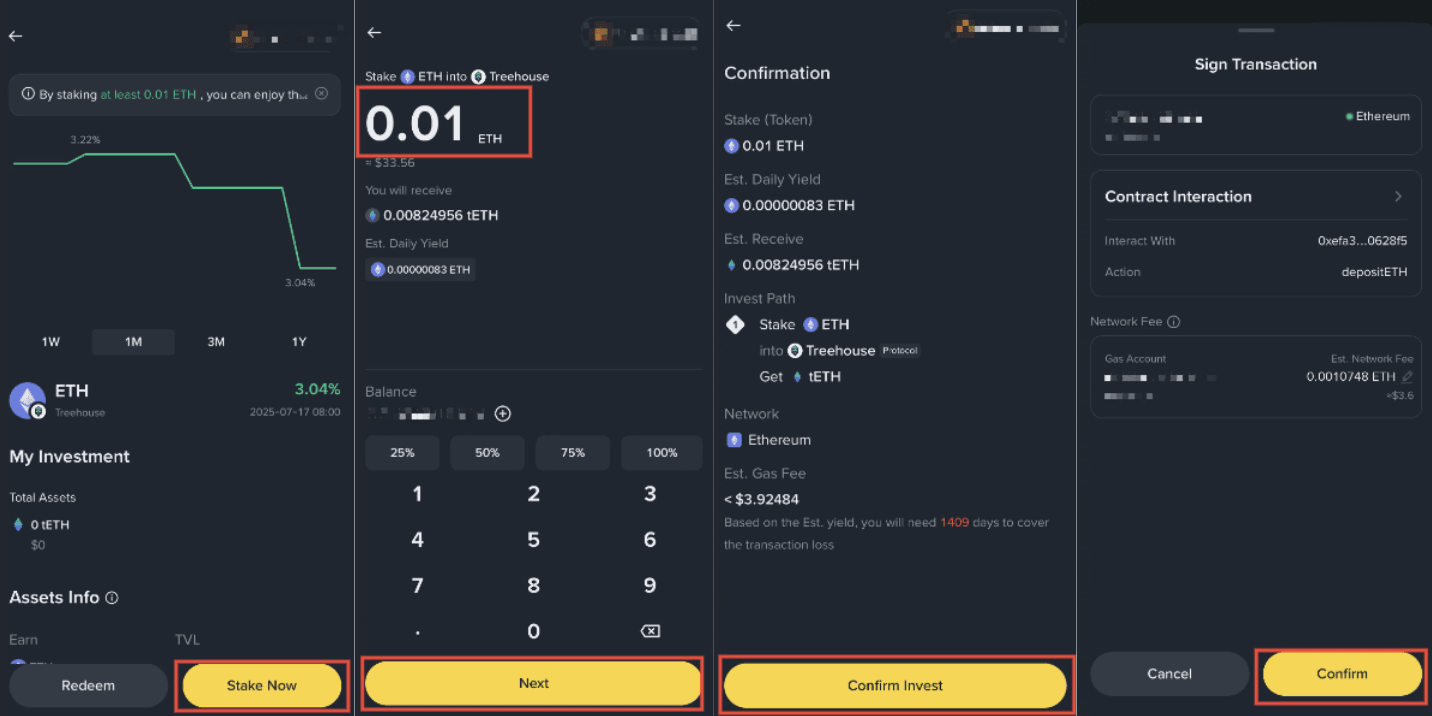

Ethereum’s liquid staking revolution has reshaped the DeFi landscape, offering yield seekers flexible, capital-efficient ways to earn on their ETH. In 2024, with Ethereum trading at $3,874.67, liquid staking tokens (LSTs) are at the heart of this transformation. Rather than locking ETH away, users can stake through top protocols and receive LSTs, unlocking new yield opportunities across DeFi. But with so many platforms and strategies, how do you maximize your returns while managing risk?

Why Liquid Staking Tokens Dominate Ethereum Yield Optimization in 2024

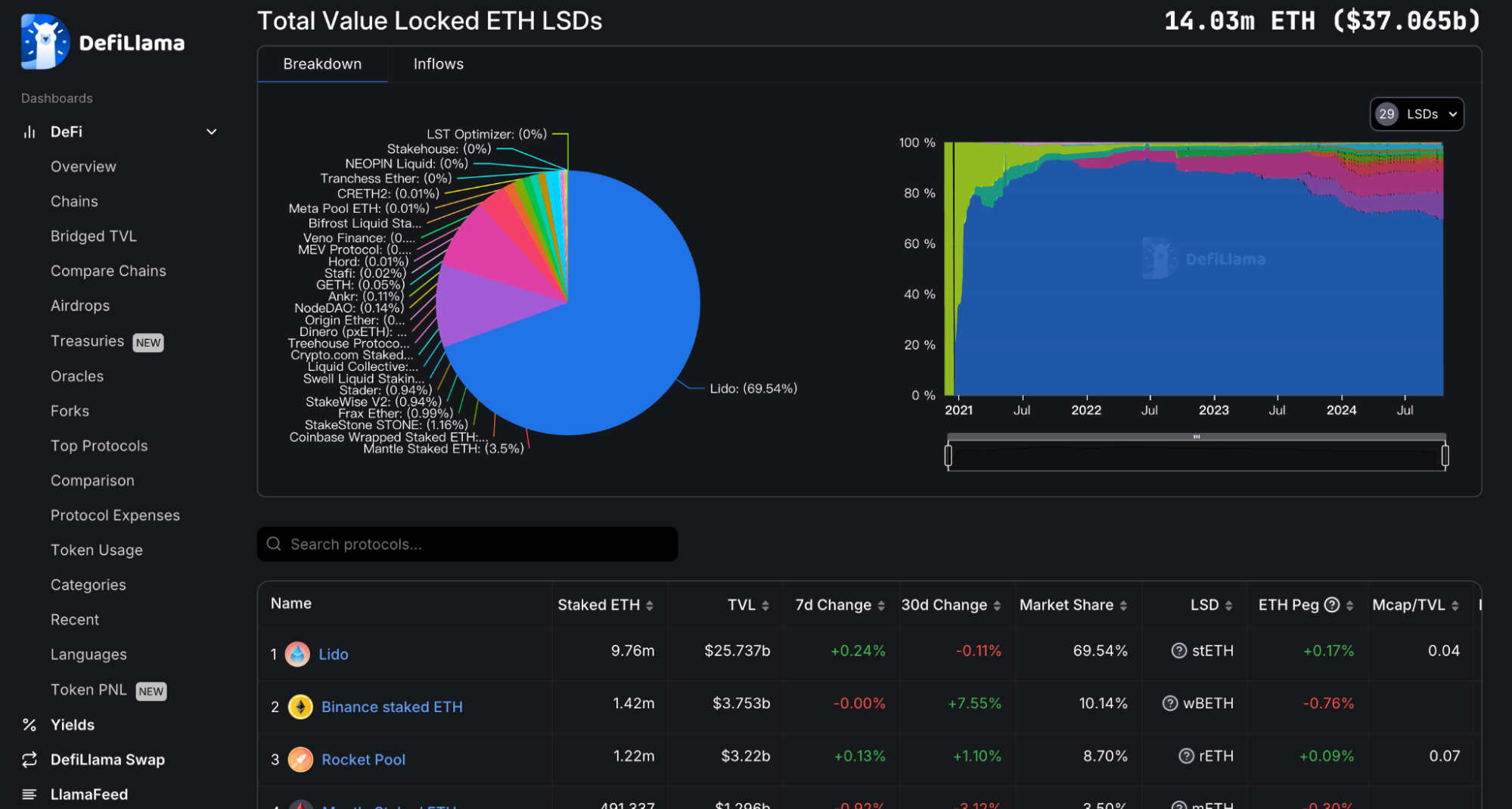

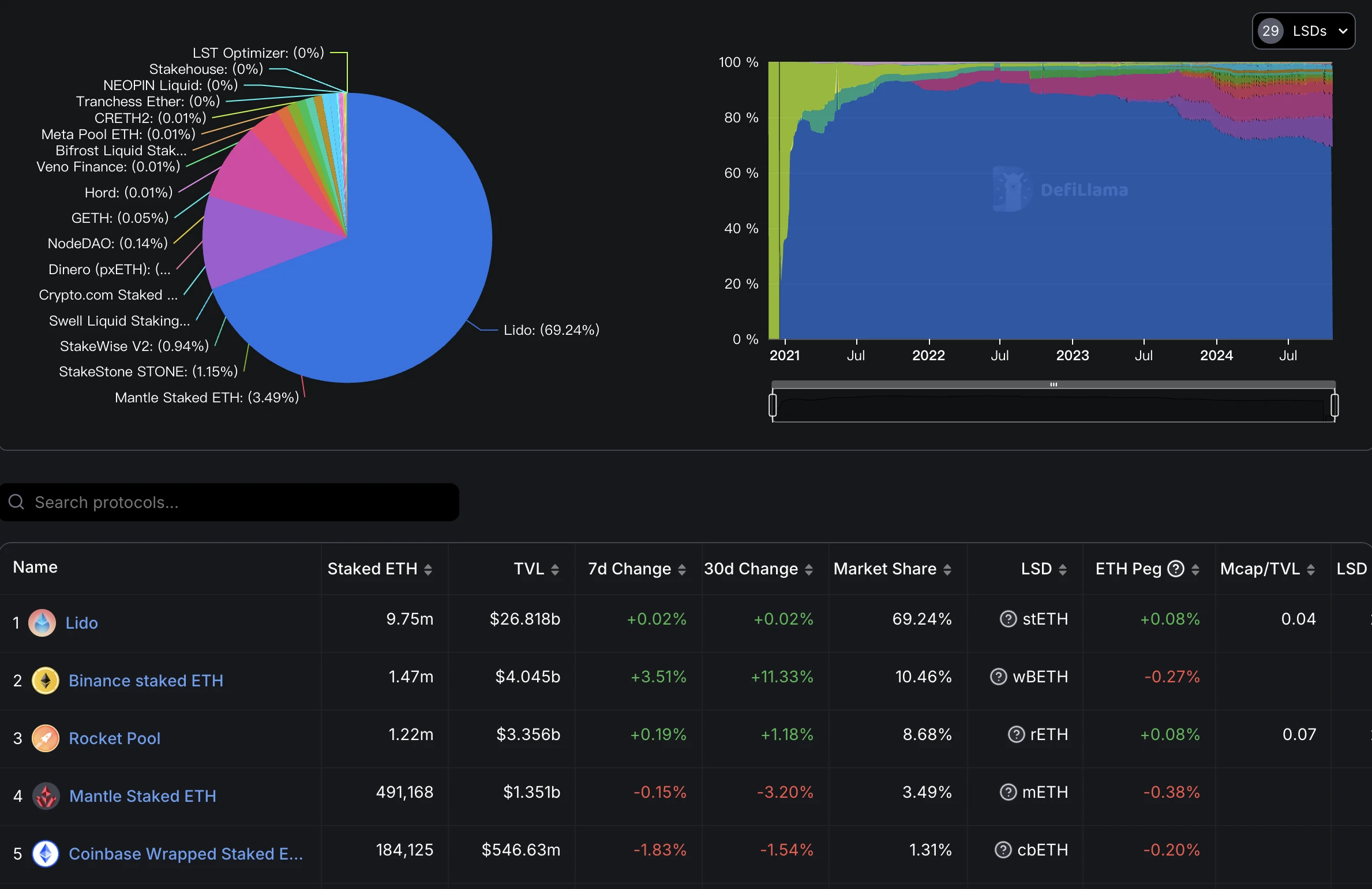

The total value locked in Ethereum liquid staking protocols soared from $284 million to over $17 billion in 2024, according to RedStone. This surge reflects both the demand for passive income and the innovation among staking platforms. LSTs like stETH (Lido), rETH (Rocket Pool), and frxETH/sfrxETH (Frax Ether) allow users to earn staking rewards while keeping their assets liquid for use in DeFi.

The top 10 liquid staking protocols on Ethereum in 2024 provides Lido Finance, Rocket Pool, Frax Ether, StakeWise, Stader Labs (ETHx), Ankr Staking, Binance ETH Staking, Origin Ether (OETH), Mantle Staked Ether (mETH), and Swell Network: each offer unique approaches to yield, decentralization, and composability. Choosing the right protocol is crucial for optimizing returns and minimizing exposure to smart contract or slashing risks.

Top 10 Ethereum Liquid Staking Protocols (2024)

-

Lido Finance: The largest Ethereum liquid staking protocol, Lido lets users stake ETH and receive stETH, which can be used across DeFi. APY: ~3.00% (after fees). Unique Feature: Deep DeFi integrations and high liquidity.

-

Rocket Pool: A decentralized liquid staking protocol allowing users to stake any amount of ETH and receive rETH. APY: ~2.90%. Unique Feature: Permissionless node operation for smaller stakers.

-

Frax Ether (Frax Finance): Frax offers frxETH and sfrxETH tokens, enabling flexible or boosted yield options. APY: ~2.84% on sfrxETH. Unique Feature: Dual-token system for liquidity and yield maximization.

-

StakeWise: StakeWise issues sETH2 and rETH2 tokens, enabling users to split staking rewards. APY: ~3.00%. Unique Feature: Reward splitting and compounding features.

-

Stader Labs (ETHx): Stader’s ETHx brings modular liquid staking with a focus on security and decentralization. APY: ~3.00%. Unique Feature: Modular architecture and multi-chain support.

-

Ankr Staking: Ankr allows users to stake ETH and receive aETHc, which is usable in DeFi. APY: ~3.00%. Unique Feature: Multi-chain staking and institutional-grade infrastructure.

-

Binance ETH Staking: Binance offers ETH staking with daily rewards and bETH tokens for use in DeFi. APY: ~2.90%. Unique Feature: Seamless integration with Binance ecosystem and high liquidity.

-

Origin Ether (OETH): OETH is a yield-aggregating liquid staking token that automatically reallocates funds for optimal yield. APY: ~3.00%. Unique Feature: Automated yield optimization across multiple protocols.

-

Mantle Staked Ether (mETH): Mantle’s mETH offers liquid staking with a focus on composability and DeFi utility. APY: ~3.00%. Unique Feature: Native integration with Mantle ecosystem and DeFi apps.

-

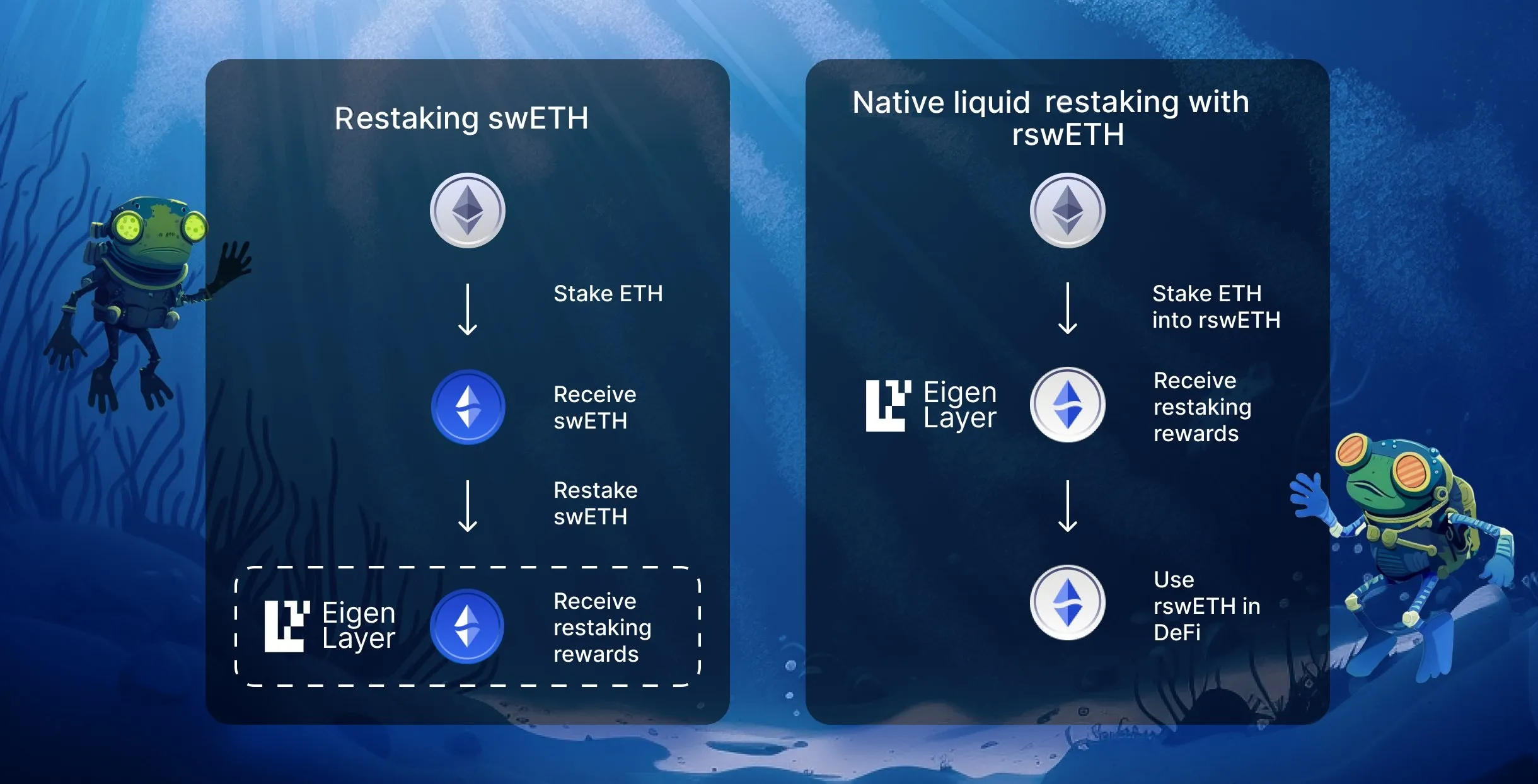

Swell Network: Swell provides swETH, a liquid staking token designed for maximum DeFi compatibility. APY: ~3.00%. Unique Feature: Non-custodial staking with flexible withdrawal options.

How Leading Protocols Stack Up: Lido, Rocket Pool, Frax Ether and More

Lido Finance remains the largest liquid staking protocol, with over $32 billion TVL and an APY of around 3.00% after fees. Its stETH token is widely accepted across DeFi platforms for lending, borrowing, and yield farming. Learn how to deploy stETH across protocols for compounding yield.

Rocket Pool democratizes staking by letting users with less than 32 ETH participate as node operators or depositors. rETH holders earn rewards with a strong focus on decentralization. Frax Ether offers two tokens: frxETH (liquid, low-yield) and sfrxETH (higher-yield but requires locking). This dual system lets users balance liquidity and returns depending on their strategies.

Other major players include:

- StakeWise: Offers modular vaults and tokenized rewards for flexible yield management.

- Stader Labs (ETHx): Known for multi-chain staking and high composability with DeFi integrations.

- Ankr Staking: Provides institutional-grade infrastructure with a focus on security.

- Binance ETH Staking: Combines exchange liquidity with competitive yields for bETH holders.

- Origin Ether (OETH): Automatically allocates staked ETH to maximize yield across protocols.

- Mantle Staked Ether (mETH): Focuses on scalability and low fees for DeFi power users.

- Swell Network: Prioritizes non-custodial staking and DeFi-native rewards for its swETH token.

LST DeFi Strategies: From Simple Staking to Advanced Yield Stacking

The real power of liquid staking tokens lies in their composability. Once you have an LST, you can deploy it across lending protocols (like Aave or Morpho), yield aggregators, or even restake on platforms such as EigenLayer to earn extra rewards on top of base staking yields. For example, looping strategies allow you to borrow against your stETH or rETH to buy more ETH, restake, and amplify your APY, but these advanced moves require careful risk management.

As competition heats up, platforms are rolling out new incentives, restaking options, and integrations to attract capital. The best approach? Diversify across leading protocols, monitor real-time analytics, and stay nimble as yields shift. For an in-depth guide to stacking yields with LSTs, check out our resource on yield stacking strategies in 2024.

Ethereum (ETH) Price Prediction 2026-2031

Based on current 2025 market data, liquid staking trends, and evolving DeFi landscape

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,150 | $4,050 | $5,200 | +4.5% | Continued liquid staking growth, steady DeFi adoption; moderate volatility. |

| 2027 | $3,000 | $4,390 | $6,100 | +8.4% | ETH 2.0 optimizations, broader LST adoption, competition from L2s; possible regulatory headwinds. |

| 2028 | $2,850 | $4,800 | $7,200 | +9.3% | New DeFi primitives, increased institutional staking, market correction risk. |

| 2029 | $3,200 | $5,280 | $8,500 | +10.0% | Ethereum scalability upgrades, global adoption rising, increased staking yields. |

| 2030 | $3,600 | $5,950 | $10,200 | +12.7% | Mainstream DeFi use, ETH as digital bond; new competitors emerge, but ETH maintains lead. |

| 2031 | $4,200 | $6,800 | $12,000 | +14.3% | Potential ETH ETF, institutional DeFi, mature staking ecosystem drives high-end targets. |

Price Prediction Summary

Ethereum is projected to see steady to strong growth over the next six years, driven by liquid staking innovation, DeFi expansion, and ongoing network upgrades. While minimum price scenarios reflect possible market corrections or regulatory impacts, the average and maximum projections show the potential for ETH to outperform as adoption deepens and new use cases emerge.

Key Factors Affecting Ethereum Price

- Continued expansion of liquid staking protocols and TVL.

- DeFi sector growth and integration with LSTs.

- Ethereum network upgrades (scalability, security, sharding).

- Potential regulatory clarity or restrictions on staking and DeFi.

- Competition from alternative L1s and L2 solutions.

- Global macroeconomic environment and crypto adoption.

- Emergence of ETH-based ETFs or institutional products.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

To truly maximize your DeFi returns with liquid staking tokens on Ethereum, it’s essential to understand the nuances and unique offerings of each protocol. While Lido’s stETH and Rocket Pool’s rETH dominate in TVL and ecosystem integration, the landscape in 2024 is far richer and more competitive than ever. Here’s how to make the most of the current opportunities, and what to watch for as you optimize your yield stacking strategy.

Comparing Yield, Risk, and DeFi Integration Across the Top 10 Protocols

Yield optimization is more than chasing the highest APY. It’s about balancing return, liquidity, and risk. For example, Lido Finance provides deep liquidity and broad DeFi acceptance but comes with higher protocol risk due to its size. Rocket Pool and StakeWise offer more decentralized alternatives, appealing to those prioritizing network security and censorship resistance.

Frax Ether (Frax Finance) introduces a dual-token system: frxETH is highly liquid and easily swapped, while sfrxETH offers boosted rewards for those willing to lock up their tokens. Stader Labs (ETHx) and Ankr Staking are carving niches with innovative restaking and institutional-grade security, respectively. Binance ETH Staking, with its bETH token, is a go-to for users seeking seamless integration with exchange services and high on-platform liquidity.

Origin Ether (OETH) stands out by automatically reallocating staked ETH across multiple protocols, maximizing returns without manual intervention. Mantle Staked Ether (mETH) is gaining traction among DeFi power users for its low fees and scalability, while Swell Network appeals to those who want non-custodial, DeFi-native staking through its swETH token.

The best protocol for you depends on your priorities: Do you want maximum composability, decentralization, or simply the highest APY? Diversifying across several LSTs can help mitigate protocol-specific risks while letting you capitalize on emerging incentives and integrations.

LST Analytics and Real-Time Monitoring: Staying Ahead of the Curve

With Ethereum’s price at $3,874.67, even small differences in APY can have a significant impact on your annual returns. Platforms like Lstfi provide real-time analytics, tracking LST prices, yields, and DeFi integrations, so you can react quickly to shifts in the market. Monitoring on-chain metrics, such as protocol TVL, reward rates, and smart contract audits, is crucial for informed decision-making.

Stay alert for new restaking opportunities, like those on EigenLayer, which allow you to earn additional rewards for helping secure emerging networks. However, always weigh the risks of smart contract bugs, slashing, or depegging, especially when leveraging or looping LSTs in complex strategies. For more on the mechanics and risks of liquid staking, see our guide on how liquid staking maximizes yield without lockups.

Key Takeaways for Maximizing DeFi Returns with LSTs in 2024

- Diversify: Spread your ETH across multiple top protocols, Lido, Rocket Pool, Frax Ether, StakeWise, and others, to balance yield and risk.

- Leverage Composability: Use your LSTs in lending, borrowing, and restaking protocols to stack additional rewards.

- Monitor Analytics: Track real-time APYs, protocol health, and new integrations to stay ahead of yield shifts.

- Assess Risk: Understand the trade-offs between liquidity, decentralization, and security, don’t chase yield blindly.

- Stay Informed: The liquid staking landscape evolves rapidly. Regularly review platform updates and community discussions.

Top 10 Ethereum Liquid Staking Protocols in 2024

-

Lido Finance: The largest liquid staking protocol on Ethereum, Lido offers users stETH in exchange for staking ETH, providing around 3.00% APY after fees. Its deep DeFi integrations make it a top choice for maximizing yield.

-

Rocket Pool: A decentralized liquid staking platform allowing users to stake with less than 32 ETH. Rocket Pool issues rETH tokens and is known for its community-driven validator network and robust security.

-

Frax Ether (Frax Finance): Frax Ether provides frxETH and sfrxETH tokens, offering flexible staking options and competitive yields. sfrxETH holders can earn boosted rewards by locking their tokens.

-

StakeWise: StakeWise issues sETH2 and rETH2 tokens, enabling users to earn staking rewards and participate in DeFi strategies. Its dual-token model offers flexibility for both yield and liquidity.

-

Stader Labs (ETHx): Stader’s ETHx is a liquid staking token designed for DeFi composability and security. It allows users to stake ETH and access a wide range of DeFi opportunities across protocols.

-

Ankr Staking: Ankr provides a simple interface for staking ETH and receiving aETHc tokens. It supports cross-chain staking and offers integrations with multiple DeFi protocols for enhanced yield.

-

Binance ETH Staking: Binance’s ETH staking service issues BETH tokens and is popular for its ease of use, high liquidity, and integration within the Binance ecosystem. It’s a leading option for centralized liquid staking.

-

Origin Ether (OETH): Origin Ether aggregates yield strategies by deploying staked ETH assets across top protocols. OETH holders benefit from diversified yield sources and automated optimization.

-

Mantle Staked Ether (mETH): Mantle’s mETH offers liquid staking with a focus on transparency and efficient DeFi integrations, allowing users to earn rewards while maintaining liquidity.

-

Swell Network: Swell Network provides swETH tokens for staked ETH, emphasizing non-custodial staking and seamless DeFi utility. Its user-friendly approach attracts both new and experienced stakers.

The rise of liquid staking tokens has made Ethereum yield optimization more accessible, flexible, and dynamic than ever before. Whether you’re a passive staker or an active DeFi strategist, leveraging the strengths of Lido, Rocket Pool, Frax Ether, StakeWise, Stader Labs, Ankr, Binance ETH Staking, Origin Ether, Mantle Staked Ether, and Swell Network can help you unlock new layers of sustainable return. As always, clarity and security drive adoption, keep learning, stay nimble, and let your ETH work harder for you.