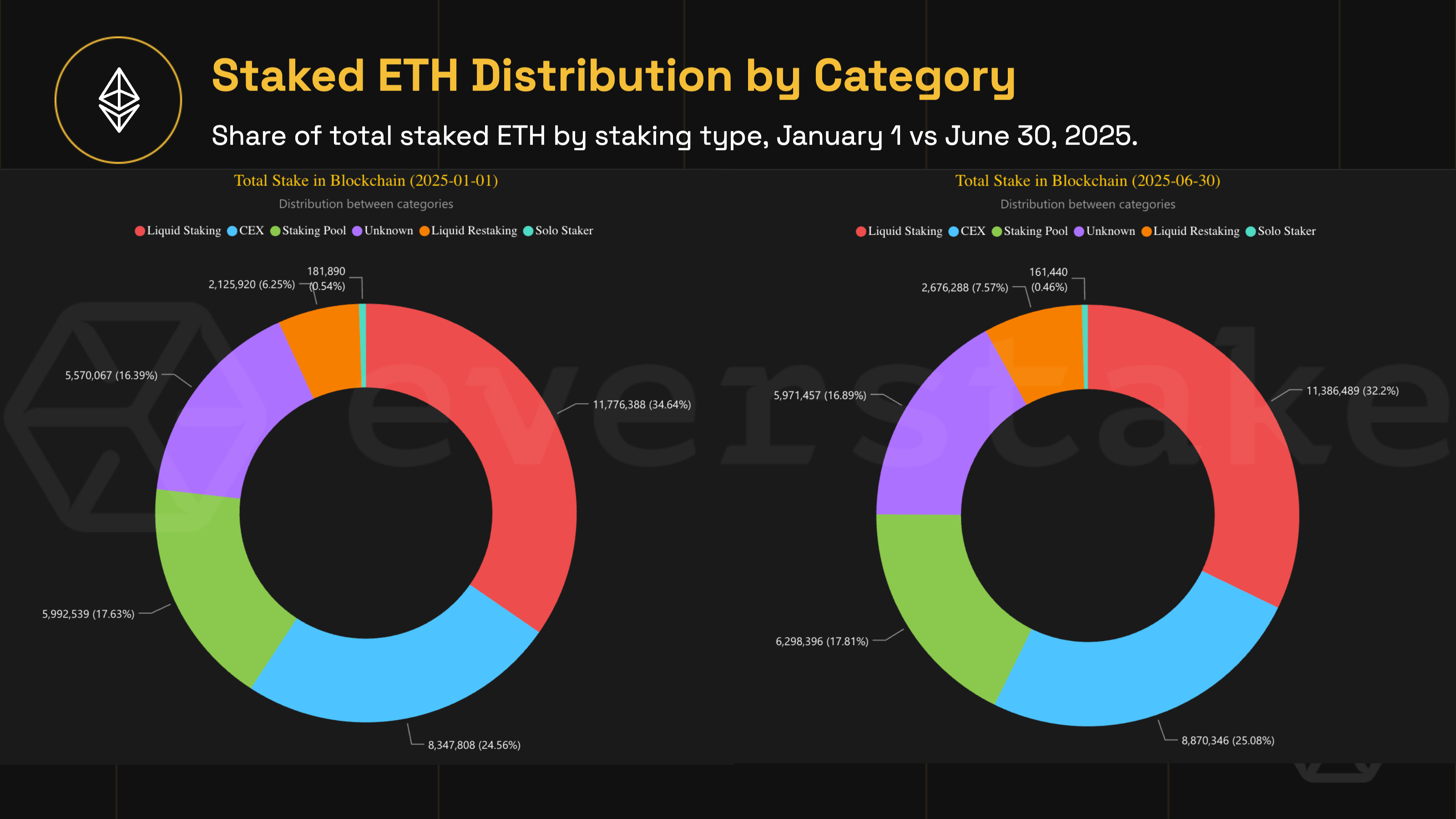

Ethereum staking has become a cornerstone of DeFi yield strategies, but in 2024, the landscape is rapidly evolving. With Ethereum (ETH) trading at $3,934.01 as of October 25,2025, and the liquid staking ecosystem more sophisticated than ever, maximizing your ETH staking yields requires a nuanced approach. Liquid Staking Tokens (LSTs) are at the heart of this transformation, enabling users to earn rewards without sacrificing liquidity or exposure to further yield opportunities.

Why Liquid Staking Tokens Dominate ETH Yield Strategies in 2024

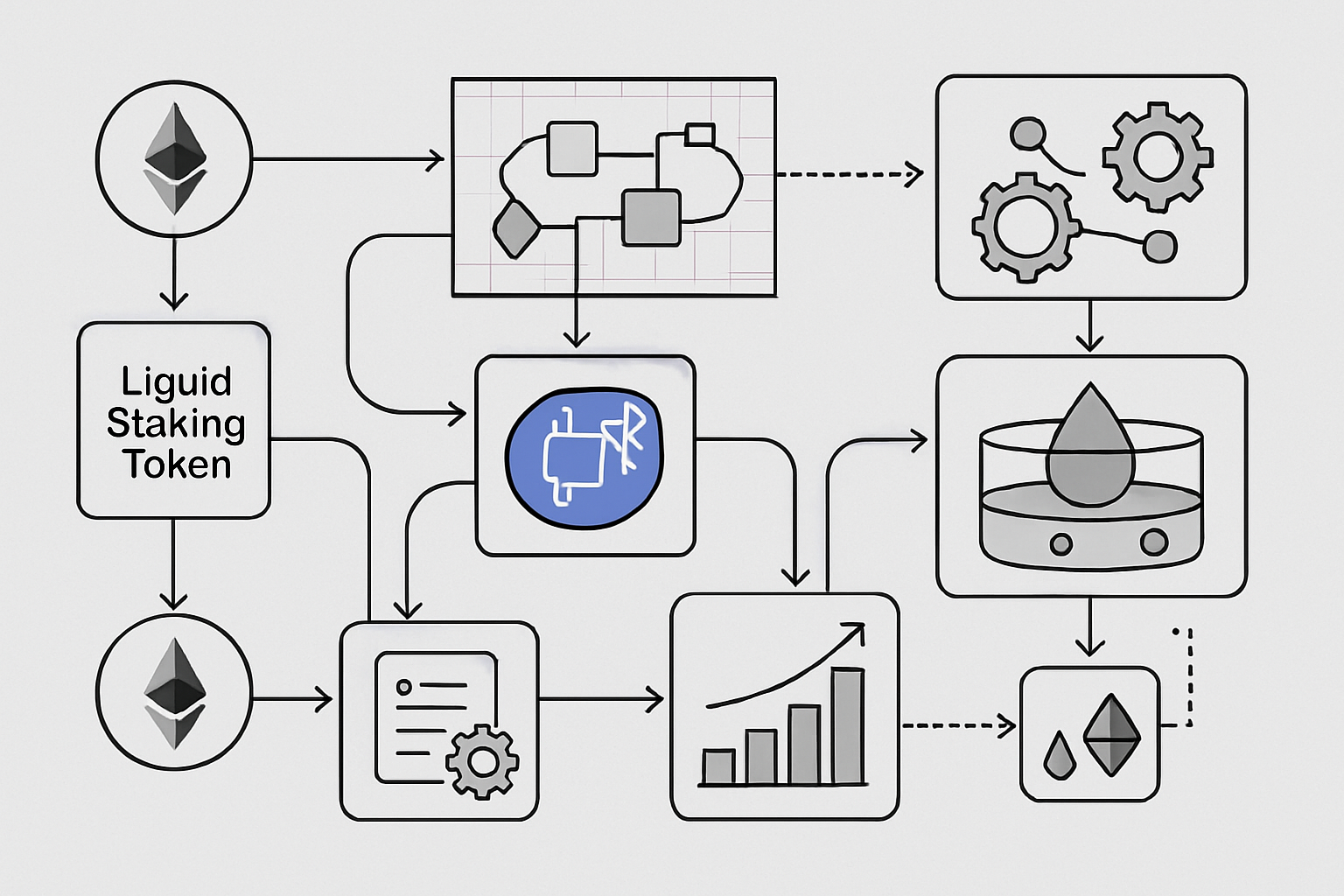

Traditional ETH staking locks your assets, limiting flexibility and access to DeFi’s broader opportunities. LSTs like wstETH, rETH, and cbETH offer a compelling alternative: when you stake ETH through leading protocols such as Lido or Rocket Pool, you receive tokenized representations of your staked assets. These LSTs accrue staking rewards and can be freely traded or deployed across DeFi platforms.

This dual utility – earning base staking rewards while maintaining liquidity – is why LSTs have become the default for anyone seeking to maximize APY with liquid staking. In fact, top protocols now offer APRs above 6%, with innovative restaking options pushing yields even higher.

The Current State of ETH Staking Yields: Key Platforms and APRs

To optimize returns, it’s crucial to select platforms with competitive yields and robust security. As of late October 2025:

- Lido Finance: Offers an APR of approximately 6.2% via stETH, which can be used across dozens of DeFi applications.

- Mantle: Delivers an industry-leading APR of 6.37% through mETH within its native ecosystem.

- Ether. fi and Renzo: Push the frontier further by enabling restaking via eETH and ezETH respectively; these tokens accrue both standard validator rewards and extra incentives from EigenLayer or AVS integrations.

The result? Savvy investors are layering these opportunities to stack yields far beyond traditional solo staking’s typical returns.

Tactical Approaches: Restaking and Yield Layering with LSTs

The most effective strategies in today’s market involve more than just holding LSTs. Here’s how sophisticated users are extracting maximum value from their staked ETH:

- Select High-Yield Platforms: Compare current APRs on platforms like Lido (6.2%) versus Mantle (6.37%) before committing capital.

- Diversify Across Protocols: Allocate holdings among multiple providers to mitigate smart contract and slashing risks while accessing unique reward structures.

- Pursue Restaking Opportunities: Use Ether. fi or Renzo to convert LSTs into restaked tokens (e. g. , eETH or ezETH), unlocking dual reward streams from both Ethereum consensus and Actively Validated Services (AVSs).

- Deploy in DeFi Applications: Supply LSTs as collateral on lending markets like Aave or MakerDAO for additional interest income; participate in yield farming pools for protocol incentives and trading fees.

Ethereum (ETH) Price Prediction 2026-2031

Professional 6-Year Outlook Based on Liquid Staking Trends, DeFi Expansion, and Market Fundamentals (as of October 2025, ETH Price: $3,934.01)

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,400 | $4,150 | $5,200 | +5.5% | Consolidation after recent rally; yield-driven demand supports price floor |

| 2027 | $3,700 | $4,800 | $6,400 | +15.7% | DeFi/LST adoption accelerates; regulatory clarity improves institutional flows |

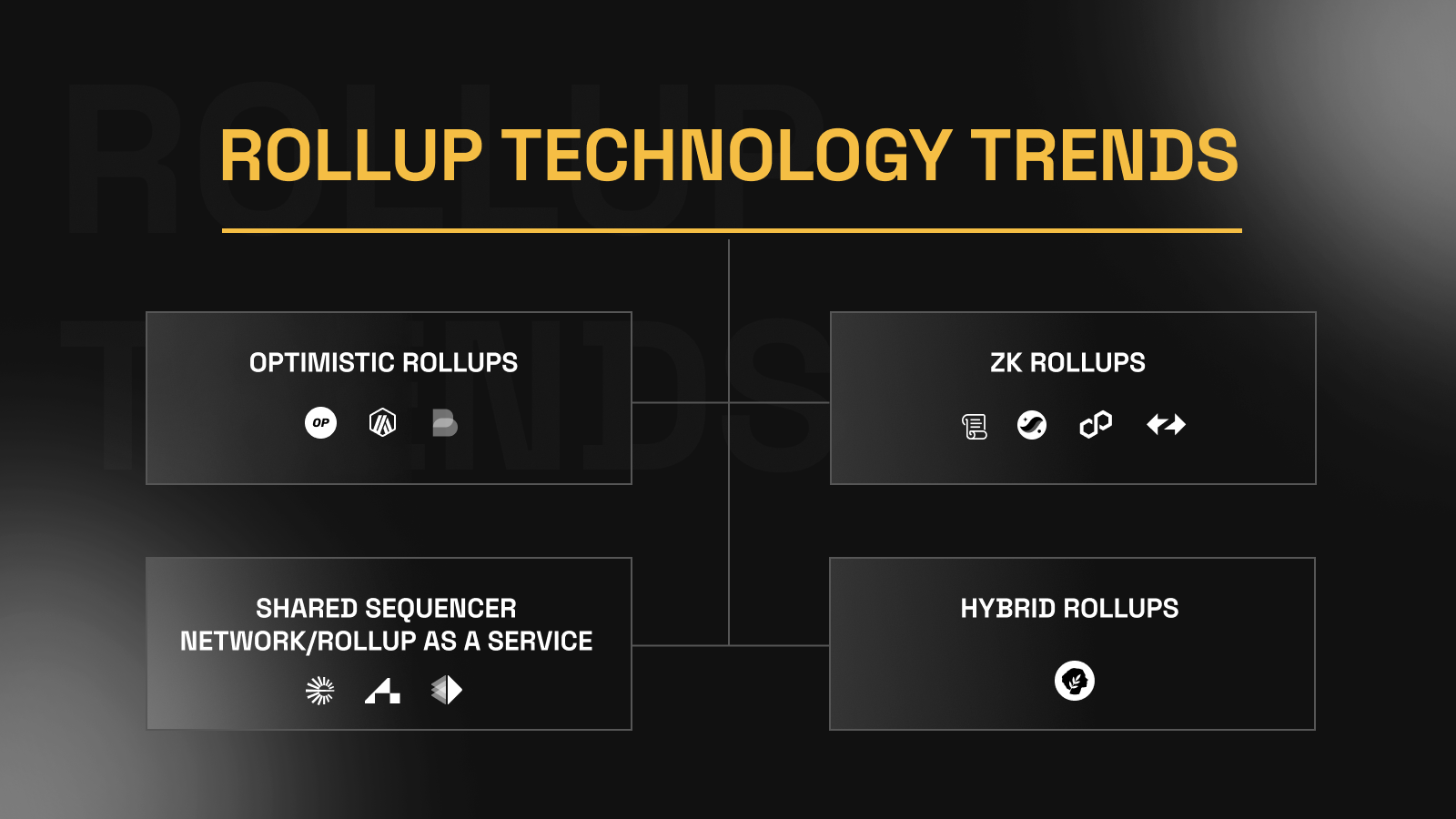

| 2028 | $4,100 | $5,550 | $7,800 | +15.6% | Ethereum 2.0 upgrades & rollup adoption enhance scalability, attracting new use cases |

| 2029 | $4,400 | $6,250 | $9,200 | +12.6% | Layer 2 and restaking protocols mature; ETH becomes core DeFi collateral |

| 2030 | $4,700 | $6,900 | $10,800 | +10.4% | Interoperability and real-world assets expand ETH’s addressable market |

| 2031 | $5,000 | $7,500 | $12,500 | +8.7% | Mainstream adoption, potential ETF approvals, and global DeFi integration |

Price Prediction Summary

Ethereum’s price outlook over the next six years remains positive, underpinned by the rapid expansion of liquid staking tokens (LSTs), continued DeFi innovation, and Ethereum’s central role as a settlement and yield-generating platform. While volatility and regulatory risk persist, the increasing institutional interest, scalability upgrades, and growth in staking yields are likely to drive both adoption and price appreciation. The minimum and maximum ranges account for potential bearish and bullish scenarios, including macroeconomic shifts, tech disruptions, or regulatory headwinds.

Key Factors Affecting Ethereum Price

- Adoption and innovation in liquid staking and restaking protocols (LSTs, LRTs)

- Ethereum network upgrades (e.g., further scalability, rollups, sharding)

- Expansion and integration of DeFi use cases, including RWAs and institutional staking

- Global regulatory developments (US, EU, Asia) impacting staking and DeFi

- Competition from alternative smart contract platforms (Solana, Avalanche, etc.)

- Macroeconomic environment (interest rates, risk appetite, global liquidity)

- Potential for spot ETH ETF approvals and broader mainstream adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This multi-layered approach is at the core of modern Ethereum LST yield optimization. By continuously monitoring protocol updates and market rates, you can dynamically shift allocations for optimal results.

Risk management remains paramount as you pursue higher yields. While liquid staking tokens introduce new opportunities, they also bring protocol-specific risks such as smart contract vulnerabilities, depegging events, and fluctuating APRs. Diversification across platforms and regular monitoring of protocol health are essential practices for anyone seeking to maximize APY with liquid staking.

Mitigating Risks and Managing Volatility

Given Ethereum’s price at $3,934.01 and the dynamic nature of DeFi protocols, volatility can impact both the value of your staked assets and the rewards accrued. Here are practical steps to safeguard your yield stacking strategy:

Top Risk Management Tips for ETH Liquid Staking in 2024

-

Diversify Across Multiple Liquid Staking PlatformsReduce exposure to platform-specific risks by distributing your ETH among reputable liquid staking protocols such as Lido (stETH), Rocket Pool (rETH), and Coinbase (cbETH). Diversification helps protect your assets if one provider faces technical or security issues.

-

Monitor Smart Contract SecurityOnly stake with platforms that have undergone independent security audits and maintain transparent bug bounty programs. Review audit reports for platforms like Lido, Rocket Pool, and Mantle before depositing your ETH.

-

Stay Informed on Protocol Updates and GovernanceRegularly follow official announcements and governance proposals from your chosen staking platforms. Changes in protocol rules, fees, or reward structures can directly impact your yields and risk exposure.

-

Understand and Manage Depeg RisksLiquid staking tokens (LSTs) like stETH or rETH may temporarily deviate from ETH’s price. Monitor market liquidity and price parity, especially during volatile periods, to avoid losses from depegging events.

-

Use Reputable DeFi Platforms When Leveraging LSTsIf deploying LSTs in DeFi protocols (e.g., as collateral on Aave or MakerDAO), ensure these platforms are well-established and have strong security track records. This minimizes the risk of smart contract exploits affecting your staked assets.

-

Regularly Review Platform Yields and FeesYield rates and fees can change frequently. Compare current APRs—such as Lido’s 6.2% or Mantle’s 6.37%—and factor in all associated costs to optimize net returns and avoid hidden losses.

-

Secure Your Wallets and Private KeysUse hardware wallets or other secure storage solutions for your ETH and LSTs. Never share your private keys, and enable multi-factor authentication where possible to prevent unauthorized access.

Smart contract audits are non-negotiable: always verify that your chosen LST provider has undergone recent, reputable security reviews. Monitor LST-ETH peg ratios on platforms like Curve or Balancer to spot early signs of depegging. And remember, reward rates can shift quickly, set up alerts or use analytics dashboards to stay ahead of changes that could affect your returns.

Advanced Yield Stacking: Beyond the Basics

For those ready to push the envelope on ETH staking yields 2024, consider integrating advanced strategies:

- Liquidity Provision: Provide LSTs (such as stETH or rETH) to decentralized exchanges to earn trading fees in addition to staking rewards.

- Leverage: Use LSTs as collateral to borrow stablecoins or ETH, then re-stake or deploy in other yield-generating protocols. This amplifies returns but also compounds risk, exercise caution and monitor liquidation thresholds closely.

- Restaking Aggregators: Platforms are emerging that automate restaking and yield optimization across multiple protocols, reducing manual intervention while maximizing returns. Explore these tools for a streamlined approach to liquid staking DeFi.

Staying Ahead in the Evolving LST Ecosystem

The competitive edge in liquid staking token strategies comes from continuous learning and adaptation. Engage with communities on Discord and Twitter, track protocol governance proposals, and leverage analytics tools to compare real-time APRs and risk profiles. The landscape is evolving rapidly, those who stay informed will be best positioned to capture outsized returns.

Ultimately, the key to maximizing ETH staking yields in 2024 is a disciplined approach: layer your strategies, manage risks proactively, and be ready to pivot as market dynamics shift. With Ethereum’s price holding at $3,934.01, every percentage point in yield is meaningful, especially when compounded through restaking and DeFi integrations.