Ethereum’s proof-of-stake transformation has unlocked a new era of yield opportunities for ETH holders. In 2024, with Ethereum (ETH) trading at $4,497.24, the landscape for maximizing returns has never been more dynamic. Liquid staking tokens (LSTs) are at the heart of this revolution, allowing users to earn staking rewards while retaining the flexibility to deploy their capital across DeFi platforms. But with dozens of protocols and strategies available, how do you ensure you’re squeezing every bit of yield from your ETH?

Stake ETH with Leading LST Protocols for Competitive Base Yields

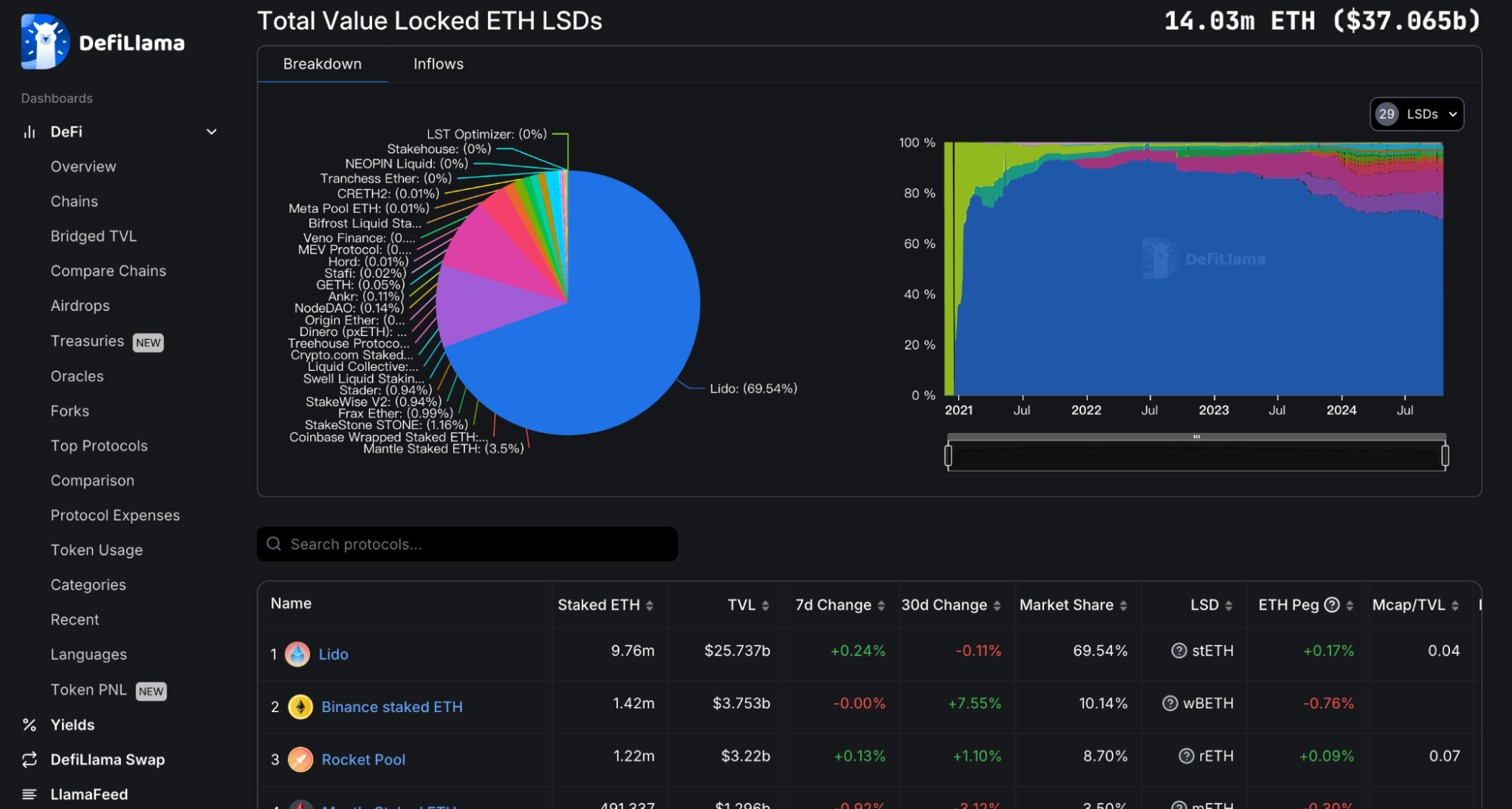

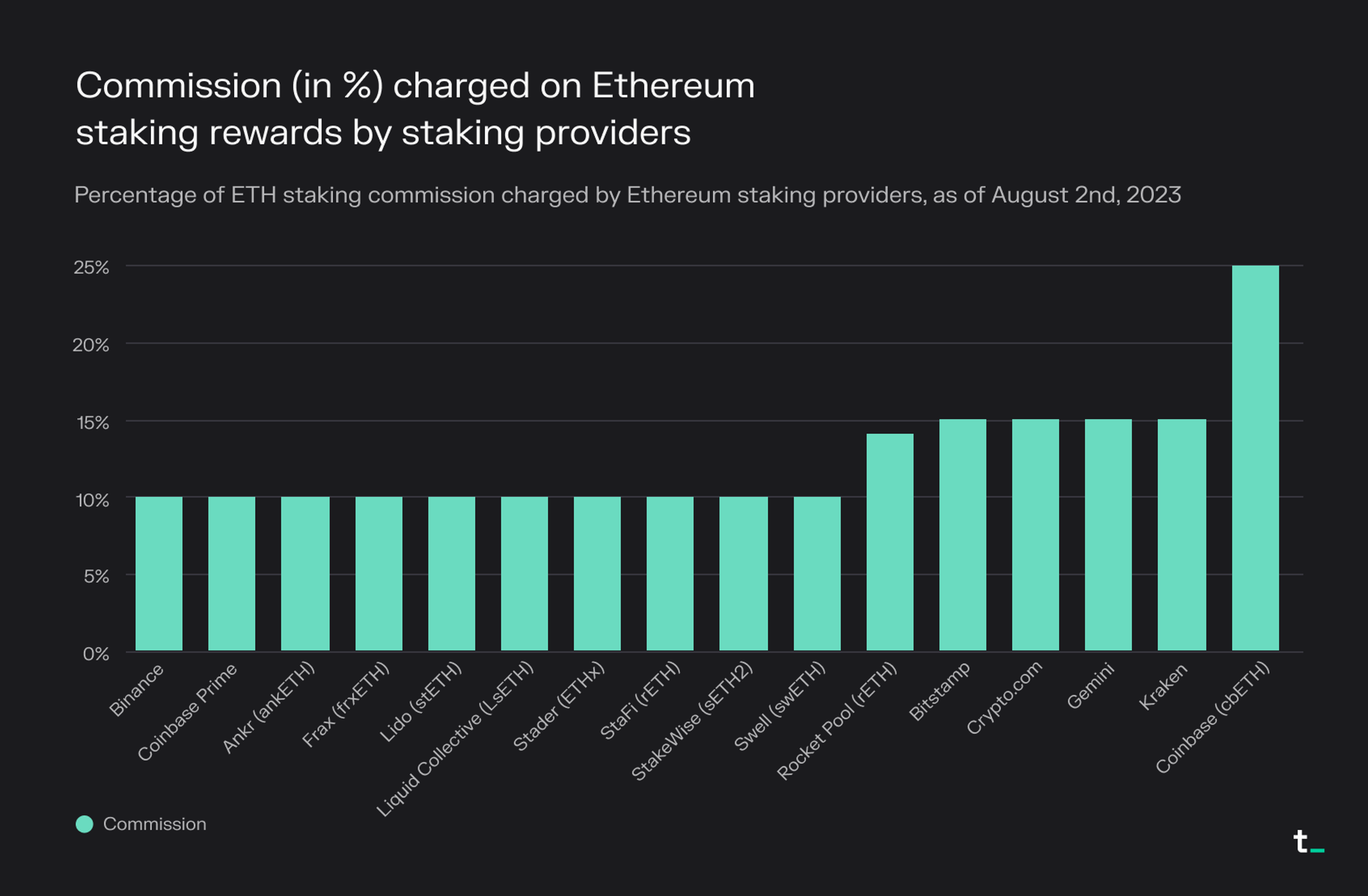

The foundation of any robust ETH yield strategy begins with selecting a reputable liquid staking protocol. Platforms like Lido Finance, Rocket Pool, and Coinbase Wrapped Staked ETH remain at the forefront in 2024, offering competitive base yields and deep DeFi integrations.

- Lido Finance: Stake your ETH and receive stETH, an LST widely accepted across DeFi. Lido currently offers an APY around 2.98%, balancing convenience with liquidity.

- Rocket Pool: For those seeking more decentralization, Rocket Pool’s rETH delivers up to 5.5% APY, powered by a distributed network of node operators.

- Coinbase Wrapped Staked ETH: Institutional-grade security and seamless exchange integration make cbETH a popular choice among conservative investors.

Your choice here sets the stage for all subsequent strategies: prioritize platforms with strong security audits, transparent governance, and active community oversight.

Leverage LSTs in DeFi Lending Platforms to Earn Additional Interest

The real magic begins when you put your liquid staking tokens to work as collateral on leading DeFi lending platforms like Aave or Compound. By depositing stETH or rETH as collateral, you can borrow stablecoins or other assets against your staked position, without giving up your underlying staking rewards.

This approach is particularly attractive during periods of market uncertainty or sideways price action. You can:

- Borrows stablecoins against LSTs to hedge volatility or pursue other yield opportunities.

- Earn both the base staking APY and additional interest from lending activities.

- Diversify risk by splitting collateral across multiple protocols.

This dual-yield mechanism is one reason why seasoned yield stackers consider LST lending an essential pillar in their portfolio construction, especially as DeFi money markets mature and competition drives borrowing rates ever more favorable for lenders.

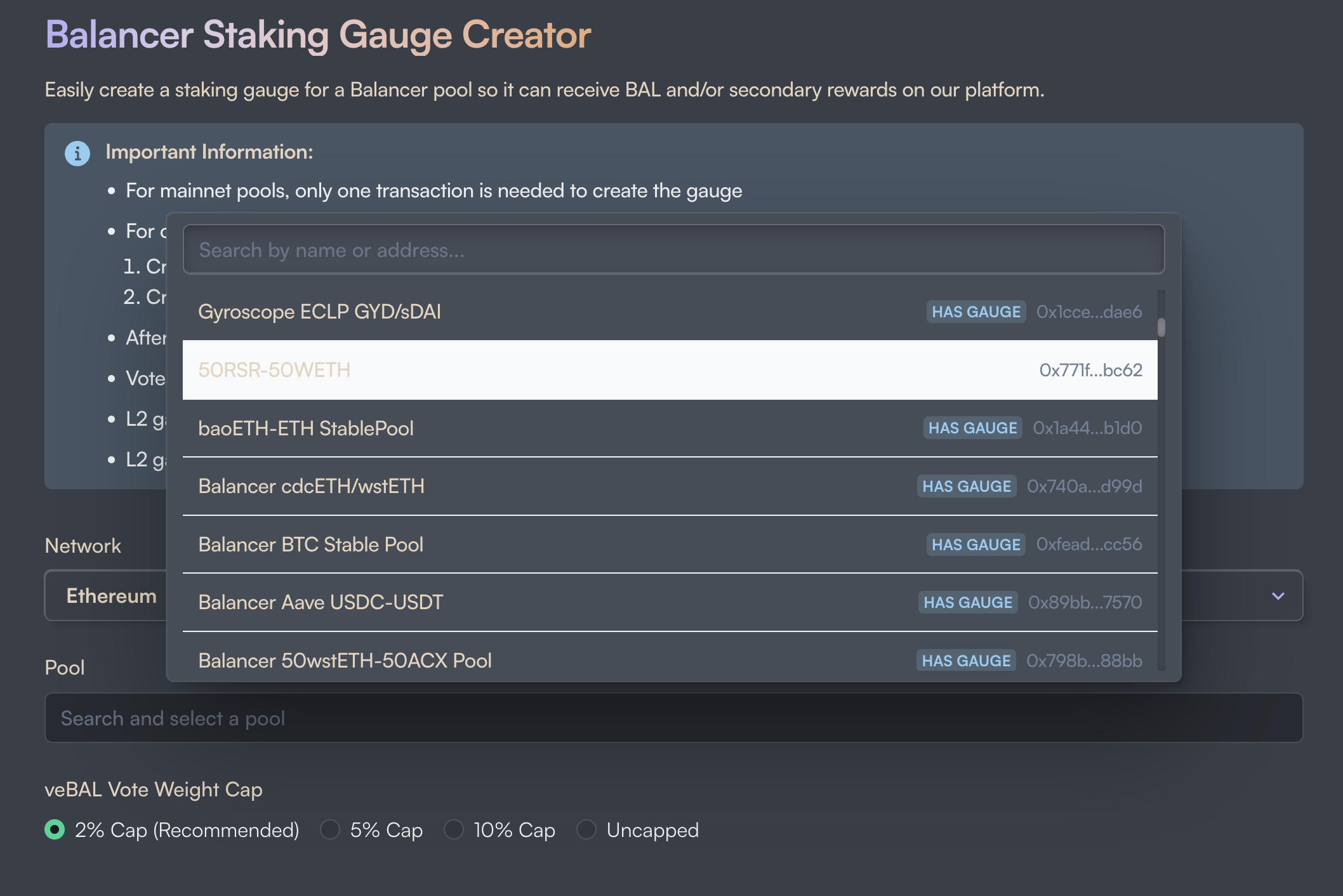

Participate in Yield Farming and Liquidity Pools Using LST/ETH Pairs on DEXs

If you’re comfortable navigating a slightly higher risk profile, deploying your LSTs into liquidity pools on decentralized exchanges (DEXs) such as Curve or Balancer can unlock bonus rewards. By providing liquidity to pools like stETH/ETH or rETH/ETH, you not only earn a share of trading fees but also often qualify for incentive programs funded by protocol-native tokens.

Top Strategies to Maximize ETH Yield with LSTs in 2024

-

Stake ETH with Leading LST Protocols (e.g., Lido, Rocket Pool, Coinbase Wrapped Staked ETH) for competitive base yields. Staking with these established protocols allows you to earn passive income, with Lido offering an APY of approximately 2.98% and Rocket Pool up to 5.5%.

-

Utilize Automated Yield Optimization Tools (e.g., Yearn Vaults or Sommelier) to rebalance and compound returns from multiple LST strategies. These platforms automatically move your assets between the best-performing pools, maximizing yield with minimal manual intervention.

-

Monitor and Switch Between Top-Performing LST Providers based on real-time APY, security audits, and protocol upgrades. Staying updated on protocol performance, audits, and governance changes helps you optimize yield and minimize risk across your LST holdings.

This strategy can significantly boost overall returns, sometimes doubling effective APY, but it’s vital to assess risks such as impermanent loss and smart contract vulnerabilities before committing substantial capital. Diversification across pools and regular monitoring are key practices here.

Ethereum (ETH) Price Prediction 2026-2031

Forecast based on current liquid staking trends, DeFi yield dynamics, and macro crypto market outlook (as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,200 | $7,100 | +15.6% | Continued LST adoption and DeFi integration drive steady growth; ETH benefits from increased staking and new DeFi use cases. Volatility persists due to regulatory uncertainty. |

| 2027 | $4,500 | $6,000 | $8,800 | +15.4% | ETH staking becomes mainstream; Ethereum upgrades improve scalability. Strong DeFi and NFT ecosystem expansion. Bullish scenario fueled by global institutional adoption. |

| 2028 | $4,800 | $6,700 | $10,000 | +11.7% | Wider enterprise adoption and rollup tech boost demand. Competition from L2s and alt-L1s tempers growth. Bearish scenario if global regulations tighten. |

| 2029 | $5,100 | $7,600 | $12,500 | +13.4% | ETH solidifies role as DeFi backbone. Restaking and cross-chain integrations gain traction. Bullish case from tokenized real-world assets. Bearish risks from macro downturn. |

| 2030 | $5,400 | $8,400 | $14,000 | +10.5% | ETH benefits from maturing crypto markets and regulatory clarity. Institutional products (ETFs, ETPs) boost demand. Bearish: Market saturation or tech disruption. |

| 2031 | $5,700 | $9,200 | $16,000 | +9.5% | Mainstream financial integration. ETH as collateral standard. Bullish: Onchain finance dominates. Bearish: Major protocol exploit or global recession. |

Price Prediction Summary

Ethereum’s price outlook through 2031 remains bullish with logical year-over-year growth, underpinned by widespread adoption of liquid staking tokens, DeFi platform integration, and ongoing Ethereum protocol upgrades. While average prices are forecast to rise steadily, significant volatility remains possible due to regulatory, macroeconomic, and competitive factors. Bullish scenarios reflect expanding institutional adoption and new use cases, while bearish risks stem from potential regulatory hurdles or major security incidents.

Key Factors Affecting Ethereum Price

- Growth and adoption of liquid staking and restaking protocols (Lido, Rocket Pool, EigenLayer, etc.)

- Continued DeFi expansion and integration of LSTs as collateral

- Ethereum protocol upgrades (scalability, security, energy efficiency)

- Regulatory developments in the US, EU, and Asia

- Competition from alternative L1 and L2 platforms

- Institutional adoption and development of ETH-based financial products

- Global macroeconomic cycles and risk sentiment

- Security of smart contracts and protocol governance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The next section will explore how automated yield optimization tools can help compound these strategies further, and why monitoring top-performing protocols is crucial for staying ahead in this fast-moving market.

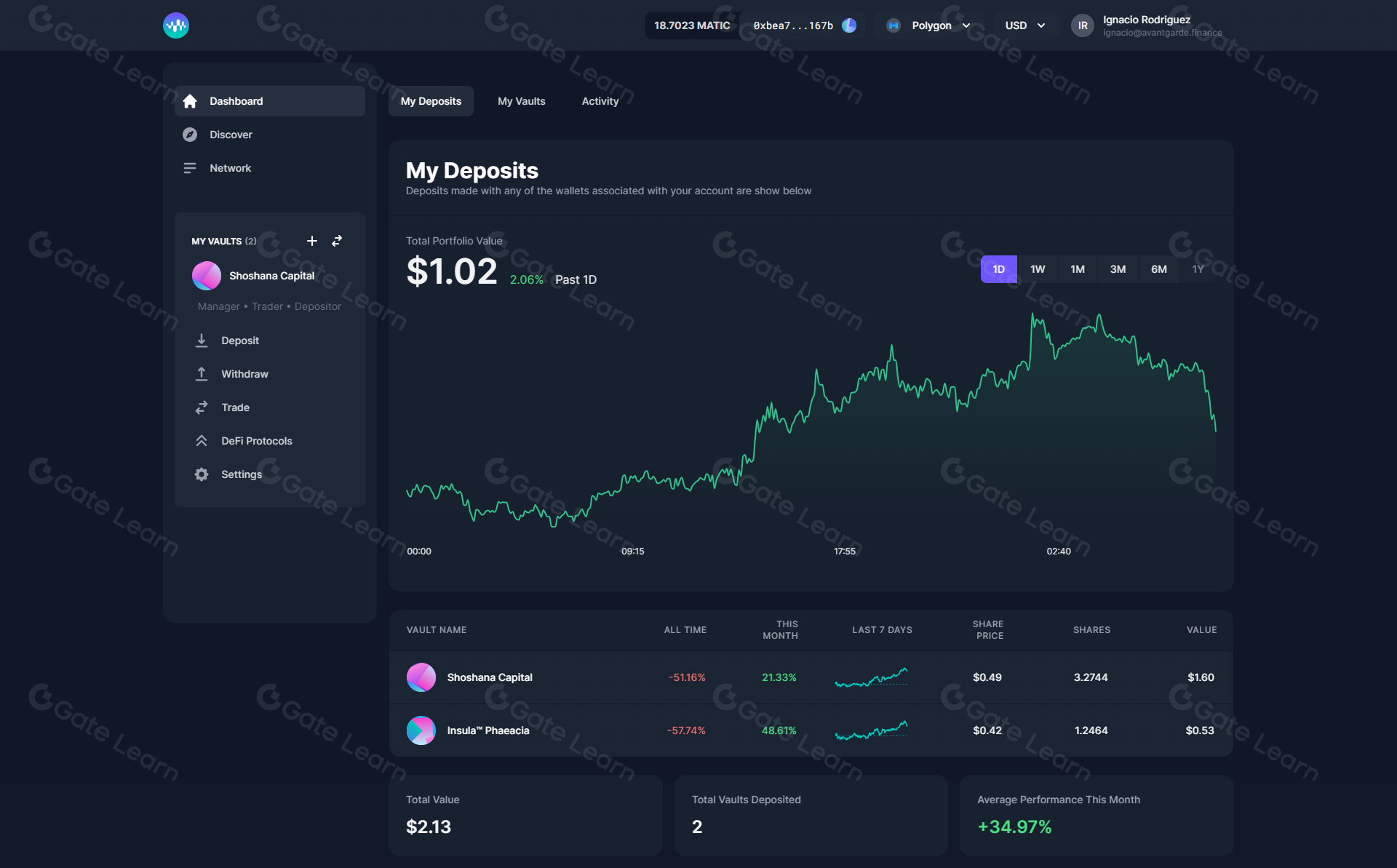

Utilize Automated Yield Optimization Tools to Compound Returns

For those seeking to streamline their ETH yield maximization, automated yield optimization tools like Yearn Vaults and Sommelier have become indispensable in 2024. These platforms aggregate and rebalance user funds across multiple LST strategies, automatically shifting capital to where yields are highest. For example, a Yearn Vault might allocate your stETH or rETH between lending protocols, DEX liquidity pools, or even cross-protocol incentives depending on real-time APY data and risk assessments.

The benefit? Compounding returns without constant manual intervention. These tools are especially valuable for investors who want exposure to the best DeFi staking strategies but lack the time or expertise for daily management. However, it’s important to review vault strategies and fee structures regularly, automation does not eliminate the need for due diligence.

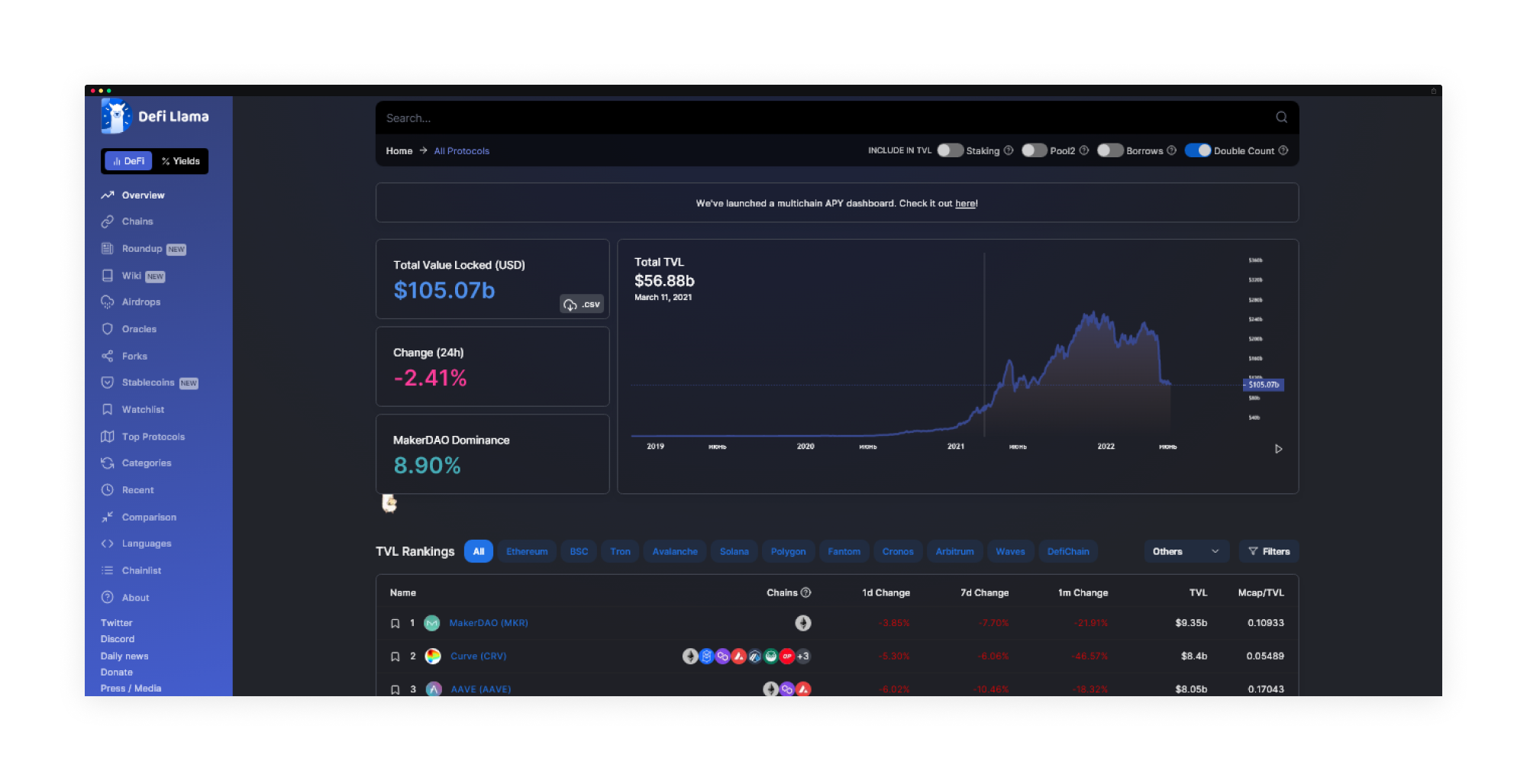

Monitor and Switch Between Top-Performing LST Providers

The liquid staking landscape is highly competitive, and yields can fluctuate rapidly as new protocols launch upgrades or attract more TVL. To consistently maximize your ETH yield, make it a habit to monitor real-time APYs, security audits, and protocol developments. Switching between providers such as Lido, Rocket Pool, or Coinbase Wrapped Staked ETH can often net you higher returns with minimal friction.

Key practices for staying ahead:

- Use analytics dashboards that track live APY changes across major LST protocols.

- Follow community forums and audit reports to stay abreast of security updates and governance proposals.

- Reallocate capital proactively, especially if a protocol introduces new rewards or improves its risk profile.

This dynamic approach ensures you’re never leaving yield on the table, an essential mindset in today’s fast-moving DeFi ecosystem. Remember: flexibility is a superpower when optimizing across liquid staking tokens.

The Five Pillars of ETH Yield Maximization with LSTs in 2024

Top 5 Strategies to Maximize ETH Yield with LSTs in 2024

-

Stake ETH with Leading LST Protocols (e.g., Lido, Rocket Pool, Coinbase Wrapped Staked ETH) for Competitive Base Yields. Platforms like Lido Finance let you stake ETH and receive stETH, offering an APY of around 2.98%. Rocket Pool provides rETH with yields up to 5.5%, while Coinbase Wrapped Staked ETH (cbETH) is widely used for its ease of access and integration in DeFi.

-

Leverage LSTs in DeFi Lending Platforms (such as Aave or Compound) to Earn Additional Interest on Staked Assets. By supplying LSTs like stETH or rETH as collateral on platforms like Aave or Compound, users can borrow stablecoins or other assets, effectively layering yields on top of staking rewards.

-

Participate in Yield Farming and Liquidity Pools Using LST/ETH Pairs on DEXs like Curve or Balancer for Bonus Rewards. Providing liquidity to pools such as stETH/ETH or rETH/ETH enables you to earn trading fees and potential token incentives, further boosting your overall yield.

-

Utilize Automated Yield Optimization Tools (e.g., Yearn Vaults or Sommelier) to Rebalance and Compound Returns from Multiple LST Strategies. These platforms automate the process of moving funds between protocols and compounding rewards, maximizing returns with minimal manual intervention.

-

Monitor and Switch Between Top-Performing LST Providers Based on Real-Time APY, Security Audits, and Protocol Upgrades. Regularly reviewing performance metrics and security updates allows you to move your ETH to the most reliable and highest-yielding LST protocols, ensuring optimal returns while managing risk.

Navigating these strategies effectively requires both vigilance and patience. By combining competitive base yields from leading LST protocols with advanced DeFi integrations, lending, liquidity provision, automated optimizers, and by staying nimble enough to switch providers as market conditions evolve, you give yourself the best chance at sustainable outperformance.

If you’re ready to dive deeper into practical tactics for maximizing crypto yields without lockups or unnecessary risk, our comprehensive guide on how liquid staking maximizes crypto yield without lockups in 2024 is an excellent next step.

The world of Ethereum liquid staking continues to evolve at pace. By focusing on security, diversification, and ongoing education, as always, you’ll be well-positioned to capitalize on every opportunity this innovative sector has to offer while safeguarding your long-term wealth.