Liquid staking tokens (LSTs) have redefined how DeFi enthusiasts approach yield stacking in 2024. With Ethereum (ETH) priced at $3,826.18 as of October 31,2025, the demand for strategies that maximize returns while preserving flexibility is at an all-time high. But how do you truly harness the compounding power of LSTs and stay ahead in this fast-evolving landscape? Let’s dive into the actionable techniques and latest trends shaping the DeFi yield stacking meta.

Why Liquid Staking Tokens Are DeFi’s Yield Stacking Engine

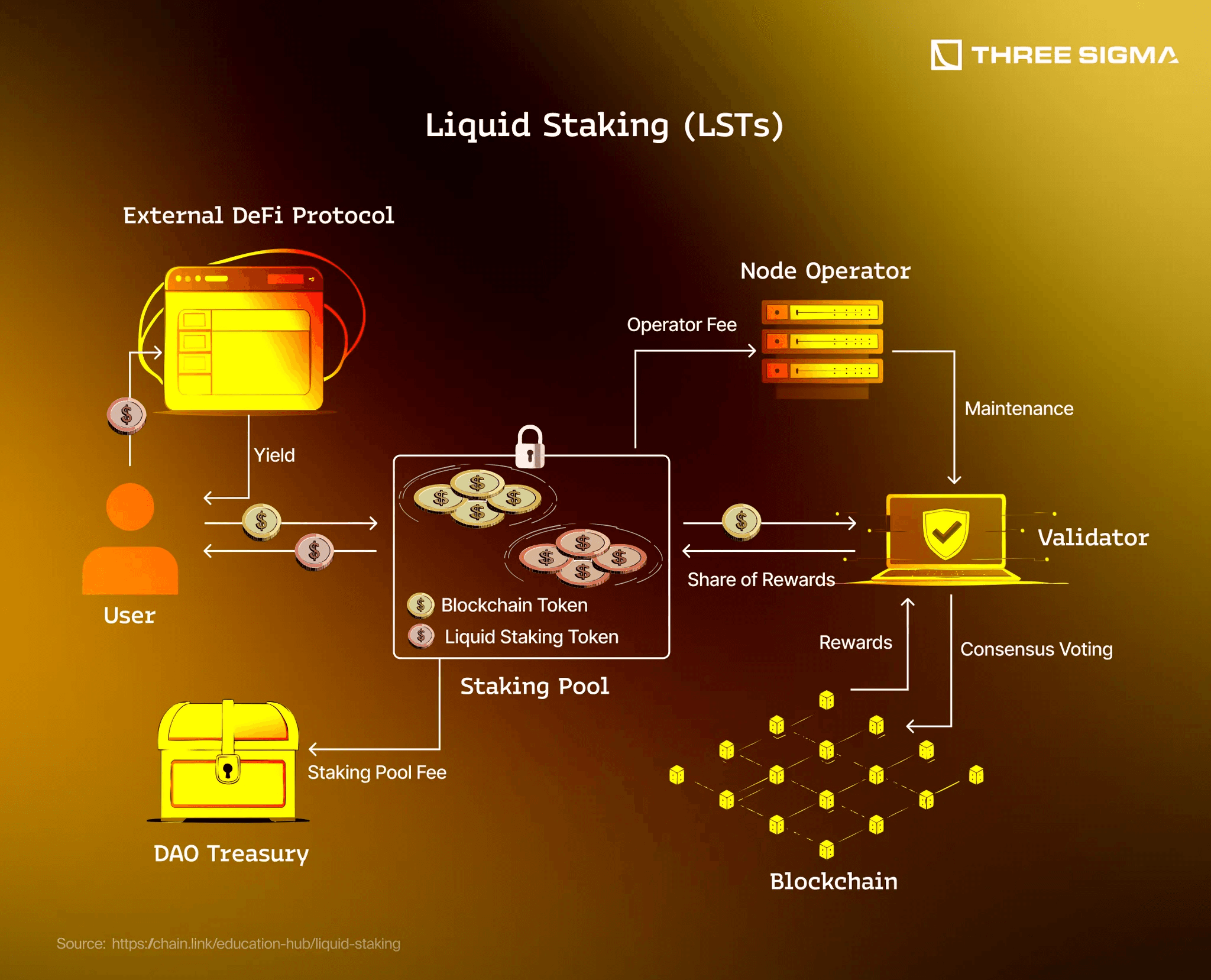

At their core, LSTs represent staked assets in a liquid wrapper. Instead of locking up your ETH or SOL for months, you stake through platforms like Lido or Rocket Pool and receive stETH or rETH, tokens that mirror your staked balance and rewards. The magic? These LSTs can be used across DeFi: lending, farming, liquidity pools, and more. This means you’re not just earning staking rewards, you’re compounding them with extra streams from other protocols.

For example, staking ETH on Lido delivers stETH to your wallet. While your underlying ETH earns network rewards, you can simultaneously deploy stETH on lending platforms or DEXs for additional yield. This is the essence of yield stacking with liquid staking tokens: unlocking multiple revenue layers without sacrificing liquidity.

Compounding Rewards: The Secret to Exponential Growth

The first lever for maximizing LST yields is compounding. Many platforms now offer automated restaking, where rewards are continuously re-delegated to boost your principal. Daily compounding can push your annual percentage yield (APY) 2-5% higher compared to monthly cycles, especially when base rates hover around 4-6%.

- Auto-compounders: Protocols like Yearn or Beefy Finance auto-harvest rewards and reinvest them for you.

- Restaking innovations: New restaking protocols let you redeploy earned LSTs into fresh validators or even external systems (think rollups and oracle networks), multiplying earning potential.

- User tip: Always check if your protocol supports auto-compounding or if manual claiming/reinvestment is required, small differences here have a big impact over time!

If you want a deeper breakdown of sustainable compounding strategies using LSTs, check out our guide on optimizing sustainable returns with liquid staking tokens.

Squeezing More Yield: Minimize Fees and Maximize Efficiency

Your net APY isn’t just about what you earn, it’s about what you keep! Gas fees and slippage can eat into profits if left unchecked. Here’s how savvy yield stackers are minimizing costs in 2024:

- Smart routing and batch operations: Advanced protocols bundle transactions to reduce overall gas expenditure.

- Tactical timing: Executing trades during low network congestion can slash gas fees by up to 80%.

- L2 solutions: Deploying on Layer 2 chains with subsidized transaction costs further protects your margins.

The difference between an average and great yield stacker often comes down to fee optimization, a crucial step if you’re serious about compounding gains over months or years.

Ethereum (ETH) & Top LSTs Price Prediction: Q1-Q3 2026 to 2031

Forecast considers liquid staking adoption, DeFi integration, and evolving market cycles. All prices are per ETH.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,000 | $4,250 | $5,600 | +11% | ETH consolidates as LST adoption expands, DeFi yields attract capital, but macro uncertainty remains. |

| 2027 | $3,350 | $4,800 | $6,800 | +13% | Improved scalability and ETH restaking drive demand; regulatory clarity improves sentiment. |

| 2028 | $3,800 | $5,450 | $8,000 | +14% | Mainstream DeFi use and ETH as a yield asset solidify, competition from other L1s/L2s grows. |

| 2029 | $4,200 | $6,200 | $9,500 | +14% | ETH benefits from next DeFi cycle, institutional adoption rises, but global regulation impacts volatility. |

| 2030 | $4,700 | $7,100 | $11,000 | +15% | Widespread LST integration, ETH becomes core yield reserve in DeFi, but tech risks and forks possible. |

| 2031 | $5,200 | $8,000 | $13,000 | +13% | ETH matures as DeFi backbone; yield stacking and restaking innovations maximize token utility. |

Price Prediction Summary

Ethereum’s price is projected to grow steadily from 2026 through 2031, supported by the evolution of liquid staking tokens and their integration in DeFi. The average price is expected to rise from $4,250 in 2026 to $8,000 by 2031, with bullish scenarios reaching up to $13,000. While upside is driven by adoption and yield innovations, risks remain from market cycles, regulation, and technological competition.

Key Factors Affecting Ethereum Price

- Expansion of liquid staking and restaking protocols increasing ETH demand and utility.

- Broader DeFi adoption and integration of LSTs into major platforms.

- Continued improvements to Ethereum’s scalability (via upgrades or Layer 2s).

- Regulatory clarity and potential global standards for staking and DeFi.

- Competition from alternative Layer 1 and Layer 2 networks.

- Risks from smart contract vulnerabilities and protocol governance.

- Macroeconomic environment (interest rates, liquidity, global risk appetite).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

LST Farming and Liquidity Provision: Double-Dip Your Rewards

The next frontier? LST farming. By depositing your liquid staking tokens into DEX liquidity pools (like pairing stETH/ETH), you earn both trading fees and ongoing staking rewards. Some pools offer an extra 3-6% APY, but beware impermanent loss! Choose pairs with correlated assets or use protocols offering impermanent loss protection where possible.

- Diversify revenue streams: Don’t just stick to one pool, spread risk across several well-audited platforms.

- Avoid rookie mistakes: Always assess total value locked (TVL), historical APYs, and security audits before jumping in headfirst.

But the true power of liquid staking tokens emerges when you layer these strategies. Imagine this: your stETH is earning staking rewards, it’s deployed in a high-yield DEX pool for trading fees, and you’re leveraging that LP token as collateral in a lending protocol to borrow stablecoins for even more yield farming. This is how advanced DeFi users are building multi-dimensional yield stacks, each layer compounding the previous one without giving up liquidity or flexibility.

Leveraging Yield Aggregators and Automated Vaults

Yield aggregators like Yearn, Beefy, and Autofarm have become staples for LST holders looking to maximize returns with minimal manual intervention. These platforms automatically rebalance your assets across top-performing pools, optimize compounding frequency, and batch transactions to reduce gas costs. The result? You capture higher net APYs while minimizing the risk of missing out on superior opportunities.

It’s crucial to stick with reputable, audited aggregators and always monitor vault strategies for changes in risk profile or underlying protocol health. Remember, automation is powerful, but vigilance is non-negotiable in DeFi.

Cross-Protocol Yield Stacking: The Synergy Play

The most sophisticated DeFi yield stackers are now combining multiple protocols for synergistic results. For instance:

- Stake ETH via Lido: Receive stETH.

- Supply stETH as collateral: Borrow stablecoins from Aave or similar lending platforms.

- Deploy borrowed funds: Farm additional yield on stablecoin LPs or vaults.

This approach lets you earn staking rewards, lending interest, and farming yields all at once, true triple-layered compounding! If you want a deep dive into these cross-protocol maneuvers, see our step-by-step breakdown at how liquid staking tokens enable effortless yield stacking across DeFi platforms.

Risk Management: Stay Sharp While Stacking

No yield strategy is complete without robust risk management. While LSTs unlock new frontiers of capital efficiency, they come with unique hazards:

- Smart contract exploits: Stick to protocols with recent audits and strong community reputations.

- Impermanent loss: Use correlated pairs or pools offering some protection mechanisms if possible.

- LST depegging: Monitor the price parity between your LST (like stETH) and its underlying asset (ETH). Sharp deviations can erode returns fast.

- Lending risks: Over-leverage can lead to liquidation cascades during volatile markets, always maintain safe collateral ratios!

The best defense? Diversify across protocols and assets, keep tabs on protocol health dashboards, and never chase unsustainable APYs blindly. For more on sustainable approaches, browse our resource on sustainable yield stacking with liquid staking tokens.

The Road Ahead: Yield Stacking Meta in Late 2024 and Beyond

The DeFi landscape is evolving at warp speed. As of October 31,2025, when Ethereum sits at $3,826.18: the competition among liquid staking protocols has intensified. Expect further innovations like cross-chain LST farming (using wrapped LSTs across multiple blockchains), real-time auto-rebalancing vaults powered by AI agents, and institutional-grade insurance products protecting against smart contract failures.

If you’re serious about maximizing returns in this meta, stay nimble: follow protocol updates closely, experiment with new strategies on testnets before going big, and tap into community wisdom through forums or dedicated analytics hubs like Lstfi. The future belongs to those who can adapt quickly while managing risk intelligently!

Your next step? Audit your current positions for inefficiencies, are you compounding frequently enough? Are fees eating into your APY? Could you diversify further by exploring emerging restaking platforms? With the right tools and mindset, every crypto cycle brings fresh opportunities to stack smarter, not just harder, in DeFi’s dynamic ecosystem.