Liquid Staking Tokens (LSTs) are reshaping the DeFi landscape, injecting agility and composability into what was once a static, locked-up staking experience. Instead of sidelining your ETH or other PoS assets for months, LSTs let you earn staking rewards while actively deploying capital across DeFi’s most lucrative strategies. This dynamic unlocks sustainable DeFi yield through yield stacking, where your assets work overtime in multiple protocols at once.

Why Liquid Staking Tokens Are a Game-Changer for Yield Seekers

Traditional staking forced users to choose: lock up tokens for network security and rewards, or keep assets liquid to chase new opportunities. LSTs eliminate that trade-off. Platforms like Lido and Rocket Pool issue derivatives (e. g. , stETH, rETH) representing your staked assets, these tokens accrue staking rewards while remaining fully transferable and composable.

This innovation means you can:

- Earn native staking rewards

- Provide liquidity on DEXs for trading fees

- Supply collateral to lending markets for borrowing or leveraged yield loops

- Participate in yield farms, vaults, or structured products

The result? Multi-layer yield and unprecedented capital efficiency. For a detailed look at how this works in practice, check out this deep dive.

The Mechanics of Yield Stacking: Turning One Yield Stream Into Many

Let’s break down how LSTs enable sustainable yield stacking in real-world DeFi strategies:

Top Yield Stacking Use Cases for LSTs in DeFi

-

Yield Farming: LSTs can be staked in DeFi platforms like Yearn Finance or Balancer to participate in multi-layered yield farming strategies, compounding returns from both staking and protocol rewards.

1. Liquidity Provision: LST holders can pair tokens like stETH with ETH or stablecoins on DEXs. This earns trading fees and sometimes protocol incentives, on top of the underlying staking rewards. Advanced pools even minimize impermanent loss, further boosting net returns.

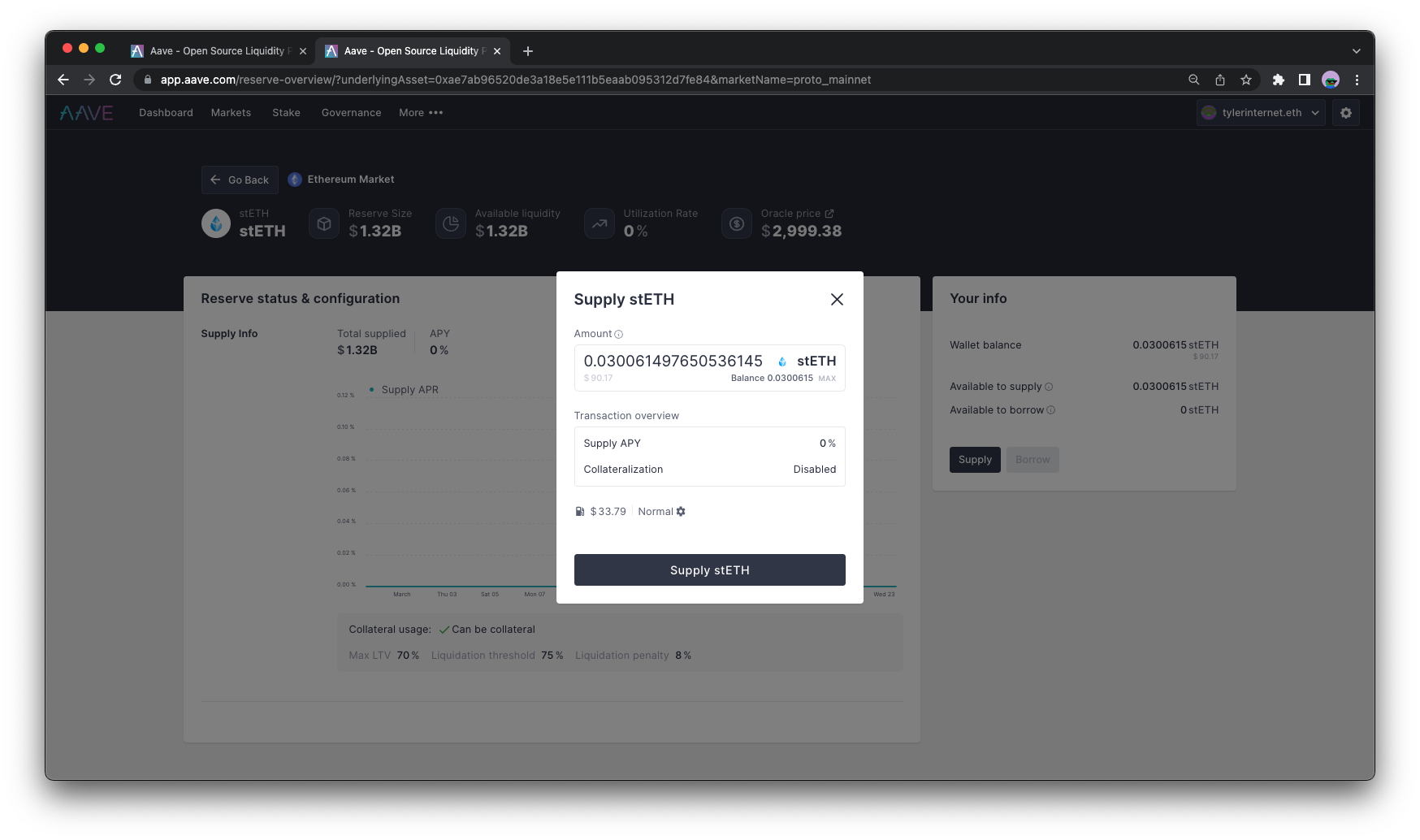

2. Collateral for Lending: LSTs are accepted as collateral on leading lending platforms. You can borrow stablecoins or other assets against your stETH, rETH, or similar tokens. This lets you leverage your staked position or redeploy borrowed capital into new yield opportunities, without ever missing a staking payout.

3. Yield Farming: Many protocols now accept LSTs in their vaults or farms, layering extra incentives for liquidity providers. This creates a feedback loop, staking rewards plus trading fees plus farming incentives, resulting in multi-source, sustainable yield.

Each layer is composable, allowing savvy users to stack yields and optimize capital efficiency. For step-by-step strategies, see our practical guide to LST yield stacking.

Risk Factors: What to Watch When Chasing Real Yield

The promise of sustainable DeFi yield via LSTs is powerful, but not risk-free. Key risks include:

- Smart contract vulnerabilities: Bugs or exploits can impact staking platforms or DeFi protocols.

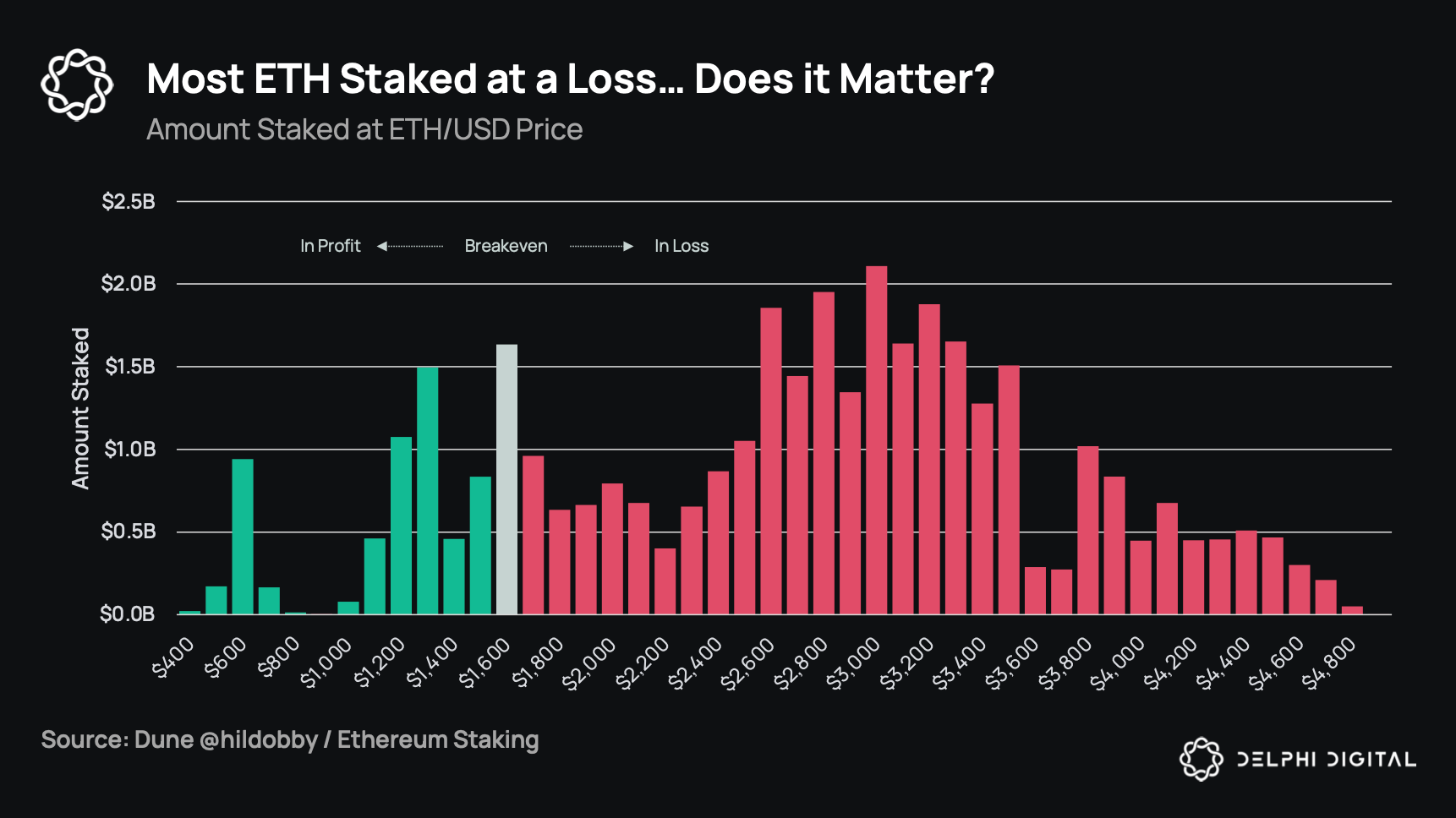

- LST depegging: If stETH or similar tokens lose parity with their underlying asset during volatility, users may face losses.

- Liquidity crunches: In times of stress, exiting positions may incur slippage or delays.

Mitigating these risks requires due diligence and robust risk management. For more on how to build resilient yield loops with LSTs, read our case study on LP and LST strategies.

Smart investors monitor protocol audits, assess liquidity depth, and diversify across multiple liquid staking platforms to hedge against idiosyncratic risks. The rise of insurance protocols and real-time analytics tools further empowers users to track health metrics, price pegs, and on-chain activity, adding a layer of transparency that was unthinkable in early DeFi cycles.

Sustainability in Focus: How LSTs Drive Real Yield and Capital Efficiency

The composability of liquid staking tokens is the backbone of sustainable DeFi yield. Unlike fleeting farming incentives or unsustainable emissions, LST yield stacking is anchored in the underlying PoS network rewards. This means your returns are rooted in real economic activity, validators securing blockchains, not just speculative token emissions.

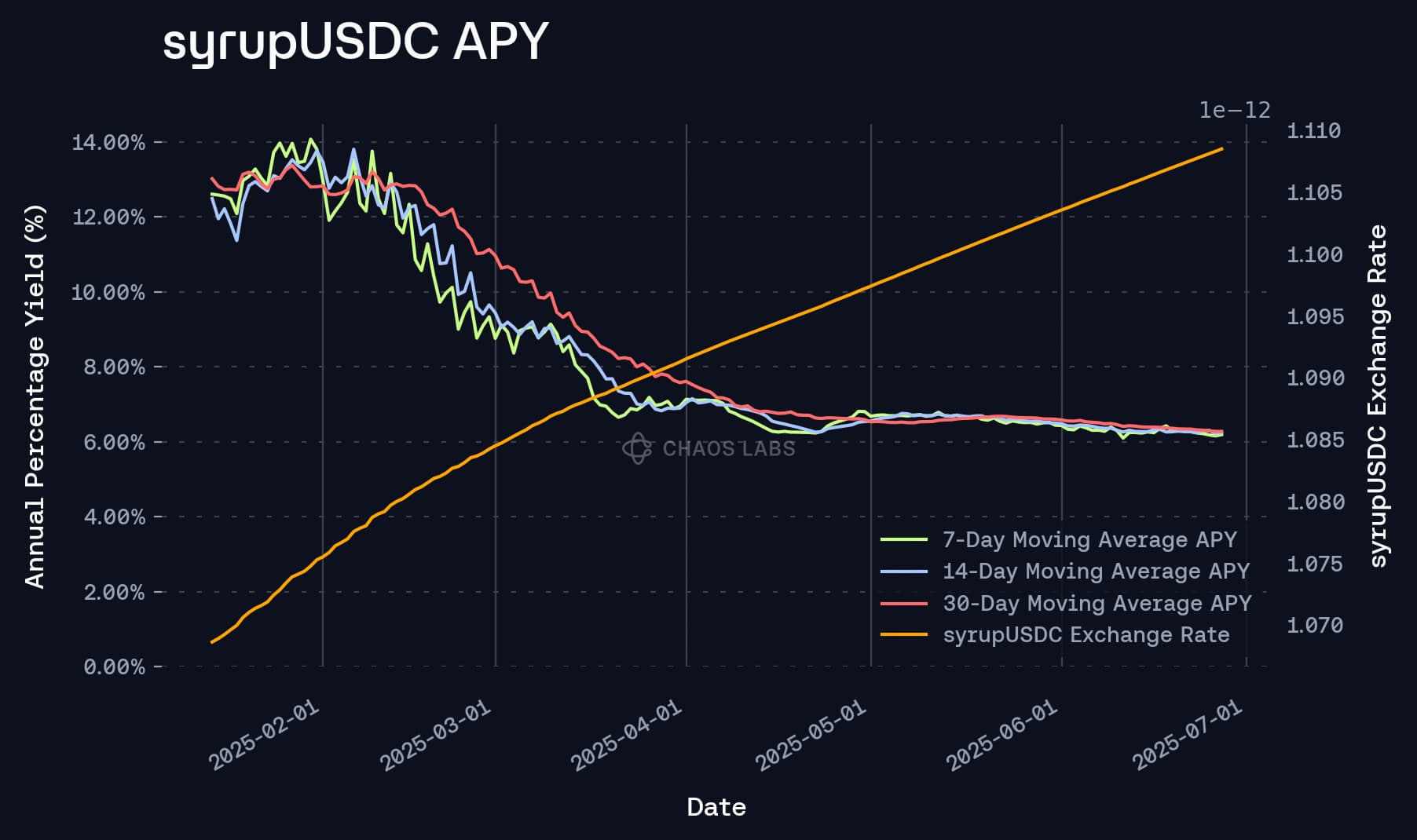

Moreover, LSTs make capital nimble. Instead of static, siloed assets, your staked capital can flow between protocols, adapting to shifting APYs and risk profiles. This agility is what powers yield loops, where assets cycle through lending, LPing, and farming, compounding returns without ever leaving the safety net of staking rewards.

Top Tips for Sustainable LST Yield Stacking

-

Diversify Across Leading LST Platforms: Spread your assets among reputable LST providers like Lido (stETH), Rocket Pool (rETH), and Coinbase Wrapped Staked ETH (cbETH) to reduce protocol-specific risks and exposure to a single smart contract.

-

Utilize Trusted DeFi Protocols for Yield Stacking: Deploy LSTs in established protocols such as Aave (for lending/borrowing) or Curve (for liquidity provision) to maximize returns while minimizing exposure to untested platforms.

-

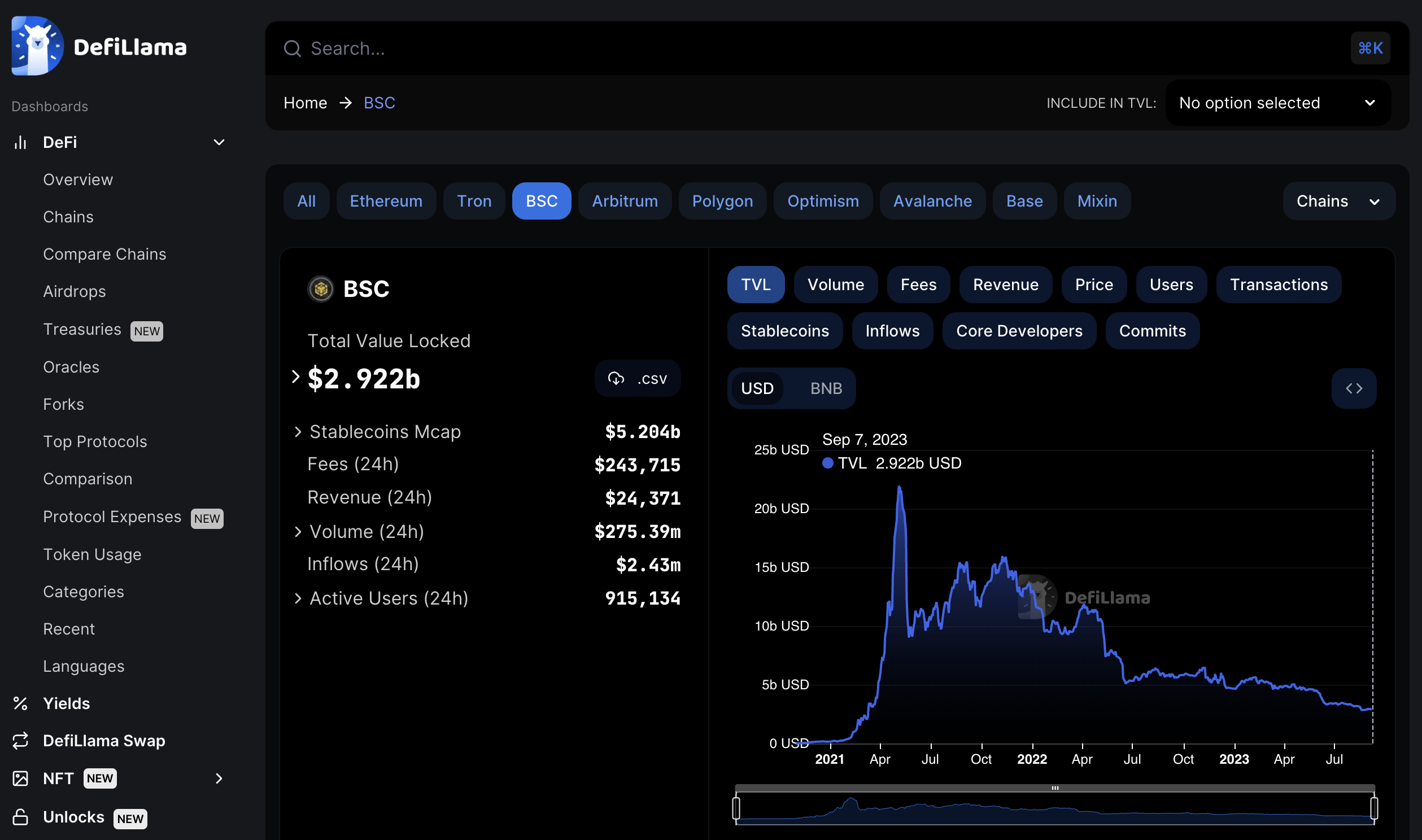

Assess Smart Contract and Platform Risks: Before committing assets, review security audits and risk disclosures from platforms like Lido and Rocket Pool. Use resources like DeFiLlama to check protocol TVL and security history.

As the DeFi landscape matures, expect new primitives, like restaking or cross-chain LSTs, to unlock even deeper layers of composable yield. Already, protocols are experimenting with auto-compounding vaults and structured products that abstract away complexity for users seeking passive, sustainable returns.

Staying Ahead: Tools and Analytics for LST Yield Stackers

Success in yield stacking hinges on data-driven decision-making. Platforms like Lstfi aggregate real-time LST yields, peg ratios, and protocol risk ratings so users can act fast when new opportunities arise. Tracking these metrics is non-negotiable for anyone serious about maximizing multi-layer yield while managing downside.

Community-driven dashboards, Telegram bots, and automated alerts now make it possible to monitor yield movements and peg fluctuations minute-by-minute. The smartest yield stackers use these insights to rebalance portfolios, exit risky positions early, or rotate into higher-yielding pools as market dynamics shift.

Pro tip: Set up custom alerts for peg deviations or APY spikes on your favorite LST pairs to stay ahead of volatility events.

The Future Is Liquid: Why LSTs Are Here to Stay

Liquid staking tokens have moved from a niche innovation to a DeFi essential. In today’s market, they power everything from institutional-grade liquidity strategies to grassroots yield farming. As more PoS chains adopt liquid staking models and DeFi protocols deepen their LST integrations, expect broader adoption, and even more creative ways to stack sustainable yield.

The bottom line: LSTs are the engine behind the next wave of capital-efficient, sustainable DeFi strategies. They let you earn real yield without compromise, staking rewards plus layered incentives, all while keeping your capital liquid and agile. For those ready to optimize every satoshi, this is the era to watch.