Liquid staking has transformed how DeFi investors approach yield generation, offering a dynamic alternative to traditional staking. With the rise of LayerBankFi’s innovative platform, maximizing returns through yield stacking with liquid staking tokens (LSTs) is more accessible than ever. As of November 2,2025, Ethereum (ETH) trades at $3,871.43, Lido DAO (LDO) at $0.88164, and Rocket Pool (RPL) at $3.29. These real-time prices underscore the importance of precision and timing when deploying capital into multi-yield DeFi strategies.

What Are Liquid Staking Tokens (LSTs)?

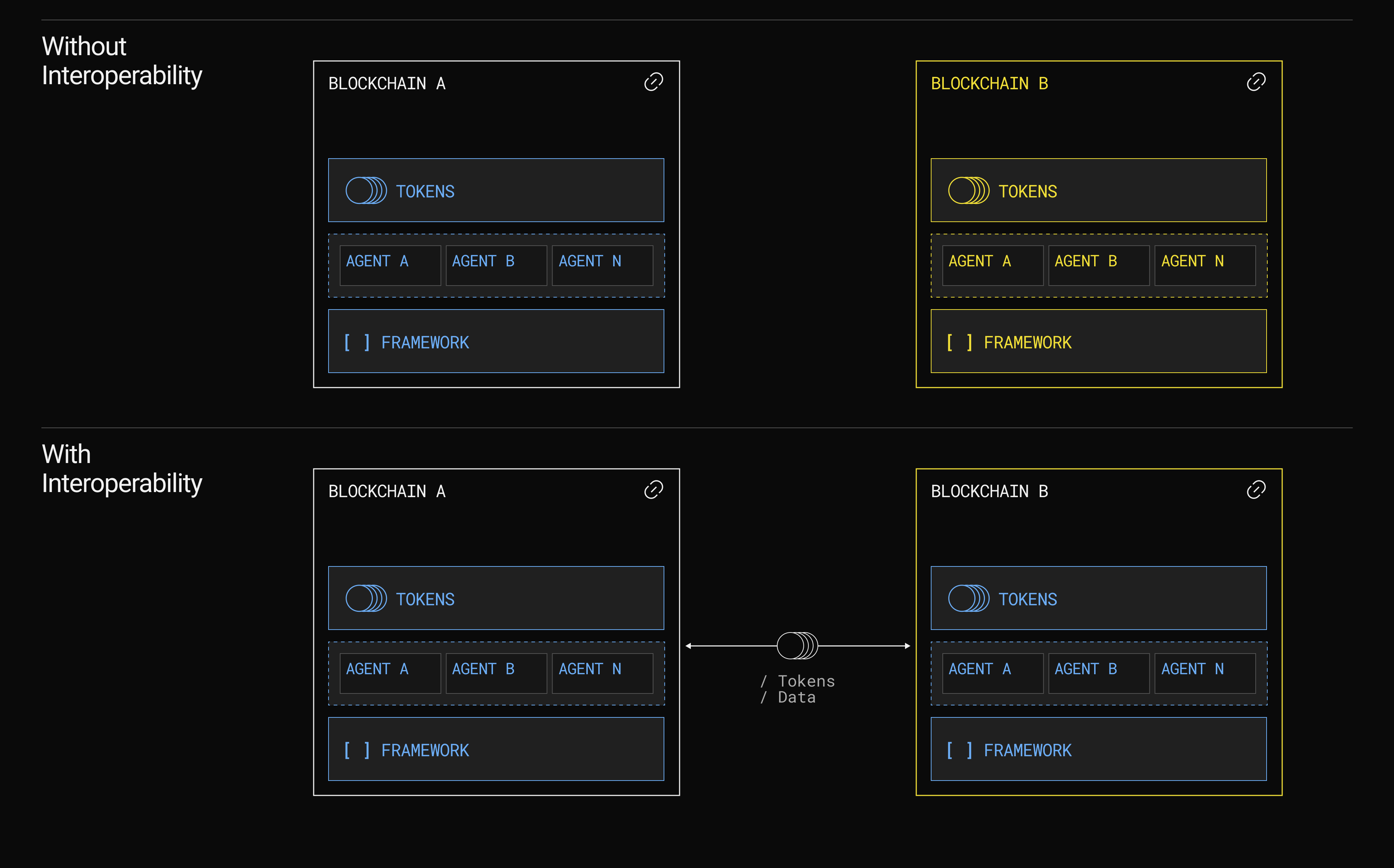

LSTs are tokenized representations of staked assets, think stETH from Lido or rETH from Rocket Pool, that allow holders to earn ongoing staking rewards while retaining liquidity. This innovation means investors can deploy their staked capital across other DeFi protocols without waiting for lockup periods to end. For example, by staking ETH on a protocol like Lido, you receive stETH in return, which can then be used as collateral or deposited into liquidity pools for additional yield stacking.

This flexibility is central to the current DeFi landscape, where maximizing every unit of capital is key. If you’re new to LSTs or want a deeper dive into their mechanics and advantages, check out our guide here.

LayerBankFi: The Engine for Multi-Yield DeFi Strategies

LayerBankFi stands out by enabling users to leverage their LSTs across multiple yield streams simultaneously, a process known as yield stacking. Let’s break down the core strategies:

- Compounding Rewards: LayerBankFi offers automated restaking features that reinvest your earned yields back into the protocol. By optimizing compounding frequency, daily or weekly, you maximize your annual percentage yield (APY), balancing gas costs with reward accumulation.

- Liquidity Provision: Deposit your LSTs into LayerBankFi’s liquidity pools to earn not only trading fees but also additional incentives. Pairing LSTs with their underlying assets (such as stETH/ETH) helps minimize impermanent loss due to correlated price movements.

- Lending and Collateralization: Use your LSTs as collateral in LayerBankFi’s lending markets to borrow other assets while still earning staking rewards, a powerful way to unlock extra capital without sacrificing base yield.

This approach allows you to stack multiple sources of income on top of your initial staking rewards. For a comprehensive look at how these strategies work in practice, see our analysis on yield stacking with LSTs.

Risk Management in Yield Stacking: What Every Investor Should Know

The promise of compounded returns comes with its own set of risks, especially when interacting with multiple protocols simultaneously. Key considerations include:

- Smart Contract Vulnerabilities: Always research LayerBankFi’s smart contracts and audit history before depositing significant capital.

- Market Volatility: The value of your LSTs fluctuates alongside their underlying assets; for example, if ETH drops below $3,871.43, both stETH and rETH will reflect this decline proportionally.

- Liquidity Risks: Assess pool depth and trading volume before entering positions so you can exit efficiently when needed.

- Leverage Risks: If using borrowed funds against your LST collateral, monitor loan-to-value ratios closely to avoid liquidation during sharp price swings.

The most resilient strategies combine high-yield opportunities with robust risk controls, a principle that underpins all successful portfolio management in DeFi. For further reading on advanced risk-aware stacking approaches, explore our dedicated guide on advanced yield strategies with LSTs.

For those intent on optimizing their DeFi returns, the interplay between flexibility, risk management, and real-time analytics is crucial. LayerBankFi’s dashboard provides granular data on pool yields, collateralization ratios, and protocol health, empowering users to make informed decisions in a constantly shifting market. By leveraging these analytics alongside your own due diligence, you can adapt yield stacking strategies to evolving conditions or new incentive programs.

Top 4 Ways to Stack Yields with LSTs on LayerBankFi

-

Automated Restaking for Compounded RewardsLeverage LayerBankFi’s automated restaking feature to continuously reinvest earned yields from Liquid Staking Tokens (LSTs) like stETH or rETH. This compounding strategy enhances your annual percentage yield (APY) without manual intervention, maximizing returns over time.

-

Providing Liquidity in LST PoolsDeposit LSTs such as stETH or rETH into LayerBankFi’s liquidity pools. Earn trading fees and additional incentives while mitigating impermanent loss by pairing LSTs with their underlying assets (e.g., stETH/ETH), as these pairs typically move in tandem.

-

Leveraging LSTs as Collateral in Lending ProtocolsUse your LSTs as collateral on LayerBankFi to borrow other assets. This allows you to access further investment opportunities while still earning staking rewards on your original assets. Always monitor loan-to-value ratios and market conditions to manage liquidation risks.

-

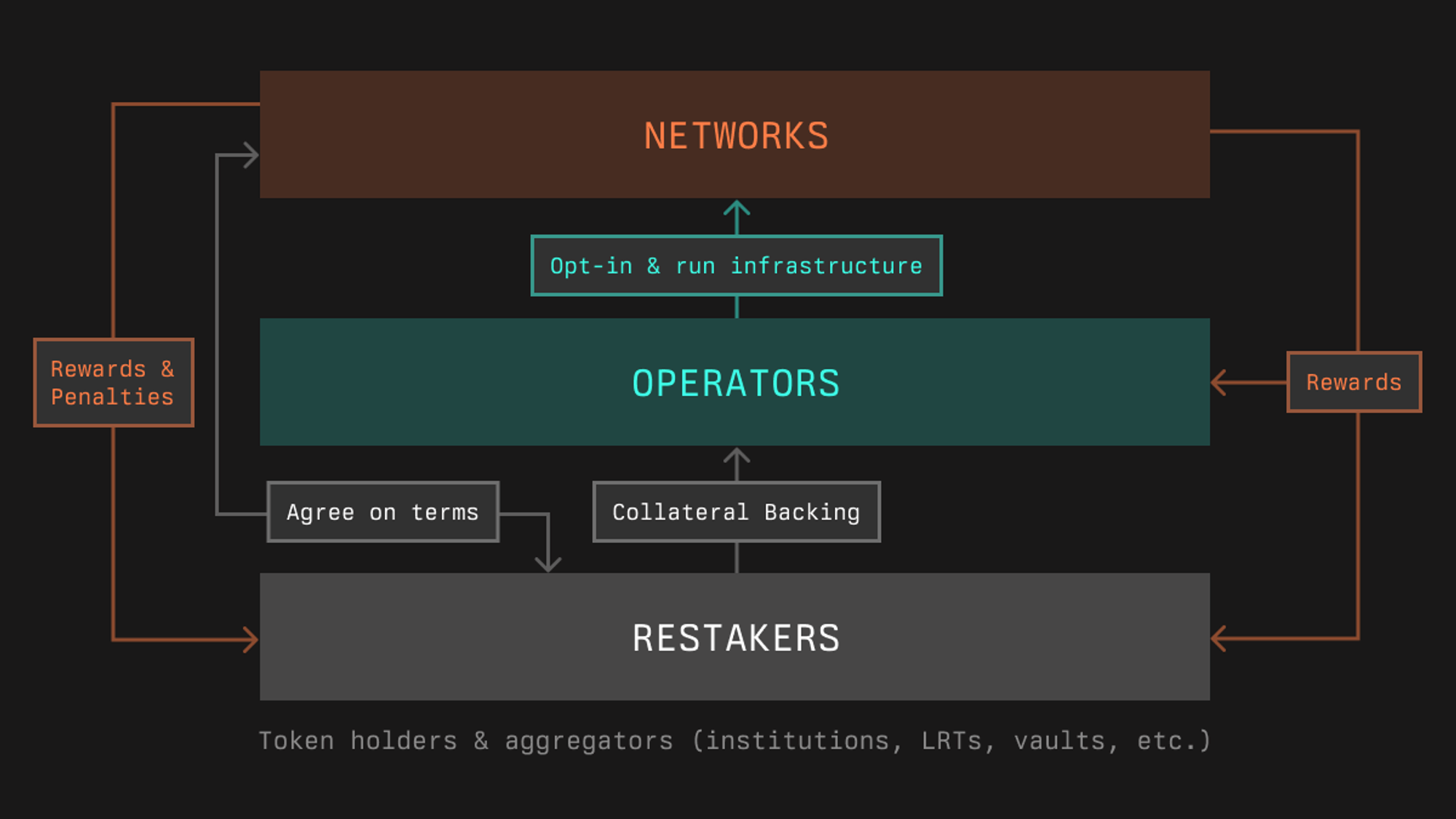

Engaging in Restaking MechanismsParticipate in restaking protocols integrated with LayerBankFi, such as those supporting EigenLayer or similar platforms. By restaking your LSTs, you can help secure additional services and earn extra yields, but be mindful of the increased risks from multiple protocol exposures.

Practical Steps for Maximizing LST Yield Stacking

Here’s a streamlined approach for getting started with multi-yield DeFi strategies on LayerBankFi:

- Acquire LSTs: Obtain stETH, rETH, or other supported LSTs via reputable platforms. Always verify contract addresses and use official channels.

- Deposit into LayerBankFi: Transfer your LSTs into LayerBankFi’s vaults or liquidity pools. Monitor APYs and select pools that align with your risk tolerance and yield objectives.

- Enable Collateralization (Optional): For advanced users, enable your LSTs as collateral within LayerBankFi to unlock borrowing power, enabling further investment or diversification.

- Monitor and Optimize: Regularly review your positions using LayerBankFi’s analytics dashboard. Adjust compounding frequency, rebalance pools, or repay loans as needed to maintain optimal yields and risk profiles.

This step-by-step process is designed for both newcomers and seasoned DeFi investors looking to boost their staking rewards optimization. For more tactical guides tailored to specific scenarios, including vault integrations and ULAB emissions, see our in-depth walkthrough here.

Key Takeaways: Navigating the Future of Yield Stacking

The rapid evolution of liquid staking means that new protocols, incentives, and risks emerge regularly. Staying agile is essential, monitoring updates from both LayerBankFi and broader DeFi markets helps you pivot strategies when necessary. As of today’s prices (ETH at $3,871.43, LDO at $0.88164, RPL at $3.29), the opportunity set remains robust but requires continuous vigilance.

If you’re seeking sustainable outperformance in the DeFi space, focus on:

- Diversification across multiple LST assets and yield streams to reduce single-protocol risk

- Active monitoring of collateralization ratios if leveraging positions

- Tapping into restaking platforms for additional incentive layers, but always weigh incremental rewards against new risks introduced by cross-protocol exposure

The most successful strategies are those that balance ambition with discipline, a hallmark of resilient portfolio construction in crypto markets.