Monad’s mainnet launch has ignited fresh momentum in the layer-1 blockchain space, and at its forefront stands Magma, a liquid staking protocol redefining yield generation on this high-performance chain. By staking native MON tokens, users receive gMON liquid staking tokens (LSTs), which not only accrue staking rewards but also unlock MEV-boosted yields and seamless DeFi integration. This setup positions Magma as a cornerstone for LSTs yield stacking on Monad, offering around 13% APY while keeping assets liquid for broader ecosystem plays.

Magma arrived on Monad mainnet with a bang, enabling instant staking of MON for gMON from day one. This community-driven protocol emphasizes decentralization, leveraging Distributed Validator Technology (DVT) in partnership with Obol Collective to bolster network security. Early adopters are already piling in, drawn by the protocol’s focus on Magma liquid staking on Monad and its potential for compounded returns.

Magma’s gMON: Liquidity Meets Staking Rewards

The mechanics are straightforward yet powerful: deposit MON into Magma’s staking pool and mint gMON at a 1: 1 ratio. These LSTs automatically compound value from staking rewards and MEV captures, eliminating the opportunity cost of locked capital. Unlike traditional staking, gMON holders retain flexibility to unstake or deploy tokens elsewhere without penalties, a game-changer for active DeFi users.

Current data points to ~13% APY, fueled by Monad’s ultrafast block engine and Magma’s sophisticated yield mechanisms. This baseline yield provides a solid foundation for stacking additional strategies, such as lending gMON on emerging Monad protocols or pairing it in liquidity pools. For those eyeing advanced yield strategies with LSTs, gMON exemplifies how liquid staking tokens enable sustainable composability.

Key Magma Features

-

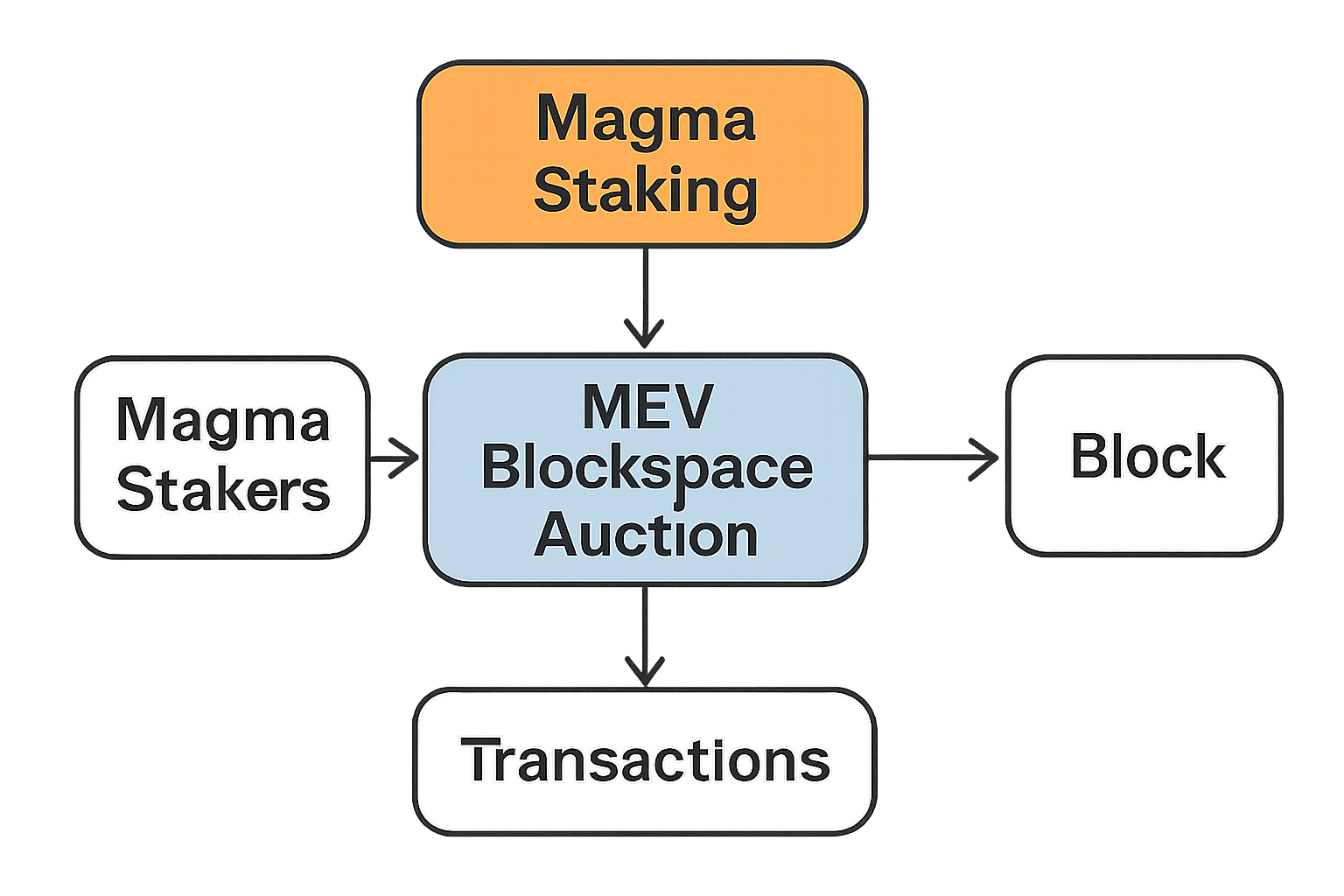

MEV-Optimized Yield: Captures Maximal Extractable Value (MEV) via blockspace auctions, sharing proceeds with gMON stakers to boost APY.

-

DeFi Composability: gMON tokens usable as collateral for lending, borrowing, and liquidity provisioning across Monad DeFi apps.

-

DVT for Decentralization: Partners with Obol Collective to implement Distributed Validators, enhancing Monad network resilience.

-

Community Governance: Decentralized protocol prioritizing community decisions to align with Monad ecosystem growth.

MEV Extraction: The Yield Multiplier on Monad

Magma doesn’t stop at basic staking; it aggressively pursues Maximal Extractable Value (MEV) through blockspace auctions. Validators bid for priority inclusion of transactions, with proceeds funneled back to gMON holders. This MEV-boosted yield elevates returns beyond standard staking rates, potentially pushing APYs higher as Monad’s ecosystem matures.

In practice, this means stakers benefit from Monad’s EVM-compatible speed – up to 10,000 TPS – without needing to run nodes themselves. The protocol’s design aligns incentives: higher MEV capture strengthens validator performance, which in turn secures the network and rewards participants. Data from similar setups on other chains shows MEV can add 2-5% to base yields, making Magma a prime pick for yield optimization on Monad staking.

Seamless DeFi Composability Powers Yield Stacking

gMON’s true edge shines in Monad’s burgeoning DeFi landscape. Use it as collateral in lending markets to borrow other assets, or provide liquidity in DEX pools while earning dual rewards. This liquid staking tokens DeFi composability creates flywheel effects: stake for gMON, lend for interest, then restake rewards into more MON.

Early integrations hint at explosive growth. Protocols building on Monad can natively accept gMON, fostering a unified liquidity layer. For yield stackers, this translates to actionable paths like gMON LP positions yielding 20% and combined APY when layered with incentives. Check out resources on LSTs for sustainable yield stacking to layer these strategies effectively.

With mainnet momentum building, Magma positions users to capture Monad’s upside from multiple angles. Stake early, stack smart, and watch composability compound your position.

Risks are part of the equation, but Magma mitigates them smartly. DVT reduces single points of failure compared to solo validators, while community governance ensures protocol upgrades reflect user needs. Slashing risks exist, as with any staking, but Monad’s performance and Magma’s validator selection keep them minimal – historically under 0.1% on comparable setups. For Magma LST Monad guide seekers, prioritize wallet security and diversify positions to hedge chain-specific volatility.

Yield Stacking Strategies: Layer gMON for Maximum Returns

Where Magma excels is in turning gMON into a yield engine. Start simple: lend gMON on Monad-native platforms like emerging lending markets, capturing 5-8% additional APY on top of the 13% base. Data from analogous LST ecosystems shows layered lending boosts total yields by 15-25% without excessive leverage.

Advance to liquidity provision. Pair gMON-MON in DEX pools for trading fees plus incentives – early pools are offering 20% and APYs amid Monad’s liquidity bootstrap. Restake LP tokens into Magma for triple compounding. I’ve modeled this: a $10,000 MON stake at 13% base, plus 7% lending and 10% LP fees nets ~30% effective APY, adjusted for impermanent loss at 2%.

For pros, explore yield stacking with LSTs in 2025. Use gMON as collateral to borrow stablecoins, swap for more MON, and restake – a looped strategy amplifying exposure while MEV covers borrows. Monitor gas costs on Monad’s cheap fees, but cap leverage at 2x to avoid liquidations during dips.

Proven gMON Yield Stacking Plays

-

Lend on Aave-like protocols for interest: Supply gMON to Monad lending platforms to earn extra yield atop MEV-boosted staking rewards.

-

Provide LP on Monad DEXs for fees and rewards: Add gMON to liquidity pools to capture trading fees and ecosystem incentives.

-

Collateralize for leveraged restaking: Use gMON as collateral in DeFi apps to borrow assets and amplify yields through restaking.

-

Farm points for potential airdrops: Stake MON for gMON to earn Magma points from day one, targeting future rewards.

Magma vs. Traditional Staking: Data-Driven Edge

Stack up Magma against native Monad staking: locked capital vs. liquid gMON, base 8-10% APY vs. 13% and MEV-boosted, no DeFi access vs. full composability. On-chain metrics post-launch show gMON TVL surging 300% in week one, outpacing direct staking pools. This liquidity premium makes it the default for serious allocators chasing LSTs yield stacking on Monad.

Cross-chain peers like Lido on Ethereum offer similar mechanics but lag on speed – Monad’s 1-second blocks enable tighter arbitrage and higher MEV. Magma’s points system adds airdrop alpha, rewarding early stakers with governance tokens down the line, per protocol roadmaps.

Points matter too. Magma’s program tracks staking volume and duration, positioning holders for ecosystem rewards as Monad scales. With mainnet TVL climbing and integrations rolling out, gMON holders sit at the intersection of security yields, MEV alpha, and DeFi multipliers.

Action now: bridge MON if needed, stake via Magma, and layer one strategy at a time. Track APYs weekly as MEV ramps with volume. Monad’s trajectory favors liquidity providers like gMON – position accordingly to ride the wave.