Yield stacking with liquid staking tokens (LSTs) is rapidly transforming the decentralized finance (DeFi) landscape, offering a sophisticated way to maximize DeFi returns by unlocking multiple layers of yield from a single asset. As Ethereum (ETH) currently trades at $4,117.20, the appetite for advanced yield strategies is at an all-time high, and LSTs are at the core of this innovation.

What Makes Yield Stacking with LSTs So Powerful?

Traditional staking locks up your ETH to secure the network and earn base rewards. However, this approach sacrifices liquidity and limits your earning potential to just one income stream. Liquid staking protocols such as Lido, Rocket Pool, and others have changed the game by issuing LSTs like stETH or rETH when you stake ETH. These tokens represent your staked position and accrue staking rewards, while remaining liquid and usable across DeFi.

This liquidity unlocks a suite of advanced strategies that combine base staking yields with additional opportunities in lending, restaking, stablecoin minting, and liquidity provision. The result? Multiple yield streams from the same capital, compounding your returns far beyond what traditional staking can offer.

The Four Pillars of Yield Stacking with Liquid Staking Tokens

Let’s break down four highly effective, up-to-date strategies that are driving the current wave of LST-powered DeFi optimization:

- Stake ETH for LSTs and Supply as Collateral on Lending Protocols: After receiving an LST like stETH for your staked ETH, you can supply it as collateral on lending platforms such as Aave or LayerBank. This enables you to borrow stablecoins or ETH against your stETH, freeing up liquidity without sacrificing staking rewards. You can then deploy borrowed assets into other high-yield opportunities or simply use them for flexible portfolio management.

- Restake LSTs on EigenLayer or Similar Restaking Platforms: Platforms like EigenLayer let you restake your LSTs to secure additional protocols beyond Ethereum itself. This means you earn both base staking rewards and extra incentives (like EigenPods rewards) from providing security to emerging networks, supercharging your total yield.

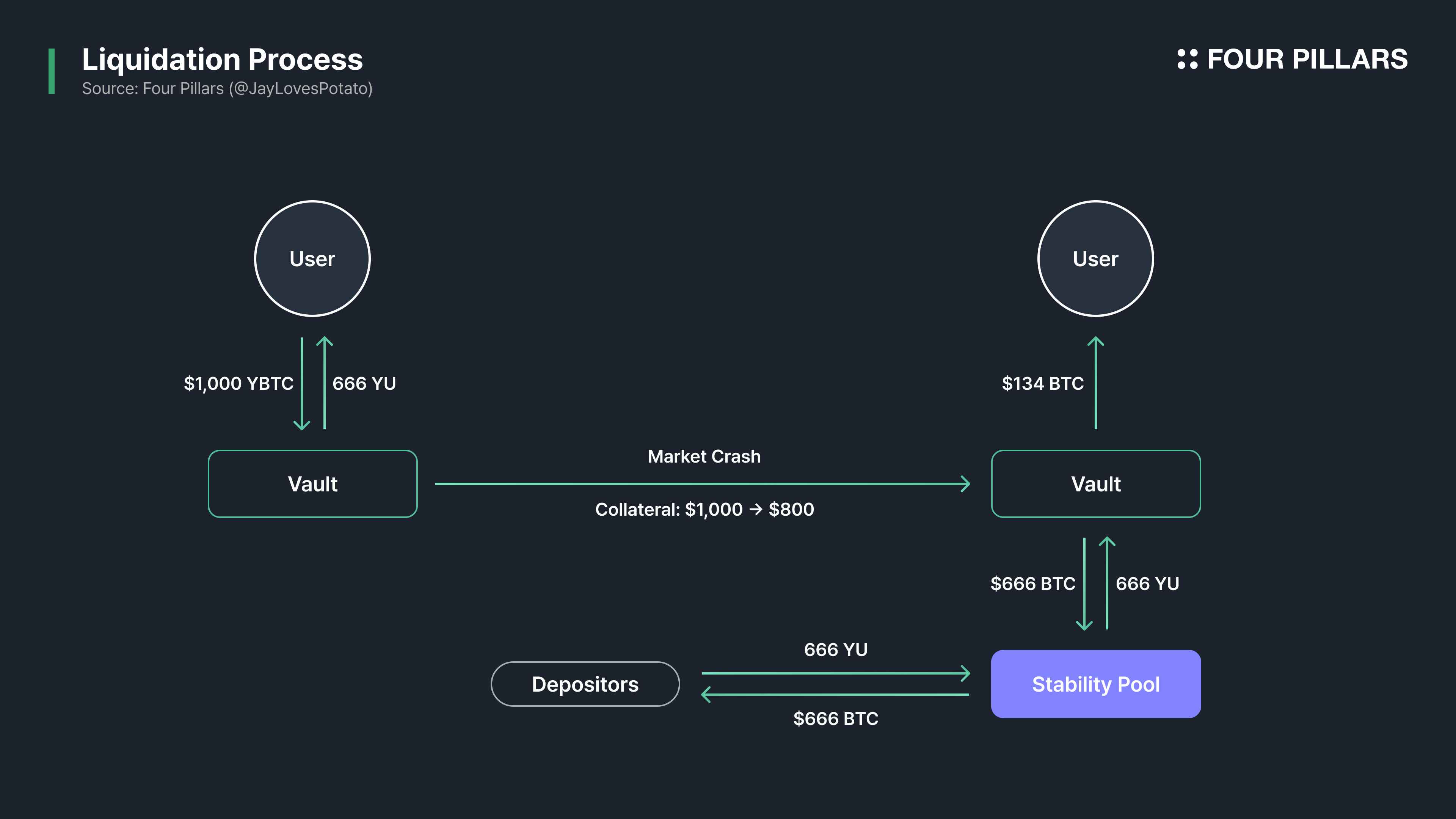

- Participate in LST-Backed Stablecoin Minting and Yield Farming: Many protocols now allow users to mint stablecoins by locking up their LSTs as collateral. These freshly minted stablecoins can be deployed into yield farms or liquidity pools for further returns. This strategy lets you extract value from both the underlying staked ETH and the farming opportunities available in DeFi.

- Leverage LST/ETH LP Pools for Dual Rewards and Incentives: By providing liquidity in pools pairing your LST (like stETH) with ETH on decentralized exchanges, you earn trading fees plus potential farming incentives, all while still accruing base staking rewards through your LST holdings.

If you’re new to these concepts or want a deeper dive into how these mechanisms work together, check out our comprehensive guide: How Liquid Staking Tokens (LSTs) Unlock Advanced Yield Strategies in DeFi.

Navigating Risks While Maximizing Returns

No strategy is without risk, even when using proven techniques like those above. When deploying yield stacking strategies involving LSTs at today’s prices (with ETH at $4,117.20), keep these considerations top-of-mind:

- Slashing Risks: If validators misbehave or go offline, some portion of staked assets may be lost due to slashing penalties.

- Smart Contract Vulnerabilities: Each protocol introduces its own set of smart contract risks, always use reputable platforms that undergo rigorous audits.

- Market Volatility and Liquidation Risk: Using volatile assets as collateral exposes users to liquidation if prices drop sharply; always monitor health factors closely when borrowing against your LSTs.

The right combination of strategies can help offset these risks while enabling powerful compounding effects through multiple yield streams, a hallmark of modern DeFi optimization using liquid staking tokens.

Real-World Examples: How Yield Stacking Plays Out in DeFi

To see these strategies in action, let’s illustrate how a savvy DeFi participant might combine them for optimal returns. Suppose you stake 10 ETH (currently worth $41,172) through Lido, receiving stETH. You then supply your stETH as collateral on LayerBank, unlocking the ability to borrow stablecoins. With those stablecoins, you can farm additional yield or diversify into other protocols. Meanwhile, you restake your stETH on EigenLayer to earn extra protocol rewards. If you’re feeling ambitious, you can also mint a stablecoin like crvUSD against your stETH and deploy it into high-yield pools or pair your stETH with ETH in a liquidity pool for dual rewards.

Each layer of this process stacks new yield streams atop the base staking rewards from Ethereum itself, without giving up liquidity or flexibility. This is the essence of liquid staking compounding: putting every token to work across DeFi’s most lucrative venues.

Best Practices for Safe Yield Stacking

Yield stacking isn’t just about chasing the highest APYs, it’s about balancing reward and risk across multiple protocols. Here are some practical tips for getting started:

- Diversify Platforms: Don’t put all your LSTs in one basket. Spread exposure across reputable lending, restaking, and liquidity platforms.

- Monitor Collateralization: When borrowing against LSTs, regularly check health factors to avoid liquidation during price swings, especially with ETH at $4,117.20.

- Track Protocol Updates: Stay informed about upgrades or changes to smart contracts that could affect yields or introduce new risks.

- Audit Your Stack: Periodically review where each asset is deployed and rebalance as needed based on market conditions and protocol incentives.

If you want to explore more advanced approaches or get step-by-step guidance on maximizing ETH staking yields with liquid staking tokens, see our detailed walkthrough: How to Maximize ETH Staking Yields with Liquid Staking Tokens in 2024.

The Future of Yield Stacking: What’s Next?

The rapid growth of LST-driven yield stacking is pushing DeFi innovation at breakneck speed. As protocols like EigenLayer evolve and new opportunities emerge for LST-backed stablecoins and liquidity pools, users who master these strategies will be well-positioned to capture outsized returns, even as competition heats up and markets mature.

The key takeaway? The days of single-layer staking are over. By leveraging liquid staking token strategies such as supplying collateral on lending platforms, restaking on EigenLayer, minting stablecoins for farming, and providing liquidity in LST/ETH pools, you unlock true capital efficiency in DeFi, turning every ETH into a multi-yield engine while maintaining access to your funds.

If you’re ready to dive deeper into the mechanics of sustainable yield stacking with liquid staking tokens, and want more real-world case studies, visit our guide: How Liquid Staking Tokens (LSTs) Enable Sustainable Yield Stacking in DeFi.