Ethereum’s liquid staking revolution has fundamentally changed how investors approach yield optimization. With Ethereum (ETH) currently trading at $3,975.79 as of October 19,2025, the competition to maximize returns has never been more intense. Liquid staking tokens (LSTs) now offer a toolkit for stacking yields far beyond the base staking rate, all while maintaining access to liquidity and composability across DeFi platforms.

Stake ETH with Top Liquid Staking Protocols to Mint LSTs

The first step toward maximizing your ETH yield is to stake through reputable liquid staking protocols. Instead of locking up 32 ETH in a validator node, you can deposit any amount with platforms like Lido Finance, Rocket Pool, or Ether. fi. These protocols mint LSTs such as stETH, rETH, or eETH at a 1: 1 ratio with your staked ETH. You continue earning consensus rewards, typically between 2.78% and 3.38% APY: but crucially, you also unlock the ability to deploy these LSTs across DeFi for additional returns.

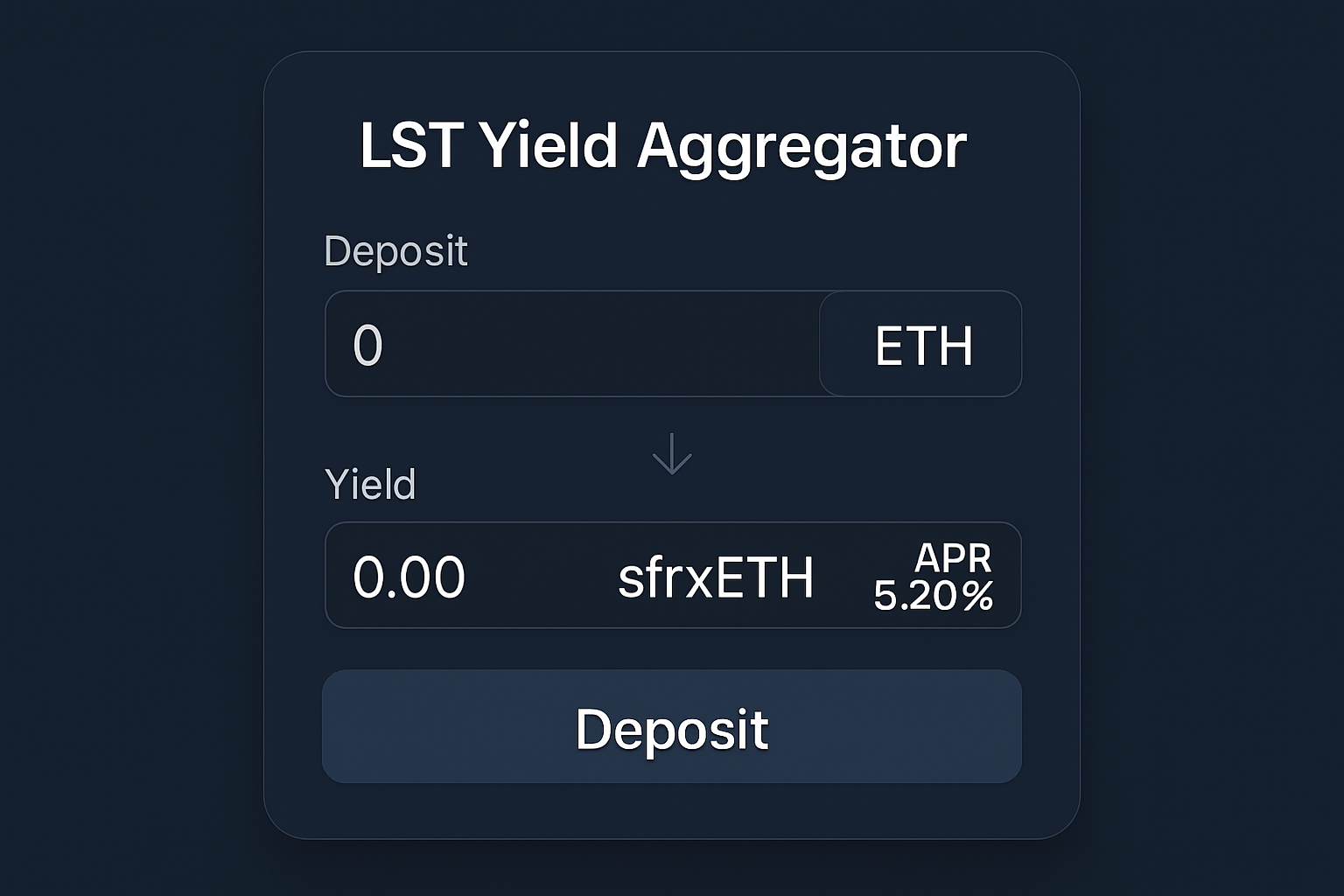

Lido remains the market leader by TVL, offering stETH at around 2.78% APY after fees. Rocket Pool appeals to decentralization advocates with rETH at approximately 2.95% APY, while Frax Ether’s sfrxETH offers a competitive 3.38%. Newer entrants like Ether. fi are gaining traction by emphasizing non-custodial staking and user key control, a growing priority after recent high-profile exploits.

Supply LSTs as Collateral on Lending Platforms for Leveraged Yield

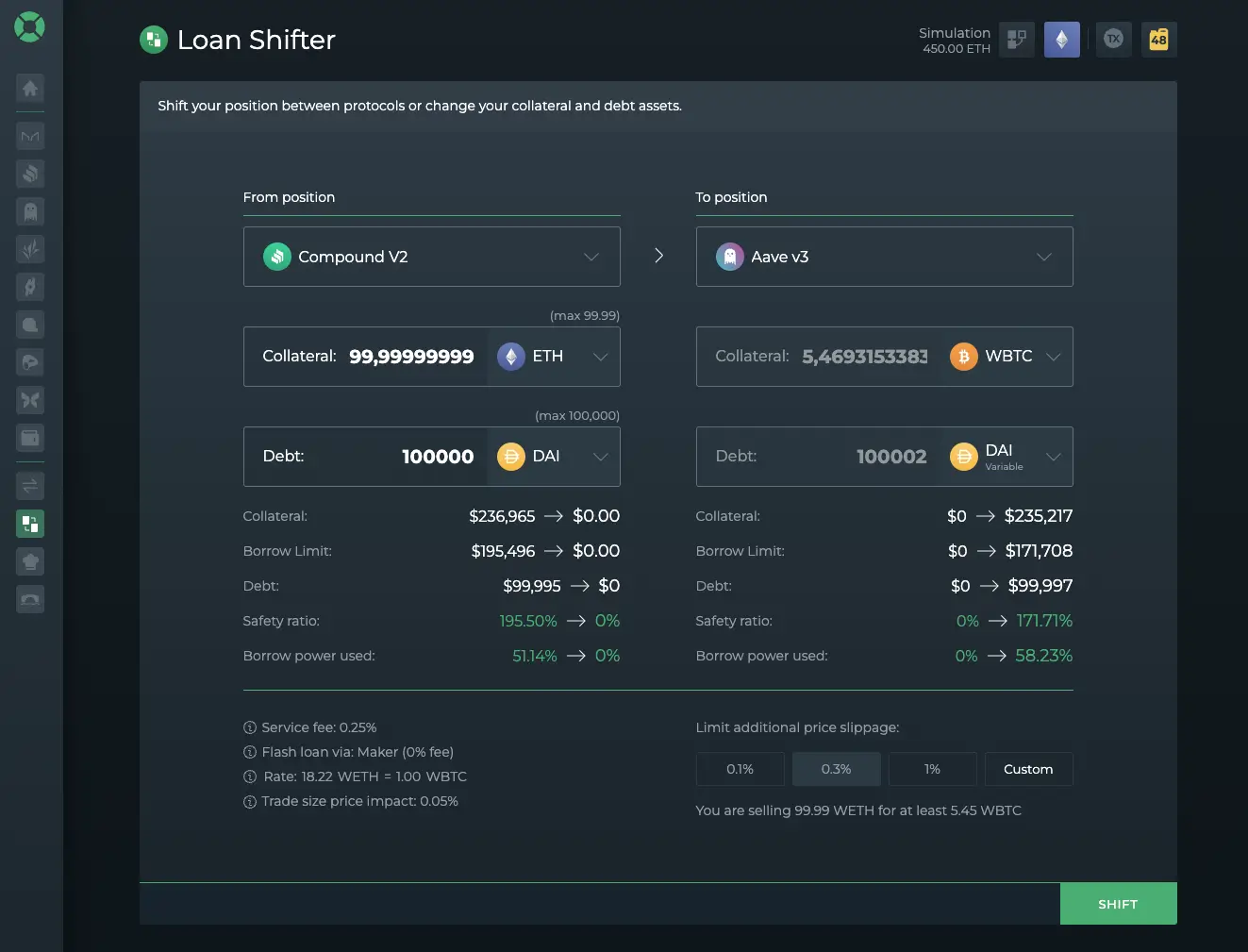

The next layer of yield stacking involves using your LSTs as collateral on lending protocols such as Aave or Morpho Blue. By depositing stETH or rETH into these platforms, you can borrow stablecoins against your position, often up to 70-75% loan-to-value depending on risk parameters.

This borrowed capital can be redeployed into further yield-generating strategies: purchasing more ETH to restake and mint additional LSTs (looping), or diversifying into other DeFi opportunities. The result is an amplified exposure to both ETH price appreciation and compounded staking rewards, but it comes with increased liquidation risk if the value of ETH drops sharply.

Deposit LSTs into DeFi Yield Aggregators for Enhanced Rewards

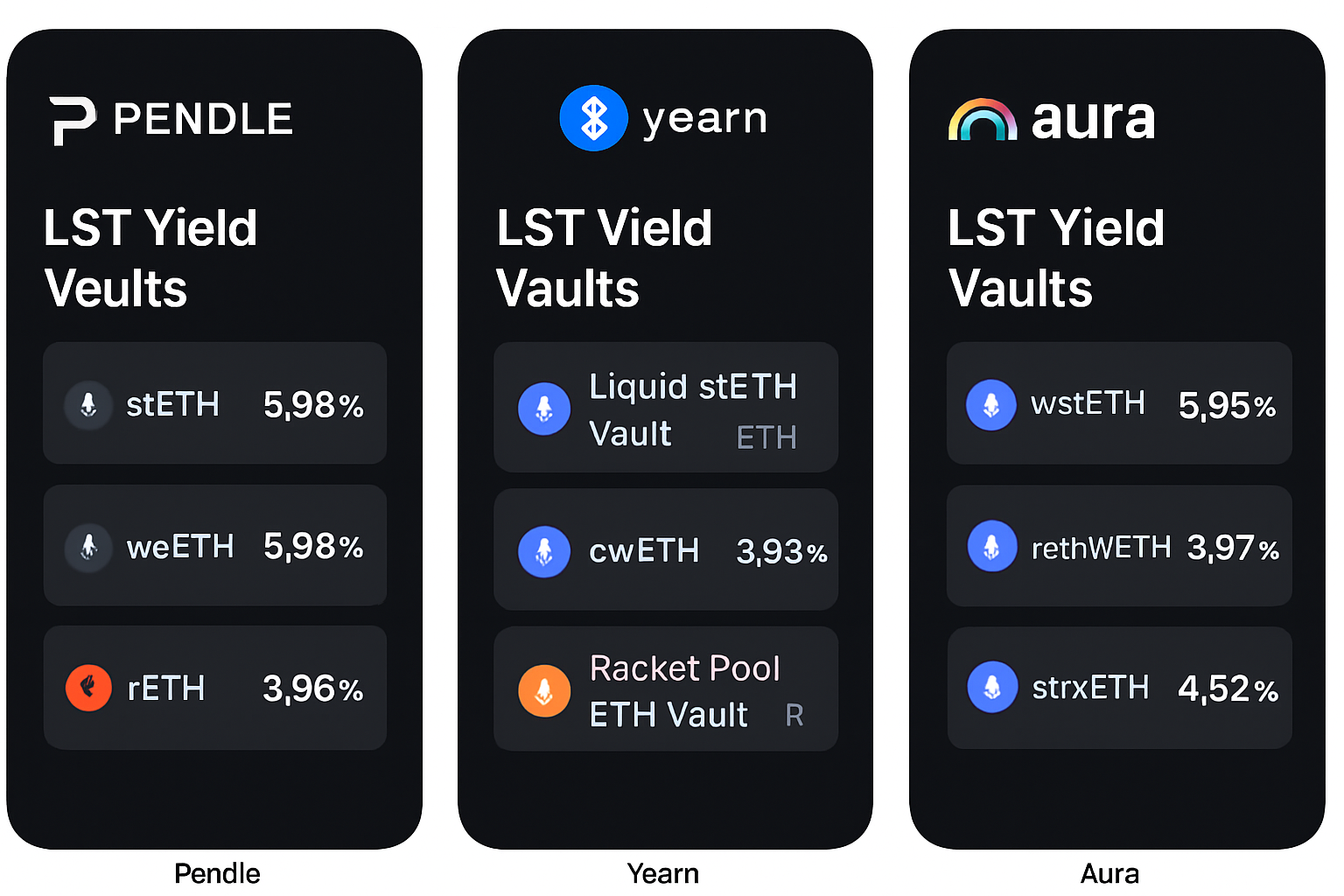

Yield aggregators like Pendle Finance, Yearn Vaults, and Aura Finance take the complexity out of farming by automating reward harvesting and compounding strategies on your behalf. For example, Pendle enables users to lock up their stETH or sfrxETH in time-segmented pools that boost yields up to 8-9% APY, depending on market demand and incentives.

Aura and Yearn aggregate incentives from multiple protocols, layering bribes, governance rewards, and trading fees, to optimize returns without constant manual intervention. This auto-compounding effect is essential for long-term capital efficiency in a competitive DeFi environment.

Top 5 Strategies for Maximizing ETH Yield with LSTs

-

Stake ETH with Leading Liquid Staking Protocols (e.g., Lido, Rocket Pool, Ether.fi) to mint liquid staking tokens (LSTs) like stETH, rETH, or eETH. These tokens represent staked ETH and earn base yields (currently around 2.78%–3.38% APY) while remaining liquid for use in DeFi.

-

Supply LSTs as Collateral on Lending Platforms (such as Aave or Morpho Blue) to borrow stablecoins. This enables leveraged yield strategies, letting you earn on both your LSTs and the borrowed assets, amplifying overall returns.

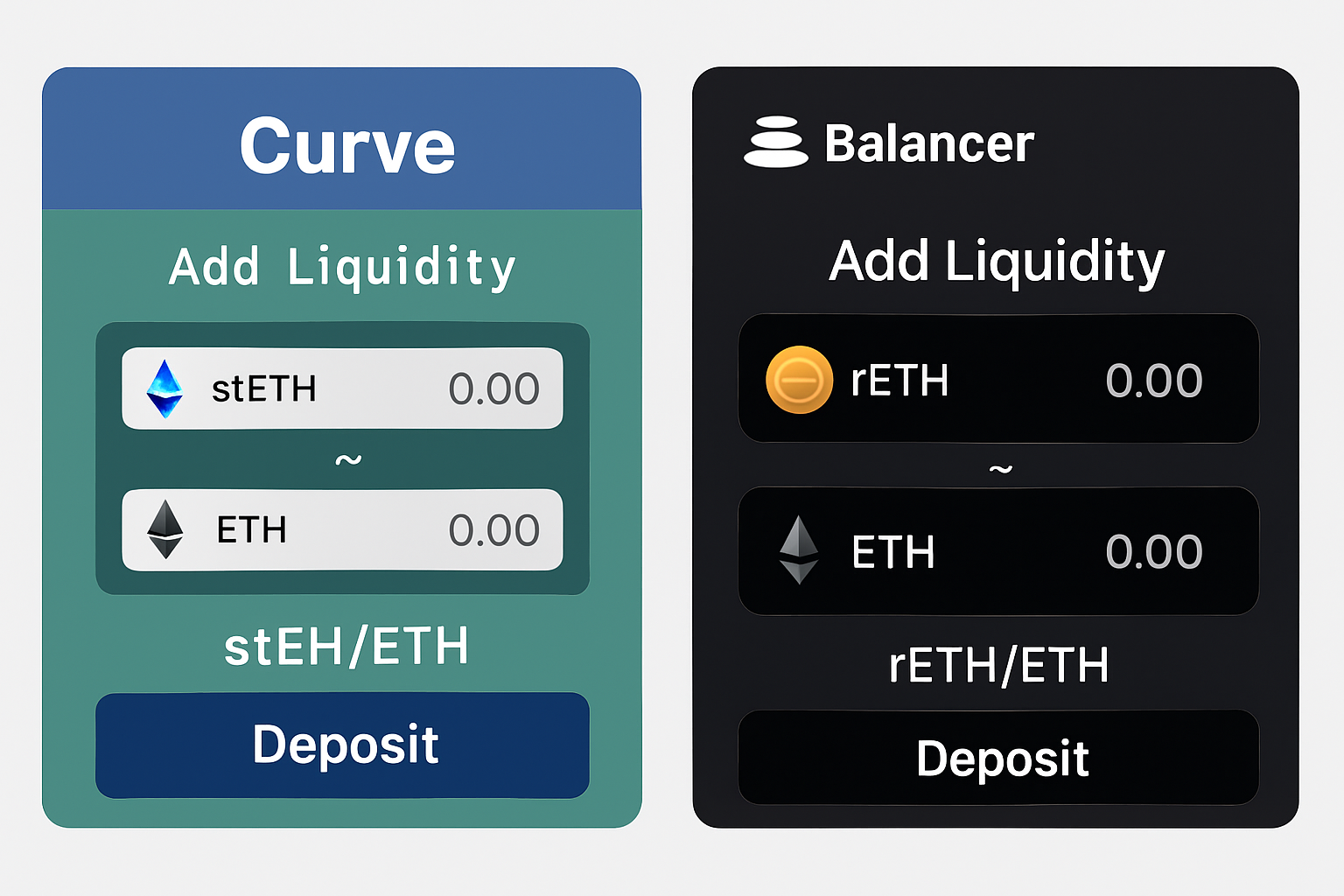

LST/ETH Liquidity Pools: Trading Fees and Incentives

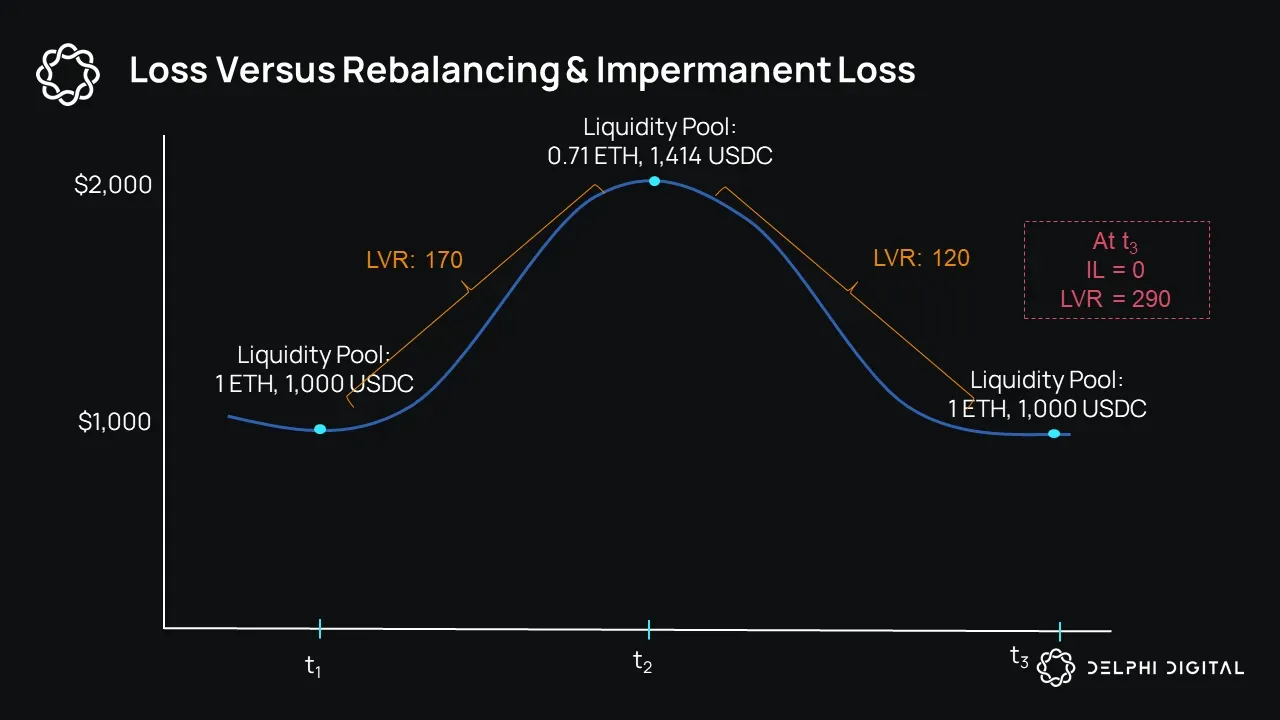

An often-overlooked but powerful strategy is providing liquidity in LST/ETH pairs on decentralized exchanges like Curve or Balancer. By pairing your stETH or rETH with native ETH in these pools, you earn not only swap fees but also protocol incentives (such as CRV or BAL tokens). This approach does introduce impermanent loss risk if the price ratio between ETH and its corresponding LST diverges significantly, but it’s offset by higher fee income during volatile periods.

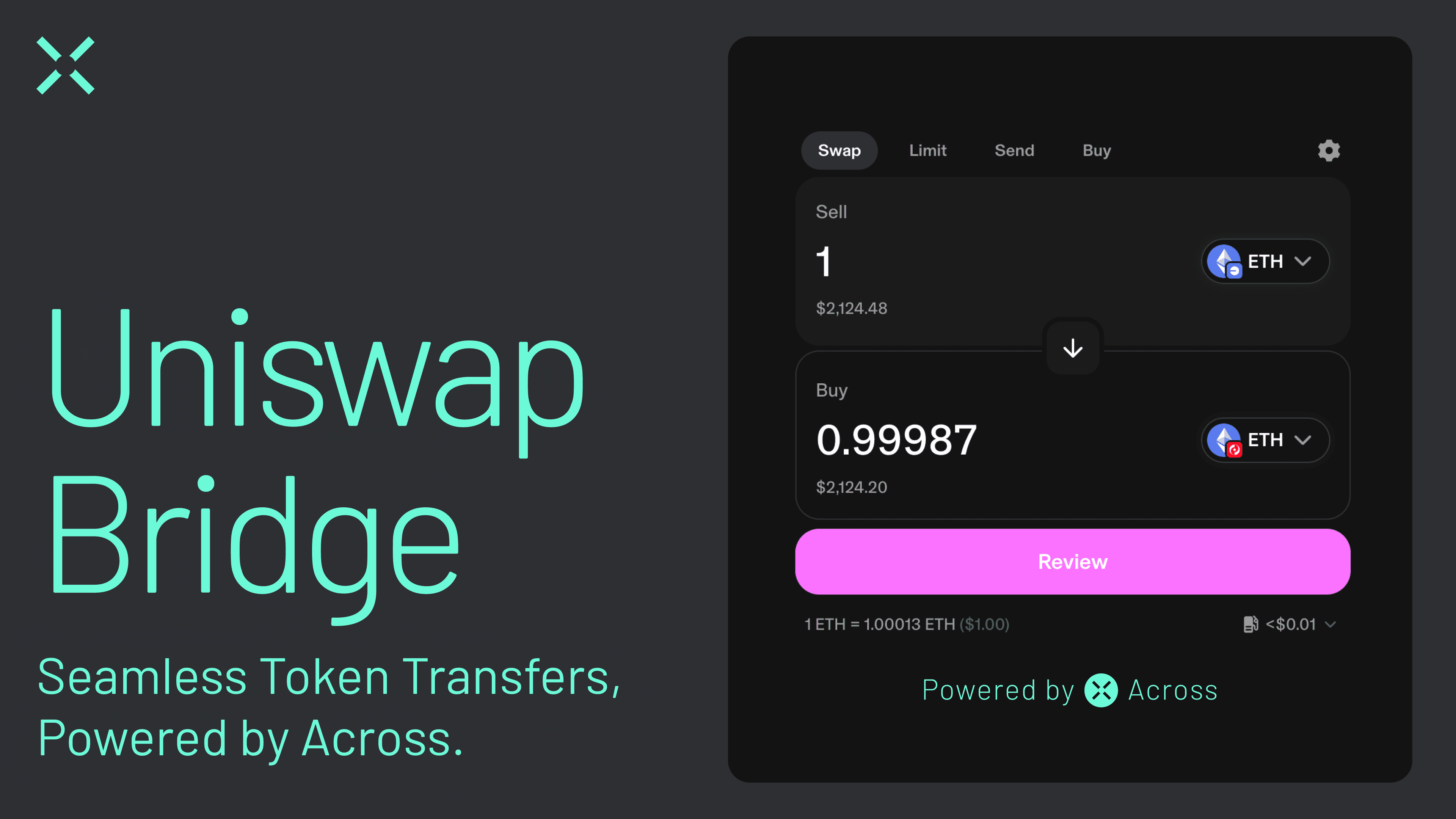

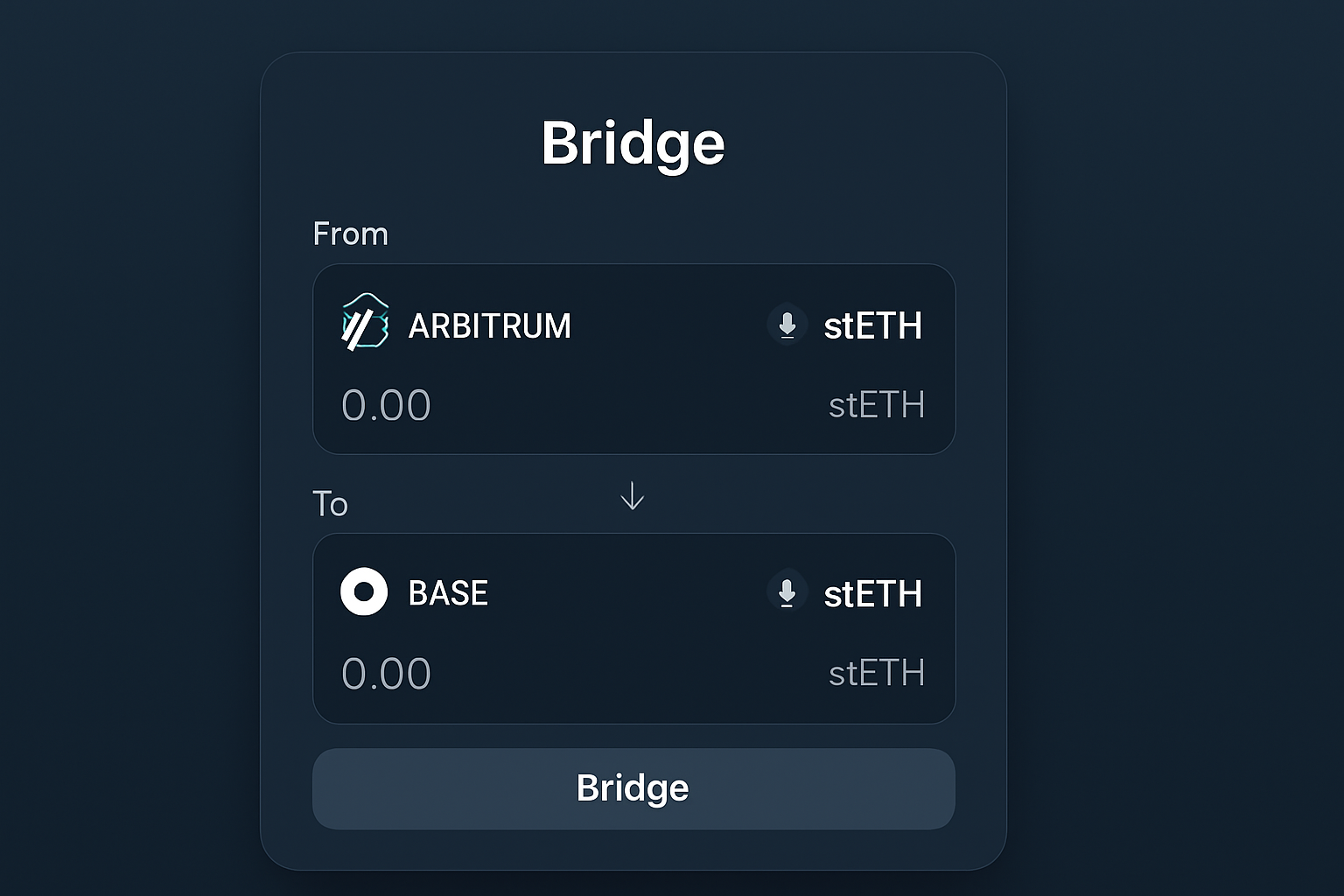

Bridge LSTs to Layer 2 Networks for Lower Fees and Extra Opportunities

The final piece involves bridging your liquid staking tokens onto Layer 2 networks such as Arbitrum or Base. These environments offer drastically reduced transaction costs compared to Ethereum mainnet and frequently host new DeFi protocols eager to attract liquidity via boosted rewards.

Ethereum (ETH) Price Prediction 2026–2031

Professional Forecast Based on Liquid Staking Trends, DeFi Adoption, and Market Analysis

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,200 | $5,200 | +5.6% | ETH consolidates post-ETF launches; LSTs and DeFi yield strategies drive steady demand but global macro uncertainty limits upside. |

| 2027 | $3,500 | $4,600 | $6,100 | +9.5% | DeFi/LST adoption expands, ETH 2.0 scaling gains traction; regulatory clarity in major regions supports moderate growth. |

| 2028 | $3,900 | $5,250 | $7,000 | +14.1% | Bullish market cycle; institutional DeFi participation increases, ETH becomes core yield asset; competition from L2s and alt-L1s tempers exuberance. |

| 2029 | $4,300 | $5,900 | $8,200 | +12.4% | ETH network upgrades (sharding, privacy) improve scalability; global stablecoin usage on Ethereum boosts demand; risk of overvaluation emerges. |

| 2030 | $4,800 | $6,650 | $10,000 | +12.7% | Peak of next crypto cycle; ETH as a global settlement and DeFi asset; regulatory risks and profit-taking create volatility. |

| 2031 | $4,000 | $7,000 | $12,500 | +5.3% | Market matures, growth slows; new tech (restaking, modular chains) sustain yield, but competition and macro headwinds increase volatility. |

Price Prediction Summary

Ethereum is projected to see steady price appreciation from 2026 to 2031, driven by continued DeFi and liquid staking adoption, technological upgrades, and expanding institutional use. However, price volatility will persist, with significant upside in bullish scenarios and resilience in bearish years. The average price is expected to rise from $4,200 in 2026 to $7,000 in 2031, with maximum price scenarios reaching as high as $12,500 if adoption and market cycles align favorably.

Key Factors Affecting Ethereum Price

- DeFi and liquid staking token (LST) adoption increasing ETH utility and demand.

- ETH 2.0 upgrades (scalability, sharding, staking improvements) enhancing network value.

- Potential regulatory clarity or uncertainty impacting institutional and retail participation.

- Global macroeconomic trends affecting risk appetite and capital flows into crypto.

- Emergence of Layer 2 solutions and competing smart contract platforms.

- Security and governance of major liquid staking platforms.

- Market cycles (bull/bear) and investor sentiment swings.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This multi-layered approach empowers sophisticated investors to transform base yields of under 4% into double-digit returns, all while retaining flexibility and capital efficiency that traditional staking cannot match.

However, yield stacking is not without its nuances. Each layer of strategy introduces distinct risks and operational considerations. For instance, when supplying LSTs as collateral on lending platforms, it’s essential to monitor your health factor and liquidation thresholds, especially with ETH priced at $3,975.79. Sudden market corrections can trigger liquidations, eroding both principal and accrued rewards. To mitigate this, conservative leverage and regular position reviews are recommended.

When depositing LSTs into yield aggregators such as Yearn, Pendle, or Aura, pay close attention to protocol-specific risks, including smart contract vulnerabilities and shifting incentive structures. While auto-compounding can enhance returns, it can also amplify losses if the aggregator is compromised or if rewards drop unexpectedly. Always verify audit status and consider using aggregators with robust track records.

Participating in LST/ETH liquidity pools on DEXes like Curve or Balancer offers attractive trading fees and governance token incentives. Yet, impermanent loss is an ever-present risk, particularly during periods of high volatility or when the peg between LSTs and ETH is unstable. Advanced users often employ tools to monitor pool health and rebalance positions dynamically. For those new to liquidity provision, starting with smaller allocations and tracking performance closely is a prudent approach.

Bridging LSTs to Layer 2 networks such as Arbitrum or Base is a powerful tactic for reducing gas costs and accessing novel yield opportunities. These ecosystems are rapidly evolving, often featuring new protocols with aggressive incentive programs. However, bridging itself introduces counterparty and operational risks, including potential downtime or exploit risk in bridge contracts. Use only reputable bridges and verify destination protocol security before deploying capital.

Checklist: 5 Actionable Strategies for ETH Yield Optimization

Top 5 Strategies to Maximize ETH Yield with LSTs

-

Stake ETH with Leading Liquid Staking Protocols (e.g., Lido, Rocket Pool, Ether.fi) to Mint LSTs: Begin by staking your ETH with reputable platforms like Lido, Rocket Pool, or Ether.fi. These protocols issue Liquid Staking Tokens (LSTs) such as stETH or rETH, allowing you to earn staking rewards while retaining liquidity.

-

Supply LSTs as Collateral on Lending Platforms (such as Aave or Morpho Blue) to Borrow Stablecoins for Leveraged Yield: Use your LSTs as collateral on established lending protocols like Aave or Morpho Blue. This enables you to borrow stablecoins and reinvest or leverage your position, amplifying your ETH yield potential.

-

Deposit LSTs into DeFi Yield Aggregators (e.g., Yearn, Pendle, or Aura) for Enhanced Rewards and Auto-Compounding: Maximize returns by depositing your LSTs into yield aggregators like Yearn, Pendle, or Aura. These platforms optimize and auto-compound rewards, often providing higher APYs than staking alone.

-

Participate in LST/ETH Liquidity Pools on DEXes (like Curve or Balancer) to Earn Trading Fees and Incentives: Provide liquidity to pools pairing LSTs with ETH on decentralized exchanges such as Curve or Balancer. This strategy lets you earn trading fees and protocol incentives while maintaining exposure to ETH.

For investors seeking to maximize returns while controlling risk, a disciplined approach is paramount. Diversify across protocols, avoid over-leveraging, and keep a close eye on market and protocol updates. The liquid staking DeFi landscape is dynamic, with yields and risks shifting as new products launch and market conditions evolve. Staying informed is your best defense against downside while positioning for sustainable yield stacking.

For further detail on advanced stacking tactics and risk management frameworks, explore our comprehensive guide: How to Maximize Yield with Liquid Staking Tokens on Ethereum in 2024.

As Ethereum continues to trade near $3,975.79, the competition for yield will only intensify. Liquid staking tokens, combined with DeFi composability, offer a new paradigm for capital efficiency and yield optimization. Approach each layer with diligence and a focus on security; capital preservation first, yield optimization second.