Liquid staking tokens (LSTs) are redefining passive income in crypto by unlocking the value of staked assets and enabling capital to flow effortlessly across decentralized finance (DeFi) platforms. Unlike traditional staking, which locks tokens and restricts their use, LSTs maintain liquidity and composability, allowing users to participate in yield stacking: the practice of generating multiple income streams from a single underlying asset. This approach is rapidly gaining traction as both institutional and retail investors seek ways to optimize returns without sacrificing flexibility.

How Liquid Staking Tokens Power Effortless Yield Stacking

At the core of this innovation are protocols that issue LSTs representing staked assets on proof-of-stake blockchains. These tokens can be freely traded, used as collateral, or deployed in other DeFi strategies while still accruing staking rewards. The result is a dramatic increase in capital efficiency and the ability to automate complex yield strategies across multiple platforms.

Let’s break down the six most effective tools and strategies for leveraging LSTs to achieve automated yield stacking:

Top 6 Tools & Strategies for Effortless LST Yield Stacking

-

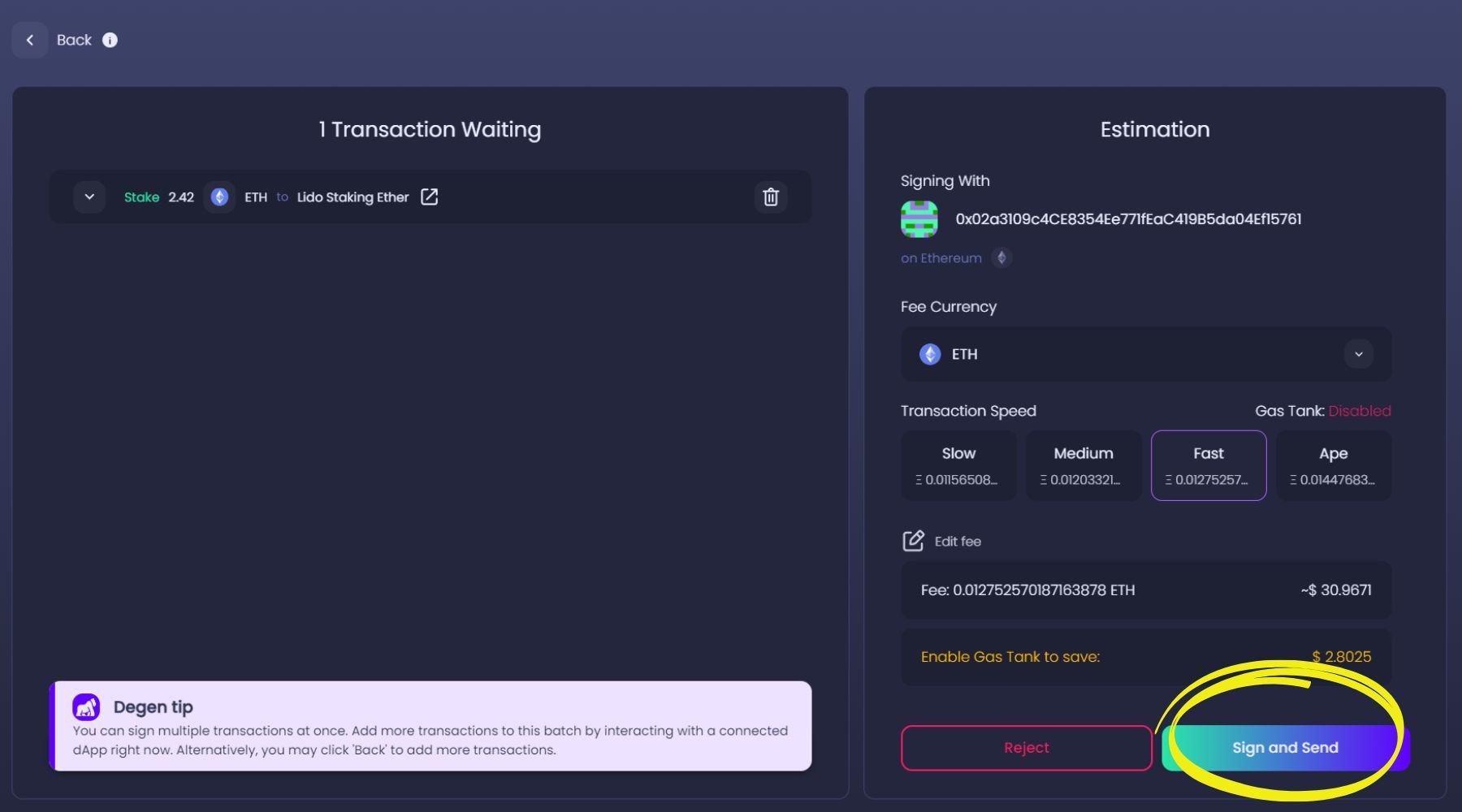

Lido Finance for Ethereum Liquid Staking and stETH Yield Stacking: Lido is the leading liquid staking protocol for Ethereum, allowing users to stake ETH and receive stETH, a liquid staking token that accrues staking rewards. stETH can be deployed across DeFi platforms for additional yield, enabling effortless stacking of rewards without locking up capital.

-

Rocket Pool’s rETH and Permissionless Node Participation: Rocket Pool offers decentralized Ethereum staking with rETH as its liquid staking token. Users can either stake ETH or run permissionless nodes, earning both staking rewards and additional incentives. rETH is widely accepted in DeFi, supporting diverse yield stacking strategies.

-

Pendle Finance for Tokenized Future Yield Trading with LSTs: Pendle Finance enables users to split LSTs into principal and yield components, allowing the trading or locking in of future staking yields. This unique approach lets users speculate on or hedge against future yield rates, compounding returns through advanced DeFi strategies.

-

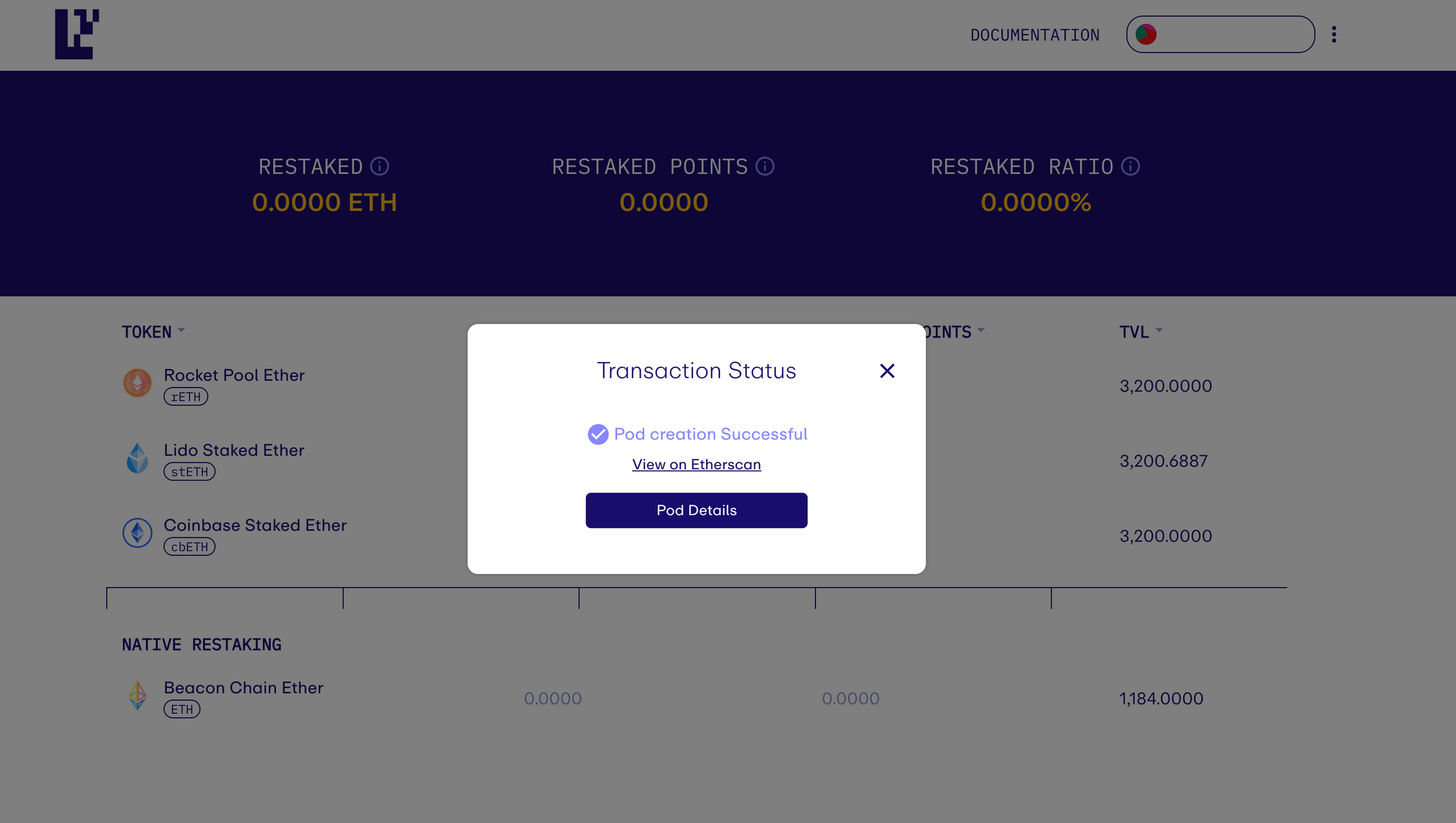

EigenLayer Restaking for Multi-Protocol Yield Aggregation: EigenLayer introduces restaking, allowing users to re-deploy their LSTs (like stETH or rETH) to secure additional protocols and earn layered rewards. This multi-protocol yield aggregation amplifies returns while maintaining exposure to Ethereum staking.

-

Automated LST Vaults on Yearn and Beefy for Cross-Protocol Compounding: Yearn and Beefy offer automated vaults that optimize LST deployment across multiple DeFi protocols. By depositing stETH, rETH, or other LSTs, users benefit from auto-compounding strategies that stack yields with minimal manual intervention.

-

Using LSTs as Collateral in Aave or MakerDAO for Leveraged Yield Strategies: Platforms like Aave and MakerDAO accept LSTs as collateral, enabling users to borrow stablecoins or other assets while still earning staking rewards. Borrowed funds can be reinvested, creating leveraged yield stacking opportunities across the DeFi ecosystem.

Lido Finance: The Gateway to Ethereum Liquid Staking

Lido Finance is the dominant player for Ethereum liquid staking. By staking ETH through Lido, users receive stETH, a tokenized representation of their staked ETH plus accrued rewards. What sets stETH apart is its deep integration across DeFi – users can deploy stETH in lending markets, liquidity pools, or yield farming protocols without forfeiting base staking rewards. For example, providing stETH-ETH liquidity on leading DEXs can generate additional APYs on top of native ETH staking yields (source).

This seamless composability has made Lido’s model a blueprint for cross-platform yield optimization. With over $15 billion in TVL by late 2025 and integrations with virtually every major DeFi protocol, stETH remains the gold standard for effortless yield stacking on Ethereum.

Rocket Pool: Decentralized rETH and Permissionless Node Participation

Rocket Pool offers an alternative approach focused on decentralization and permissionless node operation. When users stake ETH with Rocket Pool, they receive rETH, which accrues rewards as validators earn them on-chain. rETH is highly liquid and can be utilized across DeFi much like stETH but with an added emphasis on open participation – anyone can run a Rocket Pool node with just 8 ETH plus RPL collateral.

This model democratizes access to validator rewards while supporting network resilience. rETH holders benefit from broad protocol integrations for lending or liquidity provision while avoiding centralization risks seen in some larger providers.

Pendle Finance: Tokenizing Future Yields on LSTs

Pendle Finance introduces a unique mechanism by splitting LSTs into principal and future yield components via tokenization. Users can trade these components separately or lock in future yields at fixed rates – effectively building custom interest rate products atop their staked assets (source). This creates opportunities for sophisticated strategies such as hedging against rate changes or speculating purely on future staking returns without exposure to principal price movements.

Pendle’s approach brings TradFi-style fixed income dynamics into the DeFi landscape while maintaining full composability with existing LST infrastructure.

EigenLayer Restaking: Multi-Protocol Yield Aggregation

EigenLayer has emerged as a catalyst for the restaking revolution, enabling LST holders to further amplify their yield potential. With EigenLayer, users can “restake” their stETH or rETH, delegating security to additional protocols beyond Ethereum and earning layered rewards. This mechanism not only boosts aggregate returns but also supports the security of emerging middleware and rollup solutions in the broader DeFi ecosystem. The result is a new paradigm where a single LST can simultaneously secure multiple networks and unlock stacked yields from several sources.

As restaking gains momentum in 2025, EigenLayer’s model is setting the standard for multi-protocol yield aggregation, allowing capital to flow efficiently across composable layers without manual intervention.

Automated LST Vaults: Yearn and Beefy Cross-Protocol Compounding

The rise of automated vaults on platforms like Yearn Finance and Beefy Finance has brought hands-off compounding to LST yield stacking. These vaults automatically deploy deposited stETH or rETH into optimized strategies spanning lending, liquidity provision, and farming across integrated DeFi protocols. Through continuous auto-compounding and dynamic rebalancing, users maximize returns with minimal oversight, ideal for those seeking truly passive income in crypto.

This automation drastically reduces the complexity of managing multi-platform strategies while maintaining capital efficiency. Yearn and Beefy are now essential tools for anyone looking to scale their yield stacking efforts across chains and protocols.

Leveraged Yield Strategies: LSTs as Collateral on Aave and MakerDAO

Lending protocols like Aave and MakerDAO have unlocked another layer of capital efficiency by accepting LSTs as collateral. Users can deposit assets such as stETH or rETH to borrow stablecoins or other tokens, while still earning staking rewards on their underlying collateral. This borrowed liquidity can then be cycled back into more staking or yield-generating activities, creating a powerful leveraged loop for sophisticated investors willing to manage liquidation risk.

This approach exemplifies how DeFi automation tools enable advanced cross-platform strategies that were previously only available to institutional players. By integrating LST collateralization into lending markets, Aave and MakerDAO have cemented their roles as foundational pillars in the yield stacking toolkit.

The Future of Effortless Yield Stacking with Liquid Staking Tokens

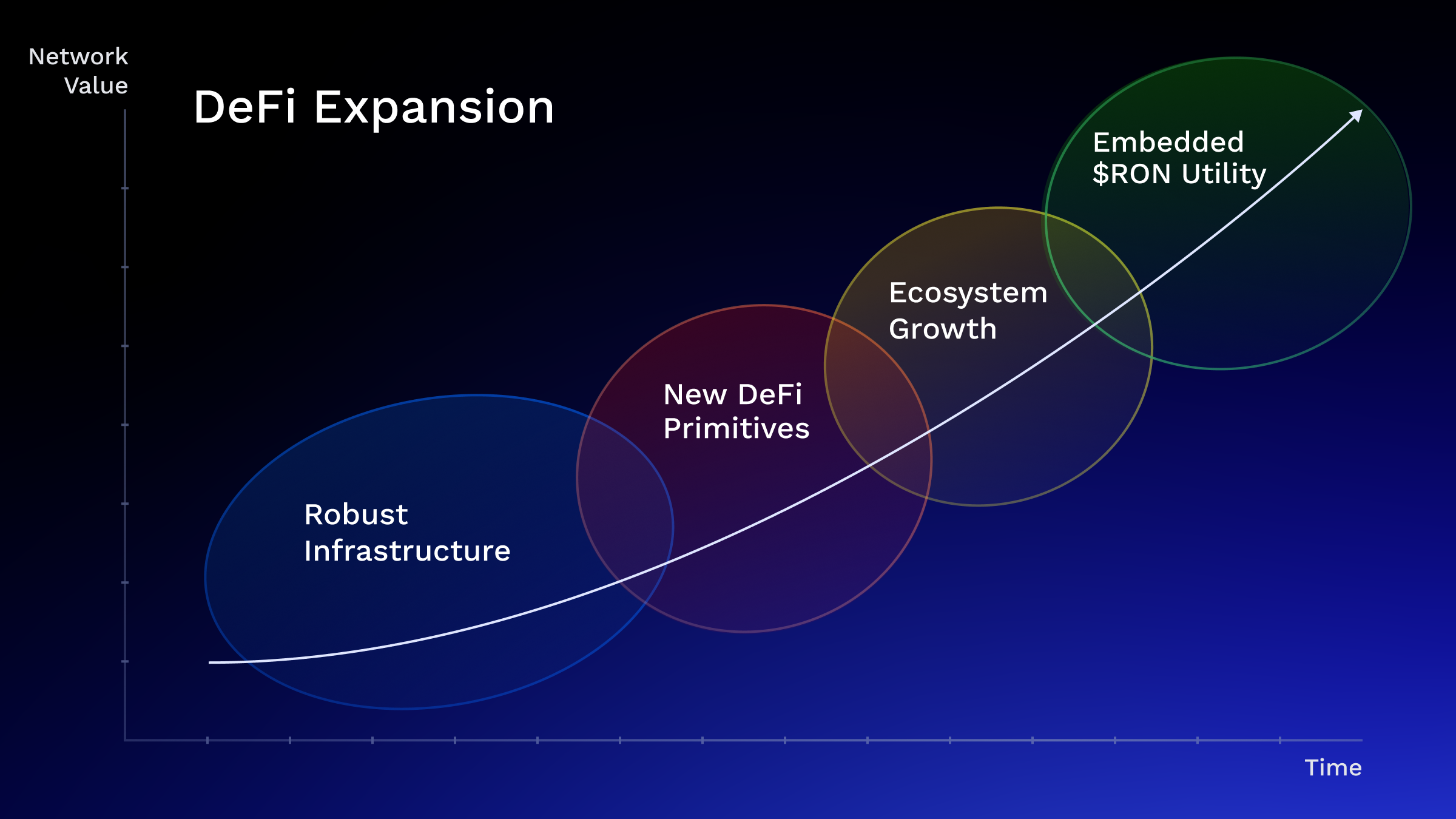

The synergy between these six strategies, spanning liquid staking issuance, decentralized node participation, tokenized future yields, restaking aggregation, automated vault compounding, and leveraged lending, has ushered in a new era of effortless DeFi automation. The ability to earn layered rewards from a single asset position is no longer theoretical; it’s accessible today through robust platforms purpose-built for composability and security-first design.

However, maximizing these opportunities requires careful due diligence around smart contract risk, platform reliability, and market volatility. As always in DeFi: optimize your strategies but never neglect risk management.

The continued evolution of liquid staking tokens will likely see even deeper integrations across chains and protocols, fueling innovations in cross-chain yield farming and passive income crypto products that are both user-friendly and institutionally robust. For those ready to move beyond speculation toward true optimization, these six tools form the foundation for sustainable success in decentralized finance.