real-time PoX cycle data and allocate your STX dynamically to maximize BTC rewards during high-yield cycles (learn more here). Whether you rebalance manually or automate with DeFi tools, this approach lets you surf the biggest yield waves instead of settling for average returns.

Top Strategies for Maximizing BTC Yield with StackingDAO & Zest

-

Looping STX Liquid Staking with StackingDAO and Zest Protocol: Stake your STX via StackingDAO to receive liquid stSTX tokens. Use stSTX as collateral on Zest Protocol to borrow BTC or sBTC, then reinvest borrowed assets into more STX staking. This looping strategy compounds your yield across multiple cycles while keeping your assets liquid.

-

BTC Yield Farming with Restaked LSTs: After staking STX and receiving stSTX, deploy these liquid tokens across DeFi protocols within the Stacks ecosystem (such as Zest Protocol) to earn additional BTC-denominated yield. This approach leverages restaking and cross-protocol integrations for maximum capital efficiency.

-

Dynamic Yield Optimization Using Real-Time PoX Cycle Data: Monitor StackingDAO analytics to identify optimal PoX (Proof of Transfer) cycles and dynamically allocate STX to maximize BTC rewards. Combine this with automated rebalancing tools or manual adjustments based on real-time yield trends for enhanced returns.

Risk Management Tips for Aggressive Yield Stackers

Pushing capital efficiency means managing risk like a pro. Here are some tactical moves:

- Monitor liquidation thresholds: When looping with stSTX as collateral on Zest Protocol, keep a close eye on your health factor, volatile price swings in STX or BTC (currently at $109,664.00) can trigger liquidations fast.

- Diversify across protocols: Don’t go all-in on a single platform; spread exposure between StackingDAO, Zest Protocol, and DEX pools like Bitflow for resilience against smart contract risk.

- Pace your leverage: Compounding is powerful but dangerous if overdone, use conservative loan-to-value ratios unless you’re ready to actively manage positions around the clock.

- Aim for points maximization: Both StackingDAO and Zest run points programs that may translate into future airdrops or incentives, track your accruals closely (see how points work) and optimize accordingly.

Your Next Move in Bitcoin LSTfi

The landscape of BTC DeFi yield strategies is evolving rapidly, and right now, the combination of liquid staking tokens (like stSTX), cross-protocol integrations (StackingDAO and Zest), and dynamic optimization puts serious firepower in your hands. With Bitcoin holding steady at $109,664.00, every well-executed cycle compounds faster than ever before.

This is not passive investing, it’s active capital deployment where speed and data-driven decisions separate winners from bagholders. If you’re ready to stack smarter yields than anyone else in Bitcoin DeFi today, start looping your STX positions via StackingDAO and Zest Protocol, and never stop optimizing as new integrations hit the market.