Liquid staking tokens (LSTs) have fundamentally altered the capital dynamics of decentralized finance (DeFi). By allowing users to stake assets such as Ethereum (ETH) and receive liquid derivatives like stETH or rETH, LSTs effectively eliminate the traditional tradeoff between yield and liquidity. This innovation is not just about convenience; it’s a catalyst for advanced, multi-layered yield strategies that are now defining the cutting edge of DeFi in 2025.

LSTs: The Engine of Capital Efficiency in DeFi

Traditional staking has always presented a dilemma: lock your assets for network rewards or retain liquidity for other opportunities? LSTs resolve this by issuing a derivative token that represents your staked position. These tokens remain liquid and composable across the DeFi ecosystem, enabling strategies that were previously impossible without sacrificing staking rewards.

For example, with stETH, users continue to earn Ethereum staking rewards while simultaneously deploying their stETH into liquidity pools, lending protocols, or even using it as collateral for further leverage. This unlocks a new dimension of capital efficiency in DeFi, allowing users to stack yields across multiple protocols without ever fully exiting their original staking position.

Leverage Staking: Amplifying Returns (and Risks)

One of the most potent applications of LSTs is leverage staking. Here’s how it works: you deposit your LST as collateral on a lending platform, borrow additional assets, and restake those to mint more LSTs. This recursive loop can dramatically amplify your effective staking exposure and total rewards. However, leverage always introduces heightened risk, if the value of your LST drops or borrowing rates spike, you face potential liquidation events that can quickly erode gains.

The ability to use LSTs as composable building blocks is fueling a wave of sophisticated strategies. For an in-depth breakdown on using liquid staking tokens as collateral in lending protocols, see our dedicated guide.

LST Yield Farming and Liquidity Provision: Double-Dipping Rewards

LSTs shine brightest when integrated with yield farming and liquidity provision. By depositing your stETH or rETH into popular DEX pools, such as Curve’s stETH-ETH, you not only earn trading fees but also retain ongoing staking rewards. This dual-income approach is sometimes called “double-dipping, ” and it’s rapidly becoming a core pillar of modern yield stacking.

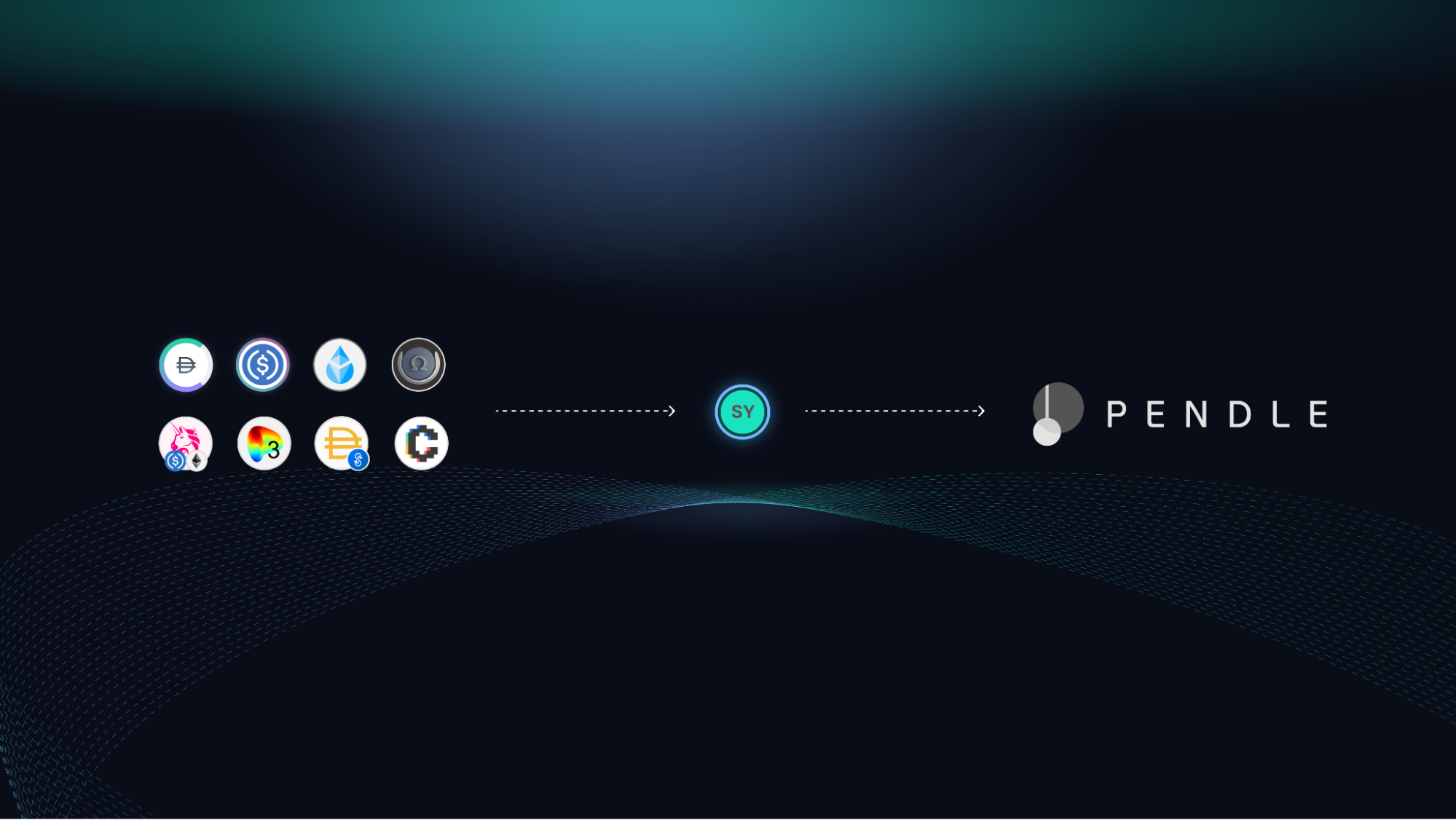

This composability extends even further with platforms like Pendle Finance, which tokenize future yields from LSTs into separate principal and yield tokens. Users can then speculate on future yield rates or lock in fixed returns, a level of flexibility that simply doesn’t exist with traditional staking models.

The Restaking Revolution: Layering Yields with EigenLayer

The emergence of restaking protocols like EigenLayer marks another leap forward. Here, users can commit their existing LSTs to secure additional decentralized services beyond Ethereum itself, think oracle networks or data availability layers, and earn extra layers of rewards. While this approach offers some of the highest yields in today’s market, it comes with added complexity and slashing risks if the underlying service misbehaves.

Diversification and Active Management: Navigating Complexity

The proliferation of LST-based strategies means risk management is more critical than ever. Diversifying across multiple liquid staking providers (e. g. , both stETH and rETH) and actively monitoring interest rates, peg stability, and market conditions are essential practices for sustainable returns. As capital efficiency increases, so does systemic risk, making ongoing portfolio rebalancing an indispensable skill for serious DeFi participants.

If you’re looking to optimize returns while maintaining robust risk controls, explore our comprehensive insights on yield stacking in liquid staking.

Smart DeFi participants are increasingly leveraging LST DeFi strategies to extract maximum value from every staked token. Yet, as the sophistication of these strategies grows, so does the need for precise, data-driven management. The interplay between liquidity in staking and advanced yield stacking means that even small shifts in market conditions or protocol incentives can have outsized effects on returns, and risks.

Top Liquid Staking Platforms for Yield Stacking

-

Lido Finance: The leading liquid staking protocol for Ethereum, Lido issues stETH to users who stake ETH. stETH can be used across DeFi for lending, liquidity provision, and yield farming, making Lido a cornerstone for advanced yield strategies.

-

Rocket Pool: A decentralized Ethereum liquid staking protocol, Rocket Pool allows users to stake ETH and receive rETH. rETH maintains liquidity and can be deployed in DeFi protocols, supporting both individual stakers and node operators.

-

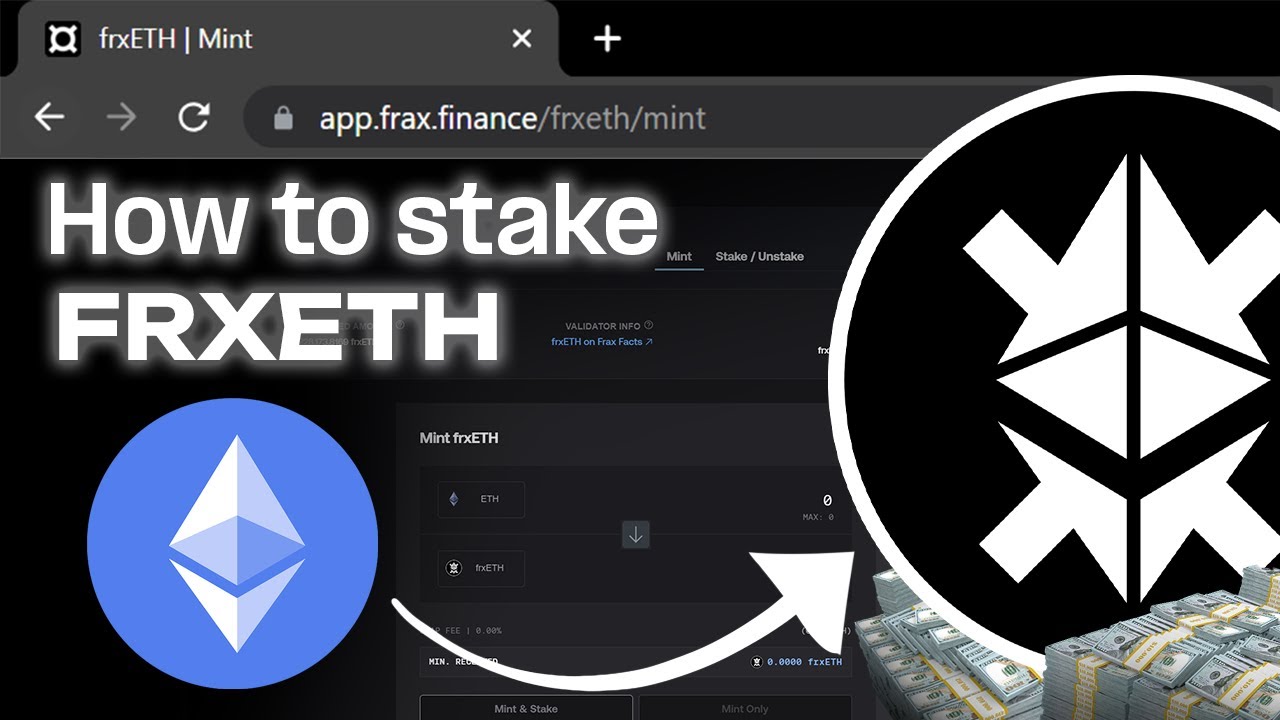

Frax Ether (frxETH/sfrxETH): Frax Finance offers a dual-token liquid staking system for Ethereum. frxETH represents liquid staked ETH, while sfrxETH accrues staking rewards. Both tokens are widely integrated in DeFi for yield stacking strategies.

-

EigenLayer: A pioneering restaking protocol, EigenLayer enables users to restake LSTs like stETH and rETH to secure additional decentralized services, unlocking layered yield opportunities and advanced risk management.

-

Pendle Finance: Specializing in yield tokenization, Pendle allows users to deposit LSTs (e.g., stETH, rETH, sfrxETH) and split them into Principal Tokens (PTs) and Yield Tokens (YTs). This enables fixed-rate yield strategies and speculation on future returns.

-

Curve Finance: As a major decentralized exchange, Curve offers deep liquidity pools for LSTs such as stETH-ETH and rETH-ETH. Providing liquidity in these pools lets users earn trading fees and staking rewards simultaneously, optimizing capital efficiency.

-

Aave: A leading DeFi lending platform, Aave supports LSTs like stETH as collateral. Users can borrow assets against their LSTs, enabling leverage staking and recursive yield strategies while maintaining exposure to staking rewards.

One of the key differentiators with liquid staking tokens is their composability. LSTs can be integrated into an ever-expanding suite of DeFi primitives, lending, automated market makers, synthetic assets, and structured products. This modularity is what enables users to build custom risk-return profiles tailored to their goals. For instance, pairing LSTs with algorithmic stablecoins or using them in cross-chain bridges opens new frontiers for capital mobility and risk hedging.

Risks and Best Practices: Mitigating Downside in Yield Stacking

While the promise of stacked yields is compelling, it’s critical to understand the risks unique to this ecosystem:

- Peg Volatility: LSTs like stETH or rETH aren’t always perfectly pegged to their underlying asset. Depegging events can create losses when exiting positions or providing liquidity.

- Protocol Risk: Smart contract vulnerabilities or governance failures in either the liquid staking protocol or integrated DeFi platforms can lead to partial or total loss of funds.

- Slashing Risk: Especially relevant in restaking scenarios where validator misbehavior can result in loss of staked capital.

- Liquidity Risk: In periods of market stress, even popular LST pools can see spreads widen or redemptions delayed.

The most resilient LST farmers diversify across multiple protocols, maintain healthy collateralization ratios when leveraging, and monitor protocol updates closely. For those new to the space, starting with single-protocol strategies before layering on complexity is prudent. Our guide on maximizing yield stacking with LSTs offers a step-by-step approach for both beginners and advanced users.

“Numbers don’t lie, let’s decode them. ”

The Future: LSTs as Core Collateral in DeFi’s Next Wave

The trajectory is clear: as more protocols adopt liquid staking tokens as core collateral, whether for lending markets, derivatives, or on-chain treasuries, the boundaries between staking and DeFi will continue to blur. We’re already seeing DAO treasuries and institutional desks allocate to LSTs not just for passive income but as foundational liquidity instruments underpinning complex strategies.

This evolution will likely accelerate as new primitives emerge: think modular restaking frameworks, cross-chain yield routers, and permissionless structured products built directly atop LST collateral stacks. The endgame? A hyper-efficient capital layer where every staked asset is perpetually productive, earning base rewards while cycling through a latticework of secondary yield opportunities.

Key Takeaways for Yield Stackers

- LSTs unlock true capital efficiency by letting you earn staking rewards while keeping assets liquid.

- Advanced strategies, leverage loops, restaking, yield farming, can multiply returns but require vigilant risk management.

- Diversification across protocols and active monitoring are essential as systemic risks grow alongside opportunity.

- The next wave of DeFi innovation will be built atop LST collateral, don’t get left behind.

If you’re ready to explore double-yield loops or want tactical walkthroughs on how liquid staking tokens enable effortless yield stacking across platforms, check out our deep dives at this resource and this platform guide.