Ethereum’s transition to proof-of-stake has made staking accessible, but the real revolution for yield seekers is the rise of liquid staking tokens (LSTs). With Ethereum (ETH) trading at $3,322.23 as of November 7,2025, maximizing ETH yields is more competitive than ever. Liquid staking unlocks a new dimension: you can earn base staking rewards while simultaneously putting your staked ETH to work across DeFi protocols for additional returns. Here’s how top stakers are turning modest ETH yields into double-digit returns through LSTs and advanced DeFi strategies.

Liquid Staking Tokens: The Gateway to Yield Multiplication

Traditionally, staking ETH required a minimum of 32 ETH and a dedicated validator node, locking up capital with limited flexibility. Liquid staking protocols like Lido Finance (stETH), Rocket Pool (rETH), and Ether. fi (eETH) have changed the game. Now, when you stake ETH through these platforms, you receive an LST that represents your claim on staked assets plus accrued rewards. Crucially, these tokens remain liquid – tradable or usable in DeFi – so your capital is never idle.

This liquidity means you’re not just earning the protocol’s base rate (currently around 3-5% APY). You can deploy your LSTs into DeFi opportunities such as:

- Providing liquidity on DEXes: Pairing stETH or rETH with ETH or stablecoins on Uniswap or Curve earns trading fees and sometimes extra incentives.

- Lending and yield farming: Supply your LSTs to lending markets like Aave or Compound to collect interest plus potential governance token rewards.

- Leveraged restaking: Use products like Index Coop’s icETH to amplify your exposure and compound returns – though this comes with added risk.

The composability of LSTs means you can stack these strategies for complex, higher-yielding positions. For a deeper dive into yield stacking with liquid staking tokens, see our guide on how yield stacking with liquid staking tokens maximizes DeFi returns.

Selecting the Right Liquid Staking Protocol for Optimal Returns

Your choice of liquid staking platform impacts both security and earning potential. Let’s break down the top contenders:

- Lido Finance (stETH): The largest by market share, widely integrated in DeFi; offers high liquidity but some centralization concerns.

- Rocket Pool (rETH): Focuses on decentralization; yields are competitive but integrations are slightly narrower than stETH.

- Ether. fi (eETH): Supports native restaking for extra composability; gaining traction among advanced users seeking maximum flexibility.

When comparing protocols, consider:

- Yield rates: Are they competitive after fees?

- LST liquidity: Can you easily trade or deploy your token in major DeFi apps?

- Security audits and decentralization: How robust is the protocol against smart contract risk?

The right choice depends on your priorities: maximum integration (Lido), decentralization (Rocket Pool), or advanced composability (Ether. fi). For up-to-date comparisons of protocol yields and risks, check our resource on maximizing ETH yield with liquid staking tokens in DeFi platforms.

Ethereum (ETH) Price Prediction & LST Yield Scenarios (2026-2031)

Projected ETH price ranges factoring in DeFi, liquid staking trends, regulatory outlook, and technological adoption. Based on current price ($3,322.23) as of Nov 2025.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $2,700 | $3,800 | $5,200 | +14.4% | ETH consolidates; LST adoption grows, new DeFi integrations |

| 2027 | $3,000 | $4,600 | $6,800 | +21.0% | DeFi expansion, ETH scaling upgrades, moderate regulation |

| 2028 | $3,500 | $5,800 | $8,900 | +26.1% | Wider LST use, ETH as DeFi collateral, institutional inflows |

| 2029 | $4,200 | $7,200 | $11,200 | +24.1% | Mainstream LST adoption, ETH ETF launches, global clarity |

| 2030 | $5,000 | $8,900 | $14,500 | +23.6% | ETH 2.0 maturity, cross-chain DeFi, robust staking yields |

| 2031 | $5,800 | $10,200 | $18,000 | +14.6% | ETH as global DeFi backbone, mass institutional adoption |

Price Prediction Summary

Ethereum’s price outlook remains bullish over the next six years, driven by the growing adoption of liquid staking tokens (LSTs), integration with DeFi protocols, and increasing institutional participation. While minimum price scenarios reflect potential bear markets or regulatory headwinds, the average and maximum projections anticipate continued network upgrades, mainstream DeFi use, and robust staking yields. By 2031, ETH could reach an average of $10,200, with bullish scenarios seeing prices up to $18,000 if DeFi and LSTs become fully mainstream.

Key Factors Affecting Ethereum Price

- Adoption and integration of liquid staking tokens (LSTs) across DeFi platforms

- Ethereum network upgrades and scaling solutions (e.g., sharding, rollups)

- Regulatory developments affecting DeFi and staking

- Institutional entry and ETH-based financial products (ETFs, structured products)

- Market cycles, Bitcoin halving effects, and macroeconomic trends

- Security and resilience of DeFi protocols and smart contracts

- Competition from alternative L1 and L2 blockchains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

LST Deployment Strategies Across DeFi Protocols

Earning doesn’t stop at holding an LST. The most successful stakers actively deploy their tokens across decentralized finance to multiply their income streams. Here are three core strategies:

- Add to Liquidity Pools: Deposit stETH/ETH or rETH/USDC pairs into DEXes like Curve or Uniswap V3. This earns trading fees plus possible bonus incentives from platform governance tokens.

- Lend Your LSTs: Platforms such as Aave now accept stETH as collateral. By lending out your tokenized stake, you capture interest payments while maintaining exposure to both principal and rewards.

- Pursue Leveraged Yield: Advanced users loop their positions using tools like Gearbox Protocol or Index Coop’s icETH index. Here, you borrow against deposited LSTs to buy more ETH/LST – compounding returns but also increasing liquidation risk if prices drop below thresholds like the current $3,322.23 level.

The beauty of these approaches lies in their flexibility: you can combine them for tailored risk-reward profiles that suit your outlook and appetite for volatility.

Risk management is the linchpin of any successful yield optimization strategy. While the allure of double-digit returns is real, it’s critical to weigh each move against smart contract vulnerabilities, market volatility, and protocol-specific risks. For instance, providing liquidity with LSTs can expose you to impermanent loss if ETH’s price (currently $3,322.23) fluctuates sharply relative to your paired asset. Leveraged strategies, meanwhile, amplify both gains and losses, if ETH dips below certain thresholds, liquidation events can quickly erode your capital.

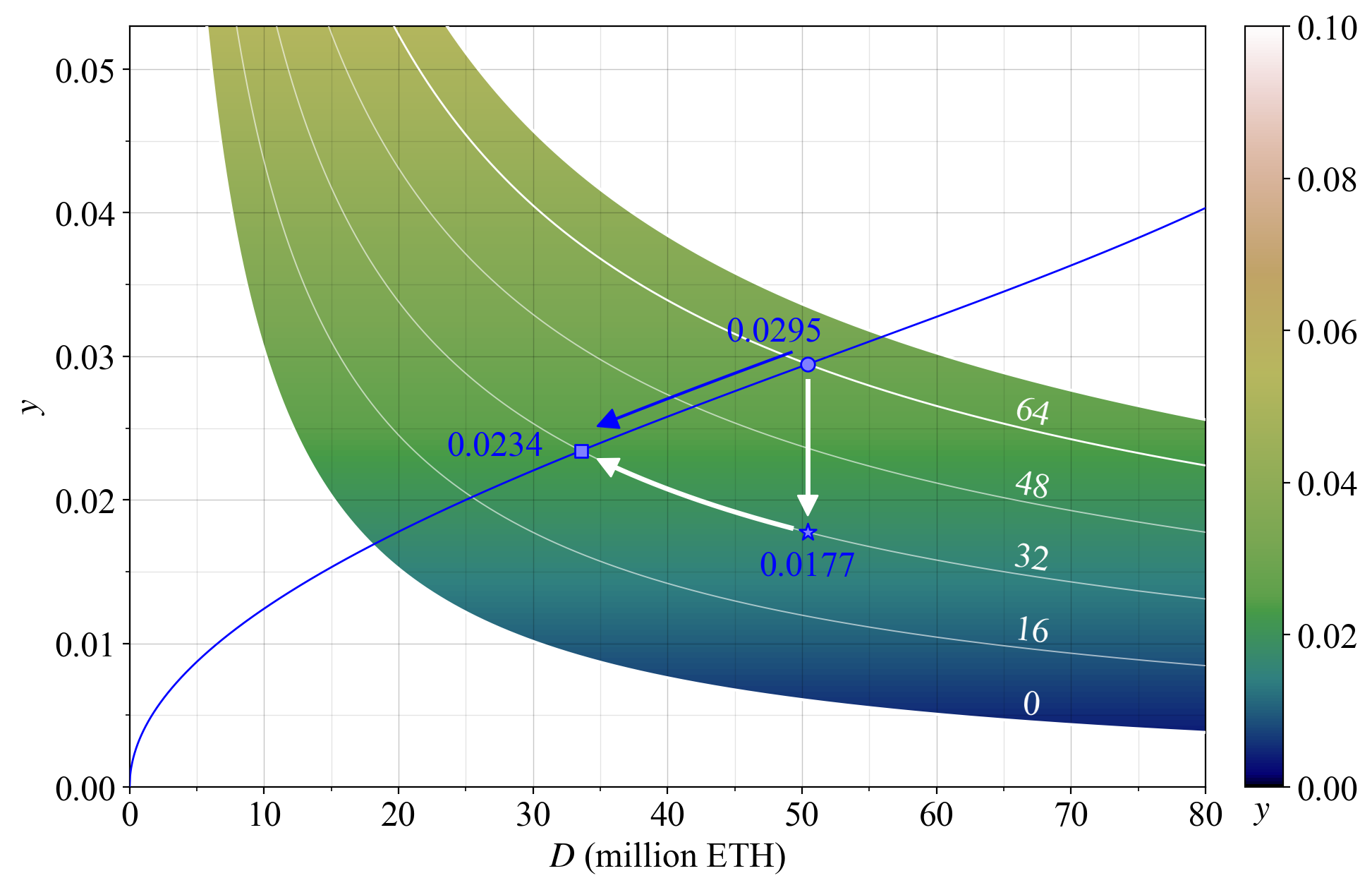

Real-World Examples: Turning 3% into 16% and

Let’s look at how top stakers are stacking yields in today’s market:

- Base staking APY: Start with a 3-5% yield by staking ETH on Lido or Rocket Pool.

- Liquidity mining: Deploy stETH/ETH or rETH/USDC in Curve pools for an extra 2-6% APY from trading fees and incentives.

- Lending and borrowing: Supply your LSTs on Aave or Morpho, a further 1-3% APY plus governance token rewards.

- Leverage loop: Use icETH or Gearbox to borrow against your staked position and restake, compounding yields up to the mid-teens, but with much higher risk.

This multi-layered approach can turn a modest single-digit yield into double digits. However, always assess the incremental risk at each step, especially as you introduce leverage or less battle-tested protocols into your stack.

Best Practices for Sustainable Yield Stacking

- Diversify platforms: Don’t put all your ETH in one protocol; spread risk across multiple LST providers and DeFi apps.

- Monitor health factors: If using leverage, track collateral ratios closely, set alerts for price moves near $3,322.23 so you’re not caught off guard by liquidations.

- Stay updated on integrations: New DeFi protocols frequently add support for LSTs; capitalize on early incentives but verify security first.

The most sophisticated stakers treat their portfolio like a dynamic system, adjusting positions as yields shift and new opportunities arise. For more nuanced strategies on stacking yields without lockups, see our deep dive on how liquid staking maximizes crypto yield without lockups.

Frequently Asked Questions About Liquid Staking Tokens

The landscape of Ethereum liquid staking is evolving rapidly. With the right mix of research, risk management, and active deployment of LSTs across DeFi protocols, it’s possible to achieve sustainable high yields while maintaining exposure to the growth of Ethereum itself. As always in DeFi: start small, iterate often, and let data, not emotion, drive your decisions.