In decentralized finance (DeFi), the transition from Liquidity Provider (LP) tokens to Liquid Staking Tokens (LSTs) is rapidly redefining yield optimization and liquidity management. This evolution is driven by a need to minimize impermanent loss, unlock capital efficiency, and stack multiple layers of yield. As protocols like $OLIVAI and S/STC experiment with these strategies, the broader DeFi community is watching closely. Let’s break down how LP to LST strategies work, their advantages, and what makes them a compelling choice for forward-thinking yield stackers.

Why Move from LP Tokens to LSTs?

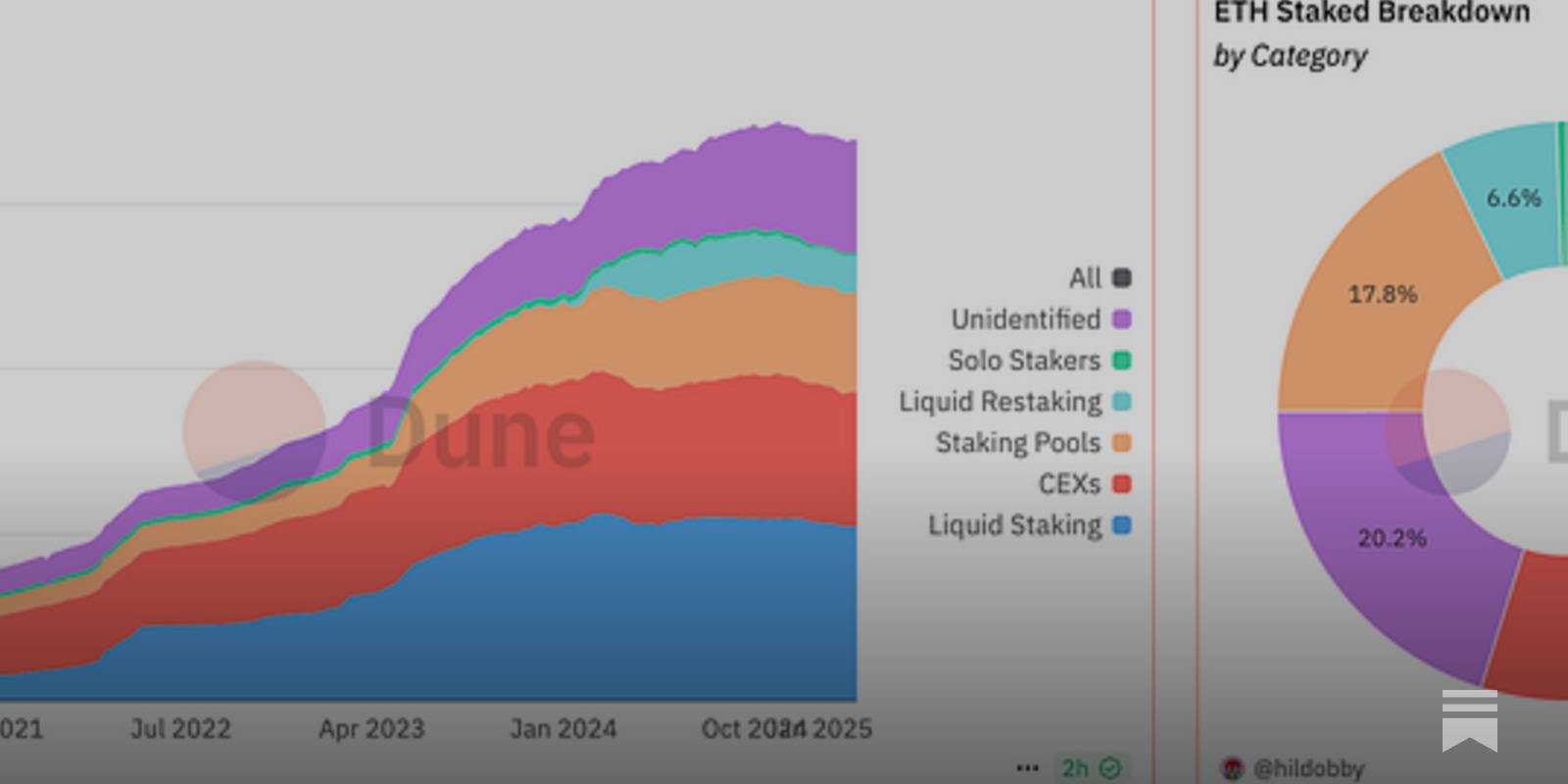

LP tokens represent shares in a decentralized exchange’s liquidity pool. They generate trading fee revenue but are exposed to impermanent loss if asset prices diverge. In contrast, LSTs are minted when users stake assets (e. g. , ETH) with liquid staking protocols. These tokens accrue staking rewards while remaining liquid, enabling holders to participate in additional DeFi opportunities without locking up their principal.

- LP Token Risks: Impermanent loss can erode gains, especially during volatile markets. Your initial deposit ratio may shift unfavorably as prices move.

- LST Advantages: LSTs maintain exposure to staking rewards while allowing composability across lending, borrowing, and further liquidity provision.

This dynamic enables a new class of strategies where capital isn’t just parked, it’s actively optimized for higher returns across multiple DeFi layers.

How the LP→LST Strategy Works

The core idea behind the LP to LST strategy is simple: swap your position as a liquidity provider for one as a staker who retains liquidity through tokenization. Here’s how it typically unfolds:

Key Steps to Convert LP Tokens Into LST Yield Strategies

-

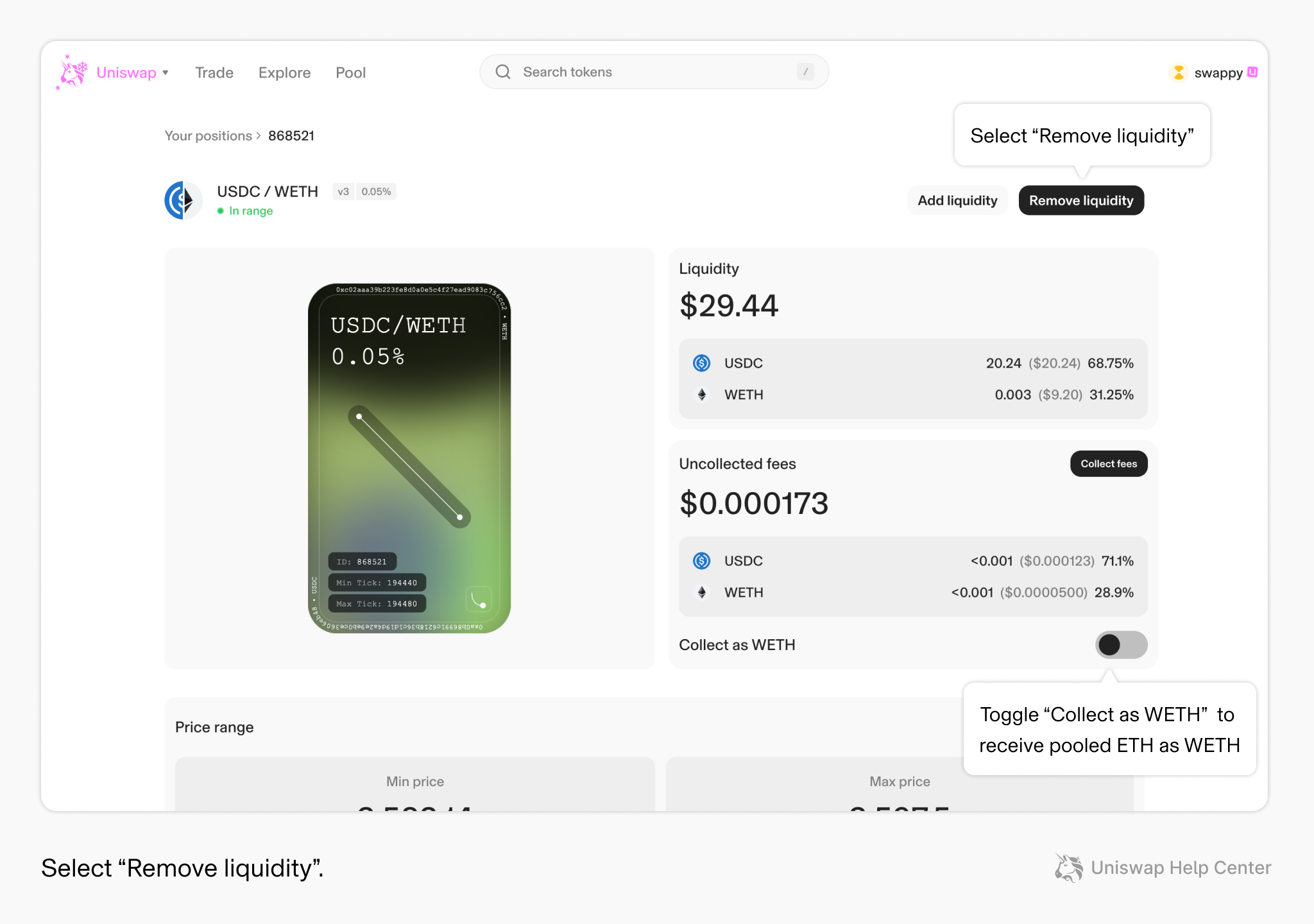

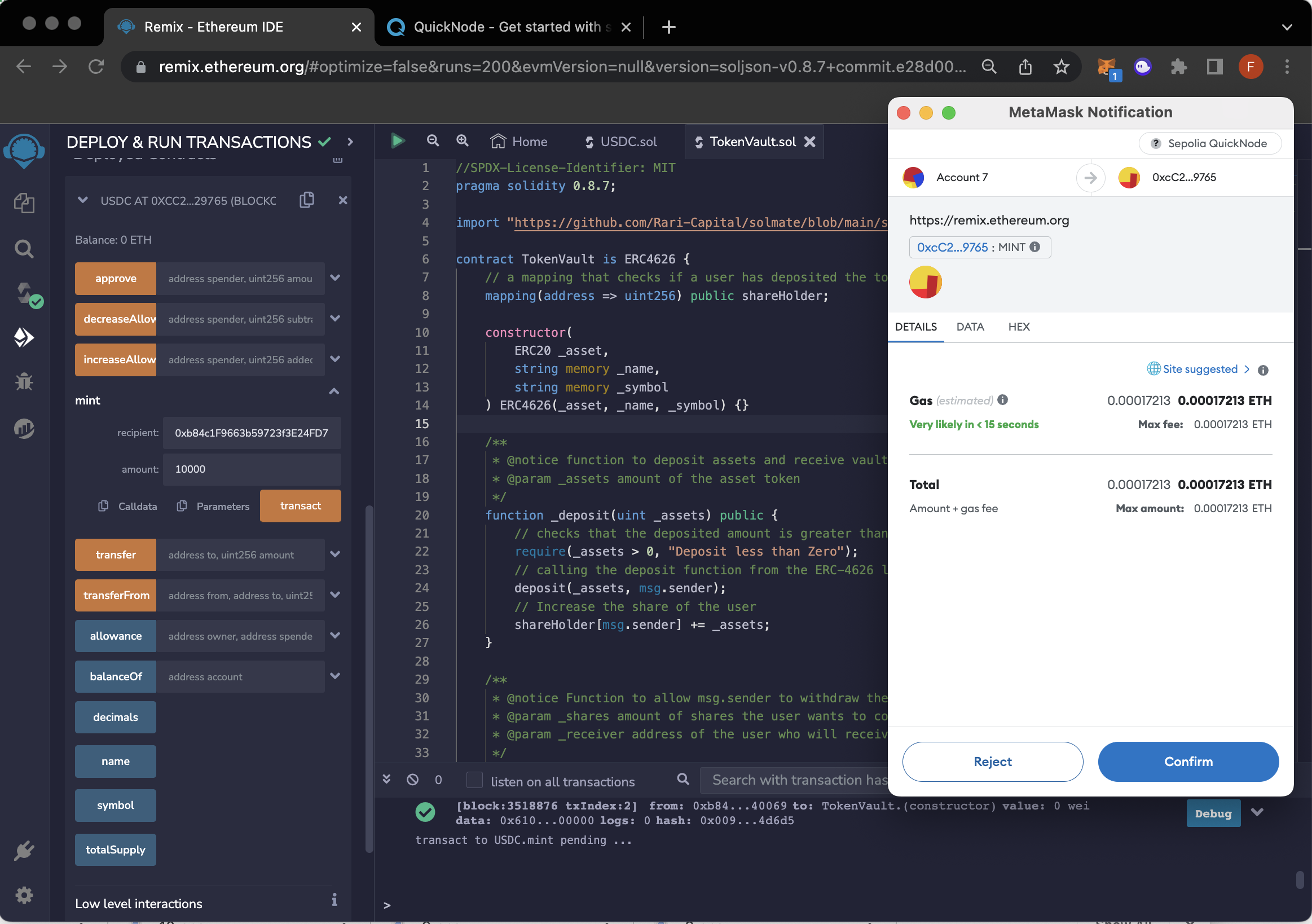

Withdraw Assets from Liquidity Pools: Redeem your LP tokens (e.g., from Uniswap or Curve) to reclaim the underlying assets, such as ETH or stablecoins. This step is essential to unlock your capital from the initial liquidity pool and prepare it for staking.

-

Stake Assets via a Liquid Staking Protocol: Deposit your assets into a reputable liquid staking platform like Lido, Rocket Pool, or Ankr. In return, you receive Liquid Staking Tokens (LSTs) such as stETH or rETH, which accrue staking rewards while remaining liquid.

-

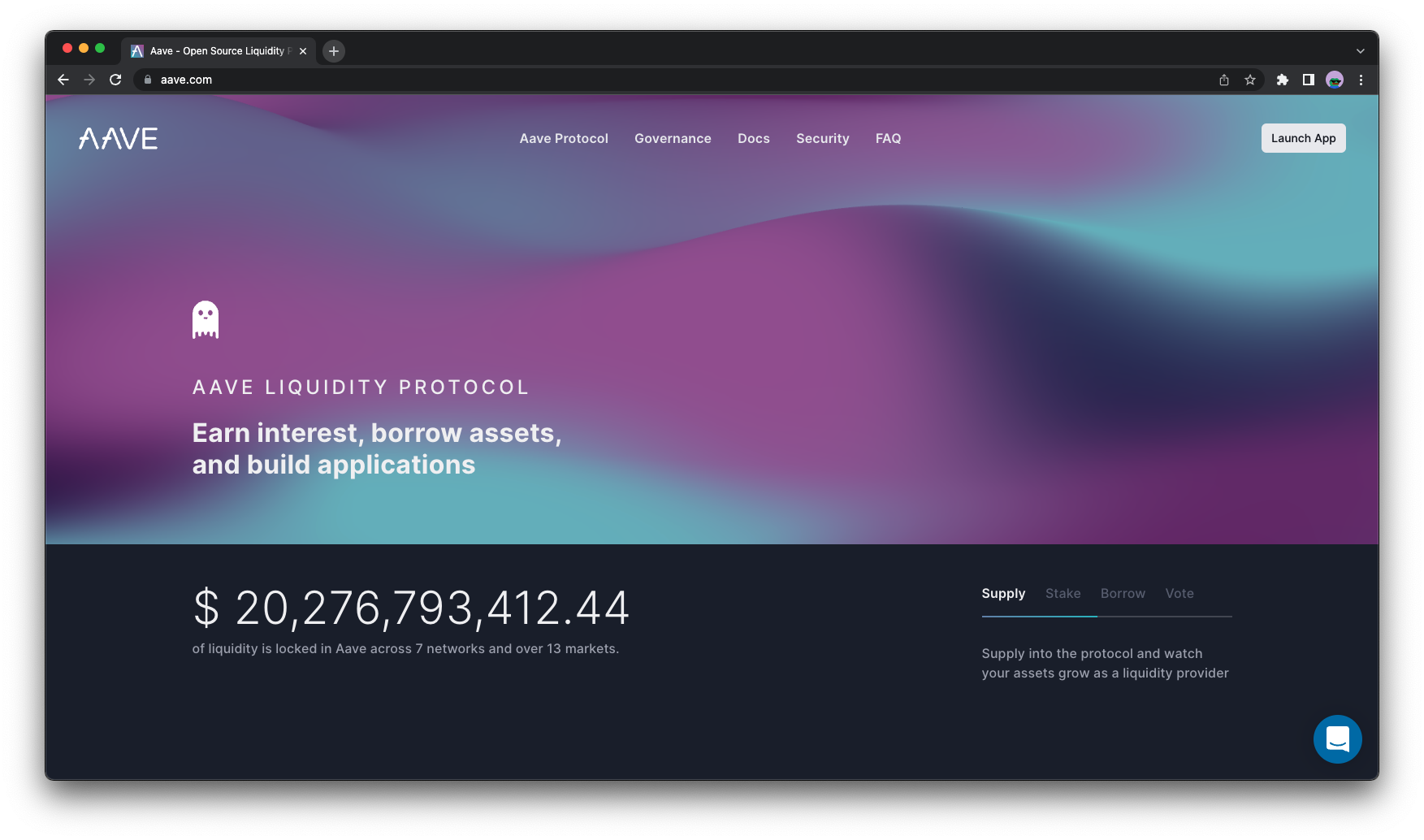

Deploy LSTs in DeFi Lending Platforms: Supply your LSTs to established lending protocols like Aave or Compound. Earn additional interest or use LSTs as collateral to borrow other assets, leveraging your staked position for extra yield.

-

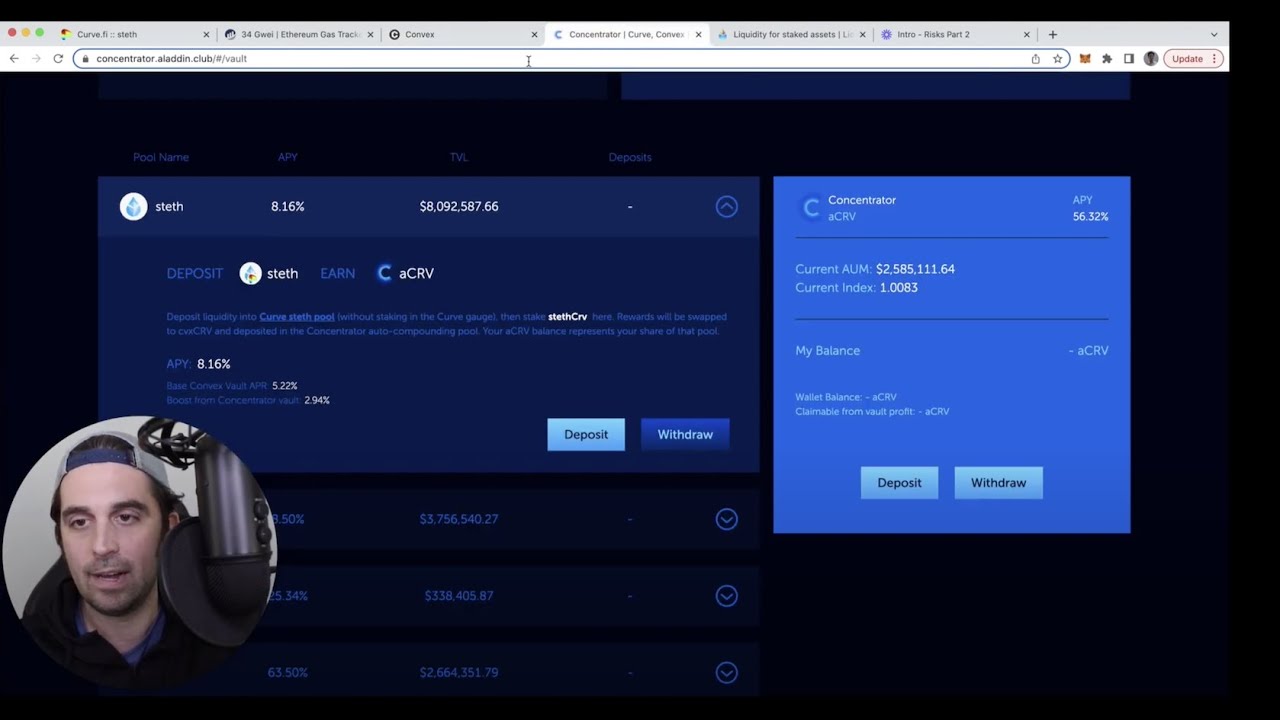

Provide LST Liquidity on Decentralized Exchanges: Add your LSTs to liquidity pools on major DEXs such as Uniswap, Balancer, or Curve. This enables you to earn trading fees and, in some cases, protocol incentives on top of staking rewards.

-

Engage in Yield Farming with LSTs: Stake your LSTs in yield farming protocols or aggregator platforms like Yearn Finance or Beefy Finance. This can provide additional governance tokens or incentive rewards, compounding your overall yield.

The process can be summarized as follows:

- Exit LP Position: Withdraw assets from the DEX pool and redeem your LP tokens.

- Stake Assets via a Liquid Staking Protocol: Deposit assets like ETH or SOL into platforms such as Lido or Sanctum to mint corresponding LSTs (e. g. , stETH or compassSOL).

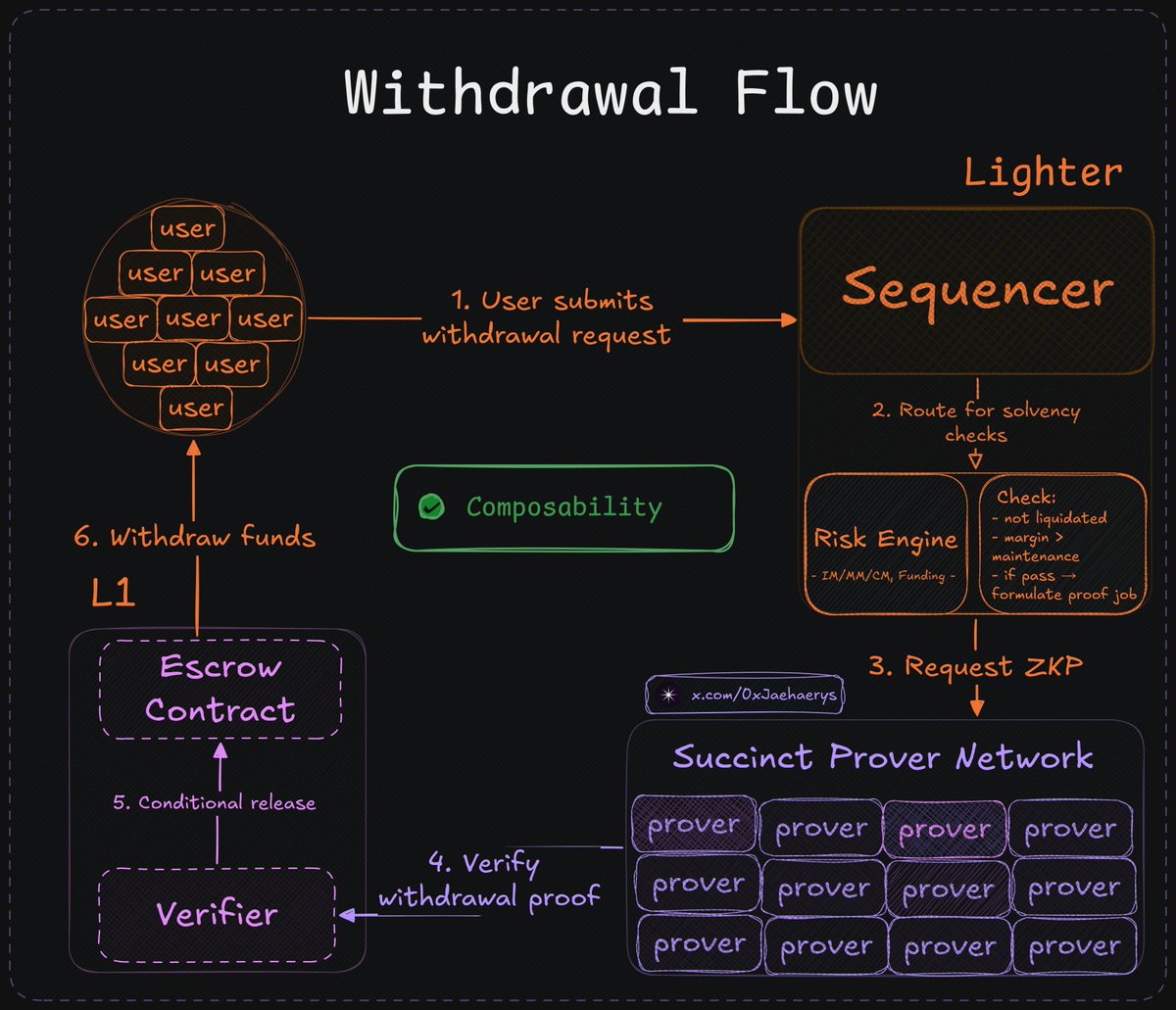

- Deploy LSTs Across DeFi: Use these liquid staking tokens as collateral on lending platforms like Aave or Compound (source). Alternatively, provide them as liquidity on DEXes or enter specialized yield farms that accept LSTs (source).

This composability is key: users can loop their capital through various protocols, staking for base rewards, lending for interest, farming for incentives, without being trapped by unbonding periods typical of vanilla staking.

$OLIVAI and S/STC: Yield Optimization in Action

The $OLIVAI and S/STC protocols exemplify this new paradigm by enabling users to migrate from traditional LP positions into innovative LST-based strategies. While granular details remain scarce at this stage, early data shows that such migrations can lead to higher net yields and reduced risk exposure compared to static LP holding.

[price_widget: Real-time price display for $OLIVAI and S/STC]

This approach aligns with recent research highlighting how liquid staking unlocks flexibility and opens new earning frontiers in DeFi (source). For active traders and yield farmers, the ability to redeploy staked capital across lending markets or stablecoin pools means more opportunities for compounding returns, without sacrificing access or liquidity.

Crucially, the LP to LST strategy isn’t just about chasing higher APYs. It’s a deliberate play for risk-adjusted yield. By sidestepping impermanent loss and tapping into stacking rewards, users can build positions that are both more resilient and more productive. The flexibility of LSTs enables dynamic portfolio rebalancing as market conditions change, an edge for those who monitor DeFi trends closely.

Key Benefits and Considerations for Yield Stackers

Adopting an LP to LST approach brings several tangible benefits, but it’s not without its challenges. Here’s what sophisticated DeFi participants should weigh before deploying capital:

Pros and Cons of Switching from LP Tokens to LSTs in DeFi

-

Enhanced Yield Opportunities: LSTs, such as stETH (Lido), rETH (Rocket Pool), and ankrBNB (Ankr), accrue staking rewards and can be deployed in DeFi protocols for additional yield, compounding returns beyond standard LP token fees.

-

Improved Liquidity: Unlike traditional staking, LSTs remain liquid and tradable, enabling users to participate in lending (e.g., Aave, Compound), yield farming, or collateralized borrowing without unbonding delays.

-

Reduced Impermanent Loss Risk: LP tokens are exposed to impermanent loss due to price divergence between pooled assets. LSTs, representing a single staked asset, largely avoid this risk, offering more predictable returns.

-

Composability with DeFi Protocols: Major LSTs are widely accepted across DeFi platforms, allowing users to stack strategies—such as using stETH as collateral on Aave or providing liquidity on Curve—to optimize capital efficiency.

-

Smart Contract and Protocol Risks: LSTs depend on the security of both the staking protocol (e.g., Lido, Rocket Pool) and any DeFi platforms they are used in, increasing exposure to potential bugs or exploits.

-

Market Volatility and Depeg Risk: LSTs can trade below their underlying asset value (e.g., stETH depegging from ETH during market stress), introducing additional risk compared to holding LP tokens.

-

Complexity and Gas Costs: Managing LST strategies often involves multiple transactions across protocols, leading to higher gas fees and increased operational complexity compared to simply holding LP tokens.

- Yield Layering: Earn staking rewards plus additional incentives from lending, farming, or liquidity provision.

- Capital Efficiency: Keep assets liquid while earning, enabling quick pivots as new opportunities arise.

- Diversification: Spread risk across protocols and strategies by leveraging the composability of LSTs.

- Smart Contract Risk: Exposure increases as you interact with multiple protocols; always audit platforms and stay informed on security practices.

- Market Volatility: While impermanent loss is reduced, price swings can still impact the value of underlying staked assets or borrowed collateral.

LSTs: Gateway to Advanced Yield Stacking

The rise of liquid staking tokens has catalyzed a new wave of DeFi innovation. Protocols like $OLIVAI and S/STC are at the forefront, demonstrating how composable yield strategies can outpace traditional LP returns over time. These approaches aren’t limited to Ethereum, ecosystems like Solana (compassSOL) and others are rapidly integrating similar mechanics (source). As more protocols support LST collateralization, expect even greater capital mobility and creative stacking opportunities.

The bottom line: moving from LP token exposure to an active LST-driven approach is increasingly favored by advanced yield seekers. In a landscape where liquidity is king and stacking yield sources is essential, these strategies offer a robust path forward, provided users remain vigilant about protocol risk and market shifts.