Bitcoin is holding firm above the $100,000 mark, trading at $104,737.00 as of today. But if you’re just sitting on your BTC, you’re leaving serious yield on the table. The Stacks network’s dual stacking mechanism is rewriting the playbook for Bitcoin yield stacking, letting you deploy both BTC and STX to supercharge your returns. If you want to maximize Bitcoin DeFi yield while staying liquid, it’s time to get tactical with sBTC and STX.

Dual Stacking: The Yield Multiplier for Bitcoin Above $100,000

Let’s get straight to the point: dual stacking Stacks isn’t just another staking gimmick. It’s a practical way to unlock your Bitcoin’s earning potential with minimal friction. Here’s how it works:

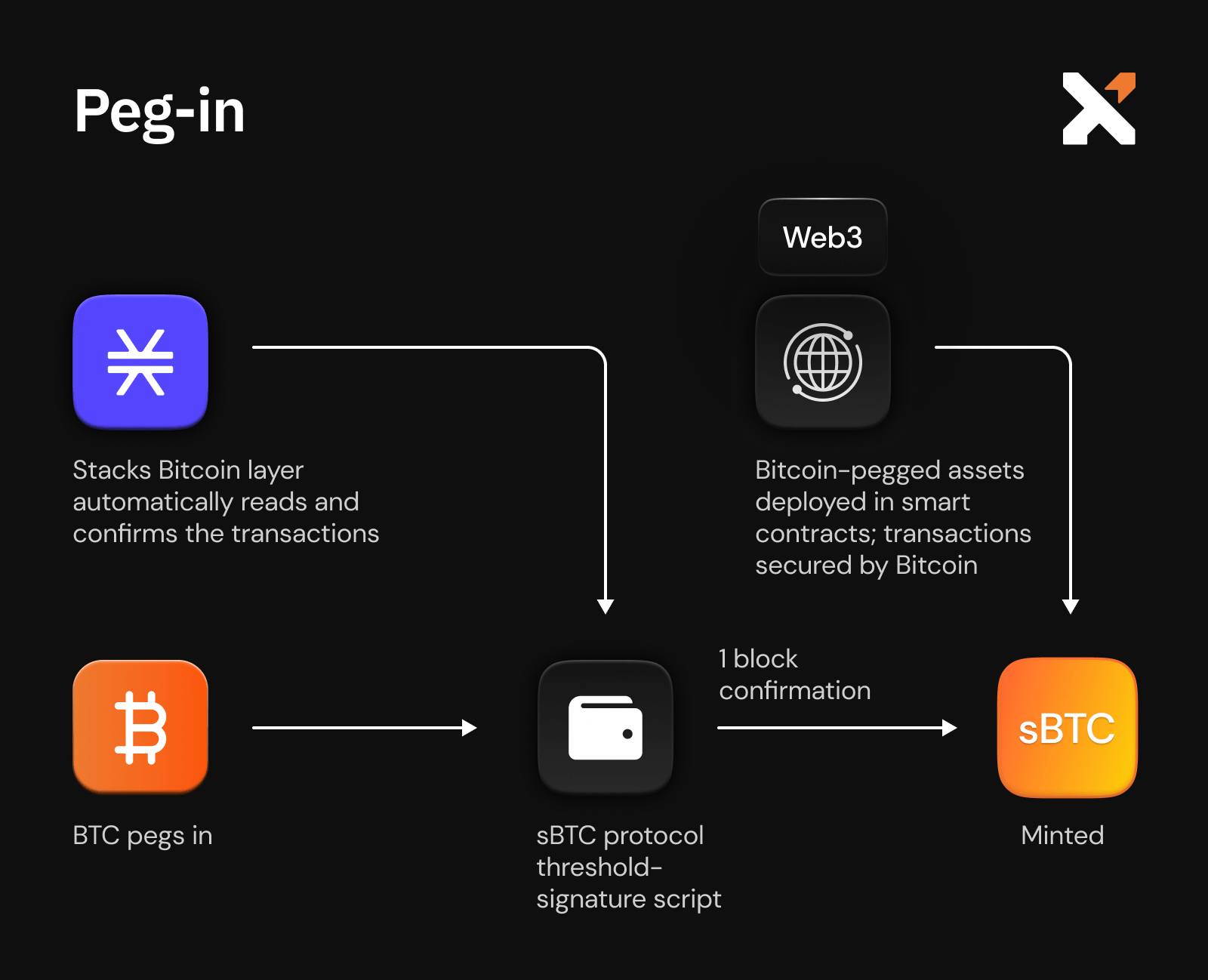

- Mint sBTC: Convert your BTC into sBTC, a Bitcoin-backed asset on Stacks. This move alone earns you a base BTC yield of 40-50 basis points (bps).

- Stack STX for Boosted Yields: Pair your sBTC with STX tokens. The more STX you stack alongside your sBTC, the higher your yield multiplier. For example, pairing 30,000 STX per 1 BTC can unlock a 10-20x boost on your base yield.

- DeFi Integration: Deploy sBTC into whitelisted Stacks DeFi protocols to chase even more aggressive returns.

This model aligns Bitcoin capital with the Stacks network in a single incentive engine. The result? A yield structure that rewards both BTC holders and STX stackers – and it’s all denominated in Bitcoin.

The Mechanics: How sBTC and STX Power Dual Stacking

Stacks’ unique Proof of Transfer (PoX) system lets you earn native BTC rewards by stacking STX. Dual stacking takes this further by letting you:

- Lock BTC as sBTC: Stay liquid while earning a steady stream of BTC rewards.

- Add STX for Multipliers: The ratio of STX to BTC determines your reward tier. Here’s how it breaks down:

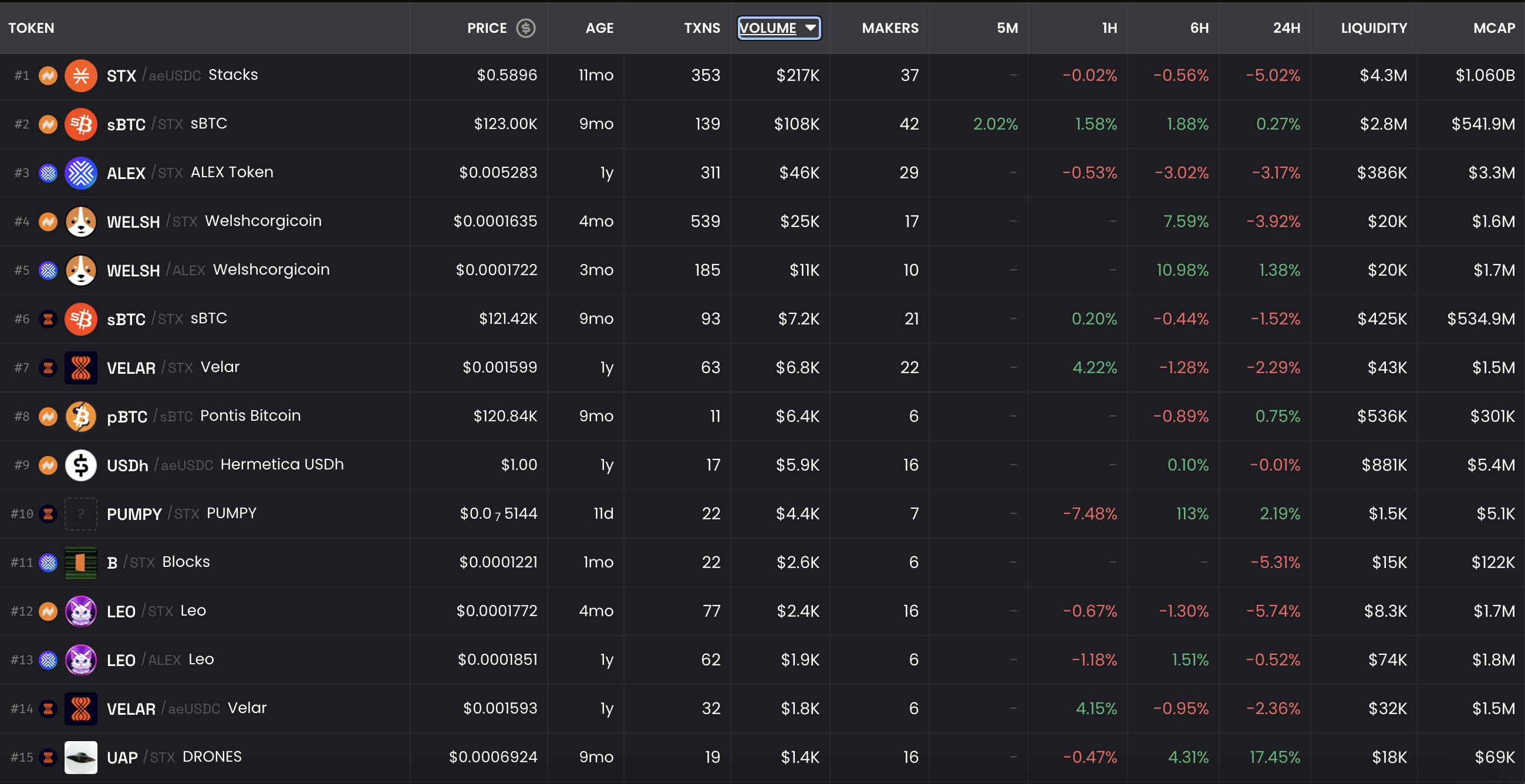

sBTC to STX Ratios and Yield Multipliers in Dual Stacking

| sBTC : STX Ratio | Example STX per 1 BTC | Yield Multiplier | Approximate BTC Yield (bps) |

|---|---|---|---|

| 1 : 0 | 0 | 1x (Base) | 40–50 |

| 1 : 5,000 | 5,000 | 1.5–2x | 60–100 |

| 1 : 15,000 | 15,000 | 3–5x | 120–250 |

| 1 : 30,000 | 30,000 | 10–20x | 400–1,000 |

- Base: 0 STX per 1 BTC = 25-50 bps

- Level 1: 5,000 STX per 1 BTC = 1.5-2x boost

- Level 2: 15,000 STX per 1 BTC = 3-5x boost

- Level 3: 30,000 STX per 1 BTC = 10-20x boost

The upshot: dual stacking lets you optimize for either capital efficiency (by stacking more STX) or liquidity (by keeping more BTC as sBTC). You’re in control of your risk/yield profile.

Step-by-Step: Getting Started with Dual Stacking on Stacks

If you’re ready to move beyond basic HODLing and start stacking real Bitcoin yield, here’s how you do it:

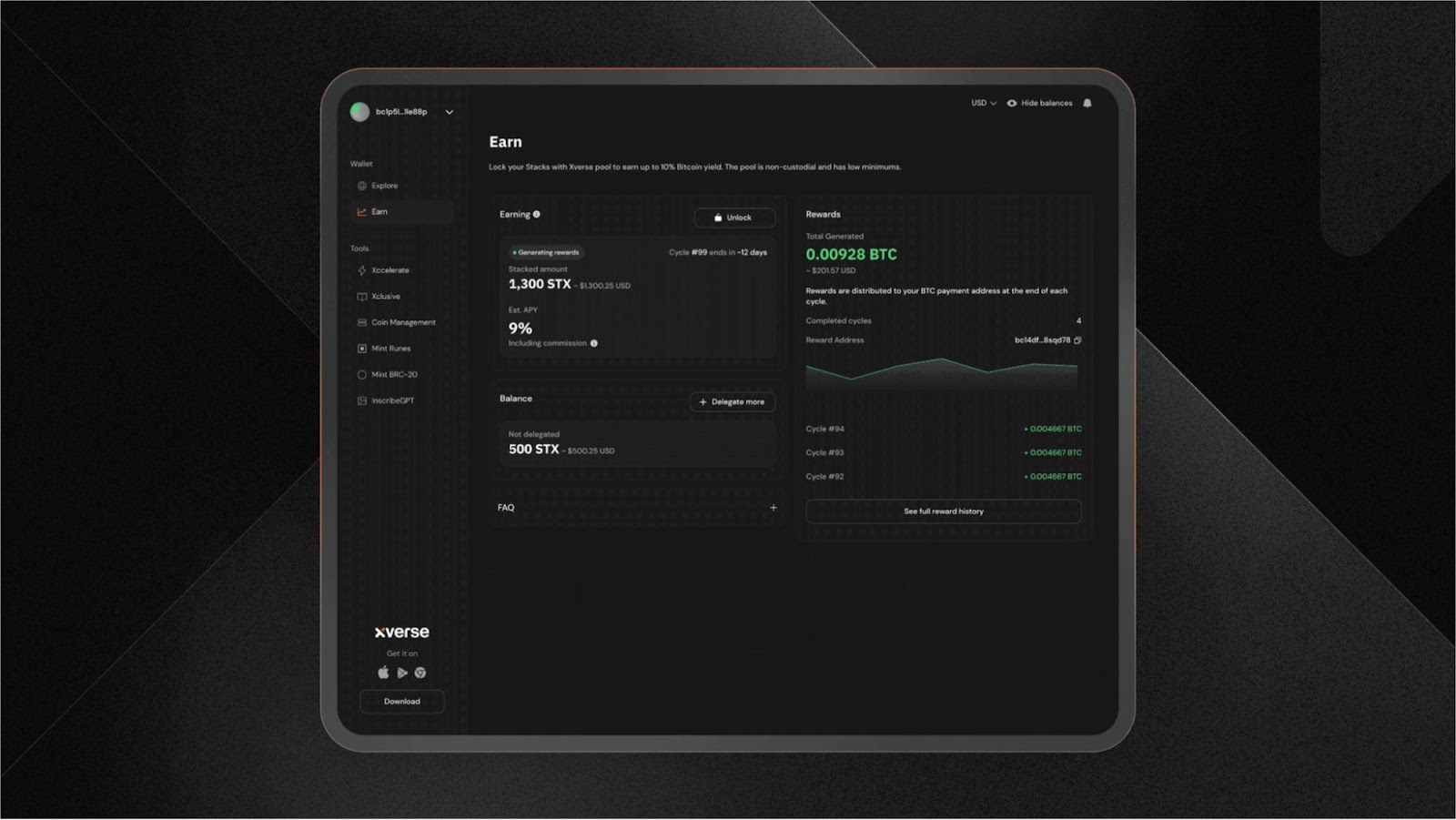

Pro Tip: Use reliable wallets like Hiro or Xverse for seamless management of both STX and sBTC. Monitor your allocations closely – the market doesn’t wait for anyone.

Bitcoin (BTC) Price Prediction 2026-2031 with Dual Stacking Yield Context

Projections based on current dual stacking multipliers, market trends, and adoption of Stacks (STX) yield mechanisms.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $92,000.00 | $119,000.00 | $145,000.00 | +13.7% | Consolidation after 2024-2025 bull cycle; gradual adoption of dual stacking. |

| 2027 | $108,000.00 | $138,000.00 | $175,000.00 | +16.0% | Growing DeFi/dual stacking adoption; regulatory clarity emerges. |

| 2028 | $120,000.00 | $157,000.00 | $205,000.00 | +13.8% | Mainstream integration of sBTC and STX stacking; institutional inflows rise. |

| 2029 | $135,000.00 | $178,000.00 | $235,000.00 | +13.4% | Bitcoin halving impact; increased BTC scarcity and yield innovation. |

| 2030 | $150,000.00 | $198,000.00 | $265,000.00 | +11.2% | Sustained institutional adoption; potential for global regulatory harmonization. |

| 2031 | $170,000.00 | $220,000.00 | $300,000.00 | +11.1% | Stacks and dual stacking become standard yield strategies; BTC as digital reserve asset. |

Price Prediction Summary

Bitcoin’s price is projected to see steady year-over-year growth from 2026 to 2031, with the average price rising from $119,000 in 2026 to $220,000 by 2031. The integration of dual stacking with Stacks (STX) and sBTC is expected to enhance BTC yield opportunities, attracting both individual and institutional adopters. Market cycles, technological advances, and evolving regulations will play crucial roles in driving both the minimum and maximum price ranges for each year.

Key Factors Affecting Bitcoin Price

- Adoption and scaling of dual stacking on Stacks network (yield boosts via STX).

- Bitcoin halving cycles increasing BTC scarcity and yield appeal.

- Institutional adoption of BTC as a yield-bearing asset through sBTC and DeFi.

- Global regulatory developments affecting crypto markets and DeFi protocols.

- Competition from other L2s and yield platforms (e.g., Ethereum, Solana).

- Macro-economic trends (inflation, interest rates, fiat instability).

- User participation in sBTC and STX stacking, increasing lockup and decreasing circulating supply.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Dual Stacking Is a Game Changer for Liquid Staking Tokens

The dual stacking model isn’t just about higher numbers – it’s about aligning incentives across the entire Stacks ecosystem. By combining the security of Bitcoin with the flexibility of liquid staking tokens (LSTs), you’re not just chasing yield – you’re reinforcing the network’s long-term growth.

What’s especially powerful about sBTC STX dual stacking is the way it opens up new territory for both institutional and retail players. With Bitcoin at $104,737.00, the risk-reward calculus is shifting. Why just watch your BTC sit idle when you can deploy it for stacked, compounding rewards? The Stacks network’s architecture means you can rotate between stacking cycles, adjust your STX-to-sBTC ratios, and even tap DeFi protocols for further optimization, all while keeping your underlying BTC liquid and accessible.

Yield stacking isn’t just theoretical. Real-world users are already capturing boosted returns, and the data backs it up. By leveraging the latest Stacks economic model, you can see how dual stacking is designed for sustainability, not just hype cycles. The protocol’s reward tiers mean you can dial up your risk or play it conservative, depending on your market outlook and portfolio objectives.

Maximize Bitcoin DeFi Yield: Dual Stacking in Action

Here’s where things get tactical. If you’re a yield stacker, you want to extract every basis point possible, without sacrificing liquidity. Dual stacking lets you do exactly that. You can:

Top Advantages of Dual Stacking for BTC & DeFi Investors

-

1. Enhanced Bitcoin Yields: Dual Stacking enables you to earn BTC-denominated rewards by minting sBTC and stacking STX, with potential yield boosts of up to 10–20x compared to base rates. This means your Bitcoin works harder for you, even during market downturns.

-

2. Flexible Capital Deployment: You can mint sBTC and deploy it into whitelisted DeFi protocols on the Stacks network, unlocking additional earning strategies and compounding returns without leaving the Bitcoin ecosystem.

-

3. STX Multiplier for Maximum Rewards: By stacking STX tokens alongside your sBTC, you access a tiered multiplier system—the more STX you stack, the higher your BTC yield. For example, stacking 30,000 STX per 1 BTC can deliver up to 20x the base yield.

-

4. Direct Bitcoin Rewards, Not Synthetic Tokens: Unlike many DeFi protocols that pay out in platform tokens, Dual Stacking delivers real BTC rewards to your wallet—no need to worry about token inflation or liquidity issues.

-

5. Strengthened Network Security and Alignment: By participating in Dual Stacking, you contribute to the security and decentralization of the Stacks network, aligning incentives between Bitcoin and Stacks holders for long-term ecosystem growth.

- Stay Liquid: sBTC means your BTC isn’t locked away forever, you can exit when you need to.

- Stack Yields: Layer STX to multiply your base BTC rewards. The more STX per BTC, the higher the multiplier.

- Access DeFi: Deploy your sBTC in approved Stacks DeFi protocols for even more aggressive returns.

- Manage Risk: Adjust your allocations between STX and sBTC to suit your risk appetite and market conditions.

It’s this flexibility that makes dual stacking a standout in the liquid staking tokens Stacks ecosystem. Whether you’re a long-term BTC holder or an active DeFi strategist, there’s a path to optimize your yield without giving up control.

Real-World Impact: Who’s Using Dual Stacking?

Institutions are taking notice, with funds like Sypher’s Bitcoin Yield Fund tapping into dual stacking to unlock new revenue streams for their clients. Retail users, meanwhile, are stacking STX to turbocharge their sBTC positions, effectively multiplying their passive BTC income. This trend is only accelerating as more DeFi protocols integrate sBTC and STX into their platforms.

And with the upcoming launch of two-way pegged sBTC, capital efficiency and composability will only improve. That means more options, more liquidity, and more ways to maximize Bitcoin DeFi yield, without giving up the security or ethos of native BTC.

Your Next Move: Ride the Dual Stacking Wave

If you want to stay ahead of the curve in this market, dual stacking is no longer optional, it’s essential. With Bitcoin holding above $100,000 and the Stacks network rolling out new features, there’s never been a better time to put your capital to work. Don’t just HODL, stack smart, stack aggressive, and let your BTC do more than just sit in cold storage.