Yield stacking with LSTs has become a cornerstone strategy for DeFi investors seeking to optimize returns while maintaining liquidity in 2024. With the evolution of liquid staking protocols and the expansion of composable DeFi primitives, users can now layer multiple yield sources on top of their staked assets. This approach not only enhances overall APY but also introduces new considerations around risk management, asset selection, and platform security.

Provide LSTs as Liquidity on Leading DEXs to Earn Dual Yields

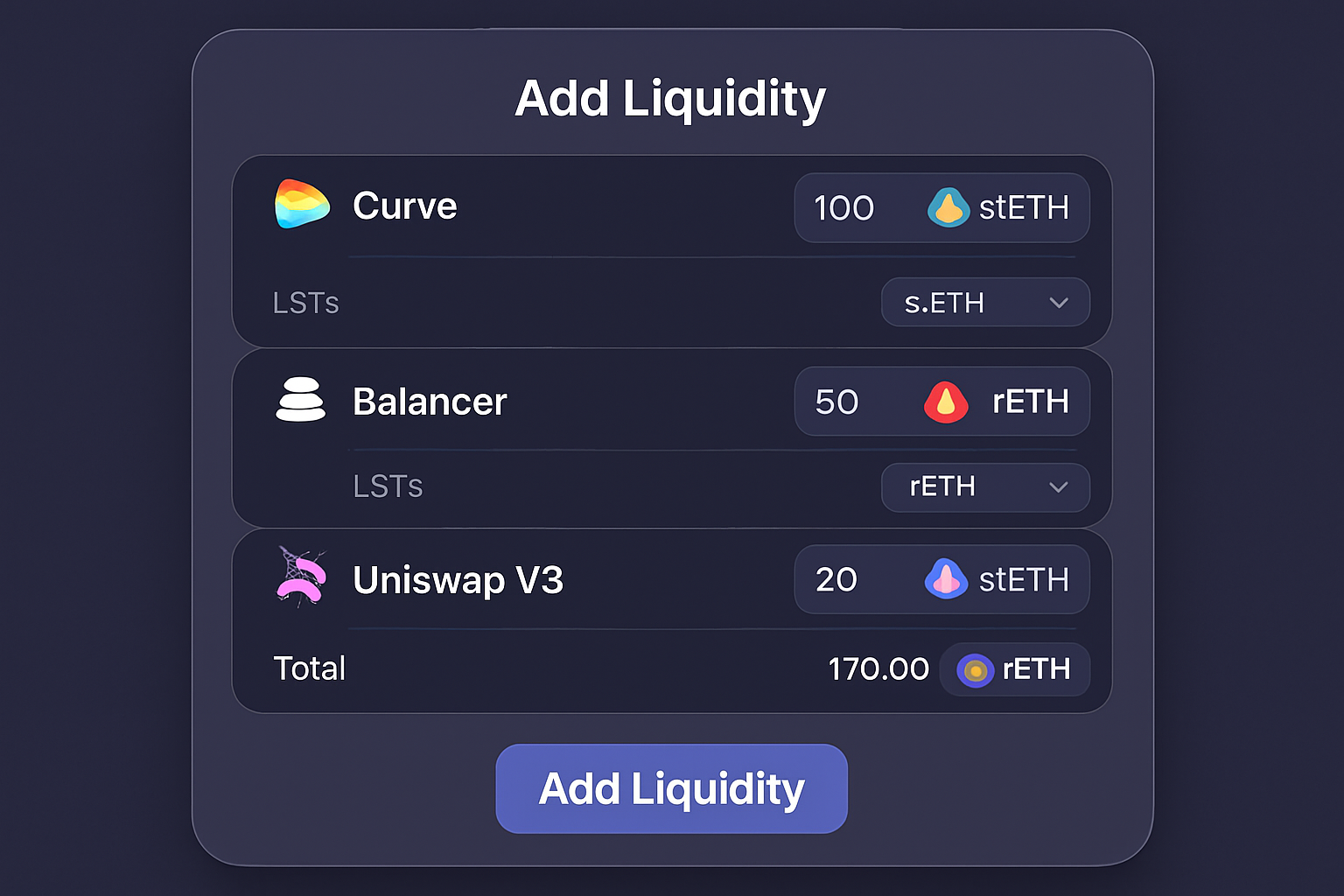

One of the most effective ways to maximize earnings with liquid staking tokens is by providing them as liquidity on decentralized exchanges (DEXs) such as Curve, Balancer, or Uniswap V3. By depositing LSTs into these pools, often paired with their underlying token (e. g. , stETH/ETH): users earn both the base staking rewards and a share of trading fees generated by swaps in the pool. This dual-yield mechanism can significantly boost returns compared to simple holding or single-platform staking.

However, liquidity providers should remain vigilant regarding impermanent loss risks and carefully assess pool composition. For an in-depth look at how LP-LST strategies impact yield and liquidity dynamics, see this case study.

Leverage Restaking Protocols for Layered Rewards

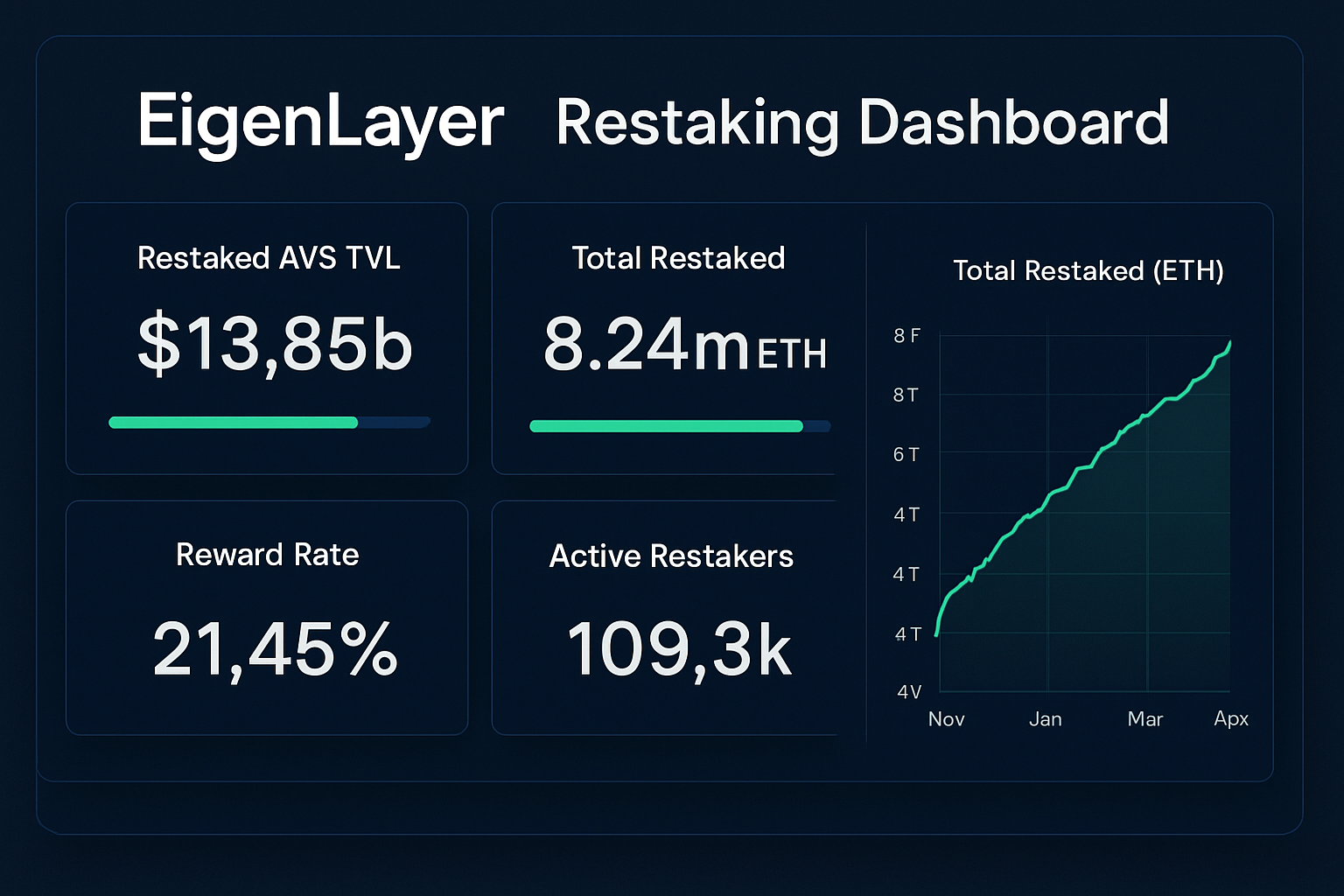

The rise of restaking protocols like EigenLayer has introduced a new dimension to yield stacking with LSTs. Restaking allows users to re-deploy their LSTs as security for additional services, such as securing middleware oracles or data availability layers, on top of their base staking position. In return, participants receive extra protocol rewards layered onto their original APY.

This strategy amplifies capital efficiency but also requires disciplined monitoring of protocol risk parameters and slashing conditions. As restaking ecosystems mature in 2024, due diligence remains paramount; always review audit statuses and community sentiment before allocating significant capital.

Top 5 Strategies to Maximize LST Yield Stacking in 2024

-

Provide LSTs as Liquidity on Leading DEXs (e.g., Curve, Balancer, Uniswap V3) to earn dual yields from both staking rewards and trading fees. Pairing LSTs with their underlying assets can help minimize impermanent loss and boost overall returns.

-

Leverage Restaking Protocols (e.g., EigenLayer) to stack additional rewards on top of base LST yields. Restaking allows you to secure extra services and participate in emerging DeFi layers for enhanced capital efficiency.

-

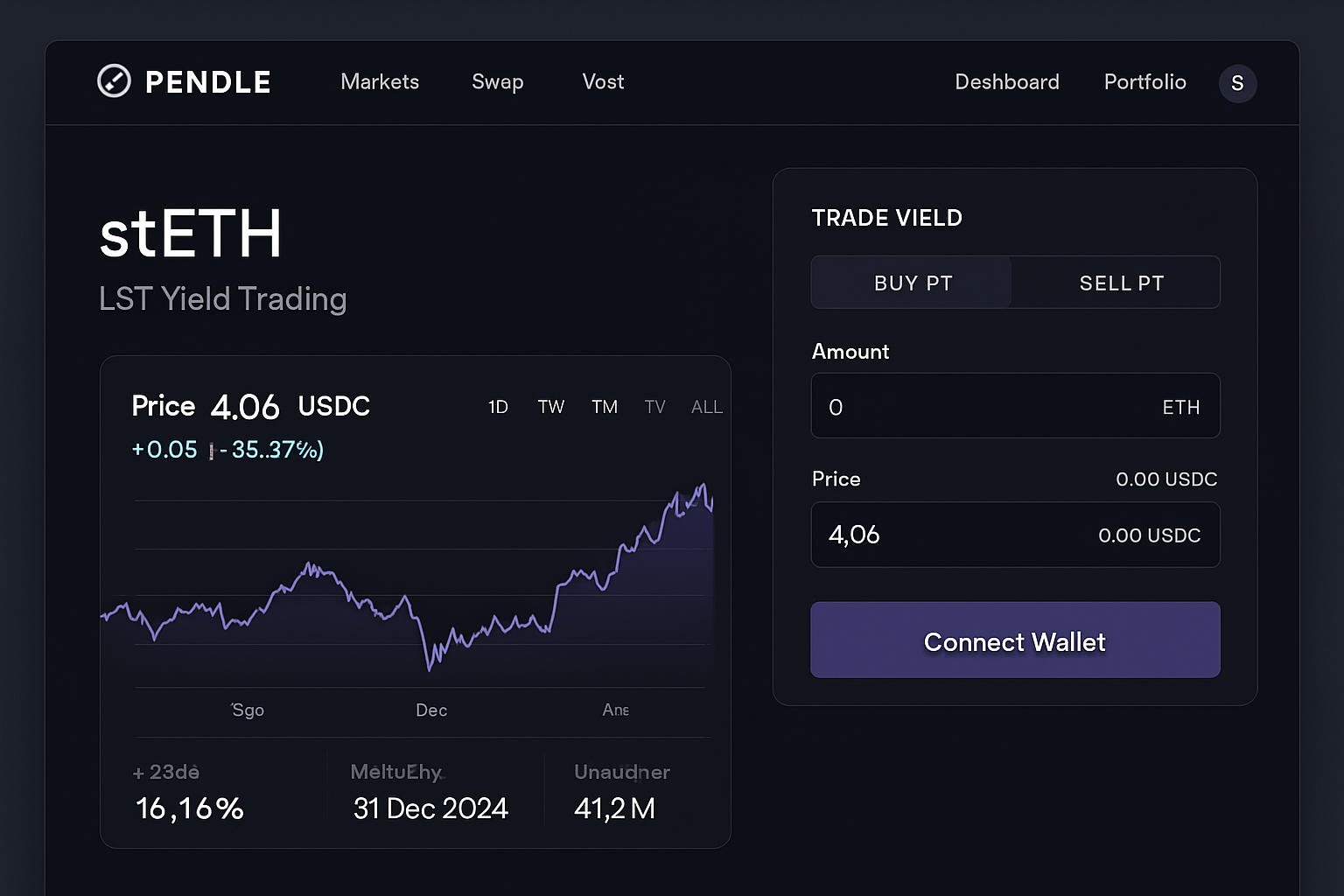

Utilize Pendle Finance to tokenize and trade future yields from LSTs, unlocking enhanced APY opportunities by selling or acquiring future yield streams in a liquid market.

-

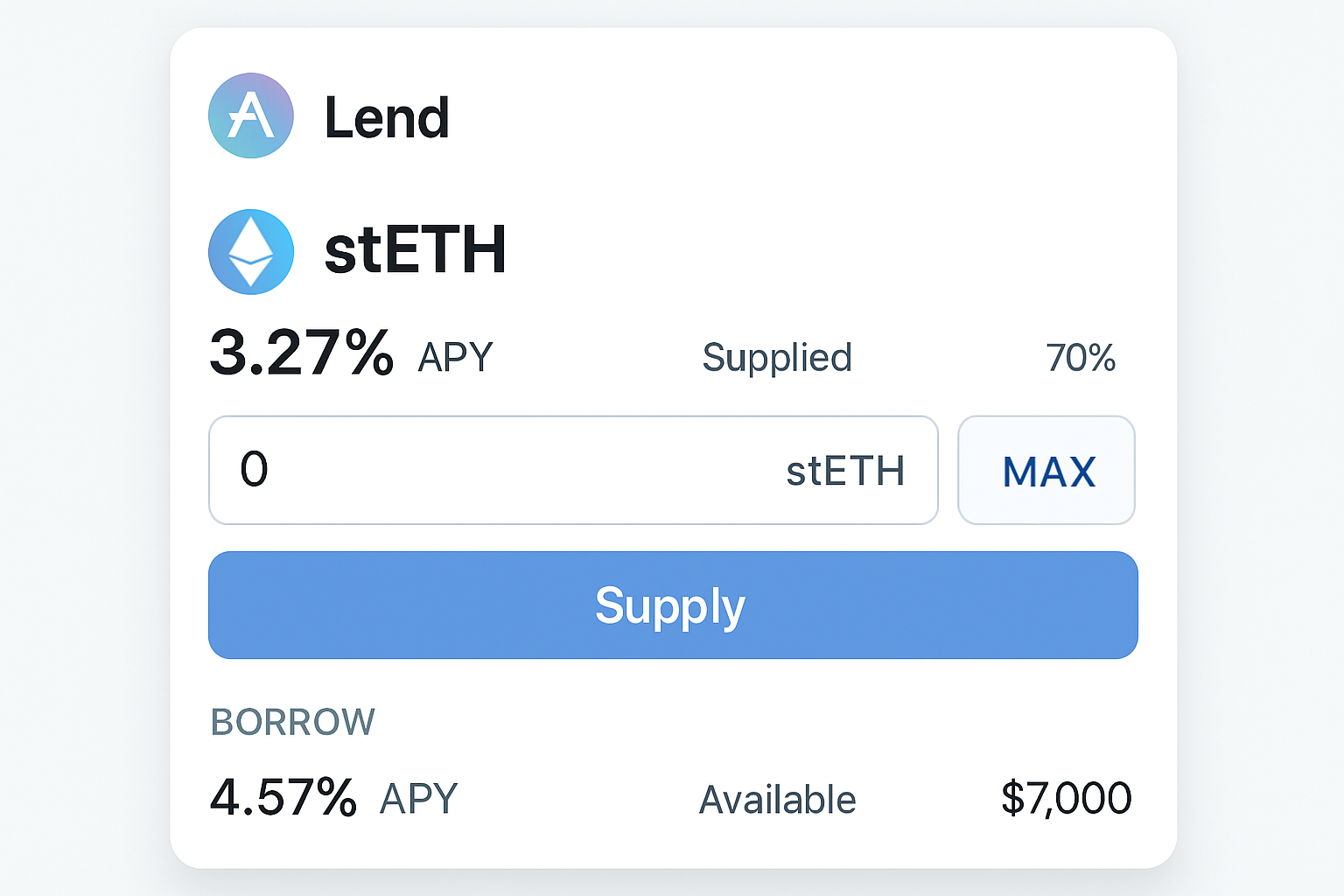

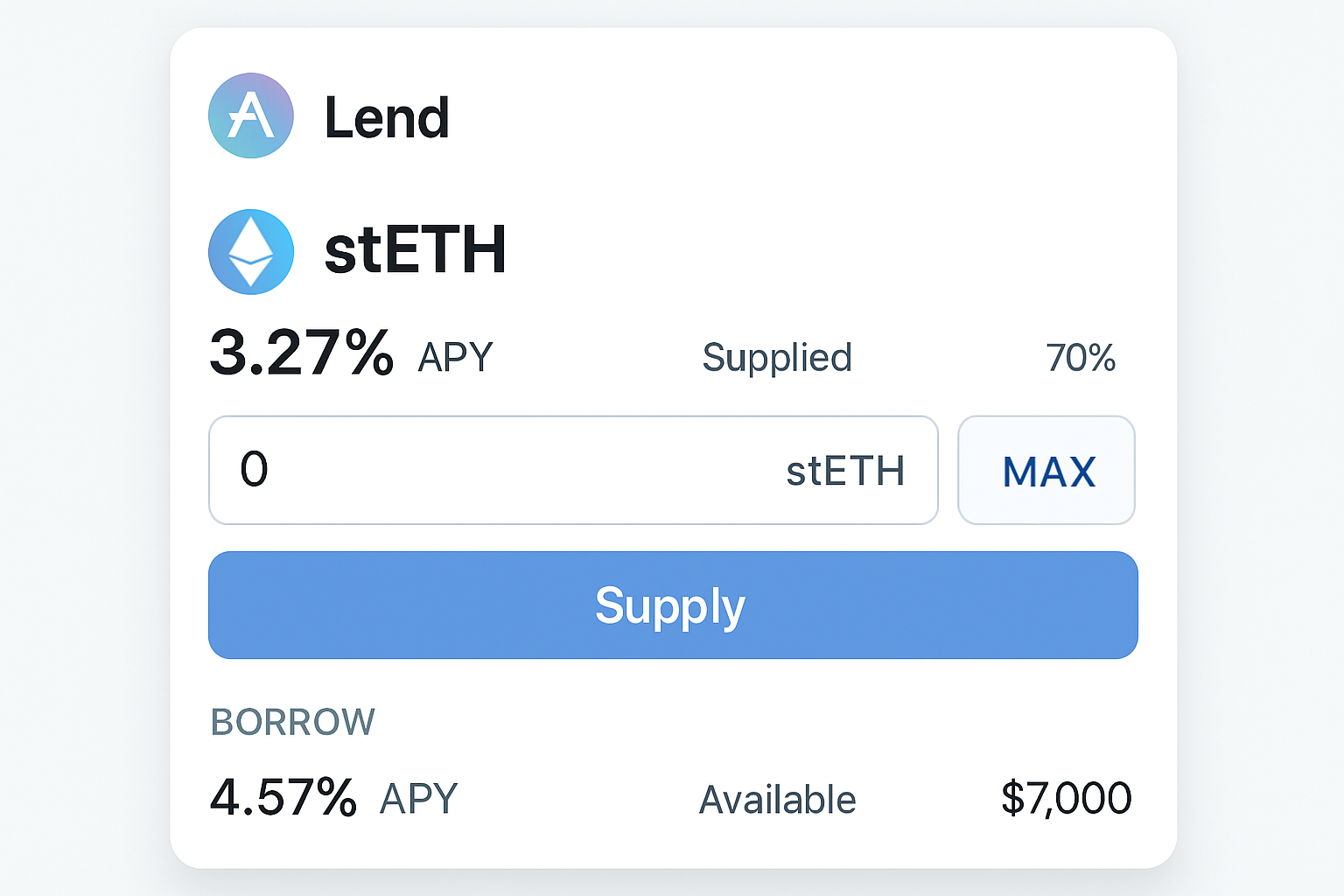

Participate in LST Lending Markets (e.g., Aave, Morpho Blue) to earn interest or borrow against LST collateral. This enables passive income generation or leveraged strategies without selling your staked assets.

-

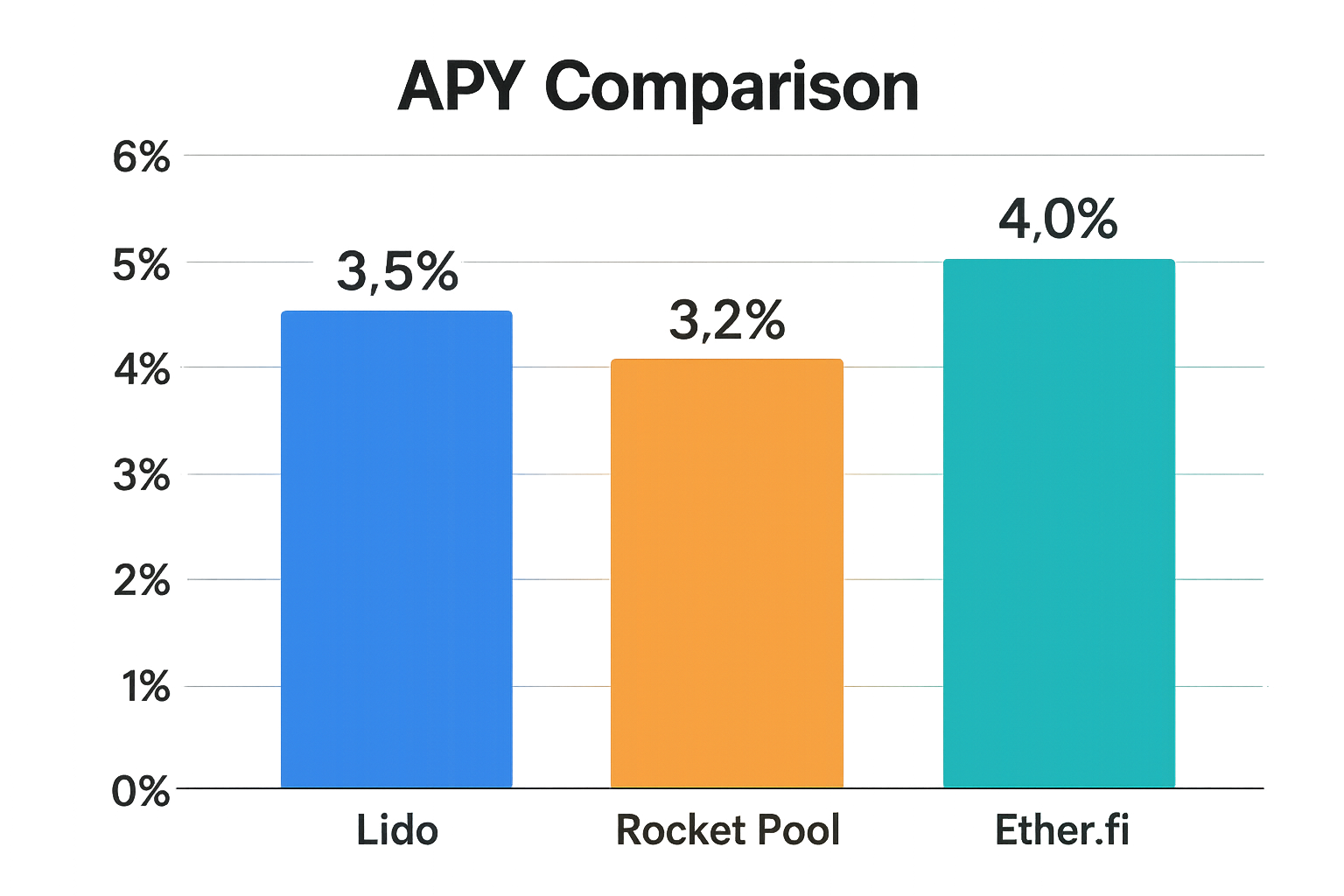

Optimize Yield by Diversifying Across Multiple Liquid Staking Platforms (e.g., Lido, Rocket Pool, Ether.fi) based on real-time APYs and security audits. Diversification helps spread risk and capture the best available yields across the market.

Utilize Pendle Finance to Tokenize and Trade Future Yields

Pendle Finance stands out among DeFi protocols by enabling users to tokenize and trade future yields from LST positions. By splitting an LST into principal (ownership) tokens and yield tokens representing future rewards, investors can sell forward their expected interest or purchase discounted future yield streams for enhanced APY opportunities. This unlocks sophisticated hedging and leverage strategies previously unavailable to retail participants.

Engaging with Pendle requires careful market timing and an understanding of interest rate volatility within DeFi markets. Advanced users may find opportunities in arbitraging between spot yields and forward rates, an emerging theme for optimizing returns in liquid staking platforms throughout 2024.

Participate in LST Lending Markets for Flexible Yield and Leverage

Another powerful component of yield stacking with LSTs is engaging with decentralized lending markets such as Aave or Morpho Blue. By depositing your liquid staking tokens as collateral, you can earn passive interest from borrowers while maintaining exposure to your underlying staked asset. This approach offers twofold benefits: direct yield from lending and the ability to borrow against your LSTs, unlocking additional capital for further DeFi strategies.

For risk-conscious investors, this method provides flexibility, if market conditions shift or more attractive APYs emerge elsewhere, you retain the option to withdraw or reposition assets swiftly. However, always monitor loan-to-value ratios and liquidation thresholds, as volatile markets can quickly erode collateral buffers. Robust risk management is essential to avoid forced liquidations during periods of heightened volatility.

Optimize Yield by Diversifying Across Multiple Liquid Staking Platforms

No single protocol or platform consistently delivers the highest returns or security profile. In 2024, optimizing yield stacking requires active diversification across leading liquid staking platforms such as Lido, Rocket Pool, and Ether. fi. By allocating capital based on real-time APYs, audit results, and platform-specific incentives, investors can maximize aggregate returns while minimizing concentration risk.

Track protocol upgrades, governance proposals, and security audits closely, platforms that prioritize transparency and proactive risk mitigation often outperform over time. Use portfolio analytics tools to rebalance positions in response to changing yields or evolving risks. This disciplined approach helps capture upside across the liquid staking ecosystem while safeguarding against isolated protocol failures.

Key Takeaways for 2024 Yield Stackers

- Layering yields through DEX liquidity provision, restaking protocols like EigenLayer, Pendle Finance’s future yield trading, lending markets such as Aave/Morpho Blue, and cross-platform diversification creates a resilient DeFi income stack.

- Risk management is non-negotiable: monitor slashing conditions in restaking protocols and maintain healthy collateral ratios in lending platforms.

- Diversification across multiple audited platforms reduces exposure to single-point failures.

The most successful investors in liquid staking tokens 2024 are those who combine opportunistic yield stacking with disciplined oversight. As the ecosystem matures, with new primitives like restaking gaining traction, the opportunity set will continue to expand for those who stay informed and agile.

Top 5 Strategies to Maximize LST Yield Stacking in 2024

-

Provide LSTs as Liquidity on Leading DEXs (e.g., Curve, Balancer, Uniswap V3) to earn dual yields from trading fees and protocol incentives. Pairing LSTs with their underlying assets can also help minimize impermanent loss while maximizing capital efficiency.

-

Leverage Restaking Protocols (e.g., EigenLayer) to stack additional rewards on top of base LST yields. By restaking LSTs, users can secure extra services and earn layered incentives, further boosting overall returns.

-

Utilize Pendle Finance to tokenize and trade future yields from LSTs for enhanced APY opportunities. Pendle allows users to separate and sell yield streams, enabling strategic yield management and access to advanced DeFi opportunities.

-

Participate in LST Lending Markets (e.g., Aave, Morpho Blue) to earn interest or borrow against LST collateral. Lending LSTs provides passive income, while borrowing unlocks additional capital for further yield strategies.

-

Optimize Yield by Diversifying Across Multiple Liquid Staking Platforms (e.g., Lido, Rocket Pool, Ether.fi) based on real-time APYs and security audits. Diversification reduces risk, captures varying yield rates, and ensures exposure to the most secure and profitable protocols.

If you want a deeper dive into how LP-LST strategies specifically impact DeFi liquidity and returns, check out this detailed case study.